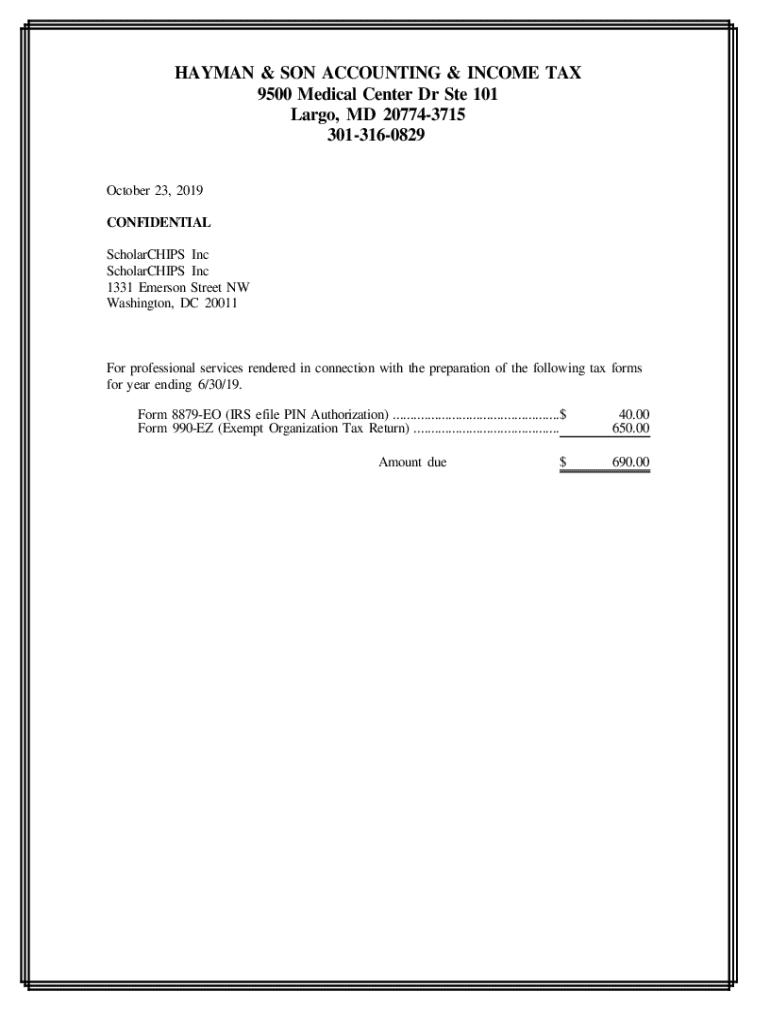

Get the free HAYMAN & SON ACCOUNTING & INCOME TAX

Get, Create, Make and Sign hayman son accounting income

Editing hayman son accounting income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hayman son accounting income

How to fill out hayman son accounting income

Who needs hayman son accounting income?

Understanding the Hayman Son Accounting Income Form: A Guide for Accurate Financial Reporting

Overview of the Hayman Son Accounting Income Form

The Hayman Son Accounting Income Form serves as a vital tool for both individuals and businesses in documenting their income for financial reporting and tax purposes. This form allows users to provide a clear, structured overview of their various income sources and deductions, ensuring compliance with regulatory guidelines.

Accurate financial reporting is critical for maintaining trust with stakeholders and for proper tax declaration. By utilizing the Hayman Son Accounting Income Form, users can ensure their financial data is reported correctly, minimizing the risk of errors that could lead to penalties.

Preparing to complete the Hayman Son Accounting Income Form

Before diving into the completion of the Hayman Son Accounting Income Form, gathering the necessary financial documents is crucial. These typically include pay stubs, bank statements, investment income reports, and records of freelance or contract work. Collecting detailed records of all income sources will provide a comprehensive view of your financial situation.

Understanding the form layout is equally important. The Hayman Son Accounting Income Form consists of multiple sections. Each section addresses different components of income, deductions, and personal information, each of which plays a critical role in defining the financial picture presented. Familiarizing yourself with these areas will facilitate a smoother completion process.

Step-by-step guide to filling out the Hayman Son Accounting Income Form

Section 1: Personal Information

Begin by accurately entering your personal information, which includes your full name, address, and contact details. Ensure that your entries match official documentation to prevent inconsistencies that could lead to confusion later. Accuracy in this section establishes a reliable basis for the rest of the form.

Section 2: Income Details

Categorizing different types of income is crucial in Section 2. This section may encompass your salary, any freelance income, dividends from investments, and rental income from properties. Clearly itemizing these entries allows you to see where your income is generated and is essential for accurate financial reporting.

Section 3: Deductions

Section 3 addresses deductions. Common deductions may include contributions to retirement accounts, healthcare expenses, and other tax-deductible items. Create a checklist to ensure you account for all possible deductions, as accurately documenting these can significantly reduce your taxable income.

Section 4: Verification and Signature

Before submitting the form, double-check all entries for accuracy. This section should be considered to ensure all income sources and deductions have been reported correctly. After verification, you can eSign the form securely using pdfFiller, which provides a reliable method for digital signatures.

Editing and managing your Hayman Son Accounting Income Form

One of the advantages of using pdfFiller is the ability to edit your Hayman Son Accounting Income Form after the initial completion. If you notice any mistakes or need to update your information, pdfFiller offers user-friendly tools that allow you to make changes efficiently.

Moreover, collaboration features enable you to invite team members to review and assist in completing the form. You can easily share the document and utilize annotation tools to leave notes or suggestions, enhancing the collaborative effort. This capability is particularly beneficial for teams working on joint income reporting.

Saving and storing your form

Once your form is completed, pdfFiller provides several options for cloud storage and access. Saving your files in the cloud not only secures your documents but also ensures you can access them from anywhere. Best practices for keeping your documents secure include using strong passwords and enabling two-factor authentication.

Common mistakes to avoid with the Hayman Son Accounting Income Form

One common mistake during the completion of the Hayman Son Accounting Income Form is misreporting income sources. For instance, classifying freelance income as a hobby income or omitting various other income streams can lead to underreporting. It’s essential to correctly categorize income to ensure compliance and accuracy.

Another frequent error is missing the signature or verification of the form. Submission of an incomplete form can lead to rejection and delays in processing. Therefore, double-checking for required signatures before submission is vital to maintain the integrity of your reporting.

Frequently asked questions (FAQs) about the Hayman Son Accounting Income Form

When encountering issues such as rejection of the form, users should first review the feedback provided by the reviewing authority and correct any highlighted errors. For timely submission, it is vital to be aware of any deadlines which can vary by entity or purpose of reporting.

If you need assistance with completing the form, consider consulting with a financial professional or utilizing online resources that provide guidance on completing the Hayman Son Accounting Income Form effectively.

Leveraging pdfFiller for better document management

Choosing a cloud-based solution like pdfFiller for managing your Hayman Son Accounting Income Form during financial reporting presents numerous advantages over traditional paper forms. Cloud-based solutions are accessible from multiple devices, allowing for real-time updates and remote access to your documents.

In addition to managing the Hayman Son Accounting Income Form, pdfFiller provides comprehensive document solutions, including features for eSigning and sharing. This seamless integration means you can manage all your documentation needs from a single platform without worrying about compatibility or security.

Success stories: How users benefited from using the Hayman Son Accounting Income Form

Various users have reported significant benefits from utilizing the Hayman Son Accounting Income Form through pdfFiller. Individuals have noted the ease of use and how the form has streamlined their annual income reporting efforts.

For example, a team consisting of freelance professionals highlighted that the collaborative features allowed them to combine their income sources efficiently, saving them time and improving their accuracy. Metrics show an increase in productivity by upwards of 30% during their reporting period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the hayman son accounting income form on my smartphone?

Can I edit hayman son accounting income on an Android device?

How do I complete hayman son accounting income on an Android device?

What is hayman son accounting income?

Who is required to file hayman son accounting income?

How to fill out hayman son accounting income?

What is the purpose of hayman son accounting income?

What information must be reported on hayman son accounting income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.