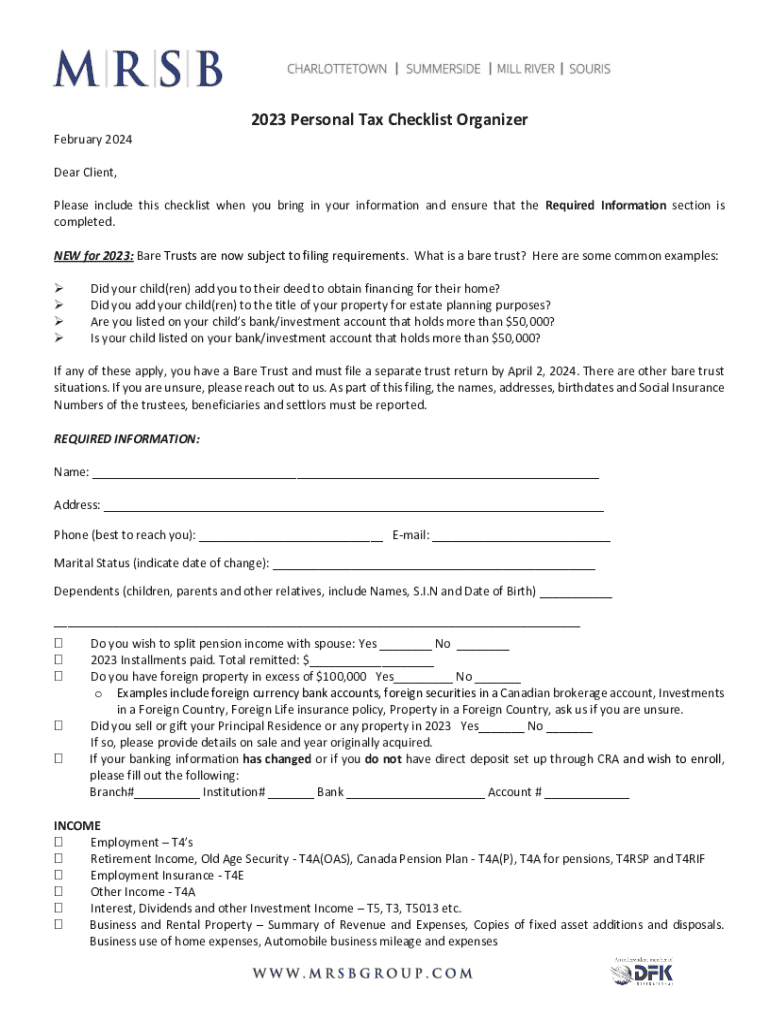

Get the free 2024 Pennsylvania Personal Income Tax Return ...

Get, Create, Make and Sign 2024 pennsylvania personal income

Editing 2024 pennsylvania personal income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 pennsylvania personal income

How to fill out 2024 pennsylvania personal income

Who needs 2024 pennsylvania personal income?

Your Complete Guide to the 2024 Pennsylvania Personal Income Form

Overview of Pennsylvania personal income tax

Filing a personal income tax return in Pennsylvania is a critical responsibility for residents, ensuring compliance with state tax laws. The personal income tax contributes significantly to the funding of vital public services, including education, healthcare, and infrastructure. For the 2024 tax year, several key changes have emerged that taxpayers need to be aware of, particularly concerning deductions and credits. Understanding Pennsylvania's tax rate structure is crucial; the state employs a flat income tax rate of 3.07% on taxable income, which distinguishes it from many other states that use a progressive taxation system based on income brackets.

Introduction to Form PA-40

Form PA-40 is the official document for filing personal income tax returns in Pennsylvania. All residents who earn income, whether through employment, self-employment, or other sources, are generally required to file this form. Eligibility to file Form PA-40 extends beyond traditional wage earners, encompassing freelancers, retirees, and individuals with investment income. It’s important to review specific eligibility requirements thoroughly to ensure compliance and avoid penalties.

Gathering necessary information

Before taking on the Form PA-40, gathering all necessary documentation is essential for an efficient filing process. Individuals should collect the following documents:

Additionally, personal identification information, such as Social Security numbers for filers and dependents, is necessary to ensure accurate processing of the form and its associated claims.

Accessing and downloading the 2024 Form PA-40

The 2024 Form PA-40 can easily be accessed and downloaded from the Pennsylvania Department of Revenue's official website. Simply navigate to the forms section and find the necessary link provided for the PA-40. Users seeking a more interactive experience can utilize tools like pdfFiller, which offer enhanced navigation features and allow for easy customization of the form. pdfFiller provides editing capabilities that allow users to fill in or modify sections of the form effortlessly.

Detailed guide to filling out Form PA-40

Completing Form PA-40 requires attention to detail to ensure a proper filing experience. Here is a step-by-step breakdown of what to fill out:

When reporting, be diligent to accurately reflect your income to avoid triggering audits, which could lead to unwanted scrutiny. Consistent documentation and receipts will fortify your return.

Filing your Form PA-40

Taxpayers can file their Form PA-40 through various methods. Traditionally, mailing the completed form to the appropriate state address was the norm. However, e-filing has become increasingly popular due to its convenience and efficiency. Utilizing platforms like pdfFiller can expedite this process, providing features that streamline e-filing and ensure compliance with state laws. Furthermore, keep track of the important deadlines for submission to avoid late penalties.

Key dates for the 2024 tax year

Staying informed about key dates for the 2024 tax year is vital for effective tax management. The tax season officially opens in early January and closes on April 15, with several important dates to note:

Remember that while the federal deadlines exist, state-specific deadlines must also be respected for proper compliance.

Frequently asked questions about Form PA-40

Many common questions arise regarding Form PA-40 that can help demystify the filing process. Taxpayers frequently ask about eligibility criteria and the consequences of filing late. Clarifying questions such as what qualifies as taxable income in Pennsylvania or how to overcome common filling errors can ease anxiety. Familiarizing oneself with this information can diminish uncertainties surrounding the filing process.

Utilizing pdfFiller for enhanced filing experience

pdfFiller offers numerous features to enhance your tax filing experience. The platform allows seamless editing, e-signing, and collaboration on documents, which is especially useful for teams engaged in tax-related preparations. Added security measures, such as encrypted document storage, ensure that your sensitive information remains protected throughout the filing process.

Post-submission: What to expect

After submitting Form PA-40, it's essential to understand the review process that might follow. The Pennsylvania Department of Revenue may take time to review your filing, and you can check the status of your return online for peace of mind. Should the department require additional information or clarification, prompt response will help ensure a smooth process.

Conclusion: Ensuring compliance and optimizing refunds

To optimize your refund and ensure compliance, thoroughness is key. Keep detailed records and receipts for future reference, as maintaining documentation simplifies your tax preparation. Whether you utilize online tools or traditional filing methods, the right preparation can lead to a positive tax experience and potentially higher returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 pennsylvania personal income in Gmail?

How can I get 2024 pennsylvania personal income?

How do I make changes in 2024 pennsylvania personal income?

What is 2024 Pennsylvania personal income?

Who is required to file 2024 Pennsylvania personal income?

How to fill out 2024 Pennsylvania personal income?

What is the purpose of 2024 Pennsylvania personal income?

What information must be reported on 2024 Pennsylvania personal income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.