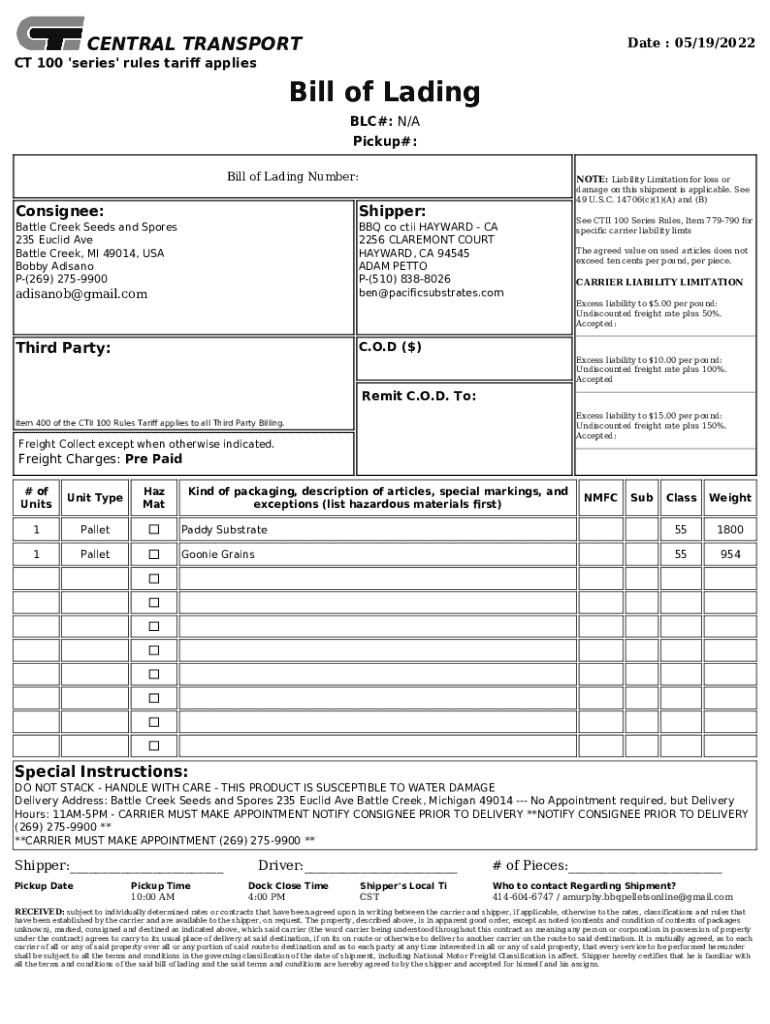

Get the free NOTE: Liability Limitation for loss or

Get, Create, Make and Sign note liability limitation for

How to edit note liability limitation for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out note liability limitation for

How to fill out note liability limitation for

Who needs note liability limitation for?

Note liability limitation for form: A comprehensive guide

Understanding liability limitations in forms

Liability limitations in forms are clauses that define and restrict the extent of responsibility that one party has towards another. Such limitations are crucial because they set a boundary within which legal and financial obligations arise. The importance of these provisions cannot be overlooked, as they help prevent disputes and clearly outline the scope of liabilities. By incorporating liability limitations, parties can protect themselves from excessive claims, unforeseen risks, and potential financial loss.

In a legal context, liability limitations serve as a risk mitigation tool, especially when drafting contracts related to services, products, or agreements. They clarify what constitutes an acceptable level of risk and provide guidelines on what each party can expect in terms of compensation should issues arise. This guarantees that both sides enter agreements with a clear understanding of their rights and obligations.

Key components of liability limitation clauses

Several essential components make up liability limitation clauses. A cap on damages, for instance, specifies the maximum amount that one party can be held liable for, which provides clarity and predictability in financial terms. Generally, these caps apply to direct damages; however, they may not include consequential damages like lost profits. Clients should carefully review these caps to ensure they are fair and acceptable.

It is crucial to recognize exceptions to these caps as well. Many forms include specific scenarios where the liability limit does not apply, such as cases of gross negligence, willful misconduct, or breach of contract. Understanding the types of recoverable damages is also vital, as recoverable damages are typically categorized into three types: actual damages, special damages, and punitive damages. Having a clear categorization also aids in dispute resolution. Moreover, it's essential to identify situations where liability limits do not apply, such as when statutory duties are breached.

Crafting effective liability limitation language

Drafting effective liability limitation clauses requires adherence to best practices. Clarity and specificity in language are paramount; vague terms often lead to ambiguity and potential disputes. Using straightforward, unequivocal language can help parties understand their rights and responsibilities better. Drafted clauses should be reviewed regularly and updated to reflect any changes in laws or business practices.

Common pitfalls to avoid include overly broad limitations that could render the clause unenforceable. Parties should ensure that their clauses adhere to jurisdictional standards. For instance, including sample wording like 'in no event shall the liability of [party] exceed $[amount]' can be effective. Additionally, using active voice when drafting can yield clearer understanding. Overall, ensuring that all parties recognize and agree on the language used will lead to fewer misunderstandings.

Examples of liability limitation clauses

Examples of liability limitation clauses can illustrate how they function in practice. For instance, a software company might include a liability limitation clause that states, 'The Company’s liability for any claim arising from this Agreement shall be limited to the amount paid by the User for the Services in the six months preceding the claim.' Such a clause is straightforward and provides a clear boundary of accountability.

Several case studies demonstrate successful utilization of liability limitations. In one notable example, a construction firm limited its liability to a certain percentage of the total contract value due to inherent project risks. This helped avert legal battles and fostered a collaborative relationship between the construction firm and its clients. Different industries also adopt varied approaches, with tech firms often favoring numerical caps, while healthcare providers may opt for clauses emphasizing quality standards to mitigate their unique risks.

Interpreting liability limitations in various contexts

Interpreting liability limitations can vary significantly across industries. For example, liability terms in IT services might emphasize data breaches, while those in manufacturing could focus on product defects. Jurisdiction also matters since enforceability can depend on regional legal interpretations. Parties should be aware that what is permissible in one jurisdiction may not be enforceable in another. This necessitates consulting local regulations and understanding how law influences these clauses.

Another area of comparison is the difference between contracts and forms. Contractual agreements typically allow for more elaborate clauses, while forms may require a more standardized approach due to space and clarity constraints. Understanding these nuances ensures that all parties involved remain protected and aware of their rights despite the type of document being used.

Legal considerations when using liability limitations

When deploying liability limitations, it's essential to understand relevant laws and regulations. Certain jurisdictions impose restrictions on how liability can be limited, especially in consumer contracts. Courts often scrutinize these clauses and may choose to enforce them strictly or nullify them based on their fairness. Courts typically analyze the nature of the relationship between the parties and how well the limitations were communicated.

To ensure legal compliance, individuals should seek the advice of legal professionals knowledgeable in this area. It’s recommended that liability clauses undergo regular review to adapt to any legal changes. Including specific language to explain the limitation clearly can also mitigate potential for disputes at a later stage.

Tips for users filling out forms with liability limitations

When encountering forms with liability limitations, users should take specific precautions. Key points to consider before signing include understanding what liabilities are being limited. For instance, is there a cap on damages or a waiver of rights that you’re giving up? Asking questions is vital, as clarifying doubts can prevent regret later on.

Users should also proactively address concerns regarding liability. Inquire about the rationale behind any caps and exceptions stated in the form. Checking for consistency in terms used across documents ensures clarity. Gathering multiple perspectives on the limitations, especially from legal counsels, can help users make well-informed decisions.

Tools and resources for document management

pdfFiller provides interactive tools to manage liability limitation documents with ease. Users can edit, sign, and collaborate on documents, ensuring a streamlined process. Utilizing pdfFiller’s user-friendly interface allows individuals to make changes and keep records of all versions of a form. The cloud-based features of pdfFiller make accessing and sharing forms convenient, providing flexibility and efficiency in document management.

Additionally, pdfFiller’s PDF editing features enable users to highlight, annotate, and clarify liability clauses effectively. Whether collaborating with a team or working independently, the platform allows for seamless integration of necessary changes while maintaining document integrity. This ensures that users are well-equipped to handle forms with liability limitations confidently.

Collaborating on forms with liability limitations

Collaboration on forms with liability limitations is essential for teams working on contracts and agreements. Effective teamwork hinges on clear communication about the implications of these limitations. Teams should engage in discussions to ensure everyone understands the risks involved and the reasoning behind each liability clause. Using platforms like pdfFiller for shared document management fosters an inclusive environment that enhances cooperation.

Strategies such as establishing a common vocabulary around liability terms can prevent misunderstandings. Moreover, encouraging an open forum for discussing concerns about liability limitations and their impact fosters an informed decision-making process. Utilizing tools within pdfFiller for real-time collaboration ensures every team member can contribute effectively.

FAQs about liability limitations

Understanding liability limitations can be daunting due to the legal jargon involved. Common questions include: What happens if a liability limitation clause is deemed unenforceable? In such cases, courts may revert to traditional liability standards, often leaving parties exposed to higher risk. Another frequent question concerns the extent of liability insurance and how that interacts with liability limitations.

Clearing misconceptions about liability limitations helps users appreciate these clauses. For instance, some may believe that signing a liability-limiting form shields them from all legal recourse, which is not the case. Understanding the nuances of these limitations is critical, and users should engage in discussions to clarify any uncertainties surrounding such clauses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit note liability limitation for from Google Drive?

How can I send note liability limitation for for eSignature?

Can I create an electronic signature for signing my note liability limitation for in Gmail?

What is note liability limitation for?

Who is required to file note liability limitation for?

How to fill out note liability limitation for?

What is the purpose of note liability limitation for?

What information must be reported on note liability limitation for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.