Get the free P.F.A. Purchase Contract Revenue Bonds - IIS Windows Server

Get, Create, Make and Sign pfa purchase contract revenue

Editing pfa purchase contract revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pfa purchase contract revenue

How to fill out pfa purchase contract revenue

Who needs pfa purchase contract revenue?

PFA Purchase Contract Revenue Form: A Comprehensive Guide

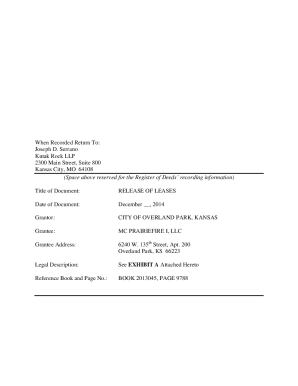

Understanding the PFA purchase contract revenue form

The PFA Purchase Contract Revenue Form serves as a vital document in business transactions, particularly for those involved in purchasing agreements. This form documents the financial aspects related to the purchase, ensuring both parties understand their financial obligations. Understanding its purpose is essential for individual and team efficiency in managing documents effectively.

Its significance extends beyond mere documentation; it acts as a safeguard that confirms the buyer’s intent and the seller's agreement on terms, establishing a clear record that can be referenced throughout the contract's duration. Additionally, by utilizing this form, individuals and teams can streamline their document management processes.

General overview of PFA purchase contracts

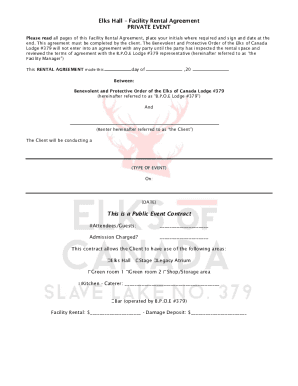

A purchase contract is a legally binding agreement between a buyer and a seller, detailing the terms and conditions of an exchange of goods or services. Within this framework, the PFA Purchase Contract Revenue Form plays a crucial role by providing a structured way to outline the revenue side of transactions, promoting clarity in the financial terms agreed upon by both parties.

Common terminology within PFA purchase contracts includes terms like 'consideration,' which refers to what is being exchanged, and 'default,' indicating what occurs if either party fails to uphold their part of the agreement. Recognizing and understanding these terms is paramount for effective communication between the contracting parties.

Preparing to fill out the PFA purchase contract revenue form

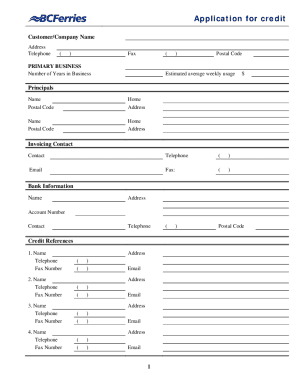

Before filling out the PFA Purchase Contract Revenue Form, it’s crucial to gather all required information. Typically, this includes personal information such as your full name and contact details, along with business specifics like your business name, address, and tax identification number. Financial details are equally important, including the purchase amount and payment terms.

Understanding the implications of the information provided on the form cannot be understated. For example, inaccuracies in financial information can lead to legal complications or disputes down the line, making it essential to be diligent and thorough when completing the form.

Interactive tools for document creation

Utilizing interactive tools can significantly enhance the efficiency of filling out the PFA Purchase Contract Revenue Form. The pdfFiller platform offers robust PDF editing capabilities, enabling users to modify the form effortlessly without compromising its integrity. This is particularly useful for making last-minute changes to terms or figures without starting from scratch.

Additionally, features like eSigning streamline the approval process. Instead of printing and scanning signatures, team members can sign documents electronically, saving time and reducing logistical challenges. Collaborating directly on the form facilitates real-time updates, allowing multiple users to work simultaneously and clarify roles within the transaction.

Step-by-step instructions for completing the PFA purchase contract revenue form

Filling out the PFA Purchase Contract Revenue Form involves several key steps that should be approached methodically. Start by gathering all necessary documents that provide the required information, such as prior agreements, invoices, and identification. Having everything organized will streamline the form completion process.

Next, input the required information into the form, ensuring accuracy at every step. Take advantage of interactive features like using pre-made templates for efficiency and easy insertion of required signatures. After completing the form, it is essential to review it meticulously for any errors or omissions before saving and exporting the final document.

Managing your PFA purchase contract revenue forms

Effective document management practices are essential for keeping your PFA Purchase Contract Revenue Forms organized and easily accessible. It's recommended to adopt a standardized naming convention for files, which can include details such as the date and parties involved to facilitate quick identification.

Organizing and storing your forms on pdfFiller provides the advantage of a cloud-based approach, enabling secure access from any location. This is particularly valuable for teams that collaborate remotely, ensuring everyone has access to the most current version of the document. Tips for easy retrieval might include creating folders based on project names or clients.

Common mistakes to avoid with the PFA purchase contract revenue form

When completing the PFA Purchase Contract Revenue Form, it's essential to be aware of common pitfalls that can lead to complications or invalid agreements. Frequent errors include providing incorrect financial details or failing to include all necessary signatories, which can jeopardize the validity of the contract.

To prevent these mistakes, take the time to review all submitted information before finalizing the document. Implementing a secondary review process, where another party checks the form for errors, can also help ensure accuracy and completeness.

Staying compliant with legal regulations

Compliance with legal regulations is paramount when dealing with the PFA Purchase Contract Revenue Form. Familiarize yourself with the relevant legal framework that governs purchase contracts, which can vary between regions and industries. Ignorance of local laws can lead to non-compliance and potential legal actions.

Post-issuance compliance is also critical. This means monitoring the terms of the contract actively and ensuring that all parties adhere to the stipulations outlined within the agreement. A legal review prior to finalization can identify any potential compliance issues that could arise.

Industry insights on PFA forms and contracts

The landscape of PFA forms and contracts is continuously evolving, with emerging trends that streamline document management processes. Digital solutions like pdfFiller are leading this transformation by incorporating innovative features that enhance the user experience. From advanced editing options to collaborative tools, these innovations are reshaping how businesses operate.

Staying abreast of these trends helps individuals and teams adapt to changing operational needs. For example, integrating automation into the form-filling process significantly reduces the time required to complete contracts and minimizes human errors, thereby increasing efficiency.

Industry-specific use cases for PFA purchase contract revenue forms

PFA Purchase Contract Revenue Forms are utilized across various sectors, including real estate, retail, and service industries. Each sector applies the form differently based on unique needs. For instance, in real estate, the form may facilitate the purchase of property, outlining terms like deposit amounts and financing details.

Furthermore, success stories highlight businesses that have improved efficiency significantly by adopting online document solutions like pdfFiller. These companies have managed to simplify their purchasing processes, reduce turnaround time for contracts, and improve overall satisfaction for both buyers and sellers.

Frequently asked questions (FAQs) about PFA purchase contract revenue forms

As users navigate the complexities of the PFA Purchase Contract Revenue Form, several common inquiries arise. These often pertain to form completion, compliance with legal standards, and how to address discrepancies. Addressing such questions is critical for empowering users to utilize the form effectively.

For example, frequently asked questions include clarifications on how to amend errors after submission and understanding the proper timelines for retaining and storing forms. By providing clear, actionable answers to these concerns, users can approach the document with confidence.

Contact information and support resources

For further assistance with the PFA Purchase Contract Revenue Form, users are encouraged to reach out to customer support available through the pdfFiller platform. They provide comprehensive support options, including direct contact methods and access to a wealth of interactive online resources that can enhance understanding of form management.

Engaging with these resources can improve proficiency in handling documents, reducing errors, and increasing overall user satisfaction. Clearly laid-out support structures ensure that users can find the help they need in a timely and efficient manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pfa purchase contract revenue directly from Gmail?

Where do I find pfa purchase contract revenue?

How do I make edits in pfa purchase contract revenue without leaving Chrome?

What is pfa purchase contract revenue?

Who is required to file pfa purchase contract revenue?

How to fill out pfa purchase contract revenue?

What is the purpose of pfa purchase contract revenue?

What information must be reported on pfa purchase contract revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.