Get the free Corporate concentration and power matter for agency in ...

Get, Create, Make and Sign corporate concentration and power

Editing corporate concentration and power online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate concentration and power

How to fill out corporate concentration and power

Who needs corporate concentration and power?

Understanding Corporate Concentration and Power Form

Understanding corporate concentration

Corporate concentration refers to the accumulation of market power in the hands of a limited number of corporations. This phenomenon often results in market domination, affecting competition and consumer choices. Historically, corporate power has evolved through various economic cycles, with notable concentrations emerging during the late 19th century industrial boom, the post-World War II economic expansion, and the recent digital transformation.

Forms of corporate concentration can vary significantly, with mergers and acquisitions being the most common methods. Mergers occur when two firms combine to form a new entity, while acquisitions involve one company purchasing another. The distinctions between monopoly, wherein a single company dominates a sector, and oligopoly, where a few companies hold significant market share, are critical in analyzing corporate power dynamics.

The implications of corporate power

The implications of corporate concentration are profound, particularly in terms of economic competition. When few corporations control the market, competition diminishes, leading to reduced innovation and higher prices. The economic landscape can transform as smaller companies struggle to compete against large conglomerates, often resulting in market stagnation.

Moreover, corporate power extends beyond economics into social and political spheres. Large corporations frequently engage in lobbying, influencing regulations to favor their interests. This dynamic raises questions about the role of corporate social responsibility (CSR), as communities demand accountability and ethical behavior from dominant market players.

Identifying corporate concentration in your industry

Identifying corporate concentration within your industry requires careful analysis of key indicators. One of the most critical indicators is market share analysis, which involves looking at the control exerted by leading firms in the market. A concentrated industry may typically exhibit a high HHI (Herfindahl-Hirschman Index) score, suggesting significant levels of monopoly or oligopoly.

Understanding industry structure also plays a crucial role. Tools for conducting research, such as market reports and financial analyses, can provide valuable insights into the level of concentration. Various financial metrics can help assess which companies are established players and how new entrants might maneuver within the market.

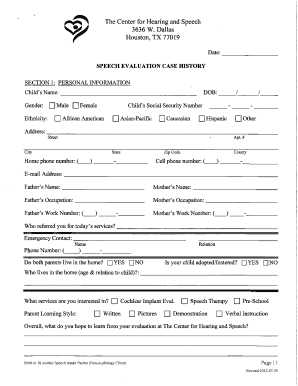

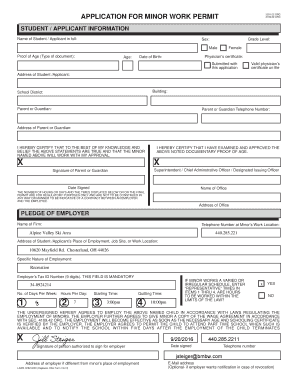

Documenting corporate concentration: essential forms and templates

To effectively document corporate concentration, several types of documents become essential. Business plans outline strategies for navigating the competitive landscape, while compliance statements ensure adherence to regulatory standards. M&A agreements play a critical role in formalizing relationships between companies, detailing terms and conditions of mergers and acquisitions.

Using pdfFiller, users can customize these documents effortlessly. The platform offers editing features that allow for easy modifications to standard templates. Interactive tools enable collaboration among team members, ensuring that every stakeholder can contribute to document creation and review.

Analyzing your findings

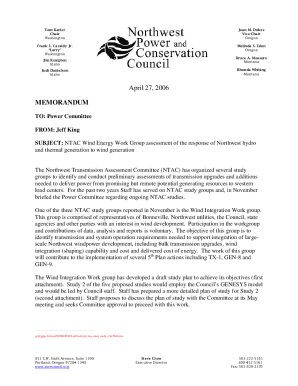

Once data regarding corporate concentration is gathered, analyzing the findings is critical. Utilizing data visualization tools such as charts and graphs can enhance clarity and comprehension of complex data sets. These visual aids help stakeholders quickly grasp trends and implications of concentration within the industry.

Creating comprehensive reports on corporate concentration involves structuring insights around key components, such as market trends, potential risks, and competitive landscapes. It's essential to highlight actionable insights to facilitate strategic decision-making for stakeholders that rely on up-to-date information to drive business success.

Strategy for responding to corporate concentration

Developing strategic responses to corporate concentration is vital for remaining competitive. Organizations should consider competitive strategies that include pricing adjustments and product differentiation to carve out a unique position in an increasingly crowded market. These strategies can help counterbalance the market power of leading corporations.

Additionally, collaborating with stakeholders is key. Engaging with community leaders and forming alliances with other companies can foster a stronger collective influence, helping smaller firms navigate the challenges posed by corporate giants. Strategic partnerships can amplify voices and resources, enabling a more robust approach to gaining market share.

Best practices for managing documentation

Managing documentation related to corporate concentration effectively requires adherence to best practices. Ensuring compliance with legal standards is essential for avoiding potential pitfalls that might arise during regulatory scrutiny. Maintaining accurate records facilitates transparency and accountability, which are crucial for building trust among stakeholders.

Leveraging cloud-based solutions like pdfFiller enhances document management capabilities. Benefits include easy access to documentation from anywhere, facilitating collaboration among teams. Moreover, robust security features in cloud platforms help protect sensitive information, allowing users to manage documents with peace of mind.

The future of corporate concentration

Looking ahead, several emerging trends may shape the future of corporate concentration. Globalization continues to interconnect markets, often leading to increased competition in local industries. As technology evolves, corporate strategies must adapt to maintain competitive advantages while addressing regulatory changes and consumer expectations.

Preparing for change is imperative. Organizations should anticipate transforming market conditions and be ready to adapt documentation and strategies accordingly. Monitoring regulatory changes is key to understanding how they may impact competitive dynamics and determining necessary adjustments for sustainability.

Case studies: successful management of corporate power

Examining case studies of corporations that have successfully managed corporate power provides valuable insights. Strategies that yielded success often involved innovative approaches to teamwork and market engagement. Conversely, analyzing failed attempts at concentration reveals important lessons about the risks of overreach and the necessity of maintaining ethical business practices.

Key takeaways highlight the importance of agility, ethical considerations, and the power of collaboration. Companies must balance ambition with responsibility, ensuring they navigate corporate concentration's challenges without compromising their values or long-term objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get corporate concentration and power?

How do I fill out corporate concentration and power using my mobile device?

How can I fill out corporate concentration and power on an iOS device?

What is corporate concentration and power?

Who is required to file corporate concentration and power?

How to fill out corporate concentration and power?

What is the purpose of corporate concentration and power?

What information must be reported on corporate concentration and power?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.