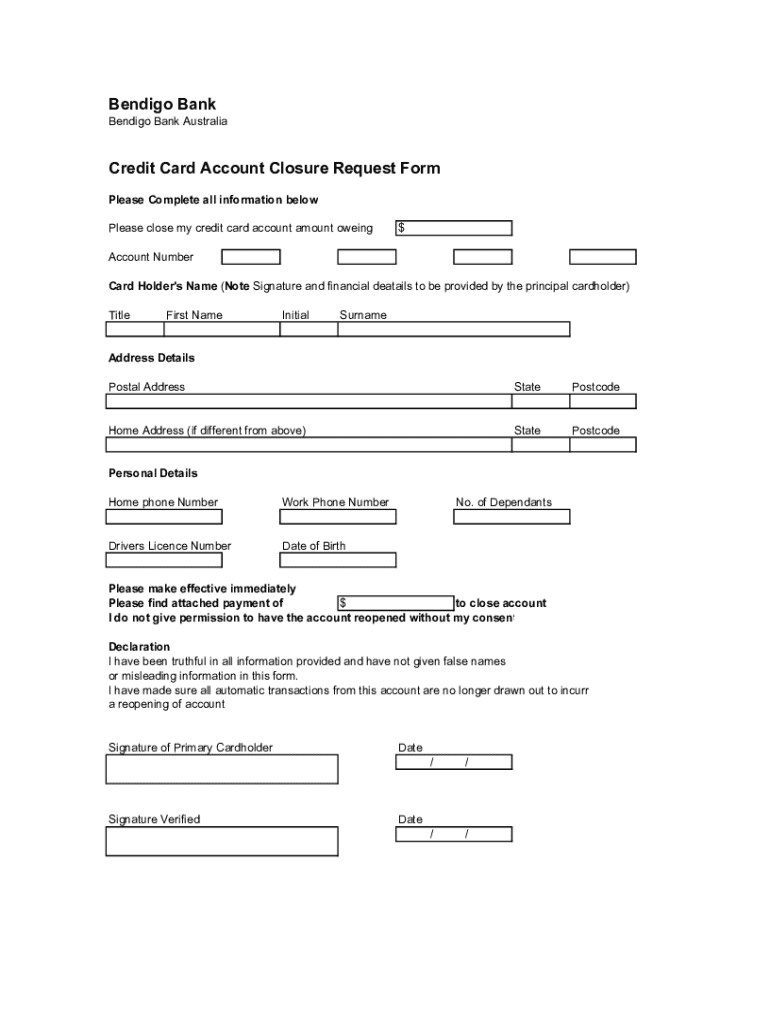

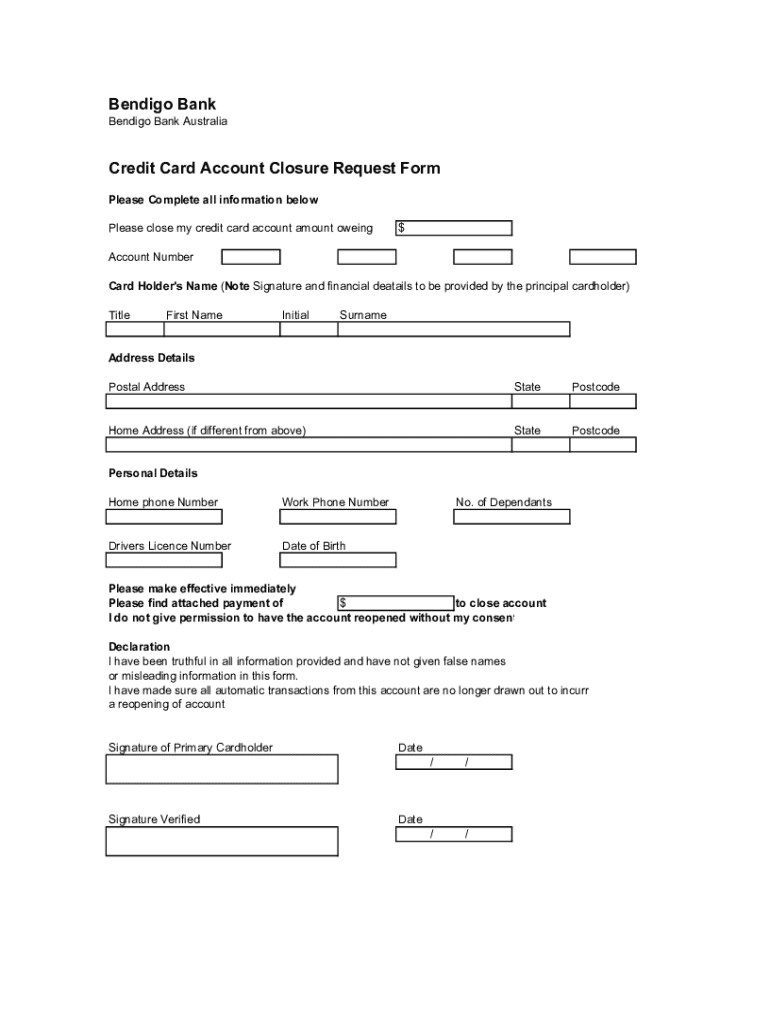

Get the free Bendigo Bank Credit Card Account Closure Request Form

Get, Create, Make and Sign bendigo bank credit card

How to edit bendigo bank credit card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bendigo bank credit card

How to fill out bendigo bank credit card

Who needs bendigo bank credit card?

Your Complete Guide to the Bendigo Bank Credit Card Form

Overview of Bendigo Bank credit cards

Bendigo Bank offers a diverse range of credit card options that cater to the varying needs of customers. Whether you are looking for a low-interest rate, rewards on purchases, or a credit card with no annual fees, Bendigo Bank has a solution that can fit your lifestyle. Selecting the right credit card is crucial, as it can help you manage your finances effectively while maximizing benefits like rewards, lower interest payments, and more.

Types of Bendigo Bank credit cards

Bendigo Bank provides several types of credit cards, each designed to meet different user needs. Selecting the right type involves understanding the features and benefits of each card offering.

Benefits of having a Bendigo Bank credit card

Owning a Bendigo Bank credit card comes with numerous benefits that can enhance your financial management. For starters, having access to a credit card provides peace of mind in financial emergencies, giving you immediate access to funds when you need them most.

Additionally, many Bendigo Bank credit cards offer rewards and discounts for cardholders, further enhancing the value of each purchase you make. Enhanced purchasing power also comes in handy during unforeseen situations, allowing you to make larger purchases without feeling constrained. On top of that, Bendigo employs robust security measures to protect cardholders against fraud, ensuring a safe and secure transaction experience.

Eligibility criteria for Bendigo Bank credit cards

Before applying for a Bendigo Bank credit card, it's essential to understand the eligibility criteria that govern the approval process. Each card carries its own unique requirements, which generally include conditions such as minimum income levels, residency status, and age limitations.

How to apply for a Bendigo Bank credit card

The application process for a Bendigo Bank credit card can be completed in several ways, particularly through online, in-branch, and phone applications. Here’s a step-by-step guide to assist you regardless of your chosen method.

Online application process

Applying online is one of the most convenient ways to submit your credit card application. Simply visit the Bendigo Bank website, locate the credit card section, and follow these steps:

Applying in branch

If you prefer the personal touch, you can apply in person at any Bendigo Bank branch. It's advisable to bring specific documents, including your ID, proof of income, and any other information that may support your application. The staff will assist you through the process.

Phone applications

You can also initiate a credit card application via phone. To do this, call the Bendigo Bank customer service line, and be prepared to provide your personal details, including your income and employment information during the call.

Understanding the Bendigo Bank credit card form

Completing the Bendigo Bank credit card form accurately is crucial for a successful application. Each section of the form must be filled in carefully to provide a clear picture of your financial situation.

It’s advisable to double-check all entries for accuracy and completeness to avoid delays in processing your application.

Managing your Bendigo Bank credit card

Once you have been approved for a Bendigo Bank credit card, effective management is vital to leveraging its benefits fully. Setting up online banking is one of the first steps you should take, allowing you to monitor your account, check statements, and manage payments from anywhere.

Understanding your statement

An understanding of your credit card statement is crucial for effective financial management. Key components include your balance, payment due dates, and reward points accrued. Tracking this information regularly can help you avoid late fees and overspending.

Direct debit and repayment methods

Bendigo Bank offers several methods for making repayments. Common options include eclipsing your budget through e-banking, phone banking, or in-person payments at branches. Scheduling regular payments can help you maintain a good credit score and avoid unexpected charges.

Enhancing security for your credit card transactions

Security is paramount in managing a credit card. Opting for mobile payments and contactless transactions can enhance security. Additionally, Bendigo Bank implements several security measures to protect your personal information and transactions.

In the event your card is lost or stolen, immediately report it to Bendigo Bank to prevent unauthorized usage. Familiarize yourself with the steps to take in such situations to mitigate risks effectively.

Frequently asked questions about Bendigo Bank credit cards

Tools and resources

Making informed financial decisions is easier with the right tools. Bendigo Bank offers interactive calculators that help you determine credit card costs, aiding in budgeting efficiently. Additionally, explore articles on maximizing credit card benefits to unlock the full potential of your account.

Additional support options

For further assistance, Bendigo Bank provides several contact methods for customer service. Whether you prefer phone support, email, live chat, or in-branch assistance, help is always at your fingertips. If you suspect fraudulent activity on your account, report it immediately to mitigate any damage.

Customer experiences and testimonials

Many current cardholders have shared positive experiences with Bendigo Bank credit cards. These range from easy-to-manage online accounts to superior customer service interactions. Testimonials frequently highlight the satisfaction rates regarding the rewards and benefits of using a Bendigo Bank credit card.

Important information

Familiarize yourself with the terms and conditions related to Bendigo Bank credit cards to avoid any misunderstandings. Understanding the privacy policies associated with financial products is also critical, ensuring that your information is protected while you utilize these banking services.

For the latest offers and promotions, visit the Bendigo Bank website regularly, where you can find updated information that may benefit your credit card experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bendigo bank credit card for eSignature?

How do I execute bendigo bank credit card online?

Can I create an electronic signature for signing my bendigo bank credit card in Gmail?

What is bendigo bank credit card?

Who is required to file bendigo bank credit card?

How to fill out bendigo bank credit card?

What is the purpose of bendigo bank credit card?

What information must be reported on bendigo bank credit card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.