Get the free Demat Account Opening Form (NSDL)

Get, Create, Make and Sign demat account opening form

Editing demat account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out demat account opening form

How to fill out demat account opening form

Who needs demat account opening form?

Demat Account Opening Form: A Comprehensive How-to Guide

Understanding demat accounts

A demat account, short for 'dematerialized account,' is a type of account that allows investors to hold their securities in an electronic format instead of physical certificates. This process eliminates the risks associated with holding physical stock certificates, such as theft, loss, or damage. Demat accounts are essential for participants in the stock market and they simplify the process of buying, selling, and tracking investments.

In modern investing, demat accounts play a pivotal role. With the rise of online trading platforms, the importance of organizing and managing investments has increased. A demat account not only stores stocks, bonds, and mutual funds but also facilitates easier and faster transactions, making it a must-have for every investor.

Why open a demat account?

There are numerous benefits to opening a demat account, making it an attractive option for both new and seasoned investors. First and foremost, a demat account provides secure storage for your securities. By eliminating the need for physical certificates, the risk of loss or fraud is significantly reduced.

Additionally, a demat account offers ease of trading. Investors can buy and sell securities swiftly without the delays associated with physical transfers. The online portfolio management feature enables users to monitor their investments in real-time, offering insights into market trends and aiding informed decision-making.

Particularly, individuals looking to invest actively in the stock market, or seeking to diversify their financial portfolio, should consider opening a demat account. It's also beneficial for those venturing into mutual funds or government securities.

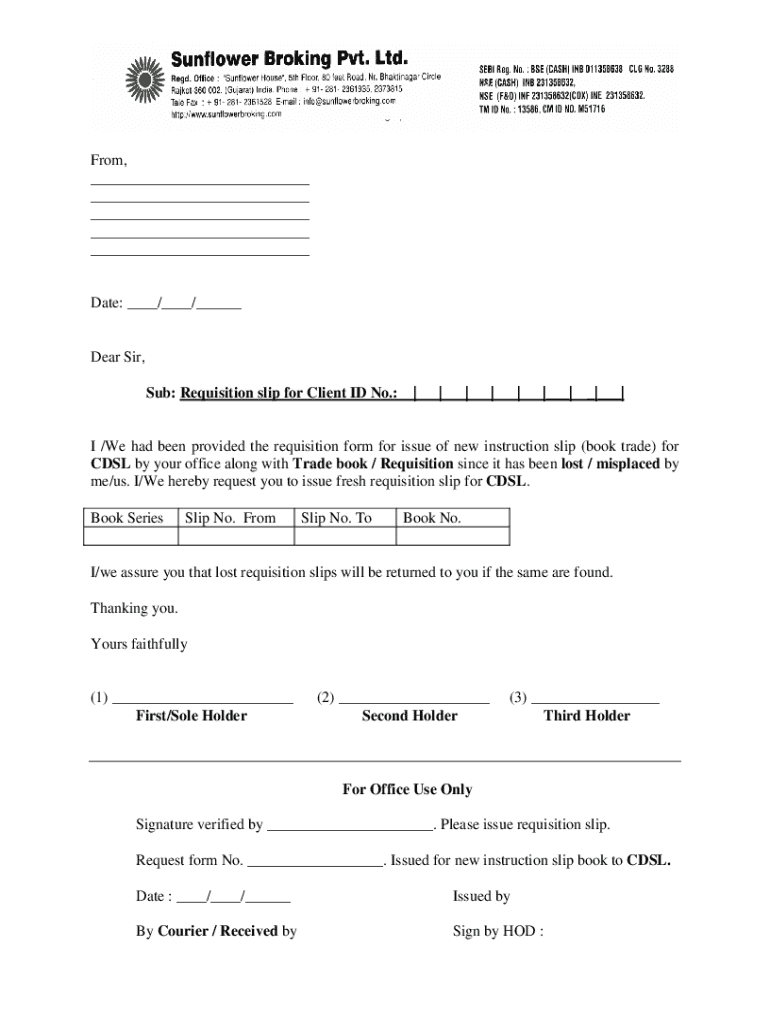

Pre-requisites for filling out the demat account opening form

Before diving into the filling process of the demat account opening form, it’s crucial to gather all necessary documents and information. Certain prerequisites include valid identity proof, address proof, PAN card details, and relevant bank account information. Ensuring accurate details are provided boosts the chances of application approval.

Identity proof can include a passport, voter ID, or driver’s license, while address proof typically can be maintained with utility bills or bank statements. The PAN card is a critical document for Indian investors, serving as a unique identifier and tax registration number. Lastly, bank account details are required to facilitate fund transfers.

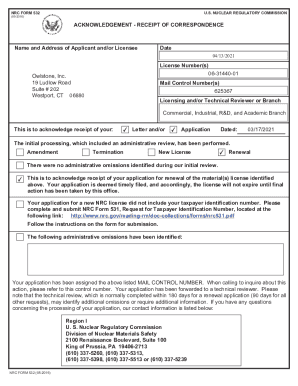

Understanding the verification process is also important. After submission, your documents will undergo scrutiny to confirm authenticity before the account is activated.

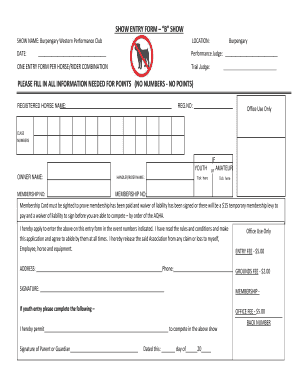

Step-by-step guide to filling out the demat account opening form

To open a demat account, you can easily access the demat account opening form on pdfFiller or the respective financial institution’s website. This form is the gateway to your demat account and must be filled out with attention to detail.

The form consists of various sections. In the Personal Information Section, you need to provide your name, address, and contact details, which must be accurate to ensure seamless communication. Double-check these details before submission as they play a crucial role in account verification.

Common mistakes to avoid include misrepresentation of information, not signing the form, and failing to attach the necessary documents. Ensure that you review the entire form before submission to eliminate these errors.

Submitting your demat account opening form

Once the demat account opening form is completed, the next step involves submission. If you’ve used pdfFiller, you have the advantage of submitting the form electronically. This method is often quicker, allowing for immediate processing of your application. In addition, it minimizes paperwork and the risk of loss during transportation.

Alternative submission methods exist, such as sending the paperwork via traditional mail or physically visiting a branch. However, these can lead to extended processing times and might lose the convenience of online submission.

Post-submission: What to expect

After your demat account opening form is accepted, you can expect a confirmation regarding the activation of your account. Typically, the account activation timeframe varies based on the service provider, ranging from a couple of hours to a few days. Updates are regularly communicated through email or SMS, ensuring you are informed at every stage.

Once your account is active, it’s crucial to familiarize yourself with the features and functionalities. Setting up your online trading profile, linking your bank account, and understanding how to navigate the platform will prepare you for seamless investing.

Managing your demat account successfully after opening

Post-activation, monitoring your investments through your demat account becomes vital. Regular checks on your portfolio can help identify trends and necessary adjustments to your strategy. Furthermore, leveraging tools like pdfFiller can enhance the management of your investment documents, ensuring everything is well-organized.

Using pdfFiller not only allows for easy electronic signing and document collaboration but also seamlessly integrates your financial records into one platform. In today’s age, where security is paramount, engaging backup and security measures such as two-factor authentication keeps your investments protected.

Frequently asked questions (FAQs) about demat account opening

With the rise in popularity of demat accounts, many potential investors often have queries that need addressing. Among the frequently asked questions is whether a demat account can be opened without a PAN card. The answer is no, as it serves as a crucial identification requirement in the financial landscape.

Another common concern involves what to do if the demat account application is rejected. In such cases, reviewing the feedback for any errors can provide clarity and enable re-application. Furthermore, many users wonder if they can link multiple bank accounts to their demat account. Most institutions allow this, enabling greater flexibility in fund management.

Leveraging technology for your document needs

In an era where technology underpins everything, understanding how to utilize cloud-based solutions like pdfFiller is essential. The service not only allows for document creation and editing but also ensures that your forms are accessible from anywhere, eliminating the hassles of manual document storage.

Using pdfFiller streamlines the document management process for investors significantly. From online access to forms to facilitating secure collaboration for investment tracking, users can appreciate the integration of technology into their routines. It drastically reduces the chances of misplacement or errors, allowing for a more efficient investment journey.

Next steps: Beyond the demat account

While opening a demat account is a significant step in the investment journey, it’s crucial to explore additional tools and resources that assist in enhancing your overall investment strategy. pdfFiller hosts a wealth of resources to help you maintain organized documents for future transactions.

Maintaining organized documentation can save time and ensure you are always prepared for your next investment move. Utilize the features that pdfFiller offers, including electronic signing and collaborative capabilities, to make your financial dealings smooth and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my demat account opening form directly from Gmail?

How do I edit demat account opening form in Chrome?

How can I edit demat account opening form on a smartphone?

What is demat account opening form?

Who is required to file demat account opening form?

How to fill out demat account opening form?

What is the purpose of demat account opening form?

What information must be reported on demat account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.