Get the free Overdraft-Form.pdf

Get, Create, Make and Sign overdraft-formpdf

Editing overdraft-formpdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out overdraft-formpdf

How to fill out overdraft-formpdf

Who needs overdraft-formpdf?

Your Complete Guide to the Overdraft Form PDF

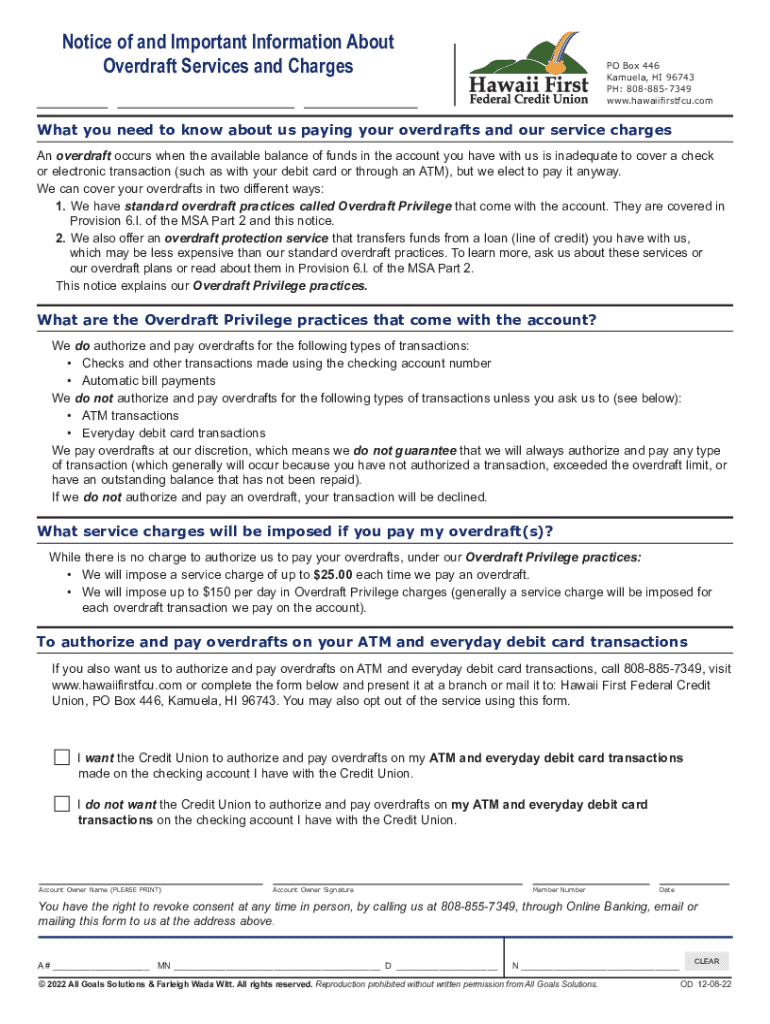

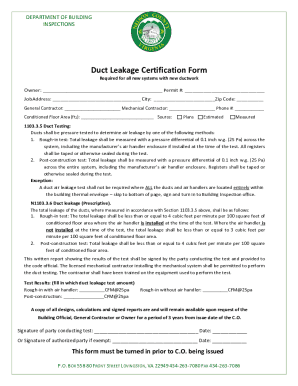

Understanding the overdraft form

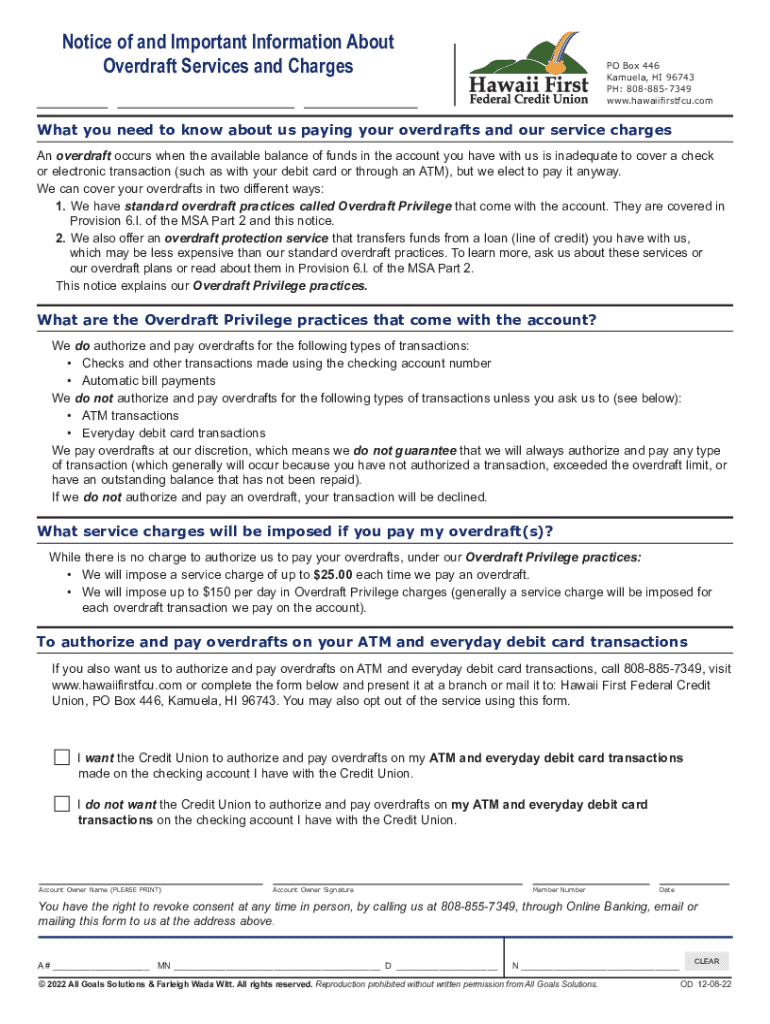

An overdraft form is a crucial document for individuals wishing to manage their bank accounts effectively. This form allows account holders to authorize their bank to extend credit when their checking account reaches a zero balance. It provides a way to cover unexpected expenses without incurring significant penalties.

Common situations necessitating an overdraft form include emergencies, unexpected bills, or temporary cash flow shortages. Filling out this form accurately is essential for maintaining a seamless banking relationship and avoiding unnecessary fees.

It’s crucial to complete the overdraft form correctly to avoid delays or rejections that can negatively impact your finances.

Key components of the overdraft form

The overdraft form generally consists of essential information required by the bank to process your request. Key details include your personal information, such as your name, address, and account number, as well as details of your bank branch.

Understanding the types of overdraft options available is equally important. Banks typically offer several options for overdraft coverage:

Each type of overdraft option has unique implications regarding fees and interest rates, making it essential to assess which option best suits your financial strategy.

Step-by-step guide to filling out the overdraft form

Filling out the overdraft form doesn’t have to be intimidating. Follow this step-by-step guide to ensure accuracy and compliance with your bank’s requirements.

Step 1: Gather Necessary Information. Compile a checklist of required details, including your account number, identification, and any other relevant financial documents.

Step 2: Accessing the Overdraft Form. Locate the PDF form on your bank’s website or pdfFiller. Many banks have downloadable forms available under their customer service sections.

Step 3: Filling Out the Form. Carefully fill in each section, ensuring all information is accurate. Misstatements can lead to delays or rejection.

Step 4: Reviewing Your Completed Form. Double-check your completed form to ensure all information is correct, as inaccuracies can result in application rejection.

Step 5: Submitting the Overdraft Form. You can submit your form online, via email, or in person at your bank. After submission, expect confirmation and processing updates.

Editing and customizing your overdraft form with pdfFiller

pdfFiller offers powerful editing tools that enhance your ability to fill out the overdraft form accurately. With its user-friendly interface, you can edit any section of your PDF easily.

You can add signatures and dates within the platform, ensuring your document is ready for submission. Collaborative features allow team members to work together on the overdraft application, streamlining the process.

These tools not only save time but also ensure that your document meets all banking requirements.

Signing and managing the overdraft form

eSigning your overdraft form has never been easier with pdfFiller. The platform allows you to sign electronically, which is legally valid for financial documents. This eliminates the hassle of printing, signing, and rescanning your forms.

Once submitted, keeping track of your overdraft application is vital. pdfFiller offers document management tools that help you store, retrieve, and organize forms efficiently for subsequent reference.

These features ensure that managing your overdraft form is straightforward and efficient.

Troubleshooting common issues with overdraft forms

Despite your best efforts, issues may arise with your overdraft form. If your form is rejected, understanding the common reasons can help you quickly resolve the situation.

Common reasons include missing information, incorrect personal details, or lack of supporting documentation. If your form is rejected, take immediate steps to correct the errors and resubmit.

Contacting customer support can provide clarity on unresolved issues and guide you through the necessary steps.

Additional tips for managing overdrafts

Managing overdrafts effectively can save you from incurring unnecessary fees. Implementing strategies to monitor your account balance is essential.

Setting alerts or notifications can keep you informed about your account status and help you avoid overdraft situations.

Understanding your bank’s overwriting policies can empower you to negotiate fees or find better terms for overdraft protection. Always check for periodic promotional offers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit overdraft-formpdf from Google Drive?

How can I edit overdraft-formpdf on a smartphone?

How can I fill out overdraft-formpdf on an iOS device?

What is overdraft-formpdf?

Who is required to file overdraft-formpdf?

How to fill out overdraft-formpdf?

What is the purpose of overdraft-formpdf?

What information must be reported on overdraft-formpdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.