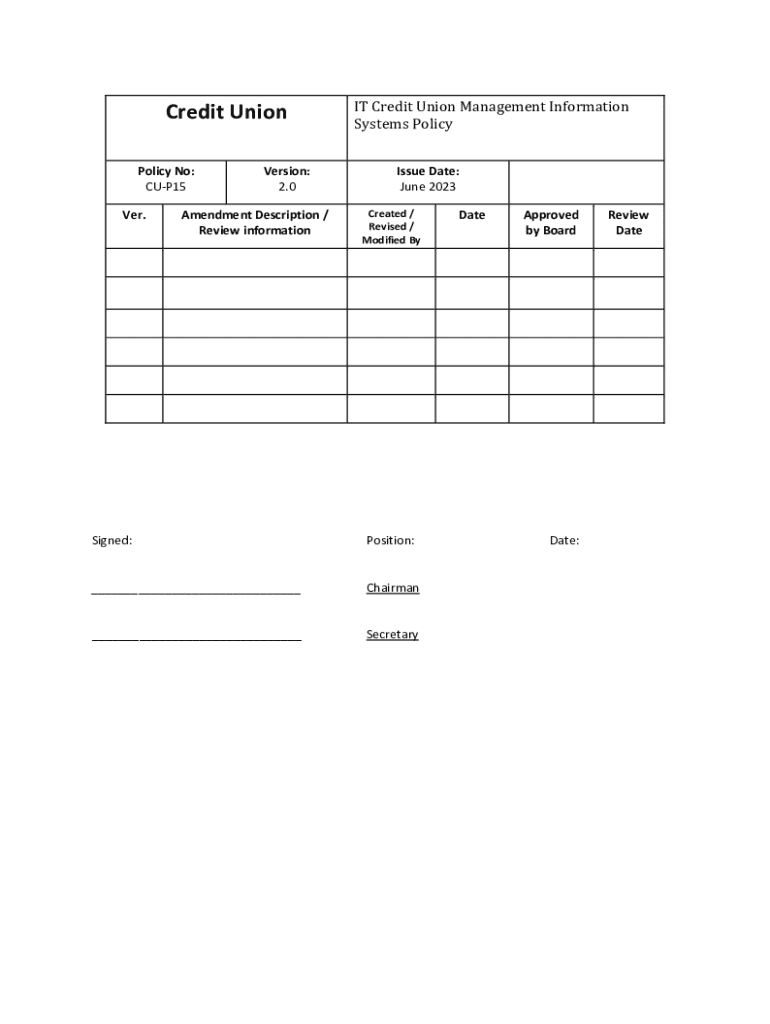

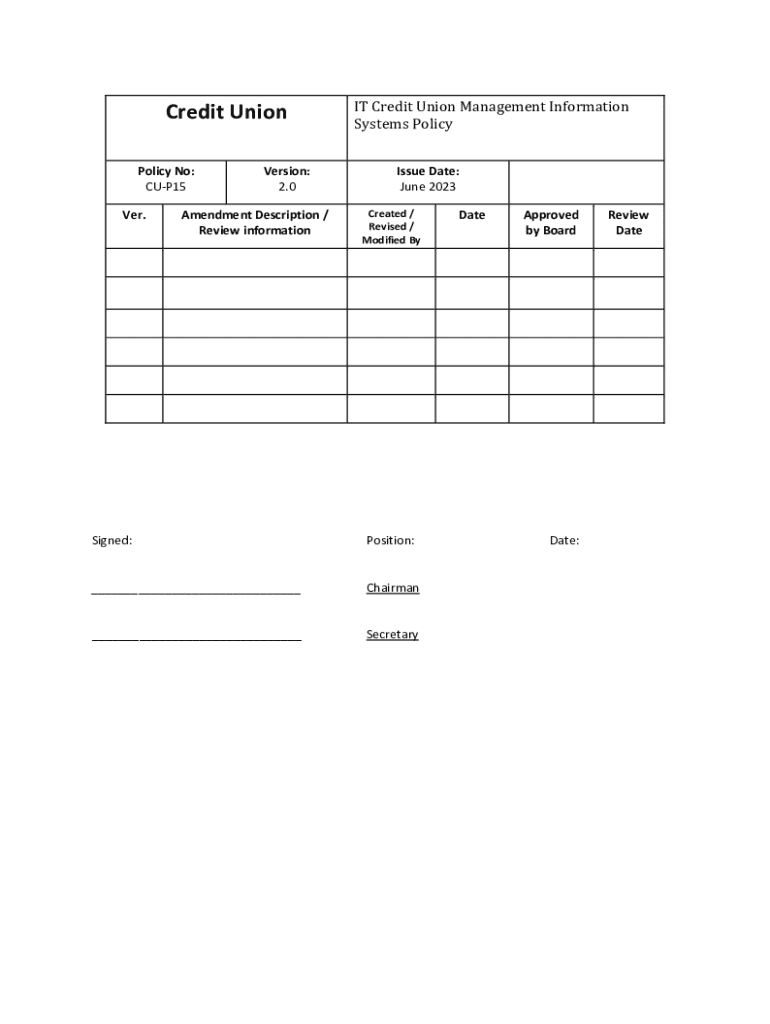

Get the free Credit Union Management Information Systems Policy

Get, Create, Make and Sign credit union management information

How to edit credit union management information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit union management information

How to fill out credit union management information

Who needs credit union management information?

Credit union management information form - How-to guide

Understanding the credit union management information form

The credit union management information form is a critical document used by credit unions to collect and report essential data pertinent to their operations and regulatory compliance. This form gathers a comprehensive range of information, including financial performance metrics, member demographics, regulatory compliance status, and management practices that are vital for effective governance.

Employing the credit union management information form is paramount for operational integrity, as it ensures that the management can track performance, identify trends, and remain compliant with legal requirements. It serves as a formalizing tool that aids in accountability and transparency, which are essential attributes in the credit union sector.

Key components of the credit union management information form

The credit union management information form comprises several sections, each designed to elicit specific information from the credit union operators. Understanding these components helps ensure that the form is filled out adequately and accurately.

Section 1 is typically focused on member information such as demographics, membership duration, and engagement patterns. This data helps credit unions understand their members better and tailor services to meet their needs.

Section 2 delves into the financial data crucial for assessing the fiscal health of the credit union. This can include income statements, balance sheets, and key performance indicators that reflect the organization's financial viability.

In Section 3, compliance and regulations are outlined, indicating adherence to various legal frameworks and industry standards, which is vital for operational legitimacy.

Lastly, Section 4 highlights management practices, where the strategies and procedures followed by the credit union can be documented for internal review and external scrutiny.

Preparing to fill out the credit union management information form

Preparation is key to successfully filling out the credit union management information form. Begin by gathering all necessary documents, including financial statements, member reports, and compliance checklists, as this foundational data will simplify the process.

Avoid common pitfalls, such as rushing through the form or neglecting to double-check information before submission. Mistakes in financial reporting or compliance data can lead to severe consequences, including penalties or regulatory scrutiny.

Implementing best practices such as collaborating with team members, using checklists for preparation, and allotting sufficient time for form completion will help ensure you deliver a comprehensive and accurate document.

Step-by-step guide to filling out the credit union management information form

To fill out the credit union management information form, start by accessing the form through pdfFiller. Once you find it, open the document in the integrated editor. This user-friendly platform allows you to interact with the PDF, making the completion process efficient and straightforward.

Editing the PDF directly in the cloud is handy because it allows real-time alterations without the constraints of traditional paper forms. After you've filled in the necessary information, utilize the annotation features to collaborate with team members, ensuring no detail is overlooked.

Reviewing the entries for accuracy is paramount. Check each section thoroughly and, if possible, have another set of eyes review the information as well. Once confident in the data presented, finalize the form for submission.

Managing your completed form on pdfFiller

Once the credit union management information form is complete, managing the document is as crucial as filling it out. pdfFiller allows you to save and store your completed forms securely in the cloud. This accessibility ensures that you can retrieve the document when needed without excessive searches.

Additionally, pdfFiller provides options for exporting and sharing the form with relevant stakeholders. This feature facilitates transparency and enables timely collaboration on necessary updates. You can also track submission status and manage revisions as necessary, keeping all parties informed.

Printing and eSigning the credit union management information form

Although digital submissions are increasingly preferred, printing the form may still be necessary in some situations. pdfFiller offers easy-to-use printing options so you can create a hard copy if required. After printing, ensure that the document is signed appropriately.

Utilizing pdfFiller’s eSignature feature streamlines this process, allowing for quick and secure electronic submissions. It's vital to consider the legal implications of eSigning documents; be aware of the laws governing electronic signatures in your jurisdiction to ensure compliance.

Common challenges and solutions

Navigating the completion of the credit union management information form can come with challenges, such as technical difficulties or confusion over specific sections. Utilizing pdfFiller’s resources minimizes many of these issues, providing user-friendly techniques and templates tailored to your needs.

In particular, the collaborative features allow team members to communicate in real-time about any challenges, streamlining problem-solving efforts. User testimonials frequently highlight successful navigations using pdfFiller's simple interface, proving that digital tools can greatly enhance efficiency in form management.

Enhancing document management with pdfFiller

pdfFiller provides numerous templates and tools tailored for credit unions, enabling users to explore various document management options effectively. By leveraging pdfFiller for ongoing document management, credit unions can maintain compliance and improve operational efficiency.

Additionally, the collaborative features enhance communication among team members, allowing for real-time edits and updates. This positioning as a centralized document management solution can significantly increase overall team productivity and satisfaction.

FAQs on the credit union management information form

It's common to have questions during the process of completing the credit union management information form. If you encounter any issues, pdfFiller offers comprehensive customer support to assist you with troubleshooting. Additionally, you should familiarize yourself with the frequency of completing the form, as this can vary depending on individual credit union requirements.

For those unsure where to find help, there are plentiful resources available directly from pdfFiller and its user community, ensuring you’re never alone in navigating these requirements.

Next steps after submission

After submitting the credit union management information form, it’s essential to follow up on any actions that may be required. Ensure you keep track of compliance deadlines and renewals related to your submission, as maintaining regulatory compliance is an ongoing process.

Preparing for future submissions might also be an important consideration. By maintaining accurate records and understanding the submission process, you'll facilitate easier and more streamlined efforts for upcoming forms.

User insights and case studies

Real-life examples can provide profound insights into the practical applications of filling out the credit union management information form. For instance, several credit unions reported significant efficiency improvements after adopting pdfFiller, which streamlined their document workflows and minimized processing errors.

Insightful case studies from credit unions demonstrate that successfully managing the form contributes not only to operational integrity but also fosters greater trust and engagement with credit union members.

Conclusion on leveraging technology for efficient form management

The value of leveraging tools like pdfFiller in managing the credit union management information form cannot be understated. By embracing innovative digital solutions, credit unions can enhance efficiency, transparency, and compliance within their operations.

Ultimately, adopting these technologies empowers organizations to streamline processes, reducing administrative burdens and improving member service experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit union management information online?

Can I sign the credit union management information electronically in Chrome?

How do I edit credit union management information straight from my smartphone?

What is credit union management information?

Who is required to file credit union management information?

How to fill out credit union management information?

What is the purpose of credit union management information?

What information must be reported on credit union management information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.