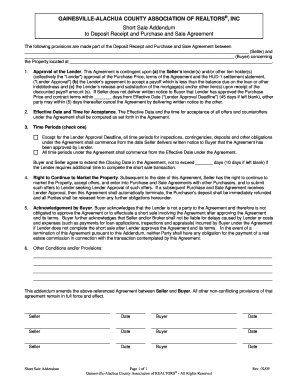

Get the free Transfer-Focused Business

Get, Create, Make and Sign transfer-focused business

How to edit transfer-focused business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer-focused business

How to fill out transfer-focused business

Who needs transfer-focused business?

Transfer-Focused Business Form: A Comprehensive Guide

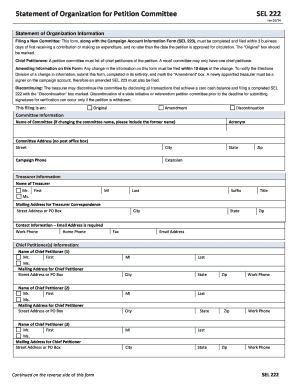

Understanding Transfer-Focused Business Forms

A transfer-focused business form is a crucial document used in various business transactions to facilitate the change of ownership of business assets, equity, or interests. Its purpose extends beyond merely documenting the transfer; it establishes clear terms that protect all parties involved, ensuring that the transfer adheres to legal standards and operational expectations. Without the correct forms, businesses risk compliance issues, potential disputes, and financial losses.

Having the right transfer-focused business form is essential, especially since the requirements can vary based on jurisdiction, the nature of the business, and the type of ownership being transferred. Ensuring that relevant parties understand and agree to the terms specified in these forms is vital for a smooth operational transition.

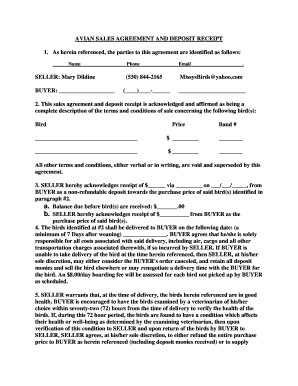

Types of transfer forms used in business

There are several types of transfer forms utilized in business, each catering to different ownership structures and specific transaction requirements. The most common forms include the following:

Key terms and concepts

Understanding key legal terms related to business ownership transfer is essential for anyone involved in these transactions. Terms like 'assignors' (the party transferring ownership) and 'assignees' (the party receiving ownership) are foundational. The 'effective date' is equally crucial, as it marks when the transfer legally comes into effect.

Common clauses found in transfer forms include the 'transfer of rights' clause, which delineates what rights are being transferred, and 'warranties,' which offer assurances regarding the ownership and condition of the asset or equity being transferred.

Preparing for the transfer process

Choosing the right transfer-focused business form involves assessing your specific needs and understanding your business structure. Factors such as the type of ownership (e.g., sole proprietorship, partnership, corporation) influence which form is suitable. For instance, LLCs have more flexible ownership structures compared to corporations or sole proprietorships and therefore may require different forms.

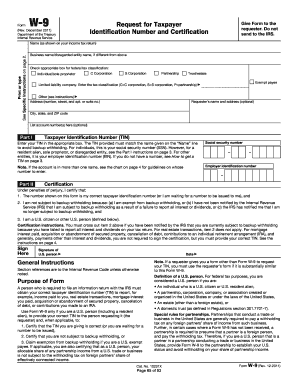

It's vital to familiarize yourself with legal obligations related to business ownership transfers. This includes understanding regulatory compliance, as various jurisdictions impose different rules and requirements that could affect the validity of your transfer.

Step-by-step instructions for completing a transfer-focused business form

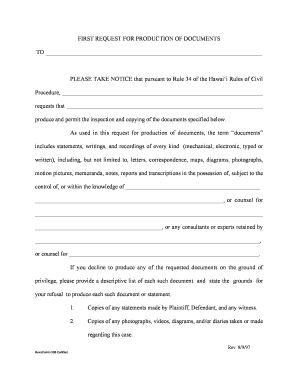

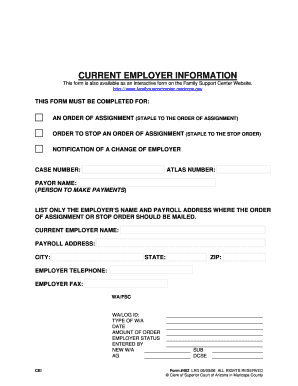

To successfully complete a transfer-focused business form, you need to gather crucial documents and information, including business details, ownership stakes, and any existing agreements that might affect the transfer. Ensuring you have all required information at hand streamlines the completion process.

When filling out the form, follow each section carefully. Ensure that you accurately represent the ownership interests and the specific details of the transaction. As you fill out the form, maintain a checklist of information included to avoid discrepancies.

Once the form is completed, reviewing and possibly revising it is critical. Look for common errors such as misspelled names, incorrect dates, or overlooked clauses. Consider seeking legal counsel, especially for complex transfers, as professional insight can help prevent costly mistakes.

Managing the transfer

Utilizing tools like pdfFiller’s eSignature capabilities can significantly enhance the document management aspect of the transfer process. These tools streamline the signing and verification process, ensuring that all parties can complete their obligations remotely and securely.

Effective collaboration among stakeholders is also essential. Use document management tools to facilitate discussions and ensure all relevant parties, including legal advisors or accountants, are involved throughout the transfer. This collaborative approach helps mitigate misunderstandings and ensures compliance with all requirements.

Common challenges and solutions

Identifying potential issues that may arise during the transfer process is key to a successful transaction. Common mistakes include not adequately documenting the form, making assumptions about what needs to be included, or failing to understand the ramifications of specific clauses. To avoid pitfalls, carefully review each aspect of the transfer form and consult legal or industry experts to navigate complex areas.

Disagreements may arise among stakeholders during the transfer process. To effectively resolve these conflicts, maintain thorough documentation to back your claims and proposed resolutions. Open and honest communication can help alleviate tensions and lead to effective solutions.

Post-transfer considerations

Once the ownership transfer is executed, updating company records is paramount. This includes notifying state authorities, updating bank records, and reflecting changes in internal documents to maintain accurate and compliant business standings.

Compliance doesn't end with the transfer. Ongoing obligations, such as maintaining clear records of ownership interests and ensuring that regulatory requirements are continuously met, must be observed. This diligence will aid in future transactions and provide clarity and security for all involved.

Utilizing pdfFiller for your transfer-focused business needs

pdfFiller offers a suite of features that streamline the document processing experience, enabling users to create, edit, and manage transfer-focused business forms with ease. Interactive tools make document creation intuitive and efficient, ensuring that users can focus more on their business and less on administration.

The cloud-based nature of pdfFiller provides real-time collaboration, allowing team members to work together seamlessly, regardless of location. This enhances productivity and ensures that everyone is on the same page throughout the transfer process.

One notable aspect is the success stories from businesses leveraging pdfFiller for effective ownership transfers. Documented case studies illustrate how companies have successfully navigated transfers using pdfFiller, highlighting the platform's versatility and ease of use.

Legal and practical insights

Insights from legal professionals underscore the importance of understanding the nuances of transfer-focused business forms. Best practices involve not only accurate documentation but also engaging trusted advisors throughout the process. Establishing clear communication and thorough reviews can prevent complications and ensure smoother transitions.

Frequently asked questions about business ownership transfers often revolve around the specifics of each form, timelines involved, and necessary approvals. Addressing these questions early in your process can alleviate anxiety and foster a more informed approach to ownership transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find transfer-focused business?

Can I create an electronic signature for the transfer-focused business in Chrome?

Can I create an eSignature for the transfer-focused business in Gmail?

What is transfer-focused business?

Who is required to file transfer-focused business?

How to fill out transfer-focused business?

What is the purpose of transfer-focused business?

What information must be reported on transfer-focused business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.