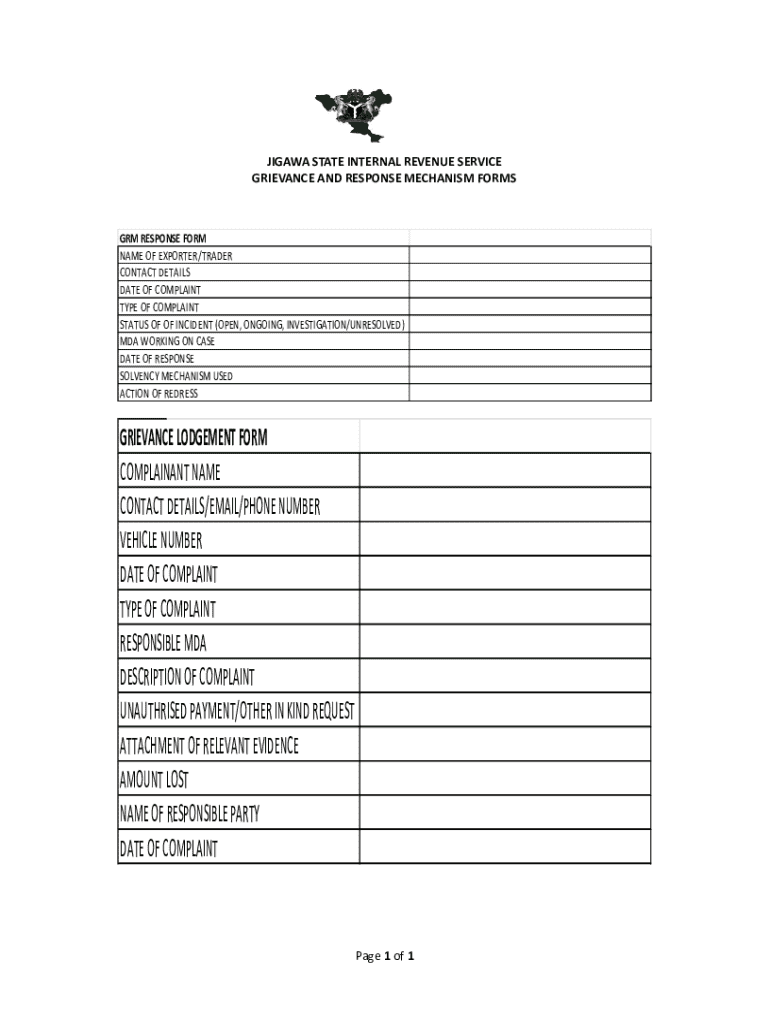

Get the free jigawa state internal revenue service contact information ...

Get, Create, Make and Sign jigawa state internal revenue

How to edit jigawa state internal revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out jigawa state internal revenue

How to fill out jigawa state internal revenue

Who needs jigawa state internal revenue?

Jigawa State Internal Revenue Form: A Comprehensive How-to Guide

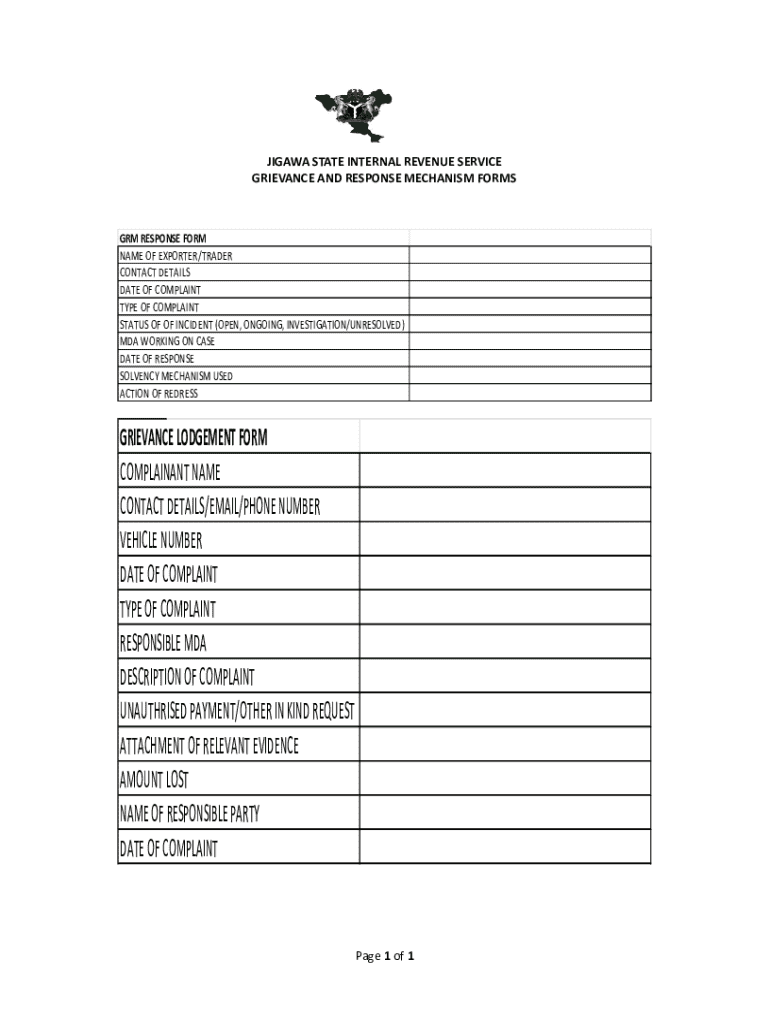

Understanding the Jigawa State Internal Revenue Form

The Jigawa State Internal Revenue Form is a vital document for residents and businesses operating in Jigawa State, Nigeria. It collects crucial information regarding individuals' and entities' income tax obligations. This form enables the state government to assess tax liabilities accurately and ensure compliance with local tax laws.

Accurate submission of the revenue form is essential as it directly affects the amount of tax owed. Discrepancies or errors in reporting can lead to penalties or audits. Therefore, understanding how to fill out the form meticulously is critically important for all taxpayers.

Eligibility and requirements

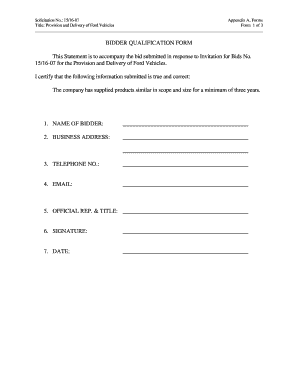

Filling out the Jigawa State Internal Revenue Form is mandatory for individuals and entities earning income within the state. This includes salaried workers, self-employed individuals, and corporate organizations. Understanding who needs to fill out this form is crucial for compliance with state tax regulations.

In terms of documentation, specific information is required for proper completion. Identification documents such as a national ID card or driver's license, alongside financial records detailing income and expenditures, must be provided.

It's important to note that some individuals may qualify for exemptions, such as those earning below a threshold specified by the Jigawa State Internal Revenue Service. However, even those exempt may still need to submit the form for record-keeping purposes.

Step-by-step guide to filling out the form

Accessing the Jigawa State Internal Revenue Form is simple. It is typically available on the official Jigawa State website or can be obtained directly from the local revenue office. Once located, users can easily download and save the form in PDF format.

Once you have the form, it's time to fill it out. Begin with the personal information section, where you'll need to provide your name, address, and contact information. Accuracy is crucial here, as this data will be used to communicate with you regarding your submission.

Next, move on to the income reporting section. Here, you will detail all sources of income received within the tax year. Ensure you report all earned income, including salary, bonuses, and any self-employment earnings.

After entering the income, assess applicable deductions and tax reliefs. This is where taxpayers can effectively reduce their taxable income by claiming eligible expenses. It's vital to understand the rules governing deductions to maximize benefits.

Lastly, conclude with final calculations and totals, ensuring all figures are accurate and correspond with previous sections. After completing the form, double-check for errors or omissions—you want to avoid common pitfalls such as misreported income or miscalculated deductions.

Editing and managing the Jigawa State Internal Revenue Form

Thanks to digital solutions like pdfFiller, editing the Jigawa State Internal Revenue Form can be streamlined. Begin by uploading the downloaded form to the pdfFiller platform, allowing for easy modification of any sections that may require changes.

pdfFiller also allows users to save different versions of the document, which can be highly beneficial when managing updates or corrections. Collaboration features enable team members to work simultaneously on the form, improving efficiency. You can easily share the document, enabling colleagues to provide input or updates.

eSigning the Jigawa State Internal Revenue Form

When submitting the Jigawa State Internal Revenue Form, eSigning adds a layer of compliance by ensuring that the submission is authorized by you as the taxpayer. This is particularly vital in avoiding disputes regarding the submission’s validity.

Using pdfFiller, you can easily add your signature to the document. Simply follow these steps to insert your eSignature:

eSignatures hold legal validity within Nigeria, making them a secure choice for document submission. This functionality alleviates the need for physical signatures, thus expediting the filing process.

Submitting the form

Once the Jigawa State Internal Revenue Form is complete and signed, the next step is submission. There are two primary submission options: online via the Jigawa State Internal Revenue Service portal or in-person at a local revenue office. Both methods have specific steps you need to follow to ensure your form is received correctly.

If issues arise during the submission process, promptly contact the Jigawa State Internal Revenue Service for assistance. Their staff can guide you in resolving errors or technical difficulties, ensuring compliance with tax obligations.

Frequently asked questions (FAQs)

Mistakes on the Jigawa State Internal Revenue Form can happen. If you realize you've made an error post-filing, it's essential to amend your submission. The procedure for amending can vary, but often it involves filling out an amendment form and resubmitting it to the relevant tax authorities.

Late submission of your tax form can result in penalties and interest on unpaid taxes. Thus, it’s crucial to stay informed about submission deadlines and file on time to avoid unnecessary financial implications.

Additional tools and resources available on pdfFiller

pdfFiller provides several resources to support users in managing their Jigawa State Internal Revenue Form and other related revenue forms effectively. Users can access templates for various tax forms, making the initial steps more accessible and intuitive.

These tools contribute significantly to a seamless experience when managing taxes, ensuring users can efficiently navigate the often-complex requirements.

Optimization tips for future filings

To ensure a smooth process for future tax filings, it’s essential to keep track of all relevant deadlines throughout the tax year. Implementing a reminder system will help you stay on top of your tax obligations and avoid penalties associated with late submissions.

By implementing these optimization strategies, taxpayers can ensure they are prepared and compliant with all tax regulations in Jigawa State.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in jigawa state internal revenue?

How do I fill out the jigawa state internal revenue form on my smartphone?

How do I complete jigawa state internal revenue on an Android device?

What is Jigawa State internal revenue?

Who is required to file Jigawa State internal revenue?

How to fill out Jigawa State internal revenue?

What is the purpose of Jigawa State internal revenue?

What information must be reported on Jigawa State internal revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.