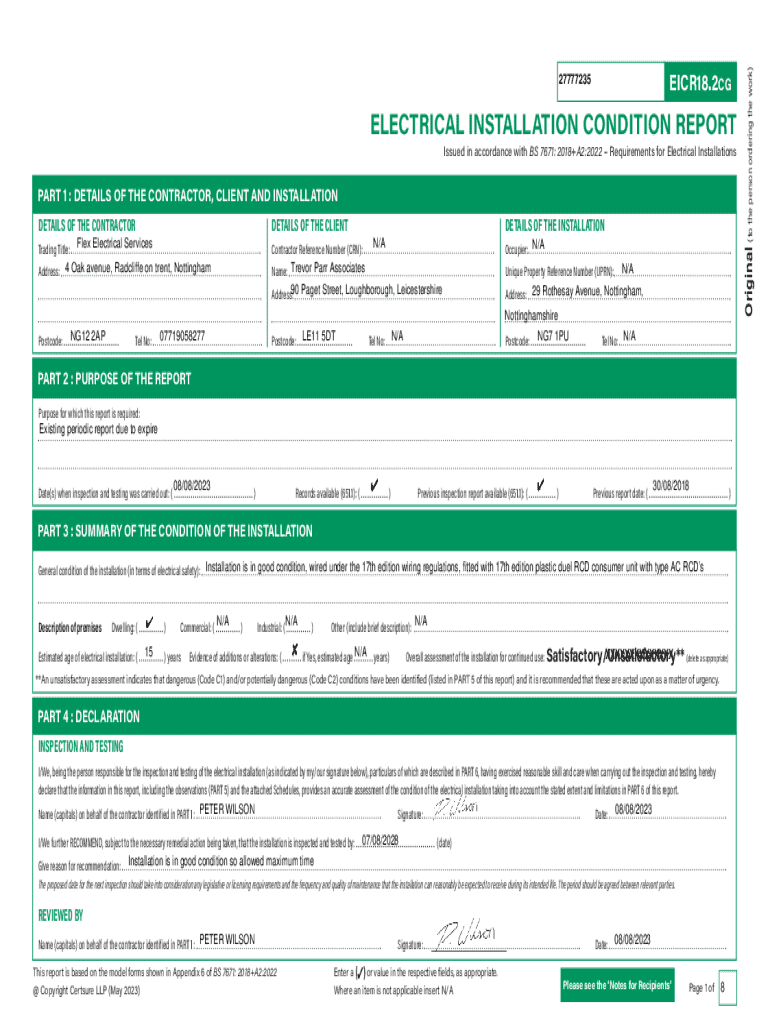

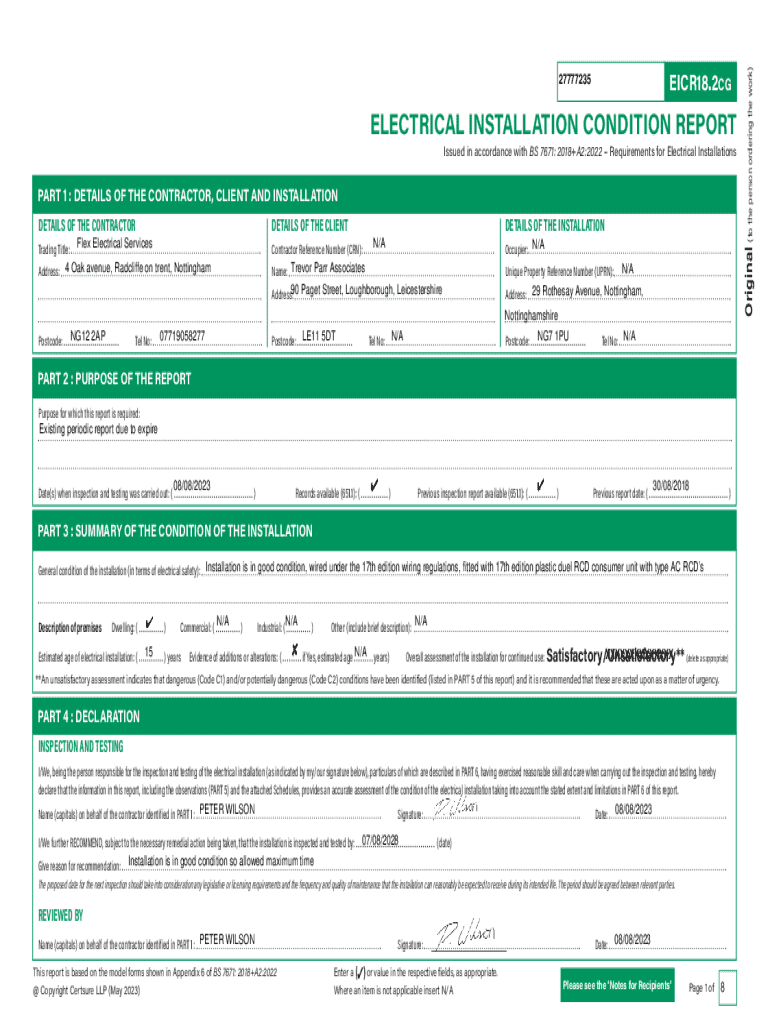

Get the free Occupier: N/A

Get, Create, Make and Sign occupier na

How to edit occupier na online

Uncompromising security for your PDF editing and eSignature needs

How to fill out occupier na

How to fill out occupier na

Who needs occupier na?

Understanding the Occupier Consent Form: A Comprehensive Guide

Understanding the occupier consent form

An occupier consent form is a legal document that confirms the consent of an individual living in a property but not holding ownership rights. This form is crucial in property transactions, especially when a mortgage is involved. Lenders often require it to ensure that all individuals residing at the property acknowledge and consent to the mortgage terms, thereby preventing future disputes related to ownership and occupation rights.

The primary purpose of this form is to protect the interests of both property owners and lenders. By signing, occupiers acknowledge that they understand the implications of the mortgage agreement, which can include aspects such as foreclosure rights and the potential sale of the property. This process also allows for clear communication between parties involved, minimizing the likelihood of misunderstandings.

Key legal considerations

Before signing an occupier consent form, it's vital to seek legal advice. This document may seem straightforward, but it carries significant legal implications. Understanding these implications can help prevent future issues that may arise regarding property rights and obligations associated with mortgages. Legal professionals can provide insights specific to an individual's situation that a general understanding may overlook.

By signing the form, occupiers may waive certain rights, such as the right to contest a lender's action if the property enters foreclosure. This waiver can be substantial, as it limits an occupier's options if financial hardship or disputes arise later on. Consequently, having clarity about what rights are forfeited is essential for any individual considering signing this form.

Who needs to sign an occupier consent form?

The individuals typically required to sign an occupier consent form include anyone residing in the property but not listed as a legal owner, such as partners, relatives, or roommates. Their consent is crucial especially when one of the owners is seeking a mortgage on the property. Non-owning parties play a vital role in the acknowledgment of occupancy rights, impacting the overall fairness and legality of the transaction.

Examples of individuals who may be affected include a partner living in a home with their significant other who holds the mortgage, or adult children still residing with parents who are in the process of refinancing. Each of these scenarios emphasizes the importance of ensuring all adult occupants consent to the legal obligations associated with the property.

Benefits of using an occupier consent form

Employing an occupier consent form offers multiple advantages. First and foremost, it protects property rights by making sure that all occupants are aware of and agree to the implications of the mortgage. This clarity can help limit disputes and misunderstandings in the future. Additionally, the form facilitates smoother transactions between parties, particularly in situations where ownership is shared or complex.

From a legal standpoint, having clear written consent ensures that both property owners and occupiers are legally protected, reinforcing agreements and making future transactions easier. When everyone understands their rights and responsibilities, it creates a more stable living environment, eliminating potential conflict.

Potential downsides of signing

While there are numerous benefits to signing an occupier consent form, certain risks exist that should not be overlooked. One primary concern is that by signing, occupiers may unintentionally waive important rights, such as the right to contest eviction during financial difficulties. This can lead to precarious situations where an occupier feels they have been unfairly treated.

Misunderstanding the terms and consequences of what the form entails is another common pitfall. Occupiers may mistakenly believe they have retained certain rights when, in fact, they have forfeited them upon signing the document. This lack of clarity can lead to disputes and challenges down the line, particularly in joint tenancy or co-ownership scenarios.

Process for signing the occupier consent form

Filling out an occupier consent form involves a structured process, ensuring that all parties are correctly informed and legally protected. Here is a step-by-step guide to navigate the signing process:

Avoiding common pitfalls is crucial in this process. Always ensure that you are clear about what you’re signing and how it may impact your future rights.

What to do if you refuse to sign?

If you refuse to sign an occupier consent form, it’s essential to understand the potential consequences. Depending on the situation, refusing to sign may halt the mortgage approval process, thereby impacting the homeowner’s ability to refinance or sell the property.

Alternative options exist for occupiers who choose not to consent. These may include negotiating terms of occupancy or finding legal remedies to protect rights. Communicating your refusal effectively, while remaining open to discussions about the implications of your decision, is crucial in maintaining a constructive dialogue.

Special situations involving occupier consent forms

Specific situations often arise concerning occupier consent forms, especially in joint tenancy versus sole tenancy arrangements. Joint tenants must consider that decisions made by one tenant can impact all, especially when it concerns signing legal documents.

In contrast, sole tenants have the full discretion to decide who occupies the property. Unique cases, such as adult children living at home, can also complicate matters. For example, even adult children may need to sign the consent form, aligning with the mortgage's stipulations, which can significantly affect their rights.

Frequently asked questions (FAQs)

Addressing common questions can help individuals make informed decisions regarding the occupier consent form. Distinguishing between consent and waiver forms is essential, as these two documents serve different purposes in property law.

Engaging with a legal professional can help clarify these questions, ensuring that every signatory understands their rights and obligations.

Navigating related legal forms and issues

It's crucial to be familiar with other forms related to property transactions, such as the occupier waiver form. This document differs from the occupier consent form, where a waiver form relinquishes specific rights, typically in favor of the property owner. Understanding when and why you may need to sign a waiver is essential.

Other relevant documentation includes transfer of equity forms and co-ownership agreements. Each of these documents serves unique purposes and can impact occupancy rights. Being well-versed in these forms can empower individuals as they navigate the complexities of property transactions.

Staying informative and updated in property law

Keeping abreast of developments in property law is essential for anyone involved in property ownership or occupancy. Essential resources for legal education include government websites, legal textbooks, and community forums where individuals share their experiences and insights.

Regularly engaging with these resources helps individuals stay informed about their rights and any changes in legislation that may impact property transactions. Effective advocacy begins with being educated!

Final thoughts on occupier consent forms

The significance of understanding occupier consent forms cannot be overstated. They play a critical role in property transactions, ensuring that all parties agree to the terms and implications of occupancy. Awareness of rights and responsibilities is paramount for both occupiers and property owners alike.

In conclusion, having a comprehensive understanding of the occupier consent form not only protects your rights but also fosters transparent and constructive relationships among all parties involved in property transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute occupier na online?

How do I edit occupier na in Chrome?

How do I edit occupier na on an Android device?

What is occupier na?

Who is required to file occupier na?

How to fill out occupier na?

What is the purpose of occupier na?

What information must be reported on occupier na?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.