Get the free BUSINESS LOAN APPLICATION REAL ESTATE

Get, Create, Make and Sign business loan application real

How to edit business loan application real online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application real

How to fill out business loan application real

Who needs business loan application real?

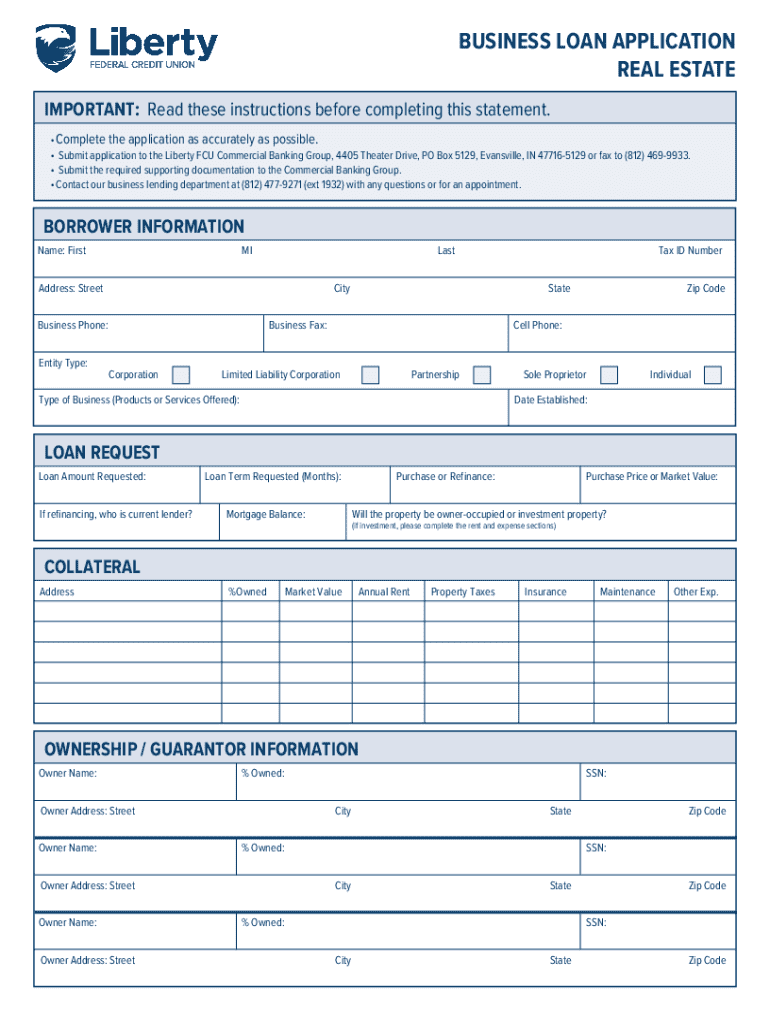

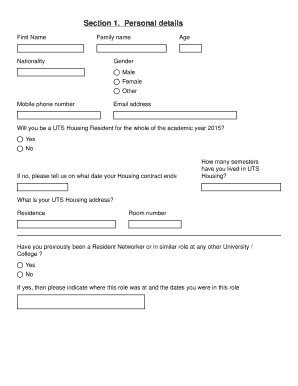

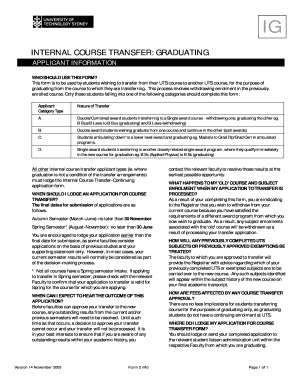

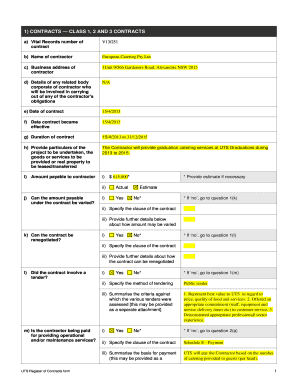

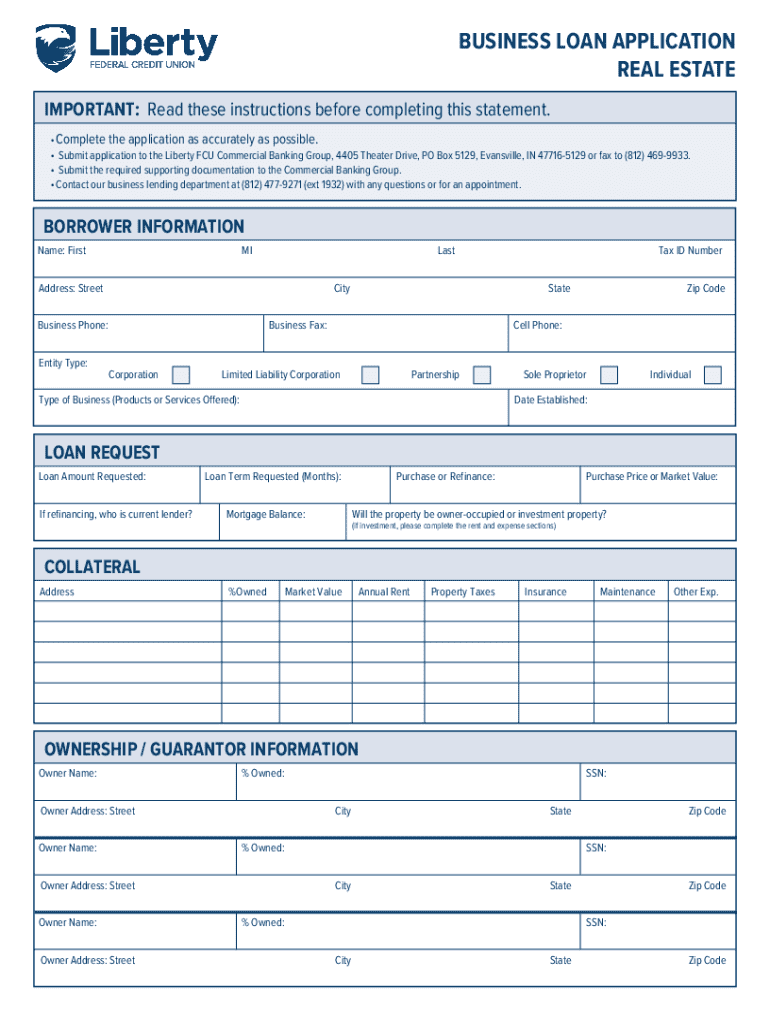

Comprehensive Guide to Completing Your Business Loan Application Real Form

Overview of the business loan application process

A business loan can be a lifeline for entrepreneurs seeking to grow their operations or navigate financial challenges. Understanding the process of applying for a business loan is critical to securing the necessary funding.

Applying for a business loan involves several steps, from initial research to submitting your business loan application real form. You'll begin by identifying the type of loan that suits your needs, preparing the necessary documents, and finally, completing the application form accurately.

Types of business loans

Different types of business loans are available depending on your objectives and financial situation. Each option serves specific needs and has its own terms and qualifications.

The primary types of business loans include short-term loans for quick funding, long-term loans that spread repayment over several years, and specialized loans such as SBA loans aimed at small businesses. Equipment financing is also critical as it allows companies to purchase machinery without upfront costs.

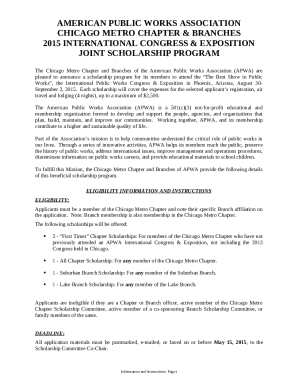

Preparing for your business loan application

Preparation is key when applying for a business loan. Being well-prepared will not only streamline the process but also enhance the likelihood of approval. Essential documents are required to provide a comprehensive view of your business's financial health.

You'll need personal and business tax returns, a current business credit report, key financial statements like your income statement, balance sheet, and cash flow statement, as well as a detailed business plan outlining your projections for growth.

Key factors influencing the success of your application include your credit score, business revenue, profitability, and debt-to-income ratio. These elements significantly shape lender perceptions and ultimately determine your financing options.

Getting started with the business loan application form

Finding the right business loan application real form is the first step in the application process. Lenders, be it traditional banks or online lenders, provide specific forms tailored to their requirements.

It's essential to use the official, real forms as provided by your chosen lender to avoid unnecessary complications. These forms often differ across institutions, which means attention to detail is paramount.

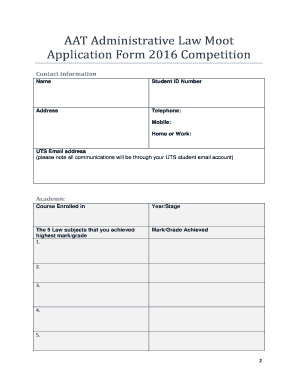

Step-by-step instructions to fill out the business loan application form

Completing the business loan application real form can seem daunting, but breaking down the steps simplifies the process. Each section serves a specific purpose that helps the lender assess your application.

It’s crucial to ensure accuracy in every detail you provide. Here's a breakdown of the key sections:

Tips for successfully submitting your application

Once you've filled out the application form, be vigilant about the submission process. Double-check all information to ensure accuracy and completeness. Any discrepancies can delay or jeopardize your application.

Keeping copies of everything you've submitted is also beneficial for future reference. Using tools like pdfFiller can streamline this process, allowing you to fill out, manage, and even electronically sign your forms efficiently.

Common mistakes to avoid

Navigating the application process can be tricky, and there are several common pitfalls to steer clear of. Overestimating the loan amount you need can lead to complications later on. Similarly, failing to provide the required documentation can stall your application just as quickly.

Each lender has specific requirements, which can vary significantly. Ignoring these can result in denial of your application, so it’s crucial to read through all provided information thoroughly.

What happens after submission?

The waiting game begins once you submit your application. Typically, lenders provide a timeline for processing. Depending on the lender, you may hear back within a few days to several weeks.

After review, the outcomes can be varied: your application may be approved, denied, or you may receive a request for additional information. Each of these scenarios dictates the next steps you should take, from accepting funds to understanding the grounds for denial.

Frequently asked questions (FAQs)

Thanks to the complexity of business loans, questions abound. Perhaps the most pressing, 'What if my application is rejected?' Understanding that rejection often stems from credit issues or incomplete documentation is crucial. You can often reapply once issues are resolved.

Another common query is whether multiple loan applications can be submitted simultaneously. While it’s possible, it’s wise to approach this cautiously, as applying for numerous loans can negatively impact your credit score.

Your credit score plays a fundamental role in securing a business loan; better scores facilitate easier approval and more favorable terms. Knowing how to manage this aspect can improve your overall financial scenario.

Utilizing pdfFiller for your business loan application

pdfFiller emerges as a powerful ally in your business loan application process. You have the ability to edit your application, manage associated documentation, and collaborate effortlessly with team members.

Its eSignature features optimize processing time by allowing you to sign forms electronically. This cloud-based platform simplifies everything — from filling out the real business loan application form to secure document management.

Testimonials and success stories

Many clients have experienced significant benefits when using pdfFiller for their loan applications. These success stories demonstrate the tangible impact on their financing needs and business objectives.

For instance, a small technology firm utilized pdfFiller to streamline their SBA loan application, enabling them to secure funding in record time, which consequently facilitated their growth and service expansion.

Related documents and resources

In addition to the business loan application real form, several related forms and templates may be useful. Ensure you have access to documents tailored to your specific loan situation.

Resources that provide insights into different loan products can further educate you, making you a more informed borrower. Additionally, accessing tools for effective document management can optimize your loan preparation process.

Disclaimer and legal information

It's essential to understand the legal implications surrounding the application process. Failure to provide accurate information can lead to severe consequences and delay in funding.

For specific queries regarding the form, you should contact the lender directly for clarity and assistance. This proactive approach will ensure you navigate the application process smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business loan application real without leaving Chrome?

How do I fill out business loan application real using my mobile device?

How do I edit business loan application real on an Android device?

What is business loan application real?

Who is required to file business loan application real?

How to fill out business loan application real?

What is the purpose of business loan application real?

What information must be reported on business loan application real?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.