Get the free Curious how Medicare might impact your health benefits ...

Get, Create, Make and Sign curious how medicare might

Editing curious how medicare might online

Uncompromising security for your PDF editing and eSignature needs

How to fill out curious how medicare might

How to fill out curious how medicare might

Who needs curious how medicare might?

Curious How Medicare Might Form

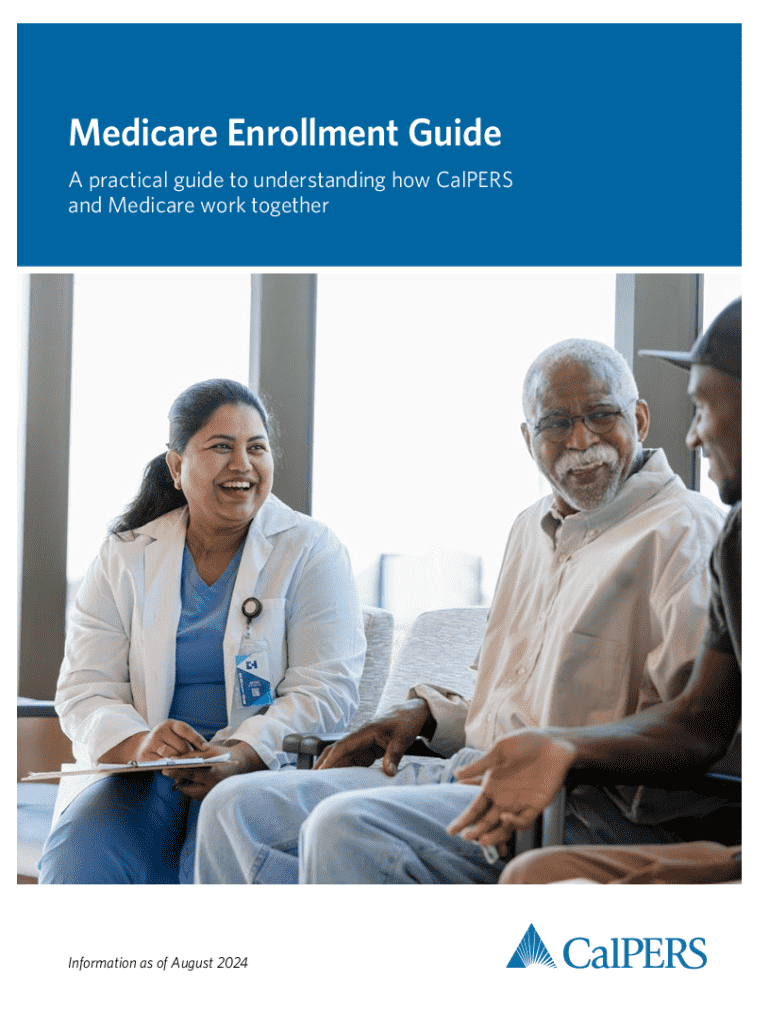

Understanding Medicare: An overview

Medicare is a federal health insurance program designed primarily for individuals aged 65 and older, although it also covers certain younger individuals with disabilities. Its primary purpose is to provide affordable healthcare coverage to senior citizens, ensuring they have access to necessary medical services without facing exorbitant costs.

The importance of Medicare in the U.S. healthcare system cannot be overstated. Not only does it serve millions of beneficiaries, but it also plays a crucial role in the broader healthcare framework by aiding in the prevention of financial hardship resulting from unexpected medical expenses. Essentially, Medicare impacts the economy by enabling smoother healthcare delivery for older adults.

The structure of Medicare: Decoding the parts

Medicare consists of four main parts, each designed to cover different healthcare needs. Understanding these parts is essential when navigating the Medicare landscape.

Medicare Part A: Hospital insurance

Medicare Part A primarily covers inpatient hospital stays, skilled nursing facilities, hospice care, and some home health services. Beneficiaries typically receive this part premium-free if they have worked for at least 10 years in Medicare-covered employment.

Medicare Part B: Medical insurance

Part B covers outpatient care, doctor visits, and necessary preventive services. Unlike Part A, Part B requires a monthly premium. Beneficiaries should consider the coverage it offers when deciding whether to enroll.

Medicare Part : Medicare Advantage plans

Part C allows beneficiaries to receive their Medicare benefits through private insurance companies. Medicare Advantage plans often combine coverage from Parts A and B and may include additional benefits such as vision or dental.

Medicare Part : Prescription drug coverage

Part D adds prescription drug coverage to Medicare, which is not included in Parts A or B. Beneficiaries can choose from various plans; understanding the formulary is vital to ensure necessary medications are covered.

How Medicare might form over time

The origins of Medicare trace back to 1965, established under the Social Security Act. Over the years, this program has evolved significantly, adapting to the changing needs of the population it serves. Historical evolution shows how Medicare has expanded to include additional benefits and services as healthcare needs have shifted.

Looking ahead to 2025 and beyond, several updates are anticipated. These may include expanded telemedicine services and rising emphasis on mental health. Legislative changes will play a pivotal role in shaping future developments. The importance of policies that address the growing senior demographic is critical for the program's sustainability and effectiveness.

Eligibility for Medicare: Who can get it?

Eligibility for Medicare primarily hinges on age, typically beginning at age 65. However, younger individuals may qualify if they receive Social Security Disability Insurance (SSDI) for 24 months or have specific conditions such as End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

Navigating the enrollment process: Step-by-step

Understanding the Medicare enrollment process is crucial for beneficiaries. The following steps distinctly outline how to navigate your way through:

Keeping track of these steps will ensure a smooth transition into Medicare coverage.

Costs and coverage: What to expect with Medicare

While Medicare provides essential coverage, beneficiaries need to be aware of associated costs. These include premiums for Parts B and D, as well as deductibles and copayments, which can add up.

Out-of-pocket costs must also be budgeted for, ensuring that beneficiaries maintain financial stability while managing health expenses. Knowing what to expect can significantly aid in financial planning.

Comparing coverage options: Original Medicare vs. Medicare Advantage

Original Medicare, composed of Parts A and B, offers flexibility in choosing healthcare providers. Conversely, Medicare Advantage plans, often with a network of providers, can provide additional benefits but may have more limited choices.

Understanding the benefits and limitations of each option is essential. Factors such as predictability of costs, choice of doctors, and additional coverage determine which plan might be better for individual needs.

The intricacies of Medigap insurance

Medigap, or Medicare Supplement Insurance, is additional coverage that can help fill in the gaps left by Original Medicare by covering deductibles and copayments. Beneficiaries often consider Medigap for added financial protection.

It is important to note that Medigap policies are not compatible with Medicare Advantage plans. Therefore, individuals need to evaluate their healthcare needs before choosing between these supplemental options.

Understanding Medicare penalties and avoiding costly mistakes

Enrolling late in Medicare can lead to penalties that significantly increase premiums for both Part B and Part D. Understanding and avoiding these penalties is crucial for beneficiaries seeking to manage their healthcare costs.

Common mistakes include missing deadlines and not fully understanding coverage options, which can lead to unnecessary costs. A proactive approach in enrollment and understanding plan rules will mitigate these issues.

Seeking help: Resources and guidance

Accessing the right resources can make all the difference when navigating Medicare. Collaborating with a knowledgeable Medicare agent ensures personalized guidance tailored to individual needs.

Additionally, numerous online tools offer comparison services for plans and sign-up assistance. Informational workshops and seminars also provide valuable education opportunities.

Frequently asked questions about Medicare

Understanding what documents are necessary for application and the nuances around switching between plans is vital for ensuring a smooth enrollment experience. The implications of income levels on Medicare premiums also warrant clarification.

Future directions: The future of Medicare

With technological advancements, Medicare’s future directions hint at more streamlined processes and personalized care strategies. Upcoming legislative frameworks are likely to enhance coverage models, addressing emerging medical needs.

The growing integration of technology within Medicare administration will facilitate better data management and accessibility, ensuring beneficiaries receive the care they need effectively.

User experience: Tips for managing your Medicare plans

Managing Medicare plans can be daunting, but utilizing online tools can simplify processes. Effective strategies include accessing your Medicare account online to review benefits and track healthcare expenses. Staying organized is key.

Additionally, keeping copies of all documents related to your Medicare plan will ensure easy reference and help avoid missing critical enrollment deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my curious how medicare might directly from Gmail?

How can I get curious how medicare might?

How do I edit curious how medicare might online?

What is curious how medicare might?

Who is required to file curious how medicare might?

How to fill out curious how medicare might?

What is the purpose of curious how medicare might?

What information must be reported on curious how medicare might?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.