Get the free tax policy's role in increasing affordable housing supply for ...

Get, Create, Make and Sign tax policy039s role in

Editing tax policy039s role in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax policy039s role in

How to fill out tax policy039s role in

Who needs tax policy039s role in?

Tax Policy's Role in Form: A Comprehensive Guide for Effective Document Management

Understanding tax policy

Tax policy serves as a framework guiding how governments collect and allocate revenue, impacting various sectors of the economy. Central to tax policy are elements like tax rates, deductions, credits, enforcement measures, and compliance requirements. Each of these components plays a crucial role in the functioning of fiscal systems and informs the financial responsibilities of both individuals and businesses.

The evolution of tax policy in the U.S. has been dynamic, reflecting changing economic landscapes and political priorities. The introduction of the income tax in 1913 marked a significant shift, but numerous reforms have occurred, including significant legislation like the Tax Cuts and Jobs Act in 2017. The ongoing adjustments to tax policy ensure its relevance in promoting economic growth by influencing behavior across the spectrum — from individual spending to corporate investments.

Tax policy's influence on document management

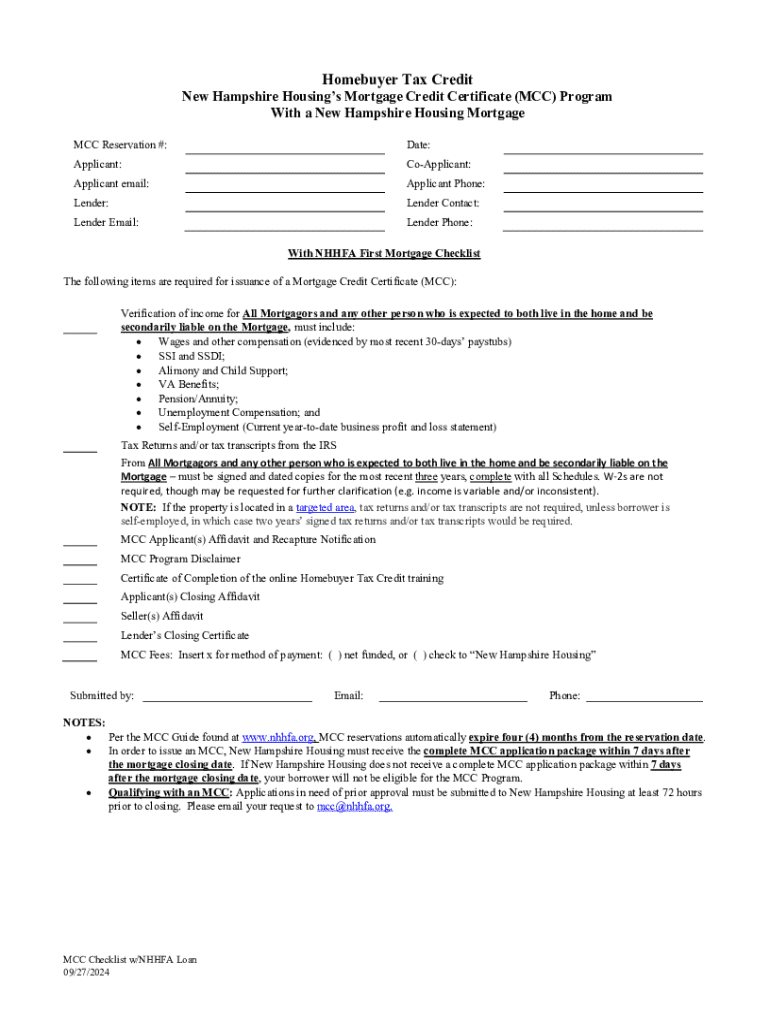

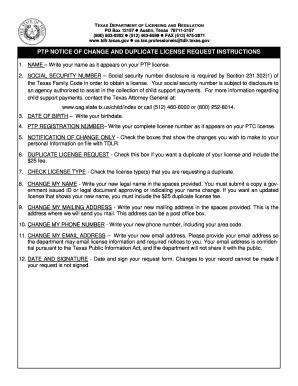

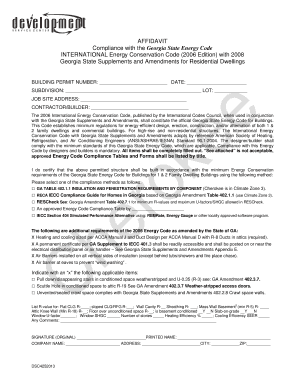

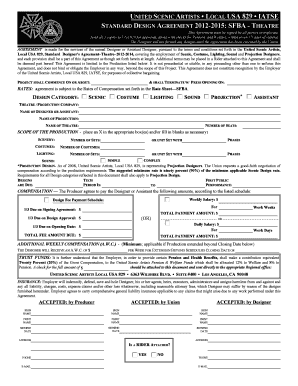

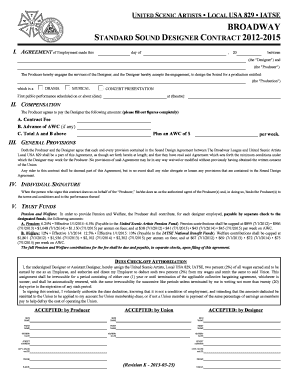

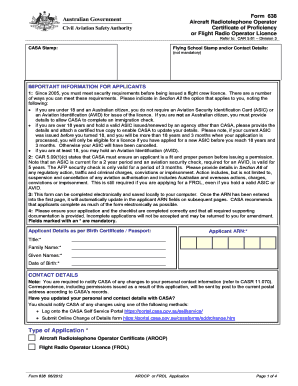

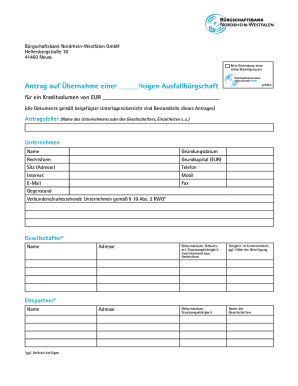

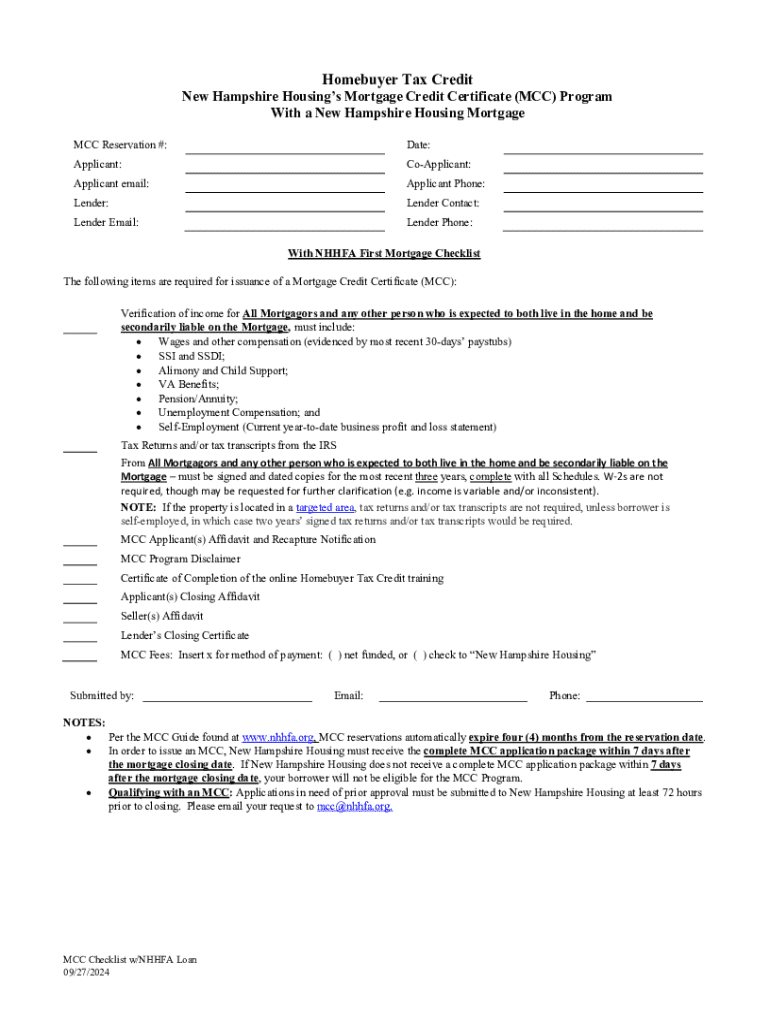

Navigating the world of tax forms requires a robust understanding of the interplay between tax policy and document management. Compliance with regulations involves meticulous attention to detail in submitting various tax forms, including individual, corporate, and non-profit documents. Accurate completion of these forms is not merely a bureaucratic necessity — it is integral to preventing penalties and ensuring eligibility for any due refunds.

The evolving nature of tax laws requires constant updates to forms, which can complicate document management. Changes prompted by new tax regulations necessitate adjustments in the forms and the information they gather, making it crucial for both individuals and businesses to stay informed and adapt accordingly. Digital solutions like pdfFiller significantly streamline the process of tax document creation and adjustment, allowing users to quickly align with the latest tax policies.

Step-by-step guide to important tax forms

Understanding which forms are essential is the first step towards effective tax filing. Individuals typically need to fill out the Personal Income Tax Return (1040), while businesses might require Business Tax Returns (1120 for corporations or 1065 for partnerships). Ensuring every required field is filled out correctly can be daunting but is vital for compliance.

When filling out tax forms, start by gathering all necessary documentation, such as W-2s, 1099s, and any relevant receipts. pdfFiller offers a user-friendly interface that simplifies editing and completing forms electronically. After crafting your form, stepping through a review process can help catch any errors before submission.

Interactive tools to simplify tax document management

Utilizing advanced features like those offered by pdfFiller can transform how tax documents are managed. With tools for PDF editing, users can fill out, sign, and send documents securely, all in one platform. The collaboration features allow for seamless interaction between users and tax professionals, ensuring that help is always just a click away.

Real-life applications illustrate the effectiveness of pdfFiller in tax documentation. Businesses that adopted the platform reported heightened efficiency in tax form preparation, which directly correlates with reduced stress during filing seasons. User feedback consistently highlights how the platform saves time and minimizes errors, echoing the importance of digital solutions in modern document management.

The role of tax policy in digital transformation

Tax policy plays a pivotal role in facilitating digital document solutions. The federal push towards electronic filing (e-filing) demonstrates how regulatory frameworks can promote efficiency and transparency in tax reporting. As more users embrace digital solutions, there are notable benefits such as reduced paper waste, quicker processing times, and enhanced security.

Looking forward, predictions indicate a continual advancement in tax policy toward incorporating technology, with cloud-based document management systems gaining traction. This transition creates opportunities for businesses to streamline compliance processes and maintain accuracy through integrated systems that automatically update based on legislative changes.

Common challenges and solutions in tax document management

Despite advances in tax policy and document management technology, individuals and businesses continue to encounter challenges. Chief among these is the complexity of tax codes, which can obscure crucial details necessary for compliant tax submissions. Additionally, the risk of errors in form submission persists, whether due to oversight or misunderstanding of tax requirements.

Overcoming these challenges requires strategic approaches. Best practices include utilizing digital tools that offer user education and error-checking features, promoting a proactive stance in form management. Furthermore, enlisting professional guidance helps navigate intricate rules effectively and can ultimately lead to reduced stress and fewer mistakes.

Tax policy and its broader economic implications

The implications of tax policy extend beyond individual financial responsibilities. Historical data illustrate how specific tax reforms have influenced economic stability, investment behaviors, and overall growth patterns. Recent research studies consistently reveal the interconnectedness between tax structures and socioeconomic conditions, highlighting the importance of equitable tax policies in fostering economic resilience.

Moreover, the interplay between tax policy, government spending, and investment can create a ripple effect throughout the economy. When tax revenues support infrastructure projects and social programs, communities benefit directly, often leading to increased opportunities for citizens. Conversely, poorly structured tax policies can exacerbate inequalities and hinder necessary investments.

Engaging with tax policy changes

Staying updated with current tax legislation is vital for both individuals and teams engaged in financial planning. Regularly checking trusted resources and subscribing to updates from official tax agencies can ensure adherence to changes as they arise. Engaging in public discussions and advocacy efforts amplifies the collective voice, allowing citizens and businesses to impact tax policy affecting their livelihoods.

Resources focused on advocacy can provide valuable insights and support for navigating tax-related issues. Community platforms can also help assemble like-minded individuals who wish to share experiences and strategies related to tax policy and compliance paths.

Connecting with tax and document management experts

In an era where tax regulations are increasingly complex, collaboration with tax experts becomes vital. Engaging the services of professionals can greatly enhance an individual’s or business's ability to navigate intricate tax codes effectively. Seeking out external expertise offers clarity on tax responsibilities and can also provide tailored advice based on specific financial situations.

In addition to personal connections in the industry, myriad online resources exist to facilitate access to tax and document management support. Joining forums or communities can quell uncertainties, offering peer guideposts as individuals tackle their tax forms. Furthermore, consulting services can offer personalized insights that make the tax filing experience far less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax policy039s role in without leaving Chrome?

Can I create an eSignature for the tax policy039s role in in Gmail?

Can I edit tax policy039s role in on an iOS device?

What is tax policy's role in?

Who is required to file tax policy's role in?

How to fill out tax policy's role in?

What is the purpose of tax policy's role in?

What information must be reported on tax policy's role in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.