Get the free Insurance Policy:

Get, Create, Make and Sign insurance policy

How to edit insurance policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance policy

How to fill out insurance policy

Who needs insurance policy?

Insurance Policy Form How-to Guide

Understanding insurance policy forms

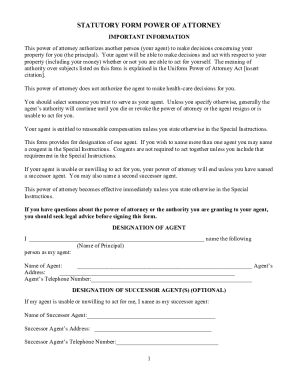

An insurance policy form is a crucial document that outlines the terms, provisions, and coverage details of an insurance contract between an insurer and a policyholder. It serves as the backbone of the insurance process, ensuring that both parties understand their rights, responsibilities, and the coverage offered. These forms are not just bureaucratic requirements; they provide essential information that protects both the insurer and the insured against misunderstandings.

The importance of an insurance policy form cannot be overstated. It sets forth the specifics agreed upon by both the insurer and the policyholder, including coverage limits, exclusions, and premium amounts. Without such a clear and defined document, disputes can arise, leading to potential legal ramifications. Therefore, understanding what an insurance policy form entails is critical for anyone engaging with insurance providers.

Types of insurance policy forms

Insurance policy forms can vary significantly depending on the type of insurance. Common forms include those for auto, health, life, and property insurance, each designed to suit the specific needs and risks associated with these sectors. For instance, an auto insurance policy form will incorporate details about vehicle usage, types of coverage (like collision and liability), and related add-ons.

There are also differences between standard and specialized forms. Standard insurance policy forms are typically uniform across insurers, making it easier for consumers to compare offerings. Specialized forms may cater to unique sectors or needs, such as catastrophic event coverage or commercial liability, which might require tailored provisions to address specific risks.

Overview of pdfFiller's insurance policy form solutions

pdfFiller is a powerful tool for managing insurance policy forms, offering several key features designed to simplify the document handling process. The platform is cloud-based, allowing users to edit and manage documents from anywhere with internet access. This flexibility is particularly beneficial for teams working in various locations, as it enhances collaboration and efficiency in completing and storing necessary forms.

Another significant feature is the eSigning capability, which streamlines the transaction completion process by allowing users to sign documents electronically. This feature eliminates the need for physical paperwork, reducing the time taken from document creation to submission. Furthermore, pdfFiller incorporates collaboration tools, enabling multiple team members to work on documents concurrently, ensuring that all stakeholders remain updated throughout the process.

Benefits of using pdfFiller for your insurance policy forms

Utilizing pdfFiller for insurance policy forms comes with a host of benefits. The main advantage is accessibility; users can easily access their documents via any device, regardless of location. This on-the-go access is invaluable, especially when dealing with time-sensitive insurance requests or modifications.

Efficiency is another key benefit. Precision in document handling and processing can significantly minimize delays in insurance claims or policy renewals. Additionally, pdfFiller prioritizes security, which is paramount when dealing with sensitive information related to insurance. With robust security measures in place, users can trust that their data is protected from unauthorized access.

Exploring the structure of insurance policy forms

Understanding the structure of an insurance policy form is essential for effective navigation and completion. Typically, these forms include several sections: applicant information, coverage details, premium calculations, and exclusion clauses. Each component plays a vital role; for instance, applicant information ensures the insurer has accurate identification and contact details, while coverage details specify what is protected under the policy.

Premium calculations detail how much the policyholder will pay, which is influenced by factors like risk assessment and coverage limits. Recognizing the importance of each section allows policyholders to grasp their agreements fully and to minimize potential disputes regarding coverage or claims.

FAQs about insurance policy form layouts

Common questions regarding insurance policy form layouts often revolve around why certain information is required and how to understand policy jargon. For example, many users want clarification on 'deductible' versus 'premium,' or why specific coverage limits exist. FAQs like these help in demystifying insurance documentation for consumers who may not be fully versed in industry terminology.

Interactive tools for handling insurance policy forms

Step-by-step guide to filling out an insurance policy form using pdfFiller

Filling out an insurance policy form using pdfFiller is straightforward and user-friendly. Here’s a step-by-step guide to get started:

This guide ensures that users can confidently navigate the pdfFiller platform and complete their insurance policy forms correctly.

Using pdfFiller’s editing tools for insurance documents

pdfFiller's editing tools make it easy to customize insurance policy forms. To add or modify content within policy forms, follow these steps:

These editing features promote teamwork and ensure all necessary modifications are properly documented and communicated.

Managing your insurance policy forms effectively

Storing and organizing completed forms on pdfFiller

After completing an insurance policy form, managing the document efficiently is crucial for quick access and reference. Best practices for digital file management include creating organized folders and utilizing tags for easy retrieval. For example, you can create a folder specifically for insurance documents and tag each form by type (auto, health, life, etc.).

This method makes it straightforward to locate forms quickly when needed, especially during discussions with insurers or when filing claims. Keeping your forms organized not only enhances efficiency but also reduces the chance of misplaced documents that could lead to delays in processing.

Cloud-based sharing features for insurance policy forms

Sharing completed insurance policy forms securely is another area where pdfFiller shines. Utilize the cloud-based sharing features to distribute forms with ease while managing permissions to maintain confidentiality. This means you can control who has access to edit or view your documents, mitigating risks associated with unauthorized changes or exposure.

For instance, you can share completed forms directly from pdfFiller, setting permissions to allow stakeholders to either view or collaborate on the document. This approach fosters transparency while ensuring sensitive information remains protected, providing peace of mind for policyholders.

eSigning your insurance policy form with confidence

Legality of eSignatures on insurance documents

eSignatures have become increasingly accepted in the insurance industry due to various legal frameworks, which ensure that electronic signatures hold the same legal weight as traditional handwritten ones. This shift is crucial as it streamlines the signing process, allowing for faster turnaround times on policy agreements and claims.

The Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) outline the legality and usage of eSignatures. These laws provide the necessary framework for insurers and policyholders to engage in electronic transactions with confidence, given that both parties consent to using electronic signatures.

A detailed walkthrough of the eSigning process on pdfFiller

eSigning your insurance policy form with pdfFiller is simple and efficient. Here’s how to do it:

This straightforward process ensures that policyholders can finalize their insurance documents efficiently, ready for submission or archive.

Troubleshooting common issues with insurance policy forms

Identifying common errors in insurance policy forms

When filling out insurance policy forms, common errors can hinder the process. Frequent mistakes include incorrect personal information, failing to sign the document, or missing coverage selections. Attention to detail is key, as these errors can lead to delays in policy approval or claims processing.

To avoid these pitfalls, always review the completed form thoroughly before submission. Utilizing pdfFiller's built-in validation checks can also help in identifying errors early in the process, ensuring a smoother experience.

Solutions for technical difficulties using pdfFiller

Occasionally, users may encounter technical difficulties while using pdfFiller. Common issues could include problems with uploading documents or difficulty accessing certain features. For these situations, pdfFiller’s support system provides quick solutions.

Consult the FAQs section for troubleshooting tips, which can guide users through many typical problems. If further assistance is needed, customer support can be reached directly to offer personalized help tailored to your specific issue.

Keeping your insurance policy forms up-to-date

The importance of updating your insurance policy forms regularly

Regularly updating your insurance policy forms is vital to ensure continued coverage and compliance with policy requirements. Life changes such as marriage, purchasing a new home, or changes in health status necessitate updates to your coverage to ensure that it reflects your current situation.

Additionally, policies often have renewal periods, prompting necessary reviews and updates. By staying proactive about updates, policyholders can avoid potential coverage gaps that could result in significant financial consequences.

Leveraging pdfFiller’s features for document updates

pdfFiller simplifies the process of revising and resubmitting forms. To update your documents, follow these steps:

By utilizing pdfFiller’s user-friendly features, policyholders can keep their information current and relevant.

Related terms and key concepts in insurance policy forms

Glossary of relevant insurance terminology

Understanding insurance policy forms requires familiarity with certain terminology. Here are some key terms and their definitions:

Familiarity with these terms helps in better understanding your insurance policy forms and discussions with insurers.

Industry resources for further understanding

To extend your knowledge and navigate the world of insurance policy forms more effectively, various industry resources are available. Websites of insurance advisory organizations can provide valuable insights into best practices, trends, and regulatory changes that affect insurance documentation.

Additionally, resources such as the Risk Management Institute offer educational materials that can enhance your understanding of risk models and insurance strategies, further empowering policyholders to manage their insurance needs proactively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute insurance policy online?

Can I create an eSignature for the insurance policy in Gmail?

How can I edit insurance policy on a smartphone?

What is insurance policy?

Who is required to file insurance policy?

How to fill out insurance policy?

What is the purpose of insurance policy?

What information must be reported on insurance policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.