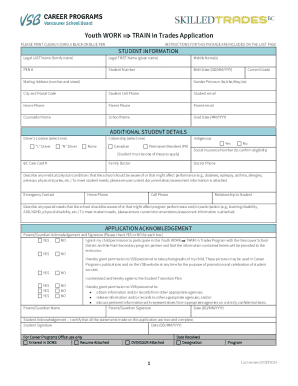

Get the free Bank Statement Template For Woodforest Bank

Get, Create, Make and Sign bank statement template for

How to edit bank statement template for online

Uncompromising security for your PDF editing and eSignature needs

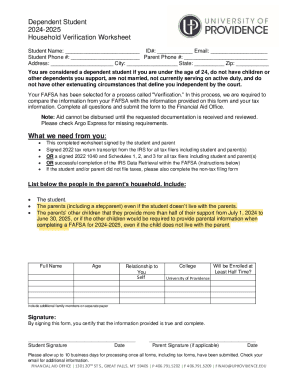

How to fill out bank statement template for

How to fill out bank statement template for

Who needs bank statement template for?

Comprehensive Guide to Bank Statement Template for Form

Understanding the importance of a bank statement template

A bank statement template serves as an essential tool for organizing and managing financial transactions, whether for personal use or business purposes. Choosing a bank statement template can streamline financial management processes significantly, making it easier to track income and expenses while enhancing accuracy in reporting. By utilizing a structured format, users can save valuable time on data entry and processing, allowing them to focus on critical decision-making.

Personal budgeting is one of the primary scenarios where a bank statement template proves advantageous. It allows individuals to visualize their spending habits and manage their finances effectively. Similarly, businesses harness bank statement templates for financial planning, enabling them to maintain precise financial records, forecast budgets, and assess the company’s fiscal health. Additionally, when applying for loans and mortgages, having a clearly organized bank statement can substantially improve the chances of approval, as it showcases a reliable financial history.

Key features of a bank statement template

When selecting a bank statement template, it’s crucial to ensure it includes comprehensive data fields to capture all necessary financial information. Key components such as account details—account number and name, transaction history detailing the date, description, and amount, as well as the closing balance and available funds—should be integrated into the template. These fields provide a seamless overview of all transactions, making it straightforward to reconcile accounts and maintain accurate records.

Design and format considerations also play a fundamental role in the effectiveness of a bank statement template. A user-friendly layout promotes easier navigation, while customization options allow for branding consistency, which is particularly beneficial for businesses. Ensuring compatibility with popular software versions, such as Excel and Google Sheets, is vital for a streamlined user experience, allowing for easy modifications and data entries.

Interactive tools for customization

Utilizing platforms like pdfFiller can simplify the customization of your bank statement template significantly. By following a straightforward step-by-step guide, users can easily upload their template and make necessary edits to suit their specific requirements. This includes adding customized fields, formatting existing text, or integrating logos and branding elements. Moreover, pdfFiller boasts an eSignature feature, allowing users to sign contracts and agreements directly through the document, enhancing compliance and validity.

The versatility of bank statement templates leads to variations tailored for specific use cases. For personal finance tracking, a simpler layout may suffice, while businesses might require a more detailed version to address specific accounting needs. Additionally, various formats suitable for different software applications are available, ensuring users can choose a version that best integrates with their existing systems.

Editing and managing your template with pdfFiller

Editing your bank statement template using pdfFiller is straightforward and user-friendly. Users can access a comprehensive template library to find suitable options and customize them according to their needs. Making adjustments to text and images is a breeze, and one can also add interactive fields for user input, which enhances engagement and usability during the financial review process.

Effective document management is equally essential when it comes to bank statement templates. Implementing best practices like version control allows users to keep track of changes over time, ensuring that they are referencing the latest information. Furthermore, organizing documents for easy retrieval is critical, particularly in business environments where multiple stakeholders might require access. Security measures should also be a priority, ensuring data privacy and integrity when handling sensitive information.

Benefits of transitioning to digital bank statements

Going paperless offers numerous advantages, especially in the world of banking and financial documentation. The environmental impact of reduced paper consumption cannot be overstated, as transitioning to digital formats contributes to sustainable practices. Improved accessibility is another key benefit; individuals and businesses alike can access their bank statements from anywhere, at any time, enhancing convenience and flexibility in managing finances.

Moreover, digital formats foster enhanced data organization and searchability, making it easier to retrieve historical records whenever needed. For those transitioning from traditional statements, utilizing OCR (Optical Character Recognition) technology can be instrumental. This technology transforms existing paper statements into editable digital formats while ensuring data integrity throughout the conversion process.

Troubleshooting common issues with bank statement templates

While utilizing a bank statement template can streamline financial tasks, users may encounter common challenges. Formatting issues across different software applications can create discrepancies, making it critical to ensure that the template is compatible with the chosen software. Regular checks should be performed to catch errors in data entry early and correct them proactively, ensuring accurate financial records are maintained.

To prevent these issues, users are encouraged to keep their templates updated and make necessary adjustments as software evolves. Adopting a proactive approach to template management will minimize disruptions and enable smoother document handling, ensuring that the bank statement template remains functional and relevant.

Integrating bank statement templates into your workflow

Incorporating bank statement templates into team workflows can significantly enhance operational efficiency. Establishing consistent practices for document use not only creates a unified approach but also reduces confusion among team members. Training teams on best practices for document management ensures everyone involved understands how to utilize these templates effectively, fostering productivity and collaboration.

To measure the effectiveness and efficiency of using bank statement templates, key performance indicators (KPIs) should be established. Tracking various metrics can help ascertain the impact of streamlined document processes, allowing for ongoing adjustments and improvements based on collected feedback. This iterative approach can lead to greater fiscal management over time.

Advanced techniques for data extraction and analysis

Bank statement templates can not only simplify record-keeping but also serve as foundational tools for advanced data analysis. Utilizing functionalities like pivot tables allows users to extract insights into spending patterns, thereby facilitating better financial planning. Graphical representations of these patterns can further aid analysis, making it easier to visualize trends and make informed decisions.

For businesses looking to integrate their bank statement templates with third-party tools, options like Docparser can be invaluable. This tool enables automation of data flow, facilitating the transfer of vital information from statements directly to analysis software, thereby streamlining processes and enhancing overall efficiency.

Real-world case studies

Examining success stories across various organizations that have adopted bank statement templates provides valuable insights. Case studies reveal comparative analyses of outcomes before and after implementation of structured templates, highlighting measurable improvements in efficiency and accuracy. Testimonials from users showcase user experiences that emphasize the increased reliability and ease of managing financial documentation.

Key takeaways from these case studies include the importance of customizing templates to suit specific organizational needs and the benefits of integrating digital tools for streamlined processes. Organizations that have optimized their document processes have reported not only time savings but also enhanced compliance in financial reporting, underscoring the efficacy of a robust bank statement template.

Future trends in document management

Emerging technologies are set to redefine document creation and management practices, including bank statement templates. Artificial intelligence and machine learning are paving the way for smarter document processing features that facilitate easier data extraction and analysis while ensuring accuracy. Additionally, advancements in data security and privacy measures are vital as organizations strive to protect sensitive financial information.

Preparing your organization for future changes involves staying current with industry best practices and actively engaging in continuous learning. Embracing these trends will not only enhance document management capabilities but also ensure businesses can pivot quickly in an ever-evolving digital landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my bank statement template for in Gmail?

How can I modify bank statement template for without leaving Google Drive?

How do I complete bank statement template for on an Android device?

What is bank statement template for?

Who is required to file bank statement template for?

How to fill out bank statement template for?

What is the purpose of bank statement template for?

What information must be reported on bank statement template for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.