Get the free Beneficiary Change Form - Option B (If Member Dies After ...

Get, Create, Make and Sign beneficiary change form

How to edit beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change form

How to fill out beneficiary change form

Who needs beneficiary change form?

Comprehensive Guide to the Beneficiary Change Form

Understanding the beneficiary change form

A beneficiary change form is a crucial document used to designate or update the individuals or entities that will receive your assets upon your passing. This form is essential for various accounts, including life insurance policies, retirement accounts, and even certain trusts. Ensuring that your beneficiary information is current can prevent potential legal disputes and make the transition of assets smoother for loved ones.

Keeping your beneficiary information up to date is crucial because life circumstances change—such as marriage, divorce, or the death of a loved one—that necessitate a reassessment of who should inherit your assets. If your beneficiary details are outdated, it could lead to complications, such as your estate following outdated wishes during the distribution process.

Who needs a beneficiary change form?

Individuals with life insurance policies, retirement accounts such as an IRA or 401(k), and trust accounts should utilize a beneficiary change form whenever needed. Common scenarios requiring a change include.

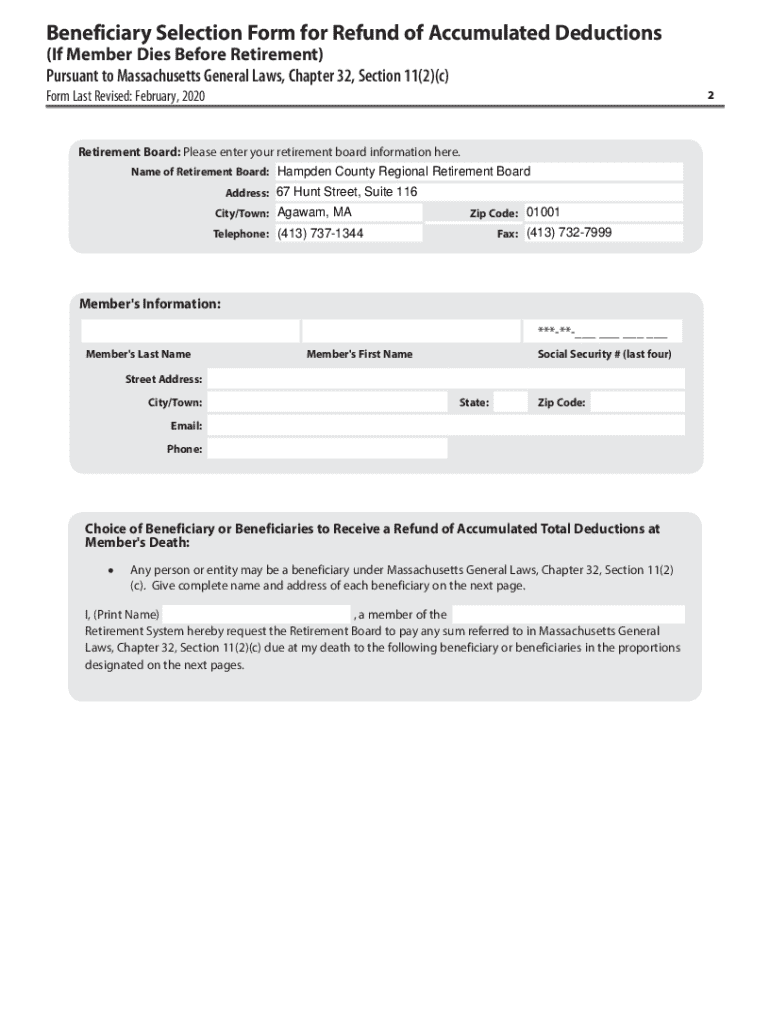

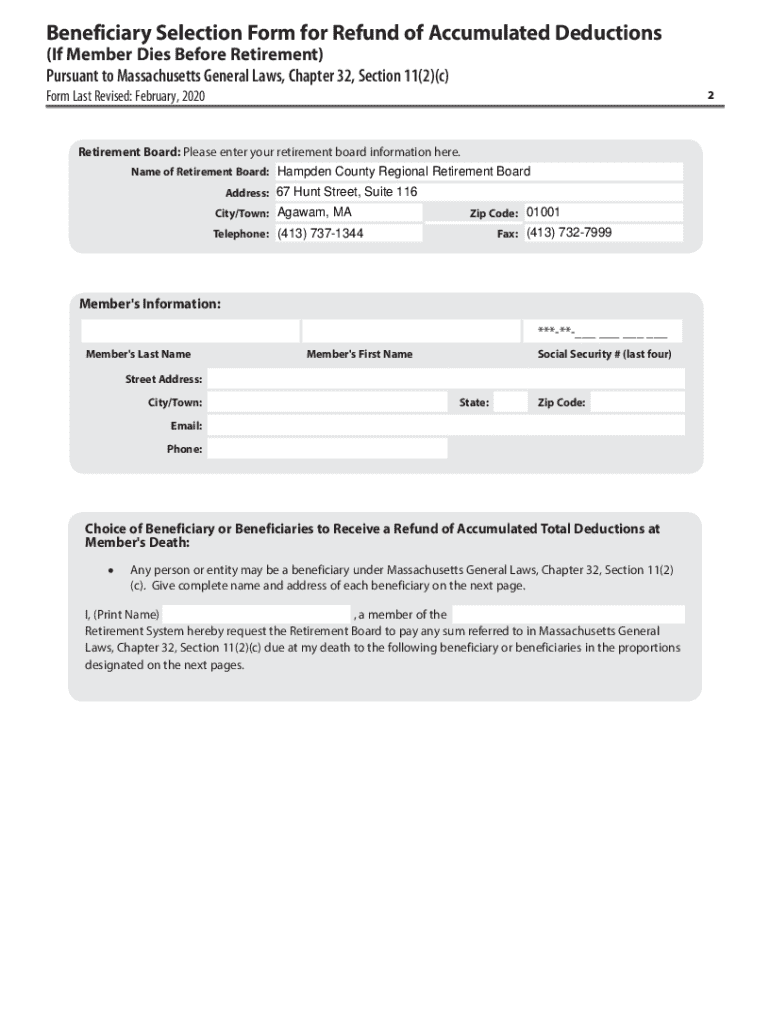

Key components of a beneficiary change form

A properly filled-out beneficiary change form consists of several key sections. The personal information section requires details such as your full name, contact information, and policy number. This section is critical, as inaccuracies can delay the processing of your request.

Next is the beneficiary information section, where you’ll specify the type of beneficiaries—primary and contingent. Primary beneficiaries are the first in line to receive your assets, while contingent beneficiaries serve as backups in case the primary ones cannot inherit. Make sure you provide their full name, relationship to you, and the percentage of the asset they are to receive.

Lastly, do not forget to sign and date the form once it is complete. Many institutions also require a witness or notary verification, hence understanding local laws and institution requirements can be beneficial.

How to fill out a beneficiary change form

Filling out a beneficiary change form can be straightforward if you follow the steps outlined below.

Common mistakes to avoid include leaving out vital information, using outdated details, and failing to update previous beneficiaries when making changes. Thoroughly reviewing the entire form can save you and your loved ones from future complications.

Editing and updating the beneficiary change form

Editing your beneficiary change form is essential when life events occur that might affect your decisions. Such events could include significant changes like marriage, divorce, or the birth of children. It’s advisable to review and edit your form regularly, ideally every few years or after major life changes.

If you need to make a correction to a submitted form, ensure you notify your financial institution of the initial error. They might require you to fill out a new beneficiary change form or provide specifics on how to correct the initial submission. With digital solutions available, note that platforms like pdfFiller allow for easy edits online.

Alternative options for managing beneficiary information

When determining how to manage your beneficiary information, consider your comfort with digital versus paper forms. While traditional paper forms are widely accepted, many institutions, including various financial organizations, now offer digital forms that streamline the process.

Using pdfFiller, for example, makes it straightforward to edit and format your beneficiary change form online. The platform enables users to fill out their forms seamlessly, making adjustments as needed without the hassle of reprinting or redrafting documents.

Submission process for the beneficiary change form

Once your beneficiary change form is complete, the next step is submission. Depending on your institution, you might submit it via mail, email, or through an online portal. Understanding where to send your completed forms is crucial, as it could differ between insurance companies and financial institutions.

While submitting, pay attention to any deadlines or specific processing times. Upon submission, it’s vital to verify that your changes have been processed. Most institutions provide a confirmation once they have approved your changes, so keep a record of your submitted forms to ensure you can reference them later.

Utilizing pdfFiller for your beneficiary change form

pdfFiller offers comprehensive features to enhance your experience when dealing with beneficiary change forms. With this platform, you can easily fill, edit, and sign forms online, enabling a smooth transition in updating your beneficiary information. Collaboration tools make it easier for teams or family members to work together on these vital documents.

Moreover, pdfFiller provides excellent document storage and management solutions, ensuring you can access your forms anytime, anywhere. The eSignature capabilities also streamline the signing process, allowing for quick processing of your updates.

Tips for ensuring your beneficiary designations are up to date

Regular reviews of your beneficiary information are recommended. Consider conducting these reviews every few years or after significant life events. Life events, specific such as marriage, divorce, the arrival of children, or the passing of a loved one, should prompt a reassessment of your designated beneficiaries.

By establishing a routine for checking and updating your beneficiary change form, you not only protect your assets but also ensure they are distributed according to your current wishes, avoiding confusion and potential family conflicts later on.

FAQs about beneficiary change forms

Addressing frequent questions can help you gain clarity on your beneficiary designations.

Additional considerations and best practices

Consider the financial implications of your beneficiary designations. For instance, the tax impact on assets can vary depending on the beneficiary's relationship to you. Spouses often benefit from certain tax breaks that other beneficiaries might not enjoy.

In complex situations, such as blended families or significant estates, consulting a financial advisor or an attorney specializing in estate planning can be invaluable. This consultation ensures that your beneficiary designations are set up to meet your needs and comply with all laws and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary change form for eSignature?

How do I execute beneficiary change form online?

Can I edit beneficiary change form on an Android device?

What is beneficiary change form?

Who is required to file beneficiary change form?

How to fill out beneficiary change form?

What is the purpose of beneficiary change form?

What information must be reported on beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.