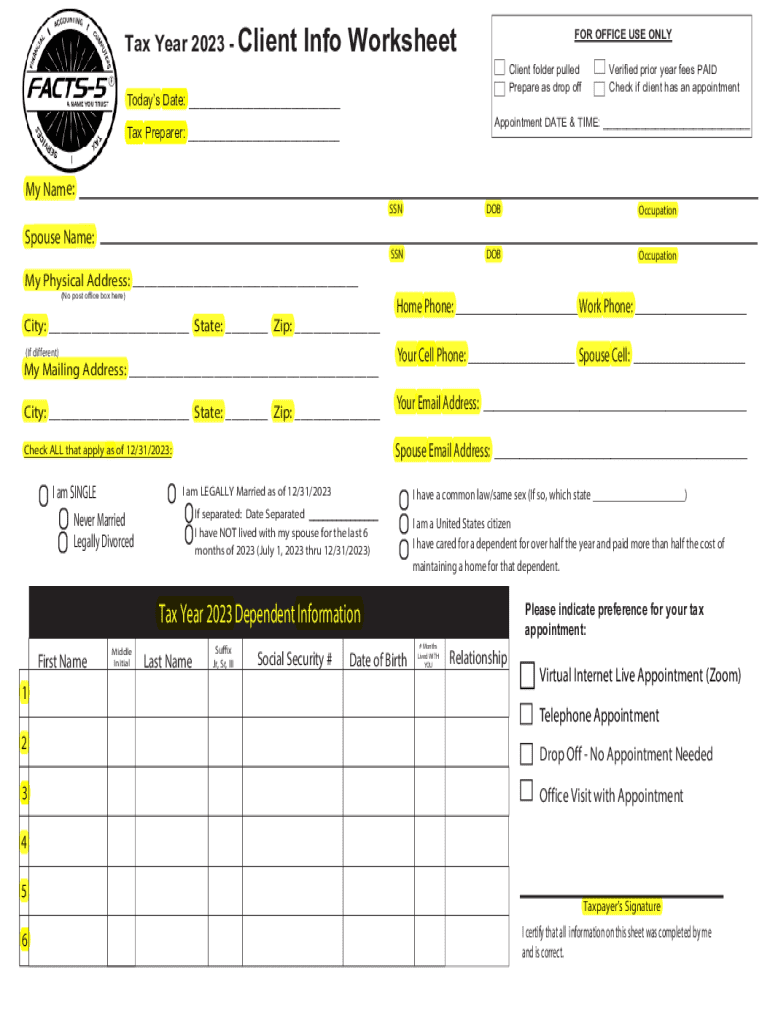

Get the free 12 year-end tax tips for 2024

Get, Create, Make and Sign 12 year-end tax tips

Editing 12 year-end tax tips online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 12 year-end tax tips

How to fill out 12 year-end tax tips

Who needs 12 year-end tax tips?

12 Year-End Tax Tips Form: Your Comprehensive Guide to Tax Optimization

Understanding the importance of year-end tax preparation

Year-end tax preparation is crucial for individuals and businesses to ensure compliance with IRS regulations while maximizing potential tax savings. Timely tax filing, complemented by strategic financial decisions made before the year's end, can dramatically impact your overall tax liability. The '12 year-end tax tips form' acts as a guiding tool to help you navigate these essential preparations, ensuring that you maximize deductions and credits available to you.

Moreover, utilizing cloud-based solutions such as pdfFiller not only simplifies tax document management but also enhances accessibility, allowing users to edit, eSign, and share forms effortlessly. This forward-thinking approach makes tax preparation less daunting and significantly more organized.

Key strategies to optimize your year-end tax experience

To make the most of the tax code and minimize your tax liability, implementing these key strategies is crucial:

Interactive tools and resources for year-end tax preparation

One of the best ways to streamline your tax preparation process is through interactive tools and resources, particularly offered by pdfFiller. By utilizing these features, you simplify the often tedious task of filling out forms and managing documentation.

Turning tax tips into actionable steps

With the vast array of strategies available, turning insights into actionable steps is essential for effective tax planning. Start by creating a personalized tax preparation checklist using pdfFiller templates. This checklist serves as a reminder system, guiding you through every important step and helping you keep track of documents and deadlines.

In parallel, you can plan for next year’s taxes by identifying strategies to enhance your year-round tax planning. Reflect on this year’s experiences to establish clear goals, ensuring that your tax approach continues to evolve and become more effective.

Testimonials and success stories from users

Users of pdfFiller have shared remarkable success stories about how the platform streamlined their year-end tax processes. From families preparing taxes together to individual users easily managing their tax forms, the testimonials highlight the efficiency gained through using pdfFiller.

For many, the ability to edit PDFs quickly, access forms from anywhere, and eSign documents with just a couple of clicks has transformed the intimidating tax preparation process into a manageable task. Their experiences serve as concrete examples of how pdfFiller's features alleviate stress and improve productivity during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 12 year-end tax tips in Gmail?

How can I edit 12 year-end tax tips on a smartphone?

How do I fill out 12 year-end tax tips using my mobile device?

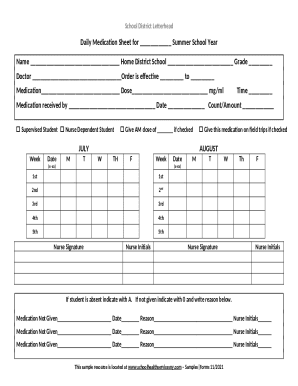

What is 12 year-end tax tips?

Who is required to file 12 year-end tax tips?

How to fill out 12 year-end tax tips?

What is the purpose of 12 year-end tax tips?

What information must be reported on 12 year-end tax tips?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.