Get the free 2020-Federal-Form-990-Donor-Copy. ...

Get, Create, Make and Sign 2020-federal-form-990-donor-copy

Editing 2020-federal-form-990-donor-copy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020-federal-form-990-donor-copy

How to fill out 2020-federal-form-990-donor-copy

Who needs 2020-federal-form-990-donor-copy?

2020 Federal Form 990 Donor Copy Form: A Comprehensive How-To Guide

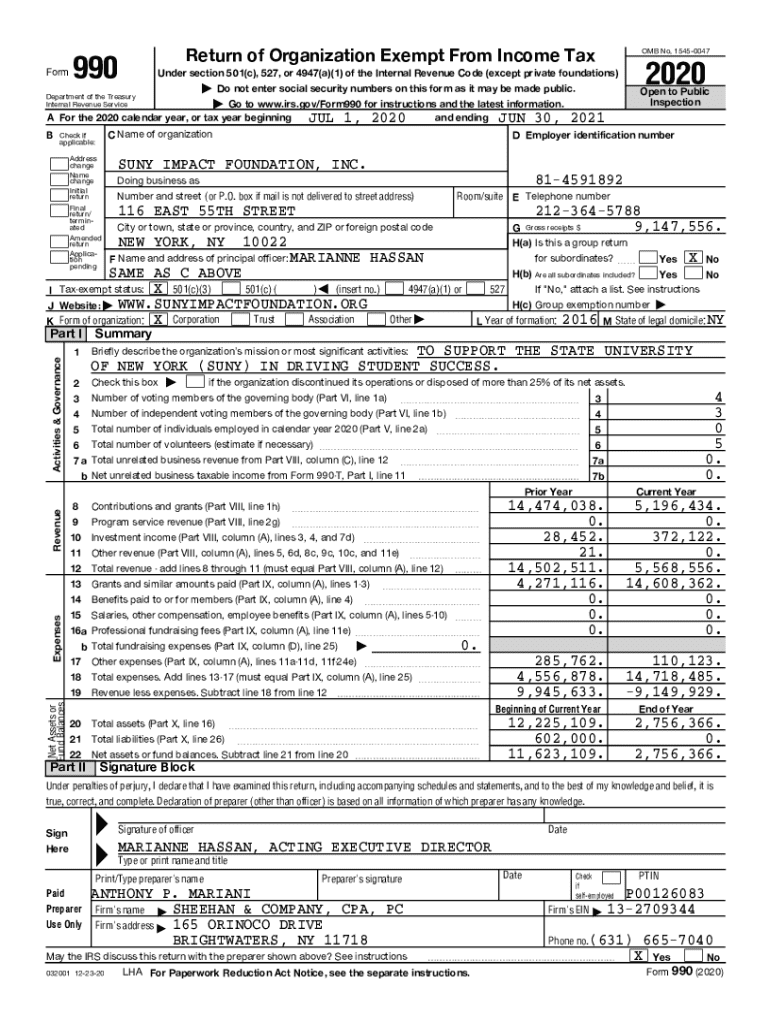

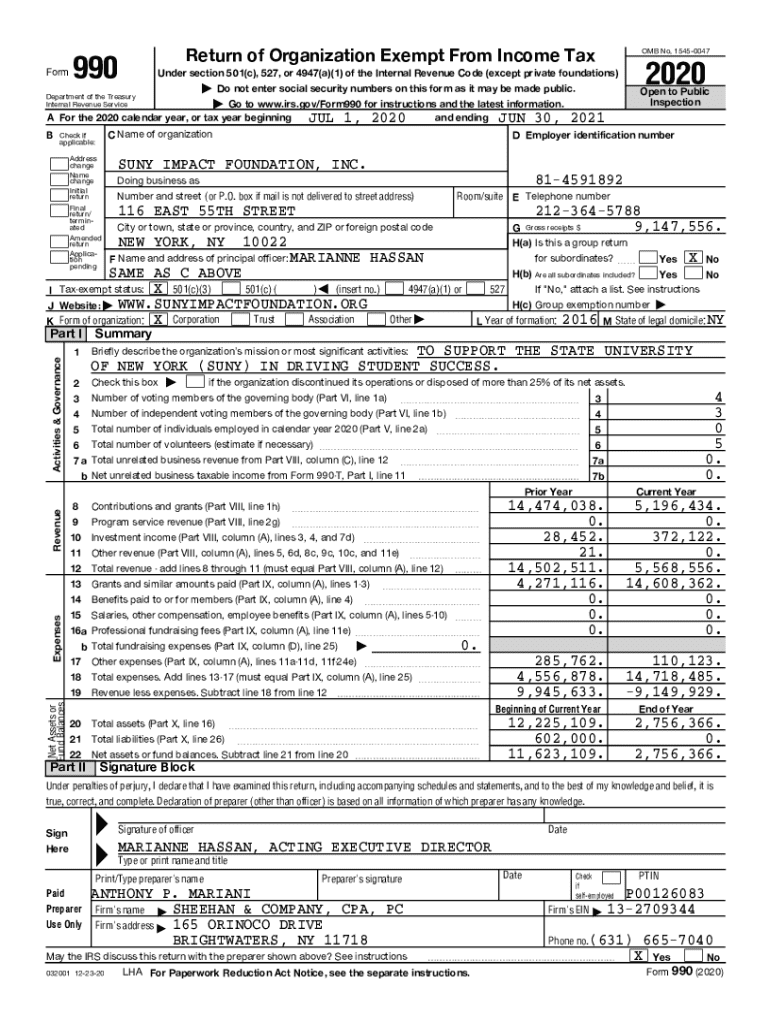

Understanding the 2020 Federal Form 990 Donor Copy

The 2020 Federal Form 990 Donor Copy serves as a crucial document for organizations to report financial activities to the IRS. This form provides transparency in the operations of charitable organizations and is essential for maintaining tax-exempt status. It is designed not only for regulatory compliance but also to instill trust among donors who contribute to non-profits.

The importance of the Form 990 cannot be overstated—it allows donors to assess how their contributions are being utilized, ensuring that funds are allocated effectively. Moreover, it aids organizations in demonstrating accountability, which is pivotal for securing future donations.

Key features of the donor copy

The donor copy of the Form 990 includes specific sections that are of particular interest to donors. Unlike the standard version submitted to the IRS, this copy may include additional notes or summaries aimed directly at stakeholders. Sections like 'Donor Information' and 'Financial Summary' give donors a clearer view of how their contributions are making an impact.

Preparing to fill out the 2020 Federal Form 990 Donor Copy

Before diving into filling out the 2020 Federal Form 990 Donor Copy, it’s imperative to gather all required documentation. This usually includes prior tax returns, accounting records, donor lists, and information about services or programs funded by contributions.

Identifying key figures, such as total revenues and expenditures, simplifies the data entry process. When preparing these figures, ensure they are up-to-date and align with your organization's financial statements.

Understanding the language of Form 990

Familiarizing yourself with Form 990 terminology is equally important. Terms such as 'gross receipts' and 'net assets' are commonly used throughout the document. Understanding the difference between these terms will aid in accurately reporting and interpreting financial data.

Step-by-step instructions for completing the 2020 Federal Form 990 Donor Copy

Completing the 2020 Federal Form 990 Donor Copy requires a meticulous approach. Each section should be filled out with precision, reflecting the organization’s financial transparency and accountability.

Section-by-section breakdown

The first section covers organization information, including the name, Employer Identification Number (EIN), and address. This lays the groundwork for the rest of the document.

Best practices for completing the form

To ensure clarity and accuracy when filling out the form, meticulously review all data entered. A common mistake is transposing numbers or miscalculating figures, which can lead to compliance issues.

Editing and finalizing the 2020 Federal Form 990 Donor Copy

Once the form is filled out, editing is a crucial step. Utilizing tools such as pdfFiller can streamline the document editing process. Accessing the form through pdfFiller allows you to make any necessary amendments efficiently.

Utilizing pdfFiller for document editing

With pdfFiller, you can upload the 2020 Federal Form 990 Donor Copy and utilize a range of editing tools to make changes. To upload your completed form, simply create an account or log in, selecting the option to upload files from your device.

Ensuring compliance and accuracy

Through pdfFiller, you can check for errors using the available validation tools, ensuring your form meets compliance standards before submission. Collaborating with team members in reviewing the document enhances accuracy and offers additional perspectives.

Signing and sharing the 2020 Federal Form 990 Donor Copy

The signing of the 2020 Federal Form 990 Donor Copy can easily be accomplished through electronic signatures. This is legally recognized and offers convenience. pdfFiller provides functionality for e-signing within its platform, making the process seamless.

Options for electronic signatures

Electronic signatures simplify document finalization, allowing for quick approval. You can e-sign using the signature features in pdfFiller, which securely stores and validates the signed document.

Sharing the donor copy with stakeholders

Once signed, sharing the 2020 Federal Form 990 Donor Copy is easy. Options include sharing via email, downloading for local storage, or utilizing cloud services. Proper record-keeping of shared donor copies is vital for transparency and future reference.

Managing your 2020 Federal Form 990 Donor Copy with pdfFiller

Effective document management is crucial for any organization. pdfFiller offers solutions to categorize and store your 2020 Federal Form 990 Donor Copy efficiently. You can use tags and categories to streamline retrieval whenever needed.

Organizing and storing document copies

Utilize pdfFiller’s organizational features to create folders for different fiscal years or categories. This practice ensures quick access to past forms and simplifies the process of reviewing historical submissions.

Reviewing past forms and records

Understanding your past filings can enhance current reporting accuracy and offer insights into your organization's growth. pdfFiller makes it simple to access historical forms, allowing for a comprehensive review.

FAQs about the 2020 Federal Form 990 Donor Copy

Many individuals and teams have questions regarding the 2020 Federal Form 990 Donor Copy. Common inquiries revolve around its usage, deadlines, and essential requirements for accurate filing.

Common questions from individuals and teams

Questions may include, 'What are the key deadlines for submitting the Form 990?' or 'What happens if I miss the deadline?' Answering these queries not only improves understanding but also promotes compliance.

Troubleshooting tips for frequent issues

If you encounter errors or need clarification, common troubleshooting tips suggest double-checking all input data and ensuring that all necessary documentation is included. Furthermore, leverage pdfFiller’s support tools to assist in resolving any issues encountered.

Interactive tools and resources available on pdfFiller

pdfFiller provides various additional templates and guidance materials to assist users navigating the Form 990 process. Utilizing these resources can simplify document creation and enhance understanding.

Utilizing help features and customer support

Support is readily available for users needing assistance with filling out the 2020 Federal Form 990 Donor Copy. Each user can access a variety of help features designed to mitigate common challenges, ensuring a smooth filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2020-federal-form-990-donor-copy from Google Drive?

Can I create an electronic signature for the 2020-federal-form-990-donor-copy in Chrome?

How do I edit 2020-federal-form-990-donor-copy on an iOS device?

What is 2020-federal-form-990-donor-copy?

Who is required to file 2020-federal-form-990-donor-copy?

How to fill out 2020-federal-form-990-donor-copy?

What is the purpose of 2020-federal-form-990-donor-copy?

What information must be reported on 2020-federal-form-990-donor-copy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.