Get the free Business address if different from home address

Get, Create, Make and Sign business address if different

How to edit business address if different online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business address if different

How to fill out business address if different

Who needs business address if different?

How-to Guide: Business Address if Different Form

Understanding the importance of specifying your business address

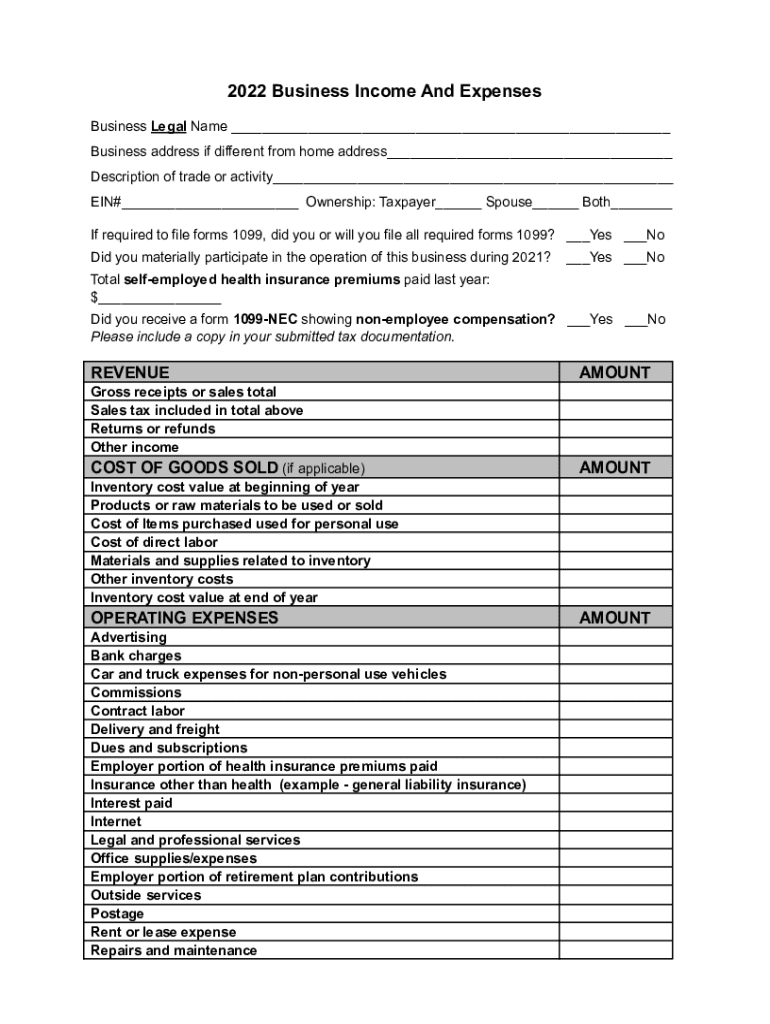

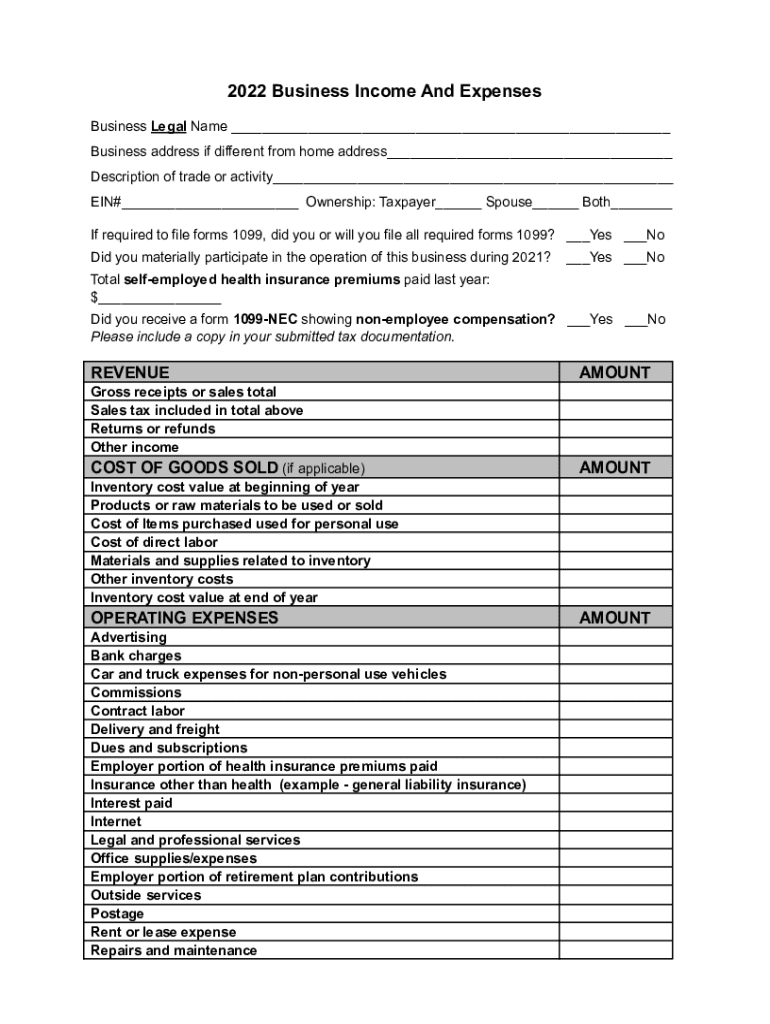

Crafting an accurate and specific business address is critical for ensuring that legal and official correspondence reaches the intended recipients. The business address serves as the official location where important documents, such as tax notifications and legal notices, are dispatched. If your business operates from a location different from where it is registered, it is vital to clarify this discrepancy through a different form. Failure to do so could result in missed communications, legal consequences, or even business penalties.

Using different addresses can have multiple implications. For instance, clients might struggle to reach your business, impacting customer satisfaction. Furthermore, regulatory authorities may misinterpret data concerning your business operations, which can lead to compliance issues. Therefore, understanding the importance of accurately specifying your business address cannot be overstated.

Types of business address definitions

In the context of business operations, two primary types of addresses are significant: the registered address and the operating address. The registered address is the official location where your business is incorporated and is often used for tax purposes. Conversely, your operating address is where your business activity occurs, which could be different, especially for businesses with multiple locations or those that operate out of home offices.

Another critical term is the principal place of business. This is typically defined as the location where the majority of business activities are conducted, and identifying it correctly on forms ensures that your business complies with state and federal regulations. In addition, small businesses may have additional addresses, like mailing addresses or branch locations. Keeping these distinctions clear is essential for accurate communication and compliance.

Identifying when to use a different business address

Several scenarios may require the use of a different business address, ranging from relocating your business to adding a new location. For instance, if a business moves its headquarters to a new city, it will necessitate updating the address to avoid mail disruptions. Additionally, companies that operate out of a home office while being registered elsewhere must specify these differences to maintain transparency.

The impacts on business operations and legal compliance can be significant. Any discrepancies in addresses may lead to delays in critical communications or, worse, potential legal issues if tax documents do not align with the operational reality. It's essential to keep track of key stakeholders who need to be informed about an address change, such as employees, clients, suppliers, and local officials, to ensure consistency in communications.

Steps to complete the business address if different form

Completing the business address if different form requires an organized approach. Here's how you can do it effectively:

Reviewing and submitting the form

Before submitting your completed form, it’s critical to review it for accuracy and completeness. Use a checklist to ensure that all necessary information is provided and that there are no inconsistencies. Key common mistakes to avoid include typos in your new address and failure to include required signatures.

Once you're confident everything is in order, you can submit the form electronically via pdfFiller. Ensure that you are aware of the submission timelines to avoid any penalties for late updates, and make sure to track your application's status post-submission.

Who needs to know about your business address change?

Notifying key stakeholders about your address change is crucial for maintaining effective business operations. One of the first steps is informing the IRS to update your business records to reflect the new address. This can prevent issues during tax seasons or audits.

Banks and financial institutions must also be informed to ensure that your banking interactions run smoothly. Further, consider best practices for updating your clients and vendors, like sending official emails or letters that clarify your new address. Likewise, you should inform local and state regulatory authorities about the address change to remain compliant with regulations.

Interactive tools for managing your business address changes

Using interactive tools like pdfFiller can streamline your address change process significantly. These tools allow you to easily edit and sign necessary documents, efficiently manage your address changes from any location, and share forms with team members for collaborative completion.

Moreover, pdfFiller provides secure cloud storage, enabling you to save and securely store your address forms. This ensures that you can easily access updated documents whenever necessary, keeping all your business records organized and readily available.

Additional considerations and best practices

Consistency is key when it comes to using your business address across all documentation. Ensure that the same address is used on your website, social media platforms, and any printed materials. This helps prevent confusion for customers and suppliers alike.

Remaining compliant with business address requirements is also crucial. Regularly verify that all records, both internal and external, reflect the current business address. A proactive approach to monitoring helps mitigate any impact that address discrepancies can have on your operations and public perception.

FAQs regarding business address changes

As you navigate the changing landscape of your business address, several frequently asked questions arise. Users often want to know the timelines associated with submissions and how long it takes for changes to reflect in official records.

Clarifications on legal obligations regarding address updates are also common. Always consult official guidelines for your state to ensure you fulfill all necessary requirements. For further assistance, don’t hesitate to reach out to local business support organizations or consult a legal professional.

Next steps after submitting your form

After submitting your 'business address if different form,' you should anticipate confirmation of receipt from the respective authorities. It's essential to monitor this process closely; for many jurisdictions, it may take a few weeks for your address to be officially updated.

Confirming updates in official records can require follow-up inquiries. Keep track of any additional forms or documentation that may come up while checking the status of your address change. This proactive approach ensures that you remain informed and prepared for any further actions needed.

Legal implications of incorrect address information

Failing to update your business address can lead to various legal implications. Missed communications could result in missing important deadlines, such as tax filings or regulatory submissions, leading to penalties or fines. Furthermore, if legal documents are sent to an outdated address, businesses may inadvertently waive their rights to contest claims or disputes.

Understanding the legal jurisdictions associated with your business address is vital. Different locations may subject businesses to varying regulations and compliances, introducing additional barriers if not managed correctly. Ensuring your address is up-to-date is essential for protecting your business’s legal standing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business address if different on a smartphone?

Can I edit business address if different on an Android device?

How do I fill out business address if different on an Android device?

What is business address if different?

Who is required to file business address if different?

How to fill out business address if different?

What is the purpose of business address if different?

What information must be reported on business address if different?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.