Understanding the Federal Student Aid Handbook Form: A Comprehensive Guide

Overview of the Federal Student Aid Handbook

The Federal Student Aid Handbook is an essential resource for students navigating the complexities of federal financial aid in the United States. It provides thorough guidelines on how to apply for aid, including grants, loans, and work-study opportunities. Understanding the Federal Student Aid Handbook is vital for students to maximize their funding options for education and avoid pitfalls during the application process.

With the increasing cost of education, awareness of federal student aid options has never been more critical. The Handbook simplifies the process by breaking down intricate information into manageable sections, making it easier for applicants to follow. Navigating this handbook effectively can lead to more informed decisions regarding financing education.

Key components of federal student aid

Federal student aid is comprised of several programs designed to assist students in meeting their educational expenses. The key components include:

Federal Pell Grant: A need-based grant that provides funding to low-income undergraduate students.

Direct Loan Program: Includes subsidized and unsubsidized loans allowing students to borrow money for college.

TEACH Grant Program: Incentivizes students to become teachers in high-need fields by offering grants that convert to loans if service obligations aren't met.

Each program has specific eligibility criteria that applicants must meet. Understanding these criteria is crucial for maximizing the financial assistance available. Additionally, managing your financial aid timeline and being aware of deadlines ensures a smoother application process.

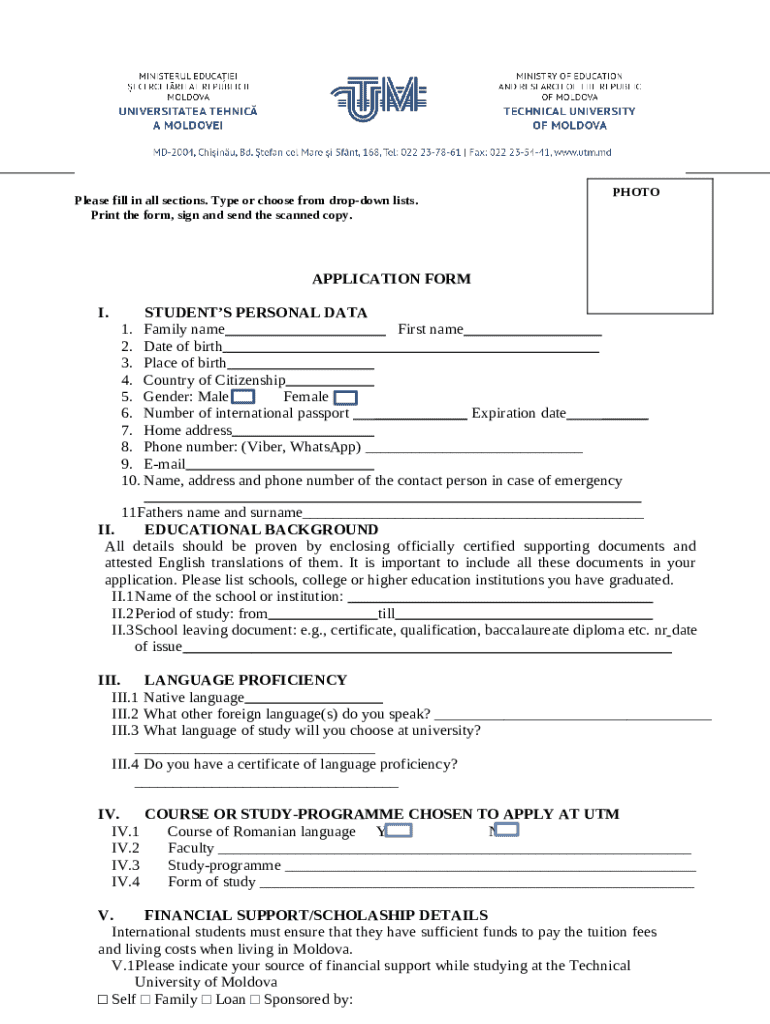

Detailed instructions for specific forms

Filling out federal student aid forms can be daunting; however, with clear instructions, it becomes manageable. Two essential forms are the FAFSA and the Verification Worksheet.

Federal Application for Student Aid (FAFSA)

The FAFSA is the cornerstone of federal student aid. Here's a step-by-step guide:

Create an FSA ID: This serves as your electronic signature.

Gather necessary documents: Include Social Security numbers, tax returns, and bank statements.

Complete the FAFSA: Fill out all sections accurately, ensuring to provide the correct financial information.

Review your application: Double-check for accuracy before submission.

Common pitfalls include incorrect Social Security numbers and failure to sign the application digitally. Taking the time to review your application can prevent processing delays.

Verification Worksheet

Verification accuracy can impact your financial aid; thus, the Verification Worksheet is crucial. It verifies information submitted on the FAFSA, and here's how to complete it:

Check if you're selected for verification on your Student Aid Report (SAR).

Gather documentation that supports your claims, including tax forms and income information.

Fill out the worksheet carefully, using accurate data.

Submit the worksheet along with required documentation to your institution’s financial aid office.

Interactive tools for filling out forms

Using tools like pdfFiller can significantly streamline the process of filling out federal student aid forms. This platform allows users to access and utilize interactive form features, making the task more efficient.

pdfFiller's online platform offers multiple functionalities:

Editing PDFs: Modify documents with ease, allowing for accurate entry of information.

eSigning documents: Securely sign required forms, facilitating faster submission.

Collaboration tools: Work with advisors or teams directly within the platform, sharing necessary documents easily.

Best practices for form submission

Successful completion of federal student aid forms relies heavily on submitting accurate and complete information. Here are some best practices to keep in mind:

Ensure precise information: Double-check all entries before submission to avoid misrepresentation.

Maintain updated documentation: Regularly check that your financial documents reflect your current situation.

Be mindful of deadlines: Familiarize yourself with FAFSA submission dates and other relevant timelines.

Late submissions can lead to loss of funds, underscoring the need for timely action on your part. By crafting a timeline for submissions, you can keep track of important dates and ensure you meet all requirements.

Managing and tracking your financial aid application

Once you have submitted your forms, managing and tracking your financial aid application is critical. Utilizing cloud-based solutions can simplify document management significantly.

Store and organize documents: Keep your student aid documentation in a centralized location for easy access.

Utilize collaboration tools: Work with family members or educational advisors by sharing access to your documents.

Track application status: Most student financial aid offices provide an online portal for checking the processing status of your application.

If you notice that your aid is denied or delayed, immediately contact the financial aid office to address the issue and explore potential remedies.

Support and resources for applicants

Navigating federal student aid can be overwhelming, but numerous resources are available to assist applicants. Starting with the online resources and forums can provide valuable insights.

Visit official financial aid websites: These platforms contain official information and updates on federal aid.

Engage with online forums: Other students can share experiences and tips that may be beneficial.

Contact financial aid offices: Do not hesitate to reach out for clarification or assistance specific to your situation.

Frequently asked questions can help clarify doubts about federal student aid. Understanding common issues helps to proactively seek solutions.

Updates and changes to federal student aid regulations

Staying informed about updates to federal student aid regulations is crucial for applicants. Recent changes have impacted eligibility and repayment options, making it essential to monitor these adjustments.

Changes in eligibility criteria: New policies may affect who qualifies for specific types of aid.

Updates on loan repayment options: Modifications to repayment plans can alter what is available for borrowers.

By regularly visiting the Federal Student Aid website and other trusted sources, you can ensure that you stay abreast of any new policies affecting your education financing.

Success stories: Navigating federal student aid

Many students have successfully navigated the complexities of federal student aid and have empowering stories to tell. These testimonials often highlight the tools and approaches that made significant differences in their experiences.

Individual A: Explains how using pdfFiller helped simplify document editing and submission.

Individual B: Shares insights into effective time management strategies that ensured timely completion of forms.

These stories resonate with potential applicants and inspire confidence in their ability to secure the necessary support for their education.

Advanced document management tips

Securing your financial data is paramount. Following best practices for data protection not only safeguards your information but also ensures compliance during the application process.

Use secure passwords: Create strong, unique passwords for all accounts related to your financial aid.

Understand privacy settings on platforms like pdfFiller: Familiarize yourself with how to keep your information safe.

Collaborate securely with advisors: Leverage secure sharing features to collaborate without compromising your sensitive data.

Through these practices, students can manage their applications and documentation effectively, paving the way for successful financial aid acquisition.