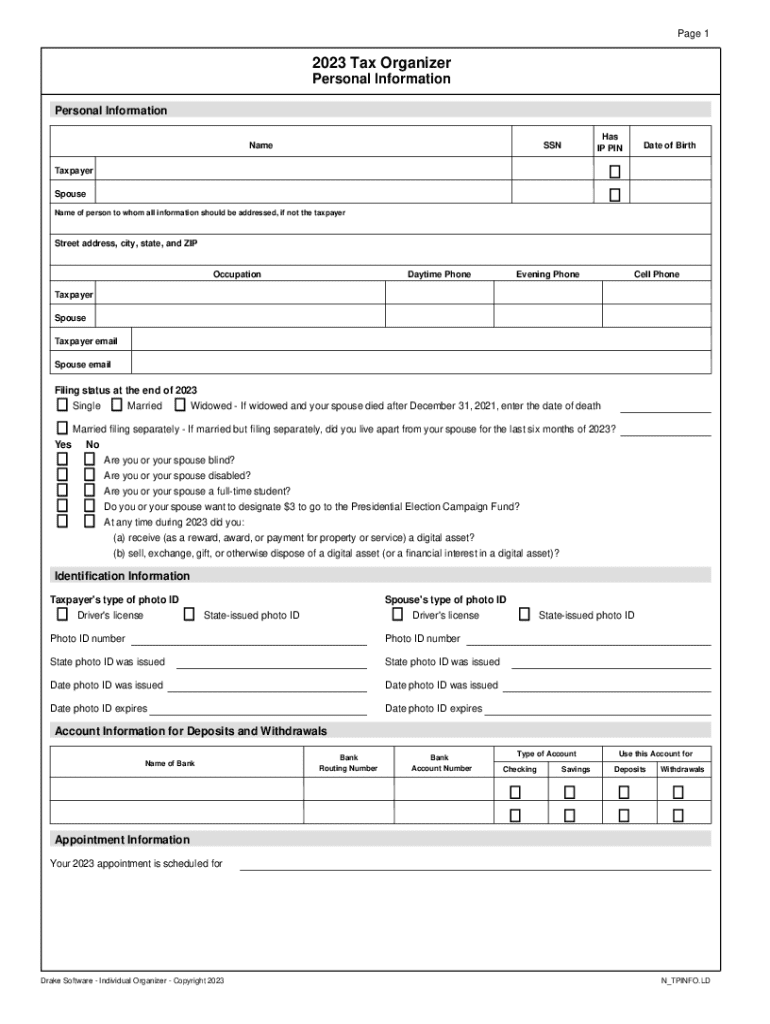

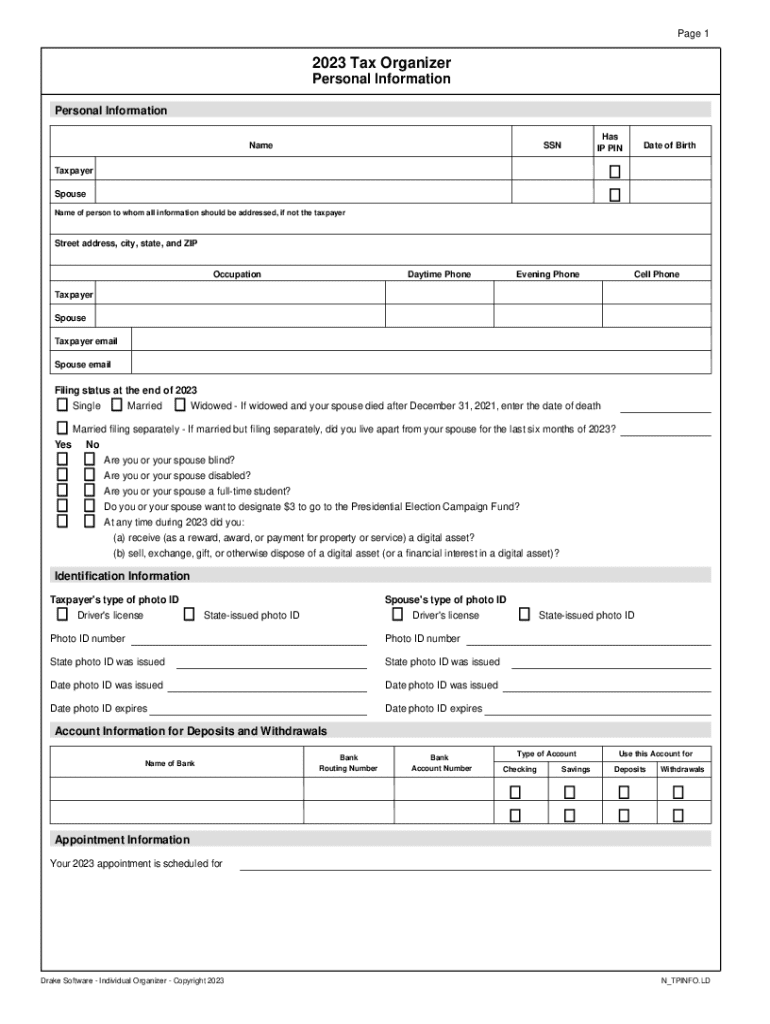

Get the free Filing status at the end of 2023

Get, Create, Make and Sign filing status at form

How to edit filing status at form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out filing status at form

How to fill out filing status at form

Who needs filing status at form?

Filing status at form

Breadcrumb navigation

Home > How-to Guide > Filing Status at Form

Overview

Filing status is a crucial component of the tax filing process, determining how individuals are taxed and what deductions and credits they may qualify for. Understanding your filing status at form not only impacts your tax rate but can significantly influence the overall amount of tax owed, refund received, or credits available. The major tax implications require a precise assessment of one’s personal and financial situation.

Choosing the right filing status can change the dynamics of your tax calculations, influencing everything from standard deductions to eligibility for certain credits. There are various classification options provided by the IRS, allowing for flexibility based on life circumstances such as marital status, dependents, and more. Knowing how filing status interacts with the tax rate schedule allows taxpayers to optimize their returns, maximizing financial outcomes.

Filing status defined

Filing status refers to the category under which an individual or a couple files their federal income tax return. This classification has significant implications for tax calculations, influencing the tax brackets applicable, the amount of deductions one can claim, and the eligibility for various tax credits. Different forms require different filing statuses, thus it’s critical to recognize the significance of selecting the correct status.

The choice of filing status not only reflects on your current financial condition but also impacts long-term financial planning. When filling out forms like the 1040, taxpayers will notice that the chosen filing status directly affects calculations on income thresholds, credits available, and the overall approach to tax liability. Understanding this relationship is essential for effective financial preparation.

Types of filing status

The IRS recognizes several specific categories of filing status, each with its own requirements and implications. Understanding these can facilitate smarter tax decisions when preparing your returns. Here’s an overview of the five primary filing statuses.

Determining your filing status

Choosing the correct filing status is a critical step in the tax preparation process. Here's a step-by-step guide to help you identify which status best fits your situation:

Interactive tools like the filing status calculator available on pdfFiller can assist you in making this determination efficiently, allowing for a seamless transition to completing your form.

Filing status FAQs

Being knowledgeable about filing status is essential. Here are some common questions answered.

Access and manage your forms

Completing your tax forms correctly is vital, and pdfFiller offers a user-friendly platform for managing this process. Let's delve into how you can efficiently fill out and manage your tax forms.

The impact of state taxes on filing status

While federal tax laws provide a framework, state taxes can differ significantly, affecting your overall filing status choice. Different states may have their own tax guidelines and regulations that influence how your federal filing status is perceived.

For example, some states allow specific credits or deductions tied to your filing status, while others might have additional competing requirements. It’s essential to check local regulations to navigate this effectively.

Resources for further assistance

Navigating the intricacies of filing status and related forms can be complex. Here are resources to further support taxpayers:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete filing status at form online?

How do I edit filing status at form in Chrome?

How can I edit filing status at form on a smartphone?

What is filing status at form?

Who is required to file filing status at form?

How to fill out filing status at form?

What is the purpose of filing status at form?

What information must be reported on filing status at form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.