Get the free Disbursing - Fiscal.Treasury.gov

Get, Create, Make and Sign disbursing - fiscaltreasurygov

How to edit disbursing - fiscaltreasurygov online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disbursing - fiscaltreasurygov

How to fill out disbursing - fiscaltreasurygov

Who needs disbursing - fiscaltreasurygov?

Disbursing - fiscaltreasurygov form: A Comprehensive Guide

Understanding the disbursing form: Overview and purpose

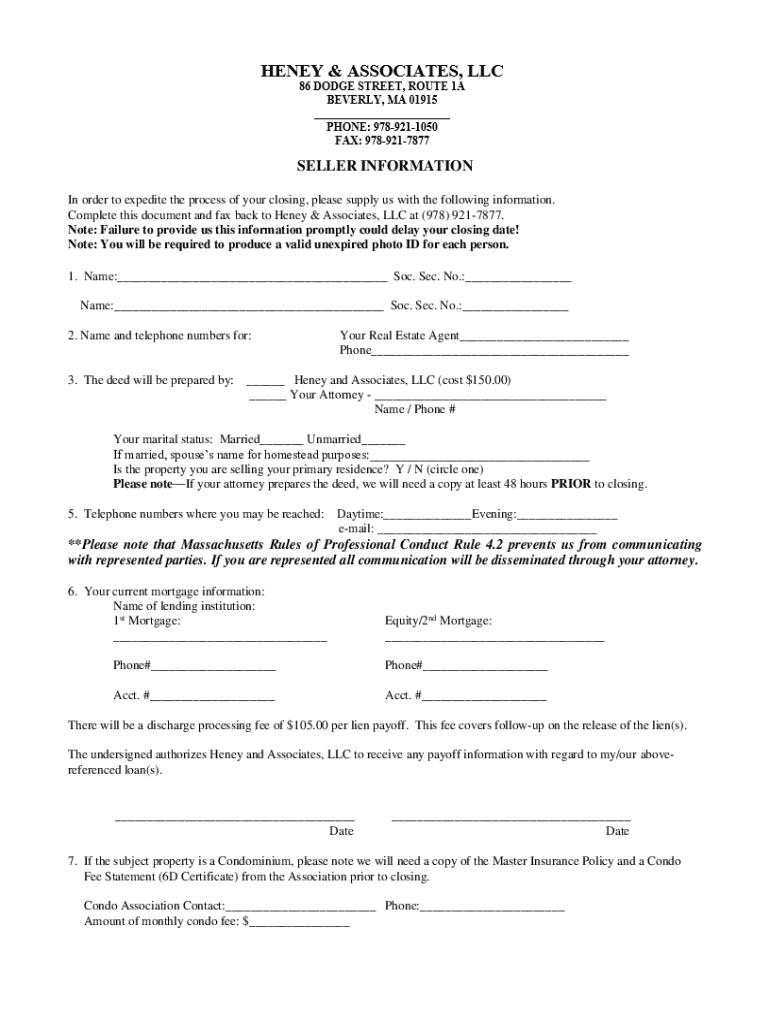

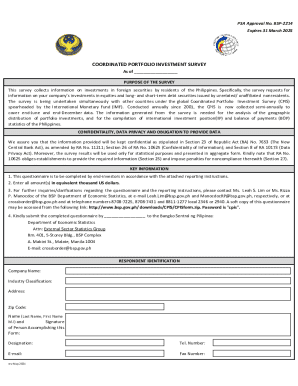

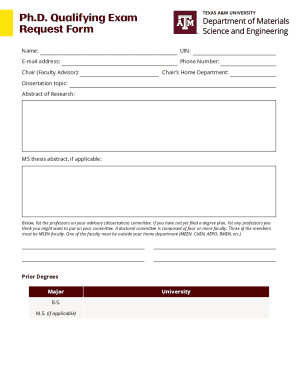

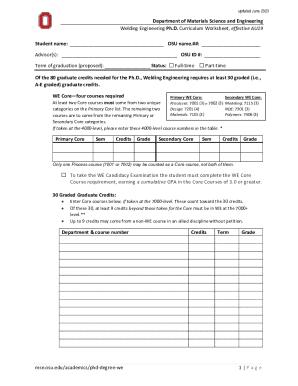

The disbursing form is a crucial document used in fiscal treasury management, allowing for the efficient allocation and tracking of government funds. This form serves to assist in the proper disbursement of public money, ensuring that financial transactions comply with federal regulations and policies.

The importance of this form cannot be overstated. It provides a standardized method for processing payments, hence promoting transparency and accountability in the financial ecosystem of public management. The key elements of the disbursing form include personal information, financial details, and necessary authorizations.

Accessing the disbursing form

To locate the disbursing form on the Fiscal Treasury website, follow these simple steps: 1. Visit the official Fiscal Treasury website. 2. Navigate to the forms section or search for 'disbursing form' in the search bar. 3. Select the relevant form from the search results.

Navigating the government portal may seem daunting, but a few tips can simplify the process. Make sure to use specific keywords, and familiarize yourself with the layout of the site. Check their FAQs for additional guidance, and don’t hesitate to reach out via their contact page.

Detailed instructions for filling out the disbursing form

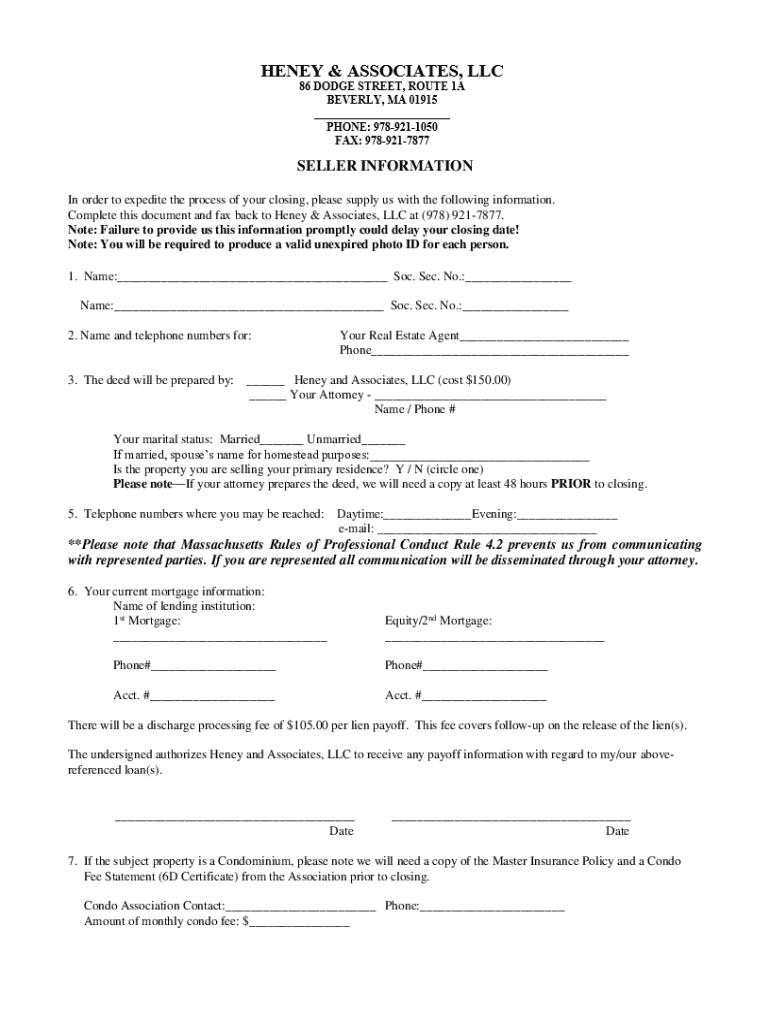

Filling out the disbursing form correctly is essential for processing your request expediently. Here’s a breakdown of what to include in each section: 1. **Personal Information Requirements:** Include full name, address, contact information, and any relevant identification numbers. 2. **Financial Details:** Clearly state the amount being requested, the purpose of the disbursement, and any account details necessary for the transfer. 3. **Authorizations Needed:** This section typically requires signatures from designated officials, confirming the legitimacy of the disbursement.

Common mistakes to avoid include overlooking required fields, failing to sign the form, and providing incomplete financial details. Ensure to attach any necessary additional documentation that supports your request. Visual aids, like filled-out examples, can be immensely helpful during this process.

Utilizing pdfFiller for editing and managing the disbursing form

pdfFiller offers a seamless way to upload and manage your disbursing form. Start by uploading the completed form onto the platform. The features provided by pdfFiller enhance your form experience significantly. Among these features, editing text is crucial to ensure accuracy. You can easily modify any section of the form before finalizing it. Additionally, adding signatures is straightforward, and the collaborative features enable teams to work on the form together, ensuring completeness.

Version control is another powerful aspect of pdfFiller. You can track changes, leave comments, and revert to previous versions of your document if needed. This guarantees that all users have access to the most up-to-date information while maintaining a clear history of changes.

Signing the disbursing form electronically

Electronic signatures have revolutionized how we complete and submit forms, providing benefits such as speed and convenience. Using pdfFiller, you can sign the disbursing form digitally without the hassle of printing. The step-by-step guide to eSigning with pdfFiller includes uploading the form, clicking on the signature area, and choosing the signature option that best fits you; this could be drawing your signature or using a pre-uploaded one. You simply follow the on-screen prompts to complete the signing process.

Security features are a top priority in pdfFiller, ensuring that your signed documents are encrypted and protected, allowing for safe submission and storage.

Submitting the disbursing form

Understanding your submission options can help ensure your disbursing form reaches the right department. There are typically two channels for submission: 1. **Online Options:** Submit directly through the Fiscal Treasury website, where forms can often be sent electronically to the relevant department. 2. **Traditional Mail Submission:** If opting for this method, follow these steps: print your completed form, check that all signatures are in place, and mail it to the designated address provided on the form.

After submission, you should receive confirmation regarding the status of your form. This confirmation may come via email or a notification on the site, informing you of what to expect next in the processing timeline.

FAQs about the disbursing form

As with any official form, users often have questions. Here are some common inquiries: - What if I made a mistake on my form? You may need to submit an amended form depending on the nature of the mistake. - How long does the disbursement process take? This can vary, but you should receive acknowledgment shortly after submission. - What should I do if my form gets rejected? Usually, you will be provided with a reason for the rejection, allowing you to correct it and resubmit.

If you're experiencing issues with form submission, troubleshooting steps could involve checking your internet connection, verifying file formats, or consulting the FAQs on the Fiscal Treasury website for guidance.

Taking advantage of financial management resources

Completing the disbursing form is only one aspect of public financial management. pdfFiller ensures you have access to various resources that enhance your financial operations. Other related forms, such as budgeting and expense tracking templates, are available on the platform, providing integrated tools for financial planning.

Understanding fiscal standards is also crucial. Keeping informed about government financial practices can help you stay ahead in compliance. Best practices for financial management often recommend regular reviews of financial submissions to streamline the process.

Getting assistance with your disbursing form

If you find yourself needing assistance while filling out the disbursing form, know that the Fiscal Treasury provides several support avenues. You can contact their support directly through their website, where they offer a comprehensive FAQ section to address common concerns.

Additionally, consider joining community forums or peer support groups that share insights on navigating governmental financial frameworks. This can be particularly useful for networking and discovering tips from others who have successfully submitted the disbursing form.

Keeping track of your disbursing activities

Maintaining organized records of your disbursing activities is vital for effective fiscal management. pdfFiller provides tools to help users manage their form records efficiently, allowing for easy retrieval and progress tracking of submitted forms.

To follow up on submitted disbursing forms, utilize the confirmation emails or dashboard notifications provided by the Fiscal Treasury to check the status. Maintaining an organized filing system on pdfFiller can further help you avoid confusion in future transactions.

Advanced topics and related services

Beyond the disbursing form, it's beneficial to explore additional financial programs and services available through government channels. Engaging with financial advisors can provide tailored support, especially regarding complex forms or larger disbursement requests.

Staying informed about government disbursement policies is essential, especially as changes may impact how forms are processed or what is required in future submissions. Keeping abreast of these updates can ensure compliance and that all your disbursing activities meet current standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete disbursing - fiscaltreasurygov online?

How can I edit disbursing - fiscaltreasurygov on a smartphone?

How do I fill out disbursing - fiscaltreasurygov using my mobile device?

What is disbursing - fiscaltreasurygov?

Who is required to file disbursing - fiscaltreasurygov?

How to fill out disbursing - fiscaltreasurygov?

What is the purpose of disbursing - fiscaltreasurygov?

What information must be reported on disbursing - fiscaltreasurygov?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.