Get the free Ret MIT Parent Form

Get, Create, Make and Sign ret mit parent form

Editing ret mit parent form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ret mit parent form

How to fill out ret mit parent form

Who needs ret mit parent form?

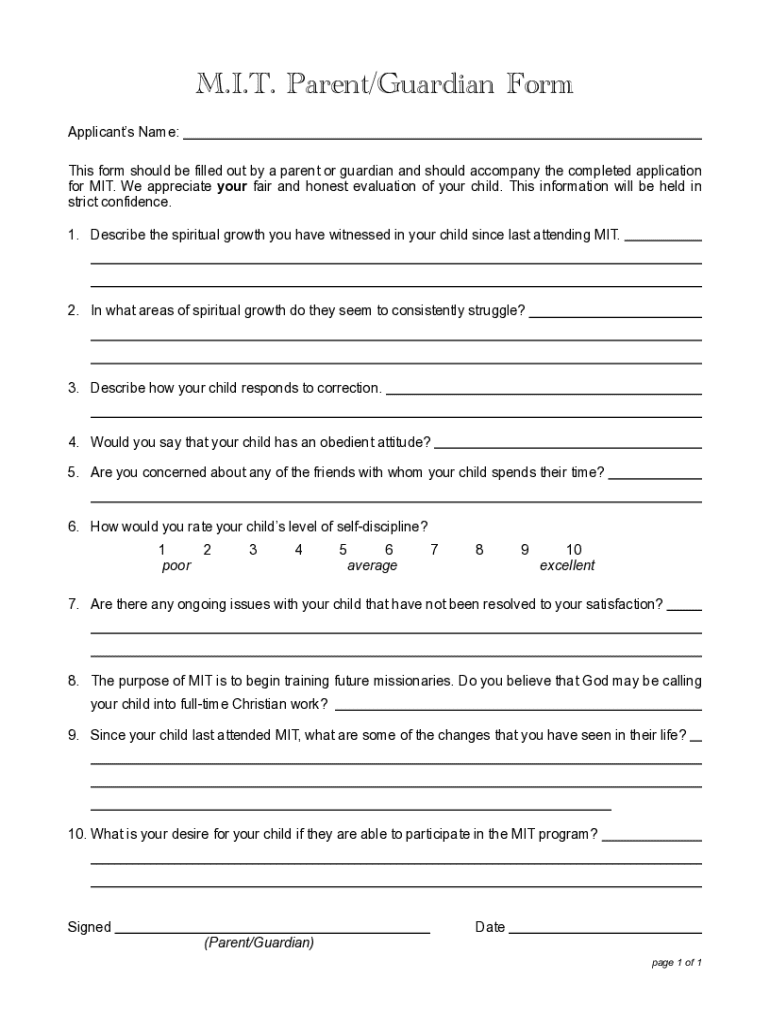

A comprehensive guide to the Ret Mit Parent Form

Understanding the Ret Mit Parent Form

The Ret Mit Parent Form is a specialized document used primarily for financial and administrative purposes within family-related applications, particularly when dealing with education and some government benefits. This form is typically required to assess the eligibility and financial statuses of applicants. Understanding the significance of the Ret Mit Parent Form is crucial, especially for parents seeking funds, subsidies, or grants that are dependent on their financial disclosures.

The importance of the Ret Mit Parent Form cannot be overstated. It aids organizations in verifying the claims made by applicants, ensuring that only those who meet established criteria receive assistance. Individuals and families involved in academic initiatives, subsidies for housing, or medical assistance programs often need to use this form. Essentially, anyone in need of state aid, scholarships, or financial grants may find the Ret Mit Parent Form a vital part of their application process.

Key features of the Ret Mit Parent Form

This form comprises several key sections, with specific data fields designed to capture vital information. The primary sections typically include:

While the core structure remains relatively uniform, variations of the Ret Mit Parent Form might exist depending on the organization or program requiring it. Some forms may include additional questions or specific requests for information, reflecting particular funding requirements or guidelines.

Step-by-step instructions for filling out the Ret Mit Parent Form

Filling out the Ret Mit Parent Form accurately is essential. Start by gathering all necessary documents and information, including recent tax returns, W-2s, and employment records. Being prepared helps streamline the process and minimizes the risk of errors.

Now, let’s break down the form into manageable sections.

Tips for editing and managing the Ret Mit Parent Form

Utilizing pdfFiller for managing your Ret Mit Parent Form makes editing straightforward. Start by importing the form into pdfFiller's interface, where interactive features can aid the process. Use the available tools to navigate through the form, allowing you to easily identify sections that require updates.

Best practices for editing include:

After making edits, ensure you save your changes in the appropriate format, enabling you to track modifications to the Ret Mit Parent Form for future reference.

Signing the Ret Mit Parent Form

The process of signing the Ret Mit Parent Form has evolved significantly with digital tools offering numerous benefits. One such advantage is the ability to eSign, which expedites the submission process and enhances convenience, particularly for busy parents.

When signing the form electronically, follow these steps using pdfFiller's eSigning tools:

It is important to be aware of the legal considerations when signing digitally. Ensure that your eSignature complies with applicable regulations, as electronic signatures are legally binding in many jurisdictions.

Common issues and troubleshooting with the Ret Mit Parent Form

Errors can occur when filling out the Ret Mit Parent Form, causing issues with submission. Common mistakes include discrepancies between reported information and existing records. If this happens, it is crucial to rectify these errors promptly.

Here are some common FAQs regarding errors and troubleshooting:

If issues persist, consider contacting support for specialized assistance with submitting the Ret Mit Parent Form.

Accessing previous versions of the Ret Mit Parent Form

Maintaining records of past submissions for the Ret Mit Parent Form can be vital, especially when dealing with ongoing applications or renewals. Using pdfFiller, you can easily retrieve past submissions.

Here’s how to retrieve your previous versions:

Keeping comprehensive records supports future applications and provides a reliable way to reference previous submissions.

Additional resources for using the Ret Mit Parent Form

Within the realm of document management, it’s essential to explore related forms that can support various processes. On pdfFiller, users can access various resources to streamline their documentation needs.

Particularly, familiarizing oneself with other relevant forms and guides can enhance the overall experience when managing the Ret Mit Parent Form. Recommendations include reviewing educational support forms or financial aid templates tailored to specific situations.

Utilizing pdfFiller not only simplifies document collaboration but also provides various tools to create, edit, and track forms efficiently.

Connecting with pdfFiller support

In instances where challenges arise during the process of filling out the Ret Mit Parent Form, seeking professional assistance becomes necessary. Knowing when to contact support can make a significant difference.

When facing persistent issues, take the following steps to connect with pdfFiller's support team:

User testimonials highlight the effectiveness of utilizing these support resources, suggesting that early communication can lead to faster resolutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the ret mit parent form electronically in Chrome?

How can I edit ret mit parent form on a smartphone?

How do I edit ret mit parent form on an Android device?

What is ret mit parent form?

Who is required to file ret mit parent form?

How to fill out ret mit parent form?

What is the purpose of ret mit parent form?

What information must be reported on ret mit parent form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.