Get the free tax preparer client worksheet - fill online, printable, fillable ...

Get, Create, Make and Sign tax preparer client worksheet

Editing tax preparer client worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparer client worksheet

How to fill out tax preparer client worksheet

Who needs tax preparer client worksheet?

Complete Guide to the Tax Preparer Client Worksheet Form

Understanding the Tax Preparer Client Worksheet Form

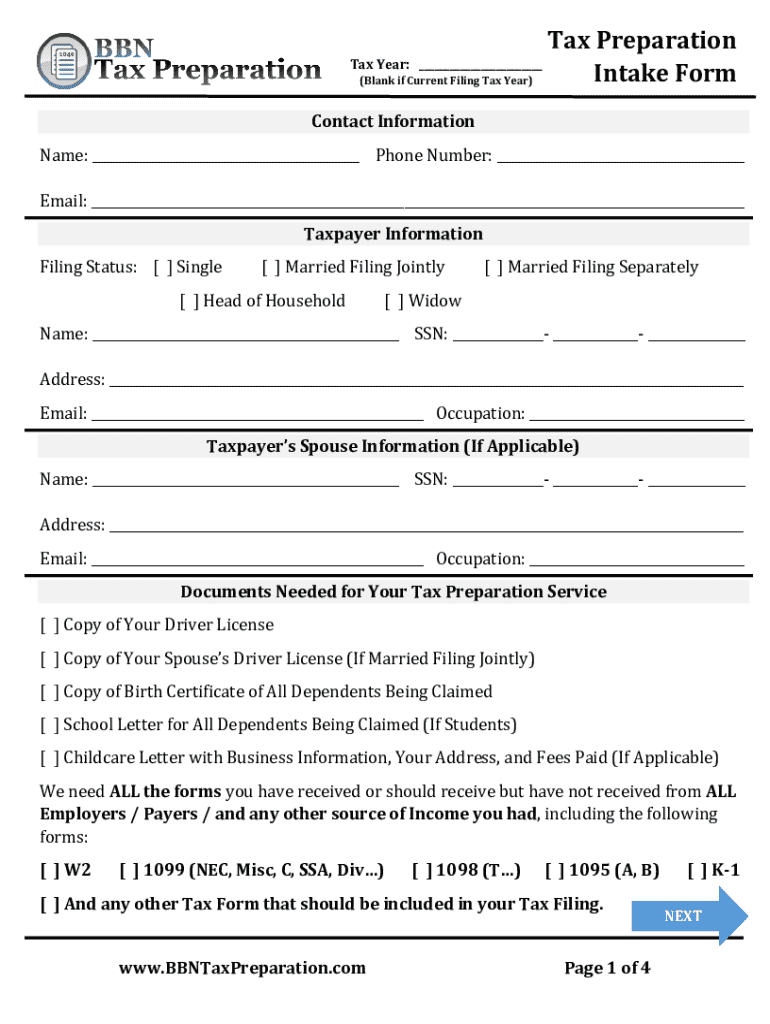

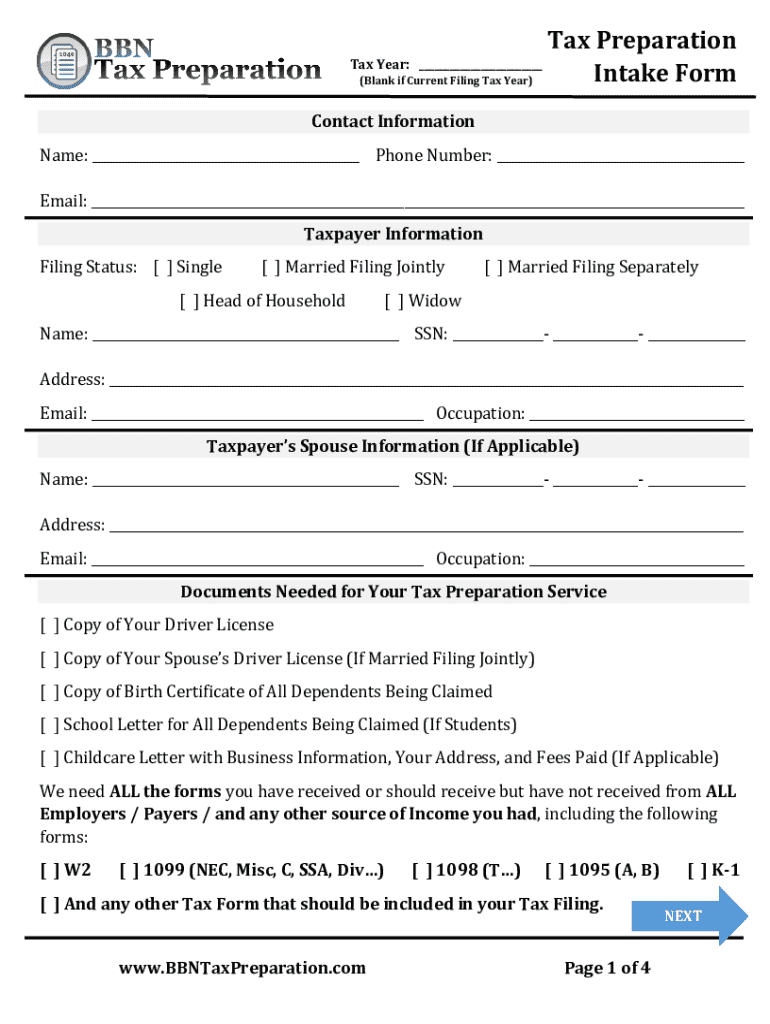

The Tax Preparer Client Worksheet Form is a crucial tool used during tax preparation, acting as a guide for clients to compile and present their financial details to tax professionals. This form captures vital information about income, expenses, deductions, and other pertinent data essential for accurate tax filing. Without a systematic approach to collecting this information, individuals might overlook important details that lead to errors in their tax returns.

The form is designed to streamline the information flow between clients and tax preparers, ensuring that necessary data is collected efficiently and accurately. Providing a clear layout of questions and sections, it helps minimize the risk of errors and omissions, which could result in delayed processing or audits. The importance of this form extends beyond mere record-keeping; it reflects comprehensive understanding and preparedness in handling one’s financial obligations.

Types of Tax Preparer Client Worksheets

Different tax situations require specialized worksheets to adequately cover varied income and expense scenarios. The most common forms include the Individual Income Tax Worksheet and the Self-Employed Income & Expense Worksheet, each tailored to meet specific needs.

Beyond these, specialized worksheets serve the unique circumstances of certain professions and situations, allowing for precise financial reporting.

The adoption of these specialized worksheets enhances the accuracy of tax filings and caters to the unique financial situations of taxpayers, highlighting the value of a customized approach.

Step-by-step guide to filling out the tax preparer client worksheet form

Filling out the Tax Preparer Client Worksheet Form requires careful attention to detail. Start by gathering all necessary personal identification documents and financial records, including W-2s, 1099s, and previous tax returns which provide insights into your financial history.

Next, process the information systematically by inputting data into the form, ensuring that each section is carefully completed. It's crucial to be thorough but also organized, as mistakes can lead to complications down the line.

Concluding the process involves reviewing the filled worksheet with your tax preparer to ensure that all critical points have been addressed. Effective communication can clarify any uncertainties, ultimately contributing to a seamless tax filing experience.

Digital tools for managing your tax preparer client worksheet form

In the contemporary tax preparation landscape, leveraging digital tools can greatly enhance efficiency. pdfFiller, for instance, offers a comprehensive document management platform that simplifies the creation and management of tax preparer client worksheet forms.

Features include seamless PDF editing capabilities that allow users to customize worksheets, add necessary information, and utilize eSignature functionalities for quick signing. This flexibility empowers both clients and tax preparers to collaborate effectively, regardless of location.

Frequently asked questions (FAQs)

Many queries arise surrounding the Tax Preparer Client Worksheet Form, and addressing them is essential for efficient tax preparation. Common inquiries can range from required information to how to rectify missing data.

Best practices for using the tax preparer client worksheet form

Maintaining accurate records is one of the best practices for tax preparation. Throughout the year, keep careful and organized documentation of your income and expenses to expedite filling out the Tax Preparer Client Worksheet Form during tax season.

Seasonal preparation is equally important. Initiating preparations early can help alleviate the last-minute rush that often leads to oversights or incomplete filings. Adopt strategies such as setting reminders and keeping a to-do list to ensure timely submissions.

Additional tools and resources

Access to downloadable client-facing tax documents is invaluable. Offering forms in both English and Spanish can improve client comprehension and ensure accurate submissions. Providing these resources demonstrates a commitment to helping clients navigate the often-complex world of taxes.

Additionally, consider acquainting yourself with e-filing applications and various tax software options that can simplify tax preparation processes tailored to specific needs, further easing the burden.

Keeping informed about tax changes

Staying updated on tax legislation is critical. Tax laws evolve, and new measures can significantly influence filing requirements and available deductions. Being prepared means keeping abreast of recent developments, such as the provisions of the 'One Big Beautiful Bill' Act, which may include changes affecting tax brackets or deductions.

Subscribing to tax newsletters can be an effective way to stay informed, providing regular updates and insights that help you make informed decisions regarding your tax situation.

Contact support for assistance

If you require additional help with the Tax Preparer Client Worksheet Form or document management, do not hesitate to reach out to the pdfFiller support team. Their expertise is designed to cater to your needs, ensuring that you can manage your documentation efficiently.

With a professional support system in place, users can navigate their tax preparation journeys with enhanced confidence and capability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax preparer client worksheet on an iOS device?

How can I fill out tax preparer client worksheet on an iOS device?

Can I edit tax preparer client worksheet on an Android device?

What is tax preparer client worksheet?

Who is required to file tax preparer client worksheet?

How to fill out tax preparer client worksheet?

What is the purpose of tax preparer client worksheet?

What information must be reported on tax preparer client worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.