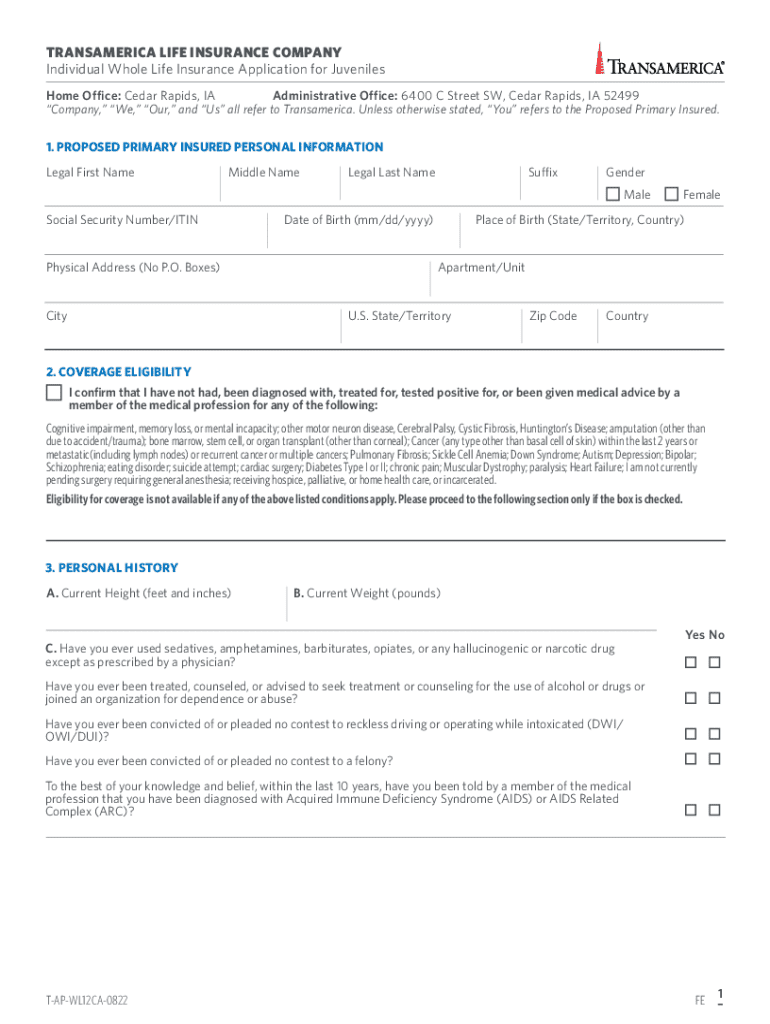

Get the free Transamerica Life Insurance Company Home Office

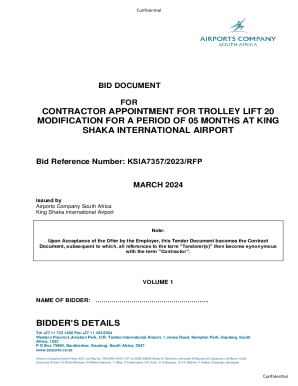

Get, Create, Make and Sign transamerica life insurance company

Editing transamerica life insurance company online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transamerica life insurance company

How to fill out transamerica life insurance company

Who needs transamerica life insurance company?

Transamerica Life Insurance Company Form: A Comprehensive Guide

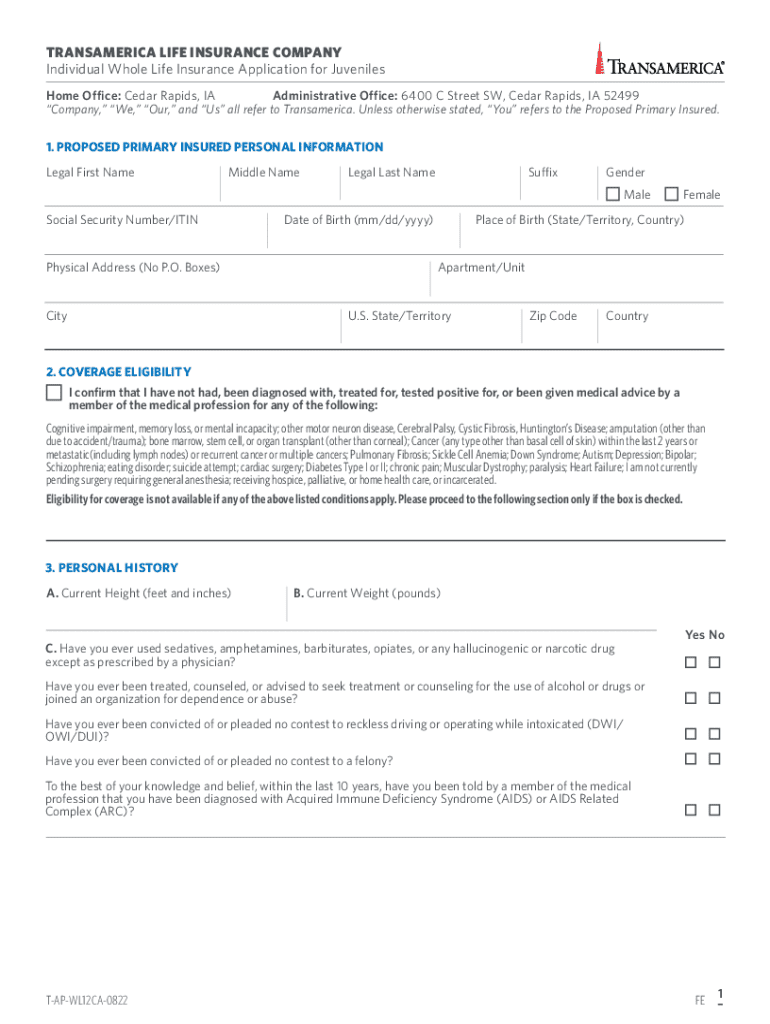

Understanding the Transamerica Life Insurance Company form

Transamerica Life Insurance Company is a prominent provider in the insurance sector, known for its diverse range of life insurance products and financial services. Understanding the Transamerica Life Insurance Company form is critical for anyone looking to secure their financial future with life insurance. This form serves as the initial step in obtaining coverage, capturing essential personal information and health details that determine eligibility and premium rates. Transamerica offers various types of policies, each suited to different needs, such as term life, whole life, and universal life insurance, allowing individuals to choose the coverage that best aligns with their financial goals.

Completing the life insurance form accurately ensures that the underwriting process proceeds smoothly, facilitating prompt issuance of the policy. The importance of this form cannot be overstated, as it lays the groundwork for the relationship between the insurer and the insured.

Types of Transamerica life insurance forms

Transamerica provides various forms to cater to different aspects of life insurance. Understanding these forms is essential for effectively navigating the application process.

Preparing to fill out the Transamerica life insurance form

Prepare to fill out the Transamerica life insurance form efficiently by gathering all essential documents beforehand. This ensures that you can provide accurate information and avoids potential delays in your application process. Key documents include personal identification, medical history records, and financial documents.

Additionally, it's crucial to understand key terms associated with life insurance policies. Knowing the definitions of beneficiary, coverage amount, and premiums can significantly enhance your confidence while completing the form.

Step-by-step guide to filling out the Transamerica life insurance form

Filling out the Transamerica life insurance form may seem daunting, but following a systematic approach simplifies the process. Begin by accessing the form via pdfFiller, a user-friendly platform for managing documents online.

Editing and managing your completed form on pdfFiller

Once you've filled out the Transamerica life insurance form, leveraging pdfFiller's editing tools creates an opportunity for refinement and accuracy. This platform allows users to make modifications easily, so your form is always up-to-date.

Signing the form

Once reviewed, it’s time to sign your completed form. pdfFiller supports various digital signature options, making it convenient and secure. The legal validity of e-signatures has been recognized in many jurisdictions, including life insurance applications, provided you follow the recommended digital signing protocols.

Submitting the completed Transamerica life insurance form

With the form signed, the next crucial step is submission. Transamerica offers multiple methods for submitting the completed application, each designed for your convenience.

After submission, it's advisable to track your application status, which can typically be done through Transamerica's customer service or online platform.

Frequently asked questions (FAQs)

Contacting Transamerica for further assistance

If you encounter any challenges during the process, don't hesitate to reach out to Transamerica's customer support. They offer several channels for assistance, ensuring you receive the help you need.

Navigating the insurance process is made easier with good communication, so don’t overlook the value of reaching out to their support resources.

Additional tools and resources available on pdfFiller

Beyond the Transamerica life insurance form, pdfFiller offers a wealth of features that simplify document management. Explore their extensive library of template forms, which can save you time and effort.

Key benefits of using pdfFiller for your life insurance forms

Engaging with pdfFiller for your life insurance forms offers numerous advantages. The platform is designed with user accessibility in mind, allowing you to manage your documents from anywhere with internet access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my transamerica life insurance company in Gmail?

Where do I find transamerica life insurance company?

How can I fill out transamerica life insurance company on an iOS device?

What is transamerica life insurance company?

Who is required to file transamerica life insurance company?

How to fill out transamerica life insurance company?

What is the purpose of transamerica life insurance company?

What information must be reported on transamerica life insurance company?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.