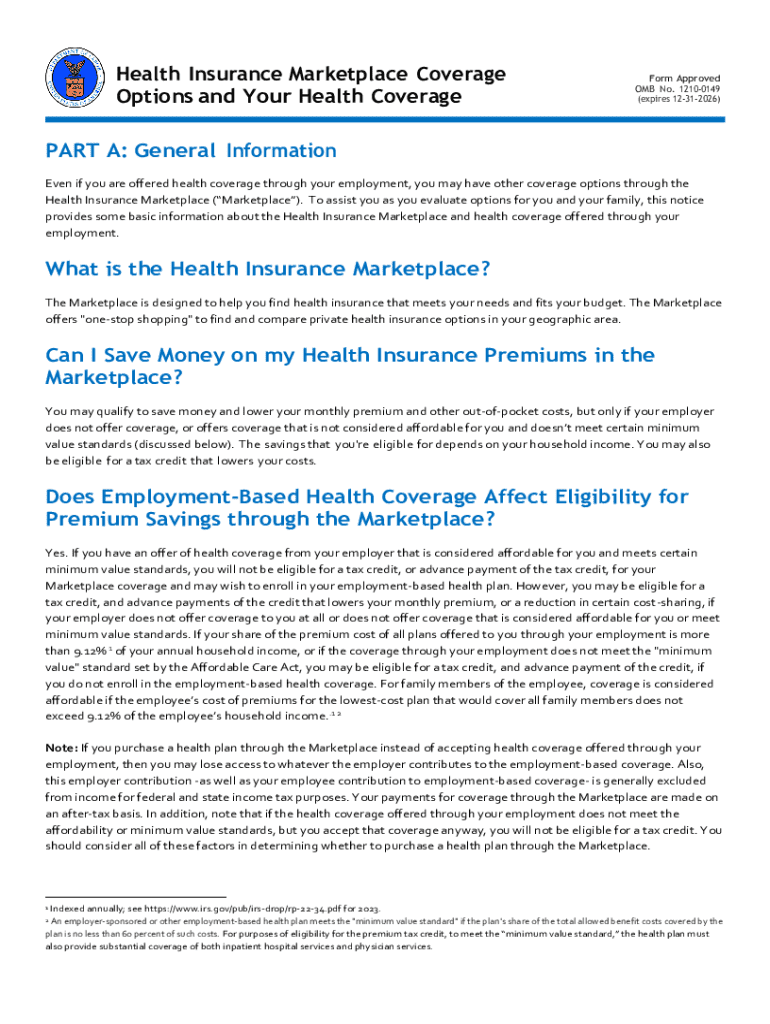

Get the free The savings that you're eligible for depends on your household income

Get, Create, Make and Sign form savings that you039re

Editing form savings that you039re online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form savings that you039re

How to fill out form savings that you039re

Who needs form savings that you039re?

Form savings that you're form: A comprehensive guide

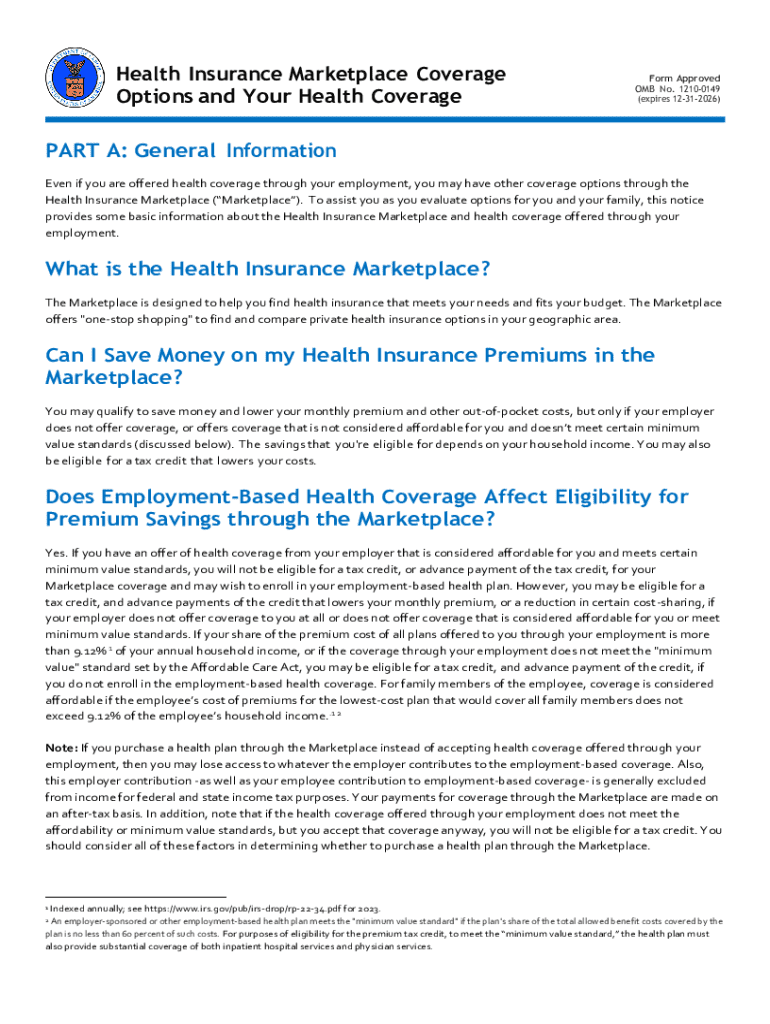

Understanding the purpose of savings forms

A savings form is a structured document used to manage and facilitate various savings-related activities. Understanding the significance of these forms is crucial for effective financial management. Whether you're applying for a savings account or purchasing government savings bonds, these forms serve to collect necessary information and streamline the process, ensuring that your financial operations are as efficient as possible.

What is a savings form?

In essence, a savings form is a document that allows individuals and organizations to provide details for specific savings products. This could include personal savings accounts, certificates of deposit, or government bonds. Each type of savings form often has unique requirements, including personal identification and financial information, which makes understanding them important for successful completion.

How to access the correct savings form

Finding the right savings form is pivotal to achieving your financial goals. Start by identifying your specific needs. For instance, if you are considering saving for education, you might need a different form compared to one required for retirement savings. Be clear about your objectives, as this will help narrow down your choices.

Once you've pinpointed your needs, access the forms via online resources. Government websites, banks, and credit unions often provide downloadable or fillable forms. pdfFiller offers an excellent platform where you can find and seamlessly interact with a variety of savings forms tailored to your needs.

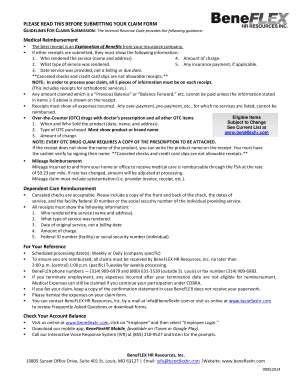

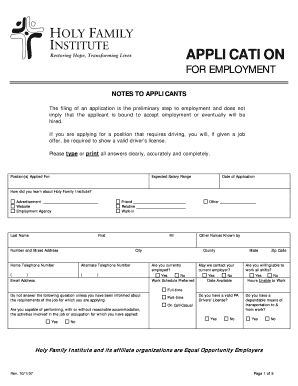

Step-by-step guide to filling out the savings form

Completing a savings form correctly is crucial to avoid delays in processing. Begin by gathering necessary information. This typically includes your Social Security number, bank account numbers, and any other personal identification required by the institution. Having this information on hand can speed up your filling process.

When filling out the form, accuracy is vital. Use clear, legible writing, and double-check that all entries are correct. Utilize pdfFiller’s interactive tools for efficient editing and electronic signing. Common mistakes to avoid include failing to read instructions carefully, skipping required fields, and providing outdated information. These errors can lead to processing delays or form rejection.

Editing and managing your savings forms

Managing your savings forms doesn’t stop after you fill them out. Utilizing a platform like pdfFiller allows you to edit forms conveniently even after they’ve been completed. This cloud-based editing solution lets you modify saved forms without starting from scratch, providing a great deal of flexibility.

Moreover, with electronic signatures, you can sign forms without printing them, enhancing the convenience factor. Collaboration features allow you to send and share forms with others for review or input, making it easier to manage group savings initiatives or family accounts.

Submitting your savings form

After completing your savings form, the submission process is the final step. There are two main methods of submission: digital and physical. Digital submissions are often more efficient and allow for immediate processing, while physical submissions may be necessary for certain types of documents.

Tracking your submission is important to ensure that it has been received and is being processed. Most banks and financial institutions provide a way to check the status of applications. Follow up with customer support if needed to address any issues or queries.

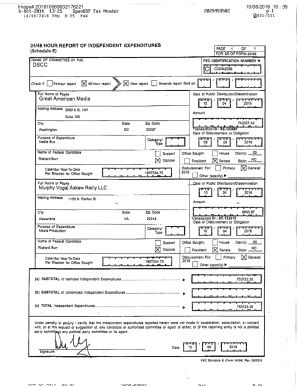

Special considerations for specific savings forms

Different savings forms come with unique rules and requirements. For example, when dealing with savings bonds, it's essential to understand ownership transfer and redemption processes. Regularly checking the status of your bonds and keeping track of their maturity dates will help you maximize your savings potential.

Updating information on current forms, such as changing a beneficiary, can also be complex. Make sure to follow the specified procedures provided by the institution to ensure your changes are registered accurately.

Frequently asked questions (FAQs)

Navigating the world of savings forms can often lead to several questions. One common query is, 'What should I do if I lose my savings form?' In this case, take immediate steps to report the loss to the issuing institution and request a replacement form. It's vital to document your efforts and follow any instructions they provide.

Another frequent concern is whether you can apply on behalf of someone else. Generally, this is possible but often requires obtaining their permission and providing necessary documentation. Always check with the institution for their specific protocols regarding third-party applications.

Additional services and resources through pdfFiller

pdfFiller goes beyond just providing access to savings forms. The platform also offers comprehensive document management services, setting it apart from standard solutions. With features like advanced editing, eSigning capabilities, and collaboration tools, users can manage all their document needs effectively from any location.

The platform’s partnerships with other document solutions enhance its offerings, allowing users to collaborate efficiently with external organizations or parties that require documentation.

Legal information and compliance

Understanding the legal requirements surrounding savings forms is essential. This includes recognizing what information is mandatory for each type of form and ensuring compliance with relevant regulations. Missteps here can lead to delays or rejections of your form submissions.

To ensure that your forms are legally binding, look into using electronic signatures where accepted and ensure that all timestamps and completion entries are logged correctly.

Connecting with pdfFiller support

If you encounter any issues or have questions while using pdfFiller, their support team is readily available to assist. You can reach out via email or through the website for specialized assistance tailored to your needs.

As pdfFiller continuously updates its features based on user feedback, keeping in touch with their support allows you to benefit from the latest advancements in document management and form processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form savings that you039re to be eSigned by others?

How do I edit form savings that you039re straight from my smartphone?

How do I fill out form savings that you039re using my mobile device?

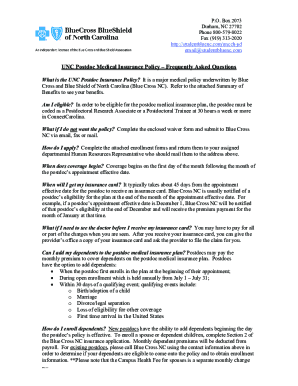

What is form savings that you're?

Who is required to file form savings that you're?

How to fill out form savings that you're?

What is the purpose of form savings that you're?

What information must be reported on form savings that you're?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.