Get the free Fixed Deposit Application Date - Nairobi

Get, Create, Make and Sign fixed deposit application date

Editing fixed deposit application date online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fixed deposit application date

How to fill out fixed deposit application date

Who needs fixed deposit application date?

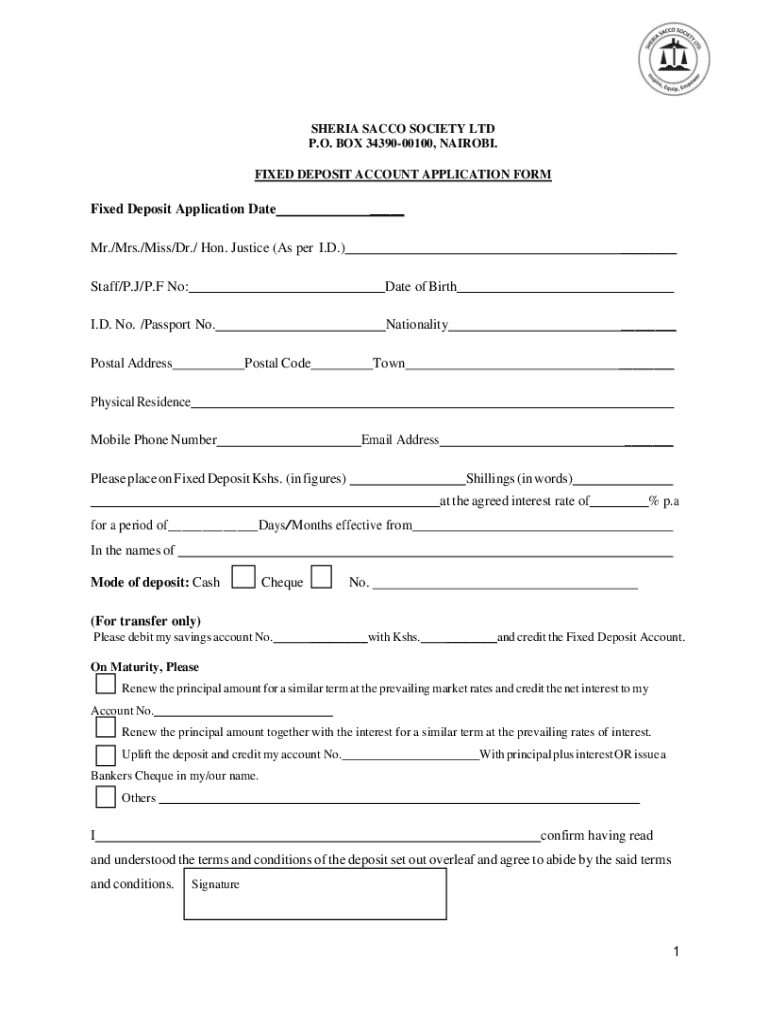

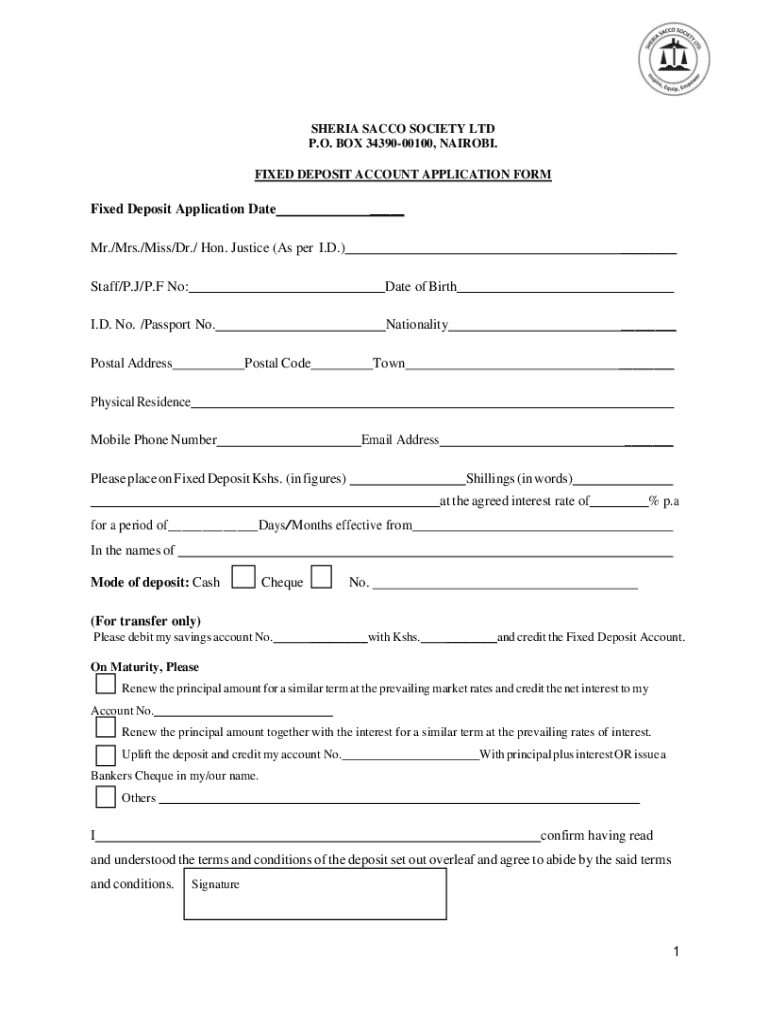

Understanding the Fixed Deposit Application Date Form

Overview of fixed deposit accounts

A fixed deposit (FD) is a financial instrument offered by banks and financial institutions that provides investors with a higher interest rate than a regular savings account, until the specified investment maturity date. Fixed deposits are generally considered low-risk investments and are ideal for individuals looking to earn guaranteed returns on their savings.

The application date plays a crucial role in fixed deposits as it marks the commencement of the investment period. Therefore, understanding this date is pivotal for maximizing the potential returns from your investment.

The benefits associated with fixed deposits include:

Understanding the fixed deposit application date form

The fixed deposit application date form is essential as it initiates the deposit process. Accurately filling this form ensures a smooth transaction and helps you avoid any delays or complications. This form collects vital information that allows the financial institution to process your application efficiently.

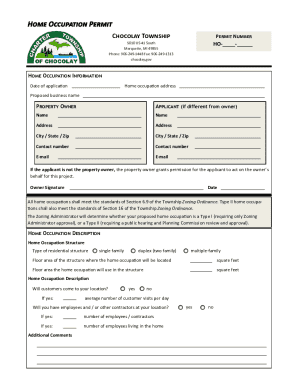

Typically, the details required on this form include:

Step-by-step guide to filling out the fixed deposit application date form

Preparing to fill out the fixed deposit application date form is essential for a smooth process. Here are the steps to follow before you start:

Now, let's walk through the form sections in detail:

Common mistakes to avoid when filling out the application form

When completing the fixed deposit application date form, several pitfalls may arise. To ensure accuracy, avoid the following mistakes:

Submitting the fixed deposit application date form

Once you’ve filled out the fixed deposit application date form, the next step is submission. You have the option to submit it either online or offline. Each method has its pros and cons. For instance, online submissions are typically faster and more convenient, while offline submissions may provide a tangible copy for your records.

If you choose online submission, you can utilize pdfFiller to streamline the process. Here’s how:

Tracking your fixed deposit application status

After you submit your fixed deposit application date form, tracking its status can provide peace of mind. Generally, you can follow up via your bank’s customer service, allowing you to inquire about the application’s progress.

Typical timelines for application processing can vary; however, most applications are processed within a few business days to a week. If any issues arise during processing, maintain communication with your financial institution to address any concerns swiftly.

Managing your fixed deposit post-application

Once your fixed deposit is active, understanding the accumulation of interest is essential for managing your investment effectively. Interest typically accrues daily but is paid out at intervals depending on your chosen option.

Additionally, you'll need to know your options for renewal or withdrawal at the end of the deposit term. Most banks offer convenient ways to either renew your deposit for another term or withdraw funds upon maturity.

Accessing statements online through pdfFiller also adds convenience, allowing you to manage and review your fixed deposit account from anywhere.

Frequently asked questions (FAQs) about fixed deposit application date forms

Addressing potential concerns, here are some frequently asked questions regarding the fixed deposit application date forms:

pdfFiller’s solutions for fixed deposit applications

pdfFiller empowers users to effortlessly manage the fixed deposit application process. By providing a range of document management features, it simplifies the complexities often associated with form-filling.

Its notable solutions include:

Furthermore, users can also access a plethora of forms and templates directly on pdfFiller, making it practical to manage documentation for various financial needs efficiently.

User experiences and testimonials

Many users have found success with pdfFiller for their fixed deposit applications. Testimonials highlight how the platform has simplified the document creation process, enabling users to fill out, edit, and submit forms quickly and easily from anywhere.

Users often express appreciation for the intuitive interface and the reassurance that comes with securely managing documents through pdfFiller. Enhanced user experiences lead to more confidence in handling financial paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fixed deposit application date in Gmail?

How can I fill out fixed deposit application date on an iOS device?

How do I fill out fixed deposit application date on an Android device?

What is fixed deposit application date?

Who is required to file fixed deposit application date?

How to fill out fixed deposit application date?

What is the purpose of fixed deposit application date?

What information must be reported on fixed deposit application date?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.