Understanding Credit Card Authorization Forms in Business Transactions

Understanding credit card authorization forms

A credit card authorization form is a crucial document that allows a business to collect payment from a customer’s credit card. This form provides the necessary permission for a one-time or recurring transaction, ensuring that the cardholder agrees to the charges made to their card. The primary purpose of this form is to protect both the merchant and the cardholder by authorizing the payment upfront, thus facilitating a seamless payment processing experience.

Credit card authorization forms are integral in the e-commerce landscape, where the physical presence of a cardholder is often absent. They play a vital role in creating a secure transaction environment, reducing the risk of fraudulent activities, and enhancing customer trust.

Definition: A written permission from a cardholder for a merchant to charge their credit card.

Purpose: To facilitate payment processing while ensuring consent from the cardholder.

Importance: Essential for preventing chargebacks and protecting both parties involved.

Differences between authorization and other payment forms

Understanding the distinctions between credit card authorization forms and other payment-related documents is essential. Unlike invoices, which request payment after services or products have been delivered, a credit card authorization form is completed in advance, securing the merchant's right to access funds. Receipts serve as proof of completed transactions post-authorization, while charge forms are often used for specific transactions without ongoing payment agreement.

These differences are vital in establishing a clear payment process and ensuring all parties understand their rights and responsibilities.

Key terms associated with credit card authorization forms

Several key terms frequently surface when discussing credit card authorization forms. Understanding these can help clarify any confusion surrounding payment processes.

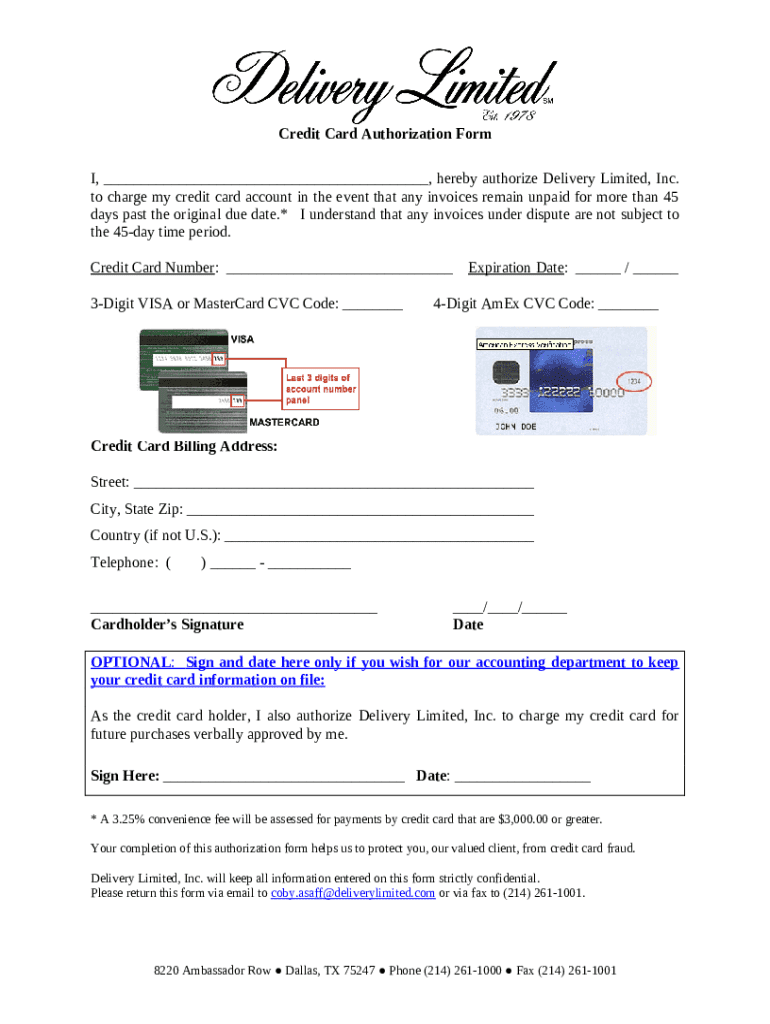

CVV: The Card Verification Value, a security feature that helps reduce the risk of fraudulent transactions.

Card-on-file: Refers to keeping a customer's card information securely stored for future transactions.

Chargeback: A reversal of a transaction when a customer disputes a charge, often seen as a risk that authorization forms can help mitigate.

The importance of credit card authorization forms for businesses

Credit card authorization forms are vital tools for businesses, especially in preventing chargeback abuse. Chargebacks occur when a cardholder disputes a charge, and their bank reverses the transaction. This can be costly for businesses, leading to loss of revenue and increased fees from payment processors.

Using a credit card authorization form effectively mitigates risk by providing documented consent from the cardholder, thus serving as a defense during disputes. Having robust records of prior agreements through these forms can strengthen a business’s position when faced with chargebacks.

Legally obligated to use authorization forms?

While the use of credit card authorization forms is not universally mandated by law, many industries strongly recommend or require their use to protect against fraud. Different jurisdictions may have specific regulations guiding their implementation, particularly in sectors involving recurring payments, like subscriptions and utilities.

Understanding your legal obligations based on your business location and the nature of services offered is essential in establishing best practices around payment processing.

Components of a credit card authorization form

A well-structured credit card authorization form includes several essential components. Firstly, it must capture the cardholder’s information, ensuring clarity about who is authorizing the transaction. This includes fields for the cardholder’s name, billing address, and contact details. Payment details such as credit card number, expiration date, and CVV are critical to successfully processing the transaction.

Additionally, the form should outline any terms and conditions, clearly stating the rights and obligations of both parties. This transparency helps in building trust and minimizing potential disputes over authorization.

Information about storage and retention

When handling credit card authorization forms, adhering to best practices for their storage and retention is crucial. These documents should be kept secure and protected against unauthorized access to maintain the confidentiality of cardholder information. Implementing encryption methods and access controls can be effective strategies.

As for retention periods, it’s often recommended to keep these forms for at least 1-3 years after the last transaction, depending on jurisdictional requirements and company policy. This ensures that in the event of a dispute, you have adequate documentation to support your claims.

How to create a credit card authorization form

Creating an efficient credit card authorization form does not have to be a daunting task. Many businesses can utilize document templates available online to streamline the process. Begin by identifying what fields to include based on the components we discussed earlier.

To ensure a smooth experience, consider the following steps when filling out your form:

Select a reliable template that meets your specific needs.

Fill in the cardholder information, ensuring all fields are accurate.

Input payment details, ensuring to highlight the importance of the CVV.

Clearly state the terms and conditions, requiring the cardholder's acknowledgment.

Provide a space for the cardholder to sign, confirming their consent.

Editing and personalizing your form with pdfFiller

With pdfFiller, customizing your credit card authorization form can be significantly more straightforward. Take advantage of interactive tools that allow you to modify templates easily and tailor them to your unique business needs. You can add your branding elements, customize fields, and even adjust the document layout.

Additionally, using pdfFiller’s cloud-based platform means you can access, edit, and manage your forms from anywhere, ensuring your business remains agile and responsive to client needs.

Use cases: when to utilize a credit card authorization form

Credit card authorization forms are particularly useful in various business contexts. They are essential when dealing with recurring payments, such as those commonly seen in subscription services or memberships. This guarantees that businesses can charge customers at agreed intervals without needing additional consent each time.

Remote services and deliveries also benefit from these forms. Ensuring that the customer has authorized the transaction before providing services or products reduces the risk of disputes and chargebacks, fostering smoother transactions.

Examples of businesses that benefit most from authorization forms

Many types of businesses can significantly benefit from using credit card authorization forms. E-commerce platforms that ship goods directly to customers often make them a standard part of their transaction process. Subscription services, like streaming and meal kit deliveries, also utilize these forms to ensure ongoing payments are authorized.

Rental companies, whether for cars, equipment, or property, frequently require credit card authorization to secure reservations and guarantee payment, further highlighting the versatility and necessity of these forms.

FAQs about credit card authorization forms

As businesses increasingly rely on credit card authorization forms, several common questions and concerns tend to arise. One frequent inquiry revolves around the use of the CVV on the forms. It’s important to clarify that including the CVV is critical for enhancing security, but storing it post-transaction is not compliant with PCI DSS regulations. Educating cardholders about this can build trust.

Another typical concern involves errors when filling out forms. Common mistakes include incomplete information or failing to secure a signature. Implementing clear instructions and reminders can mitigate these issues.

Troubleshooting common issues

If faced with challenges while utilizing credit card authorization forms, several troubleshooting tips can help. Firstly, always double-check that the cardholder's information is complete and accurately filled out to avoid processing delays. Ensuring compliance with PCI security standards can also help smooth out any potential operational blocks.

For any technical issues related to form management, accessing pdfFiller’s support resources can provide solutions and streamline your document processes effectively.

More resources on credit card authorization forms

For businesses ready to implement credit card authorization forms, customizable templates are readily available through pdfFiller. These templates provide a foundation that you can adjust to meet your specific requirements, ensuring you have a robust system for managing these documents.

In addition to templates for credit card authorization, pdfFiller offers various guides and tools for optimal document management, making your business processes more efficient and user-friendly.

Interlinked topics for further reading

Exploring related content on payment processing can widen your understanding of best practices within your business payment framework. Further reading on the use of invoices, payment links, and other essential payment documents can enhance your knowledge base.

Incorporating these insights can also help develop a comprehensive strategy to manage your payment solutions effectively, ultimately supporting your business growth.