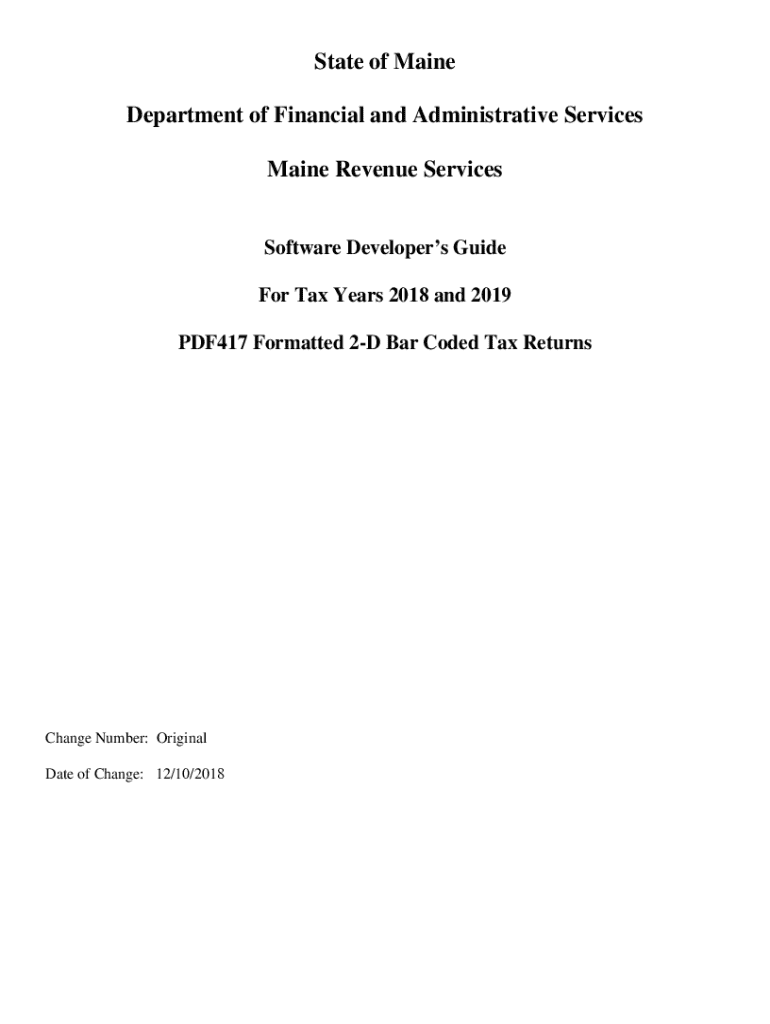

Get the free For Tax Years 2018 and 2019

Get, Create, Make and Sign for tax years 2018

Editing for tax years 2018 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for tax years 2018

How to fill out for tax years 2018

Who needs for tax years 2018?

Navigating Your 2018 Tax Year Forms: A Comprehensive Guide

Overview of 2018 tax year forms

Filing your taxes correctly is crucial to avoid penalties and ensure you maximize any potential refunds. The 2018 tax year introduced significant changes, particularly with the tax reform bill passed in late 2017, impacting the forms you need to know. Familiarizing yourself with the essential forms allows you to manage your tax obligations more efficiently.

Key forms for the 2018 tax year include the redesigned Form 1040, as well as its variants: Form 1040A and Form 1040EZ. Understanding the differences between these forms is essential for your accurate filing. Additionally, updates to deductions and credits have changed how taxpayers approach their returns.

Main 2018 tax forms for individuals & families

The primary form used by individual taxpayers is Form 1040: U.S. Individual Income Tax Return. This form is comprehensive and suitable for all types of taxpayers, whether they are claiming various deductions or reporting complex income sources.

Form 1040A is a simplified version and is designed for individuals with a straightforward tax situation, such as those with a taxable income below $100,000 and claiming certain credits.

Lastly, Form 1040EZ, which is exclusively for single and joint filers with no dependents and under a limited income threshold, offers the simplest filing process but comes with its own limitations. It does not allow itemized deductions and has a maximum income cap along with restrictions on age and filing status.

Supporting forms and schedules

Among the supporting forms, Schedule A is essential for claiming itemized deductions. Taxpayers can choose between standard and itemized deductions — it's critical to assess which benefits your financial situation more. Schedule C assists self-employed individuals in reporting their business profits, losses, and expenses.

A challenging aspect of managing your finances as a self-employed individual is knowing which expenditures to claim. Familiarize yourself with allowable deductions on Schedule C, as this impacts your taxable income significantly.

Filing options and instructions for 2018 returns

Filing options for your 2018 tax return include electronic filing (e-filing) and paper filing. E-filing is often faster and more efficient, minimizing common errors. The pdfFiller platform streamlines this process with convenient features.

To e-file your returns, simply log into pdfFiller, upload your completed forms, and follow the step-by-step instructions to submit them electronically. If you prefer paper filing, you can download the necessary forms, print them, and mail them to the appropriate IRS address.

Tax credits and deductions for 2018

The 2018 tax year included significant tax credits, notably the expanded Child Tax Credit. Eligible families can receive up to $2,000 per qualifying child under the age of 17, helping to reduce tax liability substantially. Understanding who qualifies is essential for claiming this benefit.

In addition, the American Opportunity Tax Credit offers tax breaks for college expenses, allowing nearly $2,500 off per student, while the Lifetime Learning Credit, though different in scope, helps even those pursuing lifelong learning with allowed expenses.

Common mistakes to avoid when filing 2018 taxes

Mistakes during filing can lead to costly consequences. Underreporting income is a common error that can trigger IRS scrutiny and penalties. It's crucial to keep accurate records of all income sources.

Alongside income reporting, overlooking deductions or filing the incorrect form can complicate your return. Missing deadlines further compounds these issues, potentially resulting in higher penalties and interest on outstanding balances.

Calculating taxes owed or refund expected

Estimating your tax liability involves considering various factors including income, deductions, and any credits you're eligible for. The pdfFiller platform offers tools to help you estimate your taxes accurately, ensuring you're prepared for what you owe or the refund you can expect.

Understanding your withholding and estimated payments will allow for better tax planning, helping you avoid surprises come tax season.

Amending a 2018 tax return

Sometimes, mistakes happen that require amending your tax return. The IRS form used for this purpose, Form 1040X, allows you to correct errors, whether they are related to income, deductions, or credits claimed.

Filing an amendment can seem complex, but with pdfFiller, you can simplify the process. Follow a step-by-step guide on the platform, which guides you through updating your submission appropriately.

Resources for getting help with 2018 tax forms

If you need guidance, the IRS provides robust resources for 2018 tax forms. Their website hosts a range of frequently asked questions and detailed instructions for completion. However, if personalized support is what you seek, consulting a tax professional can be invaluable.

Additionally, pdfFiller’s support tools and resources provide easy access to information, allowing you to manage your forms efficiently and with clarity. With interactive guides and tools, you can handle your tax documents seamlessly.

Accessing and managing your 2018 tax forms with pdfFiller

pdfFiller empowers you to edit, sign, store, and manage your tax documents securely. With cloud-based solutions, you can access your forms from anywhere, ensuring flexibility during tax season.

Collaboration tools on the platform facilitate teamwork for individuals and teams, making it easier to track changes and share vital tax documents, ensuring you never miss a detail during your filing.

Feedback and continuous improvement

We encourage users to provide feedback regarding their filing experiences. Your insights help pdfFiller improve, ensuring we meet your needs effectively. As a user of pdfFiller, your input directly influences how our platform develops, maintaining a focus on enhancing document management and user experience.

Staying attuned to your needs allows pdfFiller to implement innovations that improve your experience, making tax filing not just manageable but smooth and straightforward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit for tax years 2018 from Google Drive?

How can I send for tax years 2018 to be eSigned by others?

How do I fill out for tax years 2018 using my mobile device?

What is for tax years 2018?

Who is required to file for tax years 2018?

How to fill out for tax years 2018?

What is the purpose of for tax years 2018?

What information must be reported on for tax years 2018?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.