Get the TAX-FREE PROVISIONING

Get, Create, Make and Sign tax- provisioning

How to edit tax- provisioning online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax- provisioning

How to fill out tax- provisioning

Who needs tax- provisioning?

A comprehensive guide to tax provisioning forms

Understanding tax provisioning

Tax provisioning is a critical component of financial reporting, representing the process of estimating a company's tax obligations for a given period. The primary objective of tax provisioning is to ensure that a company sets aside an appropriate amount of resources to meet its tax liabilities while also providing accurate and timely information to stakeholders. This process not only affects the financial statements but also plays a vital role in tax planning and cash flow management.

The importance of tax provisioning cannot be overstated. It ensures compliance with regulations while helping organizations avoid penalties for underpayment. Moreover, effective tax provisioning informs management decisions regarding cash reserves and investment strategies, leading to more informed financial planning.

The role of tax provisioning forms

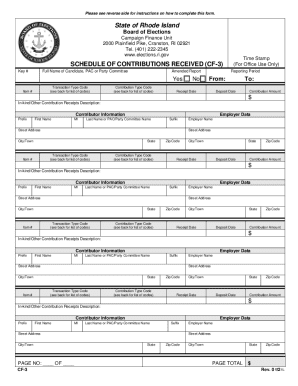

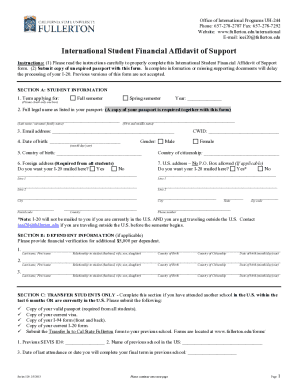

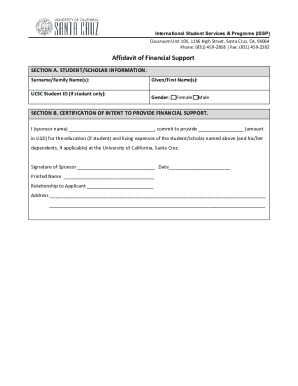

Tax provisioning forms are specifically designed documents used to estimate and report tax obligations and provisions. These forms are critical in the tax compliance process, ensuring that all relevant data is collected and reported accurately to tax authorities. Different types of tax forms serve distinct purposes, with some focusing on income tax provisions while others tackle various local or state tax obligations.

Understanding the distinctions between these various forms is essential for compliance and accuracy. For instance, the federal tax provisioning form may require different data elements compared to state or local tax forms, which could lead to inconsistencies if not carefully managed.

Key components of tax provisioning forms

Filling out a tax provisioning form requires comprehensive attention to detail. At the very least, you’ll need to provide taxpayer identification details that include the Tax Identification Number (TIN), the Business Identification Number (BIN), or Social Security Number (SSN) for individuals. Additionally, financial data, such as annual revenue, operational expenses, and other relevant financial disclosures, must be meticulously reported.

Ensuring accuracy in these sections is paramount. Errors in reporting could lead to discrepancies that might attract audits or fines.

Types of tax provisions to consider

When dealing with tax provisioning, it is vital to differentiate between current tax provisions and deferred tax provisions. Current tax provisions refer to taxes owed for the current fiscal year, while deferred tax provisions account for taxes that will be owed or received in future periods due to timing differences in revenue and expense recognition.

Additionally, understanding permanent and temporary differences is crucial. Permanent differences arise from specific items that will never reverse in the future, while temporary differences occur when an item is treated differently for tax purposes than for accounting purposes. Recognizing these differences can aid in better forecasting and budgeting.

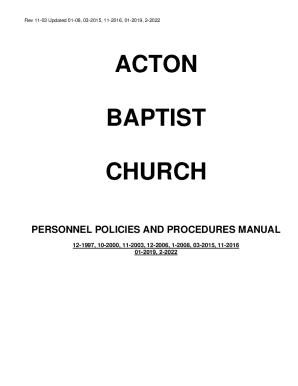

The process of completing a tax provisioning form

As you embark on filling out the tax provisioning form, maintaining a systematic approach is essential. Here’s a step-by-step guide to assist you through the process:

It’s important to be vigilant and double-check each section before submission to avoid common pitfalls such as miscalculations or incomplete information.

Common pitfalls to avoid

When filling out tax provisioning forms, several common mistakes can derail the process. Errors such as using outdated financial data, omitting crucial deductions, or failing to account for recent changes in tax law can lead to significant issues. To ensure accuracy and compliance, it's advisable to validate your data sources systematically.

Implementing a robust review process can prevent these errors, and ensuring collaboration among different departments improves the integrity of the tax provisioning process.

Enhancing efficiency in tax provisioning

Utilizing advanced software solutions can greatly enhance the efficiency of completing tax provisioning forms. Cloud-based tools like pdfFiller streamline the process by allowing users to fill out, edit, sign, and store tax documents securely online. This not only saves time but also decreases the chances of human error.

One of the key benefits of using such tools is the integration of various features that simplify document management. For instance, users can conveniently collaborate with team members, track changes in real-time, and access their documents from anywhere, making cloud solutions invaluable for tax provisioning.

Streamlining collaboration and workflow

Collaboration among team members is crucial for efficient tax provisioning. Leveraging document collaboration features available in platforms like pdfFiller enhances team synergy. With integrated capabilities for sharing, commenting, and version control, teams can work together seamlessly, ensuring that every input is captured and reflected in real-time.

Managing document versions meticulously is essential for maintaining an audit-ready trail. By utilizing tools that track changes and maintain logs of edits, organizations can ensure compliance and transparency, ultimately leading to more efficient and effective tax provisioning.

Compliance and reporting considerations

Compliance with reporting requirements is a cornerstone of effective tax provisioning. Tax regulations often dictate certain mandatory disclosures that companies must adhere to when reporting provisions. Understanding these requirements unfailingly, including filing deadlines and necessary formats for submission, will help organizations stay on the right side of the law.

Ensuring compliance extends beyond just the accurate completion of forms; it also requires that entities maintain comprehensive records to support their disclosures. This documentation serves not only to satisfy tax obligations but also to prepare for potential audits, where transparency and organization can greatly alleviate stress.

Maintaining audit readiness

Strategies for maintaining audit readiness are pivotal in navigating the complexities of tax provisioning. Keeping thorough documentation and creating a structured database of financial documents enables companies to respond swiftly to audit requests. Regular internal reviews and updates can ensure that all relevant data is stored appropriately and kept accessible.

Emphasizing transparency throughout the tax provisioning process fosters trust between the organization and its stakeholders. By documenting every step, companies can demonstrate their commitment to compliance and due diligence effectively.

Advanced topics in tax provisioning

In a continuously changing tax landscape, adapting to regulatory changes is of utmost importance. Recent updates to tax legislation can significantly affect how provisions should be calculated and reported. Companies must remain vigilant regarding such updates, incorporating them into their tax provisioning strategies promptly to avoid compliance issues.

Case studies highlighting successful adaptations to regulatory changes demonstrate the importance of a proactive approach to tax provisioning. Organizations that embrace these innovations are often those that lead in their respective sectors.

Future trends in tax provisioning

Technology is breathing new life into the realm of tax provisioning. Innovations such as artificial intelligence and automation tools are set to transform how organizations approach tax management. These technologies can streamline the measurement, calculation, and reporting of tax provisions, significantly reducing manual workload.

The ongoing trend toward tax automation points to a future where businesses can efficiently manage tax compliance with greater accuracy and fewer resources. Companies should prepare for this shift by investing in advanced software like pdfFiller, which features capabilities to automate various aspects of the tax provisioning process, making it not only efficient but also accurate.

Integrating tax provisioning with overall financial management

Conducting scenario analyses for tax provisions can be immensely beneficial. By simulating various financial situations, companies can understand how changes in revenue or expenses might impact their tax obligations. This sensitivity analysis helps in better forecasting tax provisions, allowing organizations to strategically plan their cash reserves.

Aligning tax strategy with broader business goals ensures that tax provisioning plays a supportive role in achieving financial objectives. Engaging stakeholders across departments—such as finance, operations, and legal—can yield holistic insights that enhance the overall effectiveness of tax provisioning efforts, driving better financial outcomes for the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax- provisioning online?

How do I edit tax- provisioning online?

Can I create an eSignature for the tax- provisioning in Gmail?

What is tax- provisioning?

Who is required to file tax- provisioning?

How to fill out tax- provisioning?

What is the purpose of tax- provisioning?

What information must be reported on tax- provisioning?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.