A Comprehensive Guide to the State Revenue Legislation Amendment Form

Understanding the state revenue legislation amendment form

The State Revenue Legislation Amendment Form serves as a crucial instrument in the realm of state taxation and revenue management. This form is designed to facilitate changes to existing tax legislation as mandated by new laws or amendments. Its primary purpose is to ensure that taxpayers, both individuals and businesses, are fully aware of new regulations and how they directly impact their financial obligations.

Amendments to tax legislation can significantly influence taxpayers' rights, compliance requirements, and liabilities. The State Revenue Legislation Amendment Form helps in clarifying any changes, such as updated tax rates or eligibility criteria for deductions, which need to be communicated swiftly to avoid confusion and ensure compliance.

Key changes in recent legislation

Recent legislative amendments have introduced a variety of changes affecting how taxes are collected at the state level. For instance, alterations in tax brackets or the introduction of new tax credits require immediate updates to the relevant documentation, including the State Revenue Legislation Amendment Form.

Such changes often have significant implications. Individuals may find themselves subject to different tax rates, while businesses might encounter new compliance requirements or enhanced incentives. It’s vital for all taxpayers to stay informed about these amendments to avoid penalties and maximize their benefits.

Eligibility and requirements

Understanding who needs to use the State Revenue Legislation Amendment Form is critical for compliance. Generally, this form is required for individual taxpayers and organizations that are affected by recent legislative changes in state revenue laws. Those who have recently experienced a change in their personal or business tax situations are typically obligated to fill out the form.

However, exemptions do apply. Certain categories, such as non-resident individuals or entities exempt from state income tax, may not need to file this form. It's essential to review the specific criteria outlined by your state's revenue department to determine if you need to take action.

Necessary information and documentation

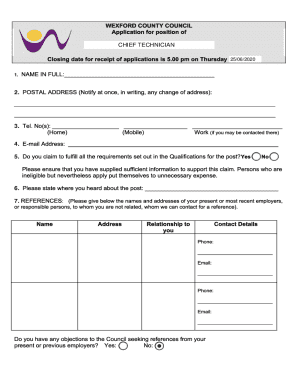

When preparing to complete the State Revenue Legislation Amendment Form, specific personal and financial information will be necessary. Taxpayers should be ready to provide details such as their name, address, social security number or tax identification number, and business information if applicable.

In addition to these personal details, it’s crucial to gather supporting documentation. This may include previous tax returns, proof of income, and any relevant documents that verify the changes in your financial circumstances. Having these materials on hand will streamline the filing process and minimize the risk of errors.

Step-by-step guide to completing the form

To begin with, accessing the State Revenue Legislation Amendment Form is simple via pdfFiller's user-friendly platform. By navigating to pdfFiller, you can locate the form easily using the search function, making it convenient to start your filing process without any hassle.

Filling out the form accurately is crucial. Each section must be completed with precise information. Typically, the initial section requires personal details, followed by revenue information that pertains to the recent legislative changes.

Personal information: Provide your complete name, address, and identification number.

Revenue details: Include any relevant updates to your income or financial situation based on the new legislation.

Signatures and declarations: Ensure you sign and date the form to validate your submission.

Being mindful of common mistakes can save you from future troubles. Ensure all fields are completed and that numbers are accurate to avoid processing delays or potential penalties.

Editing and customizing your submission

If corrections or changes are required after the initial submission, pdfFiller offers various editing tools to assist you in making necessary modifications. The platform enables users to personalize and adjust their submissions efficiently, facilitating a smooth experience even after the form is submitted.

Utilizing these editing features ensures that all information is correct and up to date, reflecting any changes that happen post-filing.

eSigning and submitting the form

When it comes to eSigning the State Revenue Legislation Amendment Form, understanding the legal ramifications is crucial. eSignatures are recognized in many jurisdictions, making them a viable option for submitting your document without the need for printed papers.

To eSign your document on pdfFiller, follow these steps: selecting the eSign option on the platform enables a straightforward process where you can create and insert your signature digitally.

Click on the eSign option on pdfFiller.

Follow prompts to create your signature.

Insert your signature into the document.

After eSigning, ensure that you thoroughly review your form before the final submission. Once satisfied, submit the form online directly through pdfFiller. You can track its status and receive notifications regarding its processing.

Managing your submitted forms

Accessing past submissions is another feature that pdfFiller offers, which allows users to review their previously submitted forms whenever needed. This function is particularly useful for future reference and subsequent tax filings.

Furthermore, collaborating with team members is made simpler with pdfFiller. You can easily share your document with others involved in the tax filing process, facilitating efficient communication and verification.

Resources for further assistance

pdfFiller provides a range of interactive tools designed to assist users in form preparation and management. These include checklists and calculators tailored to maximize efficiency during the filing process.

In addition, accessing expert support is straightforward. pdfFiller offers customer support ready to assist users with queries related to state revenue laws or the amendment form specifically, ensuring you never navigate these waters alone.

Best practices for compliance

Staying updated on legislative changes is vital for individuals and businesses alike. Engage with reliable sources, subscribe to newsletters, or attend local seminars focused on state taxation to educate yourself continually. Awareness will serve to keep you compliant and avoid unexpected liabilities.

Additionally, it helps to familiarize yourself with common FAQs and troubleshooting tips regarding the State Revenue Legislation Amendment Form. For instance, be aware of the typical issues encountered, such as incorrect information or missing signatures, and know how to address them promptly.

Related forms and legislation

In navigating state taxation, you may come across other forms that are equally important for compliance. Various annual tax returns, local business licenses, or industry-specific forms should also be considered to avoid potential pitfalls.

Understanding related legislation impacting taxpayers can further enhance compliance. State laws vary significantly, so being aware of local policies affecting your situation can make all the difference.

Leveraging pdfFiller for document management

Choosing pdfFiller offers numerous benefits for those looking to manage the State Revenue Legislation Amendment Form effectively. It provides an intuitive interface that simplifies the editing process, ensuring that users can manage documents effortlessly from any device.

Moreover, the cloud-based nature of pdfFiller enhances accessibility and collaboration, allowing multiple team members to interact with the form concurrently. User testimonials consistently affirm that this platform aids in reducing the stress and complications often associated with document preparation.