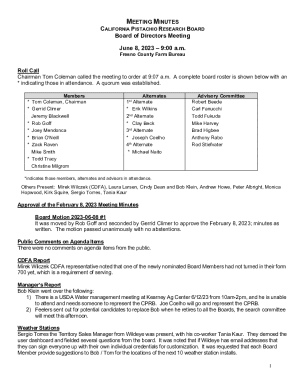

Get the free ETA & Wage and Hour Division, Final Rule, Temporary ...

Get, Create, Make and Sign eta amp wage and

Editing eta amp wage and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out eta amp wage and

How to fill out eta amp wage and

Who needs eta amp wage and?

Understanding ETA AMP Wage and Form: A Comprehensive Guide

Overview of the ETA AMP wage and its importance

The ETA AMP, or Employment and Training Administration Administrative Monetary Penalty, is crucial for maintaining compliance within the labor market. This regulation is designed to impose penalties on non-compliant employers, emphasizing the importance of accurate wage reporting. Understanding the components of ETA AMP wages ensures that both employers and employees are protected legally and financially.

For organizations, comprehending the implications of the ETA AMP wage is vital in avoiding financial penalties and ensuring ethical practices in wage determination. It also serves as a foundation for individuals to know their rights in the workplace. Compliance not only reflects a commitment to lawful conduct but also boosts organizational credibility and operational integrity.

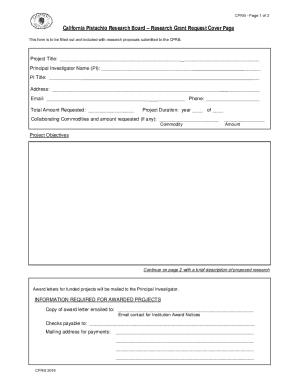

Understanding the form: key components and requirements

The ETA AMP wage form serves as the primary document for reporting wages and ensuring compliance with federal labor laws. This form includes several key sections designed to capture essential wage-related information necessary for accurate reporting.

Successful submission of the ETA AMP wage form mandates the inclusion of specific information from both employers and employees. This allows for a thorough review and compliance check.

Step-by-step guide to filling out the ETA AMP wage form

Filling out the ETA AMP wage form requires careful attention to detail. Here’s a comprehensive step-by-step guide to navigate the process effectively.

Preparation: gathering necessary information

Before starting the form, gather essential documents that provide the necessary data. This preparation phase helps in ensuring that all information is accurate and complete.

Step 1: Accessing the form

To begin, navigate to the official ETA AMP wage form, which is available in PDF format. You can also access it conveniently through platforms like pdfFiller, which streamlines the editing process.

Step 2: Completing the form

Filling in the form requires attention to detail in each specific field. For example, correctly inputting company details and accurate wage data is essential for compliance.

Step 3: Reviewing and editing

Using tools like pdfFiller’s editing features, review the filled form thoroughly. It’s important to check for errors to ensure compliance and to maintain clarity throughout.

Step 4: eSigning and final submission

Once completed, you can eSign the document directly within pdfFiller and follow the established submission guidelines, paying attention to deadlines to avoid potential penalties.

Managing and storing your ETA AMP wage forms

Effective management of ETA AMP wage forms is crucial for any organization. Properly storing these documents allows for easy access during audits and ensures that compliance records are up to date.

Regulatory considerations for ETA AMP wage compliance

The landscape of wage regulations can be complex, but staying informed about the governing laws is necessary for compliance. Regularly reviewing the ETA AMP guidelines is essential for both employers and employees.

Common issues and troubleshooting tips

Filling out the ETA AMP wage form might lead to common issues, such as discrepancies in wage calculations or incomplete submissions. Being aware of these can enhance accuracy.

Interactive tools and resources available on pdfFiller

pdfFiller offers a range of interactive tools that enhance the process of creating and editing the ETA AMP wage form. These features are particularly useful for teams working collaboratively.

Best practices for document management and compliance

Maintaining organized document management systems is essential for effective compliance with the ETA AMP wage regulations. Implementing best practices can minimize errors and improve overall workflow.

Future of wage regulations impacting the ETA AMP form

Emerging trends in wage regulations will undoubtedly affect how the ETA AMP form is structured and used. Staying ahead of these changes requires careful attention to upcoming legislation and alterations in the labor market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my eta amp wage and directly from Gmail?

How can I send eta amp wage and for eSignature?

How do I execute eta amp wage and online?

What is eta amp wage and?

Who is required to file eta amp wage and?

How to fill out eta amp wage and?

What is the purpose of eta amp wage and?

What information must be reported on eta amp wage and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.