Get the free Zacks Funds - Simple IRA Application

Get, Create, Make and Sign zacks funds - simple

Editing zacks funds - simple online

Uncompromising security for your PDF editing and eSignature needs

How to fill out zacks funds - simple

How to fill out zacks funds - simple

Who needs zacks funds - simple?

Understanding Zacks Funds - A Simple Guide

Understanding Zacks Funds

Zacks Funds refer to the various investment opportunities managed by Zacks Investment Research, a globally recognized financial research and analysis firm. They focus primarily on helping individual and institutional investors make informed decisions through detailed investment insights. Zacks offers different types of funds, including mutual funds and exchange-traded funds (ETFs), designed to cater to various investment strategies and objectives.

These funds benefit from Zacks' commitment to a systematic research process. The team leverages sophisticated quantitative models and qualitative assessments to identify trends and opportunities, ensuring robust performance in the marketplace. Investors can access a range of funds tailored to their specific financial goals.

Fund selection criteria

Choosing the right Zacks Fund involves a thorough evaluation of your investment goals and risk appetite. Each investor has unique objectives, whether it’s long-term capital growth, income generation, or stability. You should assess how a specific fund aligns with your financial aspirations and what level of risk you are comfortable with.

In addition to personal goals, it is crucial to consider key performance indicators, such as historical performance data and expense ratios. A fund that has historically shown strong performance may indicate effective management strategies, while lower fees can enhance your overall returns. Analyzing these criteria can help guide your selection process.

How to invest in Zacks Funds

Investing in Zacks Funds is straightforward, with multiple options available to suit different preferences. You can invest directly by establishing an investment account with Zacks or work through a financial advisor who can provide personalized assistance. Direct investment typically has minimal requirements, such as lower initial deposits compared to other funds.

To begin, follow a step-by-step approach to ensure a smooth investment process. Start by setting up an investment account, which you can do through Zacks' online portal. Next, choose the right fund based on the thorough research you've conducted. Finally, complete the investment by making your initial deposit, leading you one step closer to achieving your financial goals.

Managing your Zacks Fund investments

Once you invest in Zacks Funds, ongoing management is essential to ensure they perform as expected. Monitoring your fund's performance can be easily managed using various tools available through Zacks and platforms like pdfFiller. These tools provide real-time updates and analytical insights, allowing you to track how well your investments align with your financial objectives.

As market conditions change, you may need to make strategic adjustments to your portfolio. This could involve deciding when to buy additional shares, hold your current position, or sell to realize gains. Moreover, regularly rebalancing your portfolio will help you maintain your desired asset allocation and risk profile.

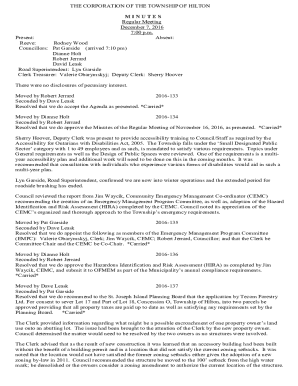

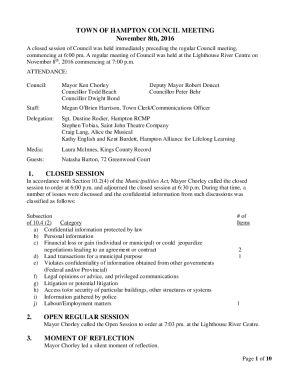

Interactive tools for fund management

Investors can leverage interactive tools on pdfFiller for efficient document management associated with Zacks Funds. These include capabilities to upload, edit, and share investment documents securely within a collaborative environment. You can digitally sign important forms and documents, which streamlines the investment process while ensuring compliance with regulatory requirements.

Moreover, using pdfFiller’s platform, you can easily manage permissions for document sharing. This is especially beneficial when collaborating with financial advisors or team members, allowing for seamless discussions and ensuring everyone has access to the most current information and forms necessary for decision-making.

Advanced planning with Zacks Funds

Integrating Zacks Funds into your retirement strategy can significantly enhance your long-term financial outlook. For instance, if you're considering an Individual Retirement Account (IRA), understanding the application process and fund options available through Zacks is crucial. Additionally, you may explore various strategies for utilizing Zacks Funds within a 401(k) plan to ensure optimal asset growth and risk management.

Understanding the tax implications of fund investments is equally essential. It's important to consider how capital gains tax applies depending on how long you hold your investments and plan strategically for withdrawals. Using tax-efficient strategies can save you money and maximize your returns, which is beneficial, especially during retirement.

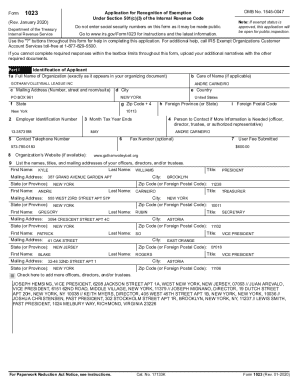

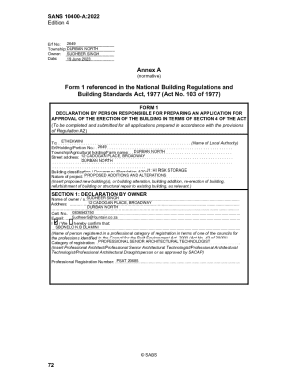

Common forms associated with Zacks Funds

Familiarizing yourself with common forms associated with Zacks Funds is vital for seamless management of your investments. Key forms include the New Account Application Form and IRA Application with step-by-step instructions for new investors. Additionally, you will encounter forms for transactions, such as the Redemption Request or Systematic Withdrawal Form that facilitate smooth operations once your portfolio is set up.

Using platforms like pdfFiller simplifies this process, allowing you to fill out, sign, and edit these forms from any device. This convenience ensures managers and investors maintain accurate records without the hassle of traditional paperwork.

Expert insights and trends

To navigate the investment landscape effectively, it's beneficial to stay informed about current market trends affecting Zacks Funds. This involves evaluating sector performance and identifying relevant economic indicators that could impact your investments. Staying abreast of this information allows you to make informed decisions about your fund strategy.

Insights from fund managers also provide valuable perspectives on potential investment opportunities and strategies. Engaging with interviews, discussions, and manager viewpoints can deepen your understanding of the market dynamics at play and help guide your investment decisions.

Resources for investors

For individuals looking to enhance their financial literacy and investment strategy, Zacks provides a variety of resources. One key initiative is their free e-newsletter subscription, which offers financial tips, market updates, and timely investment advice delivered directly to your inbox. This is an excellent way to stay informed without working hard to find daily market insights.

Additionally, a comprehensive blog and resource library are available, filled with articles on financial planning and the latest research findings related to Zacks Funds. Engaging with these resources can deepen your understanding and equip you with the knowledge necessary to make sound investment decisions.

FAQs about Zacks Funds

Investors often have common questions regarding Zacks Funds, including how to select the appropriate fund type for their needs and the policies surrounding dividends and distributions. Understanding these aspects can clarify many uncertainties about investing and lead to more confident decisions.

Several educational resources are available through the Zacks platform to address these FAQs comprehensively. This guidance equips you with the knowledge to navigate your options efficiently while ensuring you remain compliant with any investment policies.

About Zacks Investment Research

Zacks Investment Research has a storied history rooted in providing high-quality investment insights. The firm is built on a mission to empower investors through reliable research and adherence to high fiduciary standards. Their commitment to integrity and excellence ensures clients receive robust tools and resources to navigate the investment landscape successfully.

With a focus on innovative research methods, Zacks aims to enhance the investing experience for individuals and institutions alike. As a trusted name in the financial industry, investors can rely on Zacks for sophisticated analysis and actionable recommendations.

Contact Zacks for personalized assistance

If you require personalized guidance with your Zacks Funds investment, Zacks provides multiple contact options for support. You can reach their expert team through phone or online platforms, which offer quick responses to inquiries. Additionally, investors can schedule appointments for one-on-one consultations, ensuring they receive tailored advice that aligns with their financial objectives.

Engaging directly with Zacks’ support team can enhance your investment understanding and provide clarity regarding any concerns you may have. This proactive approach can lead to more informed investment choices and a smoother investment journey.

Moving forward with Zacks Funds

Embarking on your Zacks investment journey is an exciting step towards financial empowerment. Understanding Zacks Funds equips you with the confidence needed to make informed decisions. Remember to utilize the powerful tools available on the pdfFiller platform for document management, ensuring your forms are complete and correctly signed.

By combining the insights gained from this guide with the resources provided through Zacks and pdfFiller, you can effectively create a streamlined investment strategy that aligns with your goals. Start today, and take control of your financial future with Zacks Funds!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send zacks funds - simple to be eSigned by others?

How do I fill out the zacks funds - simple form on my smartphone?

How do I complete zacks funds - simple on an Android device?

What is zacks funds - simple?

Who is required to file zacks funds - simple?

How to fill out zacks funds - simple?

What is the purpose of zacks funds - simple?

What information must be reported on zacks funds - simple?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.