Get the free Form PA-10169 (2017) (AM) (IN)

Get, Create, Make and Sign form pa-10169 2017 am

How to edit form pa-10169 2017 am online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form pa-10169 2017 am

How to fill out form pa-10169 2017 am

Who needs form pa-10169 2017 am?

Understanding Form PA-10 AM Form: Your Comprehensive Guide

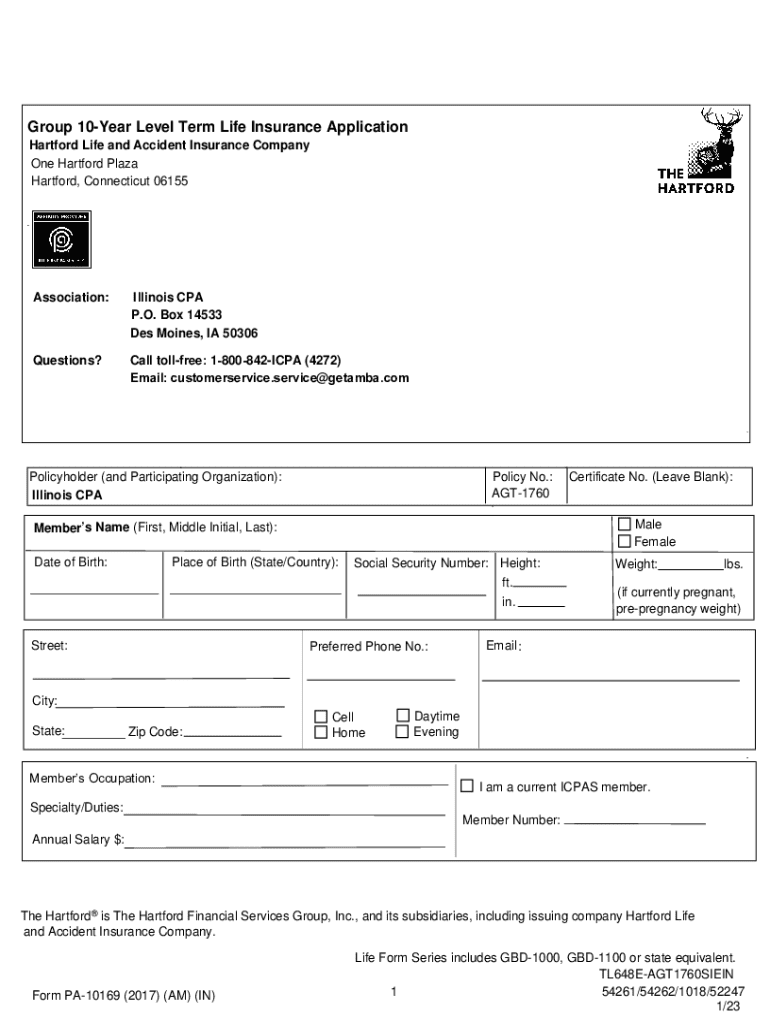

Overview of the Form PA-10 AM Form

The Form PA-10 AM Form serves as a crucial document used in various administrative processes. Its primary purpose is to capture essential information for tax assessments, allowing individuals and businesses to report income, deduct expenses, and claim credits accurately. Understanding this form is essential for ensuring compliance with financial regulations.

Many sectors utilize the PA-10 AM Form, including small business owners and freelancers who need to file annual tax returns. This ensures that tax liabilities are properly calculated and reported, ultimately affecting the financial health of individuals and their businesses.

To ensure the integrity of the filing process, accuracy in submitting the PA-10 AM Form is imperative. Mistakes can lead to delayed processing, fines, or even audits, while doing it correctly can result in financial benefits and peace of mind.

Accessing the PA-10 AM Form

To access Form PA-10 AM Form, users can easily obtain it via pdfFiller, offering a direct and convenient online resource. Downloading the form as a PDF allows users to have a standard format that is widely recognized, while other formats like DOCX may also be available.

Moreover, users can find the PA-10 AM Form at local tax offices or official state websites. It’s crucial for users to ensure they are accessing the most recent version of the form to guarantee compliance with current regulations.

Choosing the right format is essential; PDF is often preferred for its compatibility, while DOCX could be advantageous in scenarios requiring intensive customization.

Step-by-step instructions for filling out the PA-10 AM Form

Filling out the PA-10 AM Form involves careful attention to detail. Start by gathering all necessary documents to ensure accurate reporting of your financial situation. Each section of the form serves a distinct purpose, from personal details to income declaration, and filing in the correct information is crucial for accuracy.

Begin with the identification section, where you input your name, address, and Social Security number. Then proceed to report various income sources; this is where many users commonly misreport numbers or forget to include certain forms of income. It is helpful to use pdfFiller's interactive tools to ensure each portion is filled correctly before moving on.

By avoiding common mistakes, like transposing numbers or omitting required fields, you can streamline the submission process and mitigate any potential repercussions.

Editing the PA-10 AM Form

Editing the PA-10 AM Form is made seamless with pdfFiller’s features. Users can modify text, add new fields, or delete sections that are not applicable to their unique situation. This versatility ensures your form is customized to meet your needs accurately.

For team environments, pdfFiller allows collaboration in real-time. Multiple members can work on the document simultaneously, which significantly enhances productivity and ensures everyone involved can contribute their insights while maintaining version control.

By utilizing these features effectively, teams can focus on accuracy and efficiency, optimizing their workflow beyond just filling out forms.

Signing the PA-10 AM Form

The signing process has evolved, and adding an electronic signature using pdfFiller is both straightforward and legally valid. Within the platform, users can simply navigate to the signature field, creating or uploading their electronic signature with just a few clicks.

This e-signature process not only saves time but also creates an audit trail that tracks when and where signatures were added, ensuring transparency throughout the process. Users can also send the form for signature to others, making it easy to gather required approvals from stakeholders or team members.

By adopting e-signatures, users streamline their document processes, reducing turnaround times and expediting workflows across teams.

Filing and managing your PA-10 AM Form

Effective management of the PA-10 AM Form post-filing is critical. Following best practices ensures that not only is your submission accurate, but it is also stored securely and retrievable when needed. Always keep copies of submitted forms, ideally both digitally and in hard copy.

Using pdfFiller’s storage solutions allows for easy organization of your documents, enabling users to retrieve previous versions quickly. Version control features are particularly helpful if changes are made after initial submission, allowing users to track alterations and revert to earlier versions if necessary.

Keeping organized and maintaining good records is essential for tax preparation and future financial considerations.

Frequently asked questions (FAQs)

When dealing with the PA-10 AM Form, it’s natural to have questions. One common concern is what to do if errors are discovered after submission. The immediate action is to contact the relevant tax authority for guidance on how to amend the filed form. It’s important to act quickly to mitigate potential penalties.

Updates to the information provided on the form, such as changes in income or deductions, should also be promptly addressed. Maintaining open channels of communication with a tax professional can aid in managing these changes effectively and ensure compliance with regulatory standards.

Common issues include difficulties in accessing the form or technical challenges during submission. Utilizing pdfFiller’s customer support or community forums can provide quick resolutions and valuable insights.

Additional tools and resources available on pdfFiller

The PA-10 AM Form is just one piece of your documentation process puzzle. With pdfFiller, users can integrate this form into a broader document management strategy. This integration facilitates seamless data flow between various forms and documents, significantly enhancing organizational efficiency.

Additionally, pdfFiller offers educational resources in the form of tutorials, guides, and webinars that equip users with the knowledge necessary to navigate forms and documents with expertise. This ensures that users can maximize the platform's capabilities.

These ancillary tools and resources bolster user confidence and efficiency, creating a well-rounded document management experience.

Contacting support for assistance

If you encounter challenges while using the PA-10 AM Form, pdfFiller’s support team is ready to assist. Users can reach out via email, phone, or online chat for immediate help. This accessibility ensures you are never left in a lurch when navigating complex forms.

Additionally, community forums present a valuable opportunity for shared insights among users. Engaging with others can lead to tips and potential shortcuts, making your documentation efforts smoother and more efficient.

This combination of professional support and community engagement cultivates a comprehensive resource network for form completion and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form pa-10169 2017 am?

How do I edit form pa-10169 2017 am on an iOS device?

How do I complete form pa-10169 2017 am on an Android device?

What is form pa-10169 2017 am?

Who is required to file form pa-10169 2017 am?

How to fill out form pa-10169 2017 am?

What is the purpose of form pa-10169 2017 am?

What information must be reported on form pa-10169 2017 am?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.