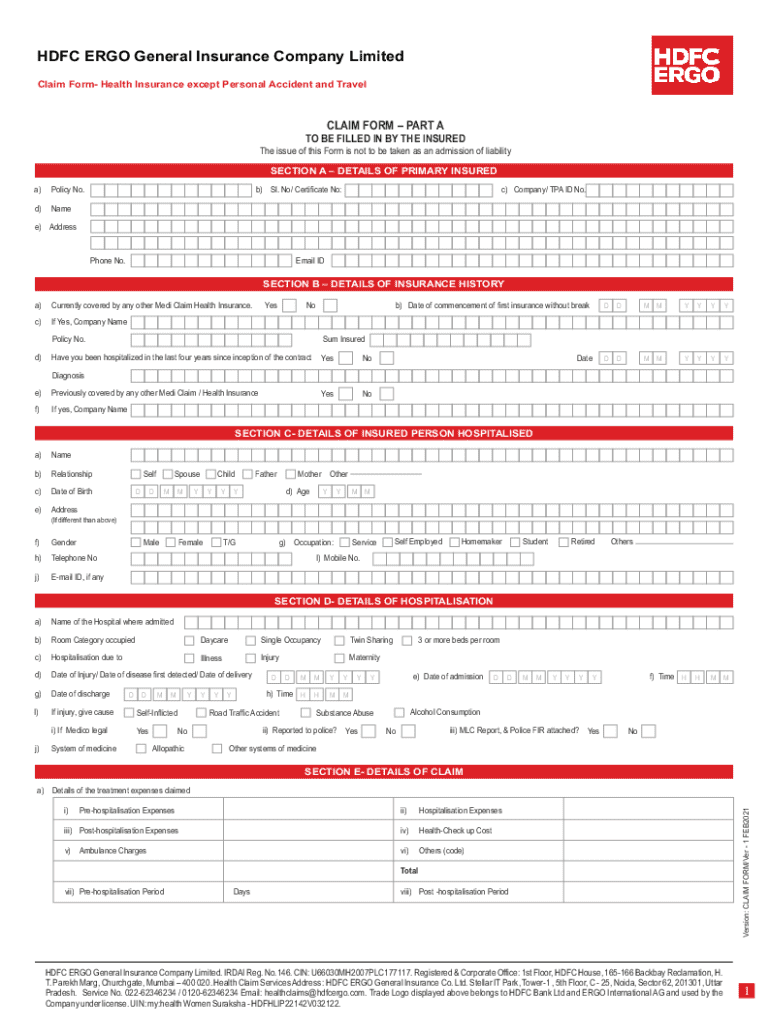

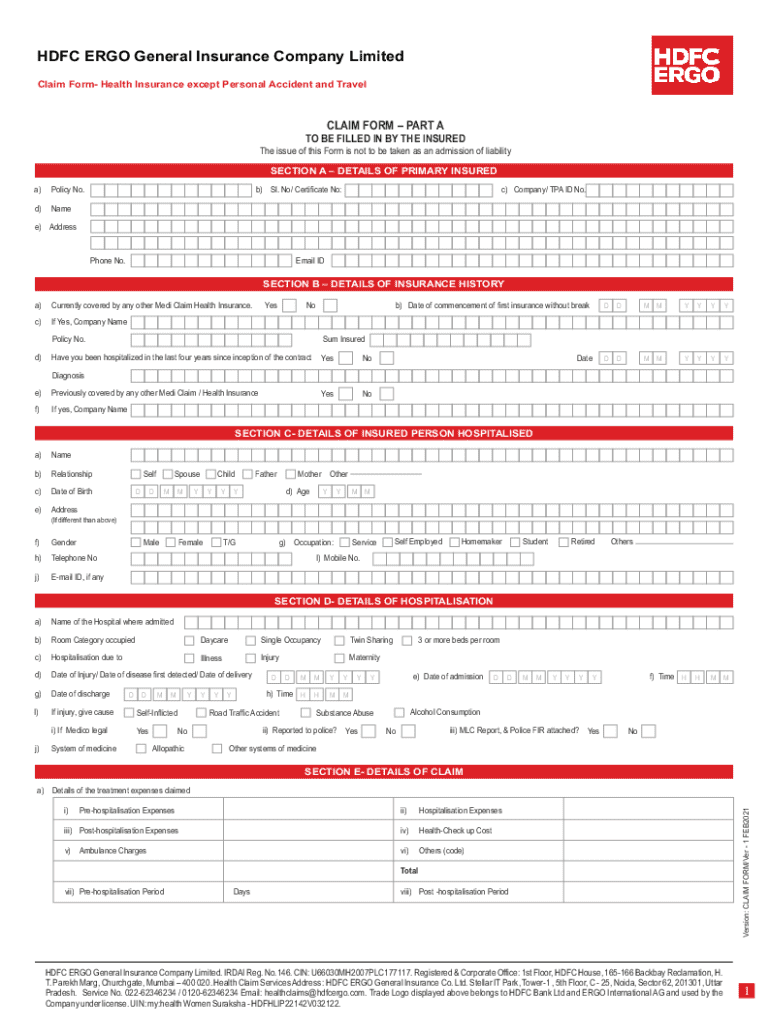

Get the free Claim Form- Health Insurance except Personal Accident ...

Get, Create, Make and Sign claim form- health insurance

Editing claim form- health insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim form- health insurance

How to fill out claim form- health insurance

Who needs claim form- health insurance?

Claim Form - Health Insurance Form: A Comprehensive Guide

Understanding health insurance claims

Health insurance claims are formal requests made to an insurance company to obtain reimbursement for medical services rendered. These forms are crucial for patients who wish to be compensated for their medical expenses, making the correct completion of claim forms paramount. Missing or inaccurate information can lead to claim denials, thereby increasing out-of-pocket costs and causing unnecessary delays.

Properly filling out claim forms not only expedites the reimbursement process but also ensures that you receive the benefits entitled to you according to your policy. There are various types of claims that can be made, including those for hospital stays, outpatient care, and diagnostic testing, all of which can often be completed through a streamlined claims process.

Preparing to fill out your health insurance claim form

Before tackling the claim form, gather all necessary documents to avoid delays and ensure accuracy. Essential documents include your insurance policy information, which provides specifics about your coverage and limits, details from your doctor’s visit, and all itemized medical bills that list the services rendered and their costs.

Understanding insurance terminology is also vital in successfully completing your claim. Key terms include:

Step-by-step guide to completing the health insurance claim form

Carefully following the steps outlined below will help you avoid mistakes and ensure your claim is processed efficiently.

Common mistakes to avoid when completing a claim form

Navigating health insurance claim forms can be challenging, and several mistakes can lead to unnecessary delays or denials. Avoid these common pitfalls:

Tips for ensuring your claim is processed smoothly

To facilitate a smooth claims process, consider the following tips:

Understanding the claims process

Once you submit your claim, it goes through a reviewing process. The insurer will evaluate the form, verify coverage adequacy, and determine eligibility for reimbursement. Understand that claim processing times can vary based on complexity but typically take a few weeks.

Should your claim be denied, it's essential to interpret the reasons accurately. Common denials stem from incomplete information, non-covered services, or insufficient documentation. In such instances, you can appeal the denial by submitting additional information or clarification, taking care to follow specified timelines.

Tools and resources available on pdfFiller

pdfFiller provides an array of features designed to streamline the claims process. Its interactive form completion allows users to enter information easily, while the eSign functionality ensures that your submissions are authorized efficiently. Collaboration tools available on the platform simplify submission processes for teams, enabling multiple users to contribute without confusion.

Additionally, pdfFiller's document management solutions facilitate easy tracking of submitted claims and stored information, ensuring you can access documents whenever necessary.

Real-life examples of claim scenarios

Understanding the nuances of real-life claim experiences can further educate users on best practices. For example, a case study detailing a successful submission showcases the importance of meticulous documentation and prompt follow-up with the insurer to secure timely reimbursement.

Conversely, lessons learned from a claim denial often highlight the need for clarity in communication with health providers and insurance representatives, illustrating how small oversights can lead to substantial financial loss.

User testimonials on how pdfFiller's features enhanced their claim process reveal a clear trend—many users emphasized the ease of document management and how the interactive nature of forms reduced errors significantly.

FAQs about health insurance claim forms

Navigating health insurance claims raises several questions. Here are some common inquiries:

Encouragement to utilize digital tools

Harnessing digital tools like pdfFiller for health insurance forms can significantly enhance efficiency and reduce stress. Users have reported streamlined processes, fewer inaccuracies, and quicker responses by utilizing the features available on this platform.

Exploring the interactive features on pdfFiller can empower individuals and teams, ensuring that navigating health insurance claim forms becomes a less daunting and more successful endeavor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute claim form- health insurance online?

How do I edit claim form- health insurance in Chrome?

How do I edit claim form- health insurance on an Android device?

What is claim form- health insurance?

Who is required to file claim form- health insurance?

How to fill out claim form- health insurance?

What is the purpose of claim form- health insurance?

What information must be reported on claim form- health insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.