Get the free Procedures for Form S-1-7

Get, Create, Make and Sign procedures for form s-1-7

Editing procedures for form s-1-7 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out procedures for form s-1-7

How to fill out procedures for form s-1-7

Who needs procedures for form s-1-7?

Procedures for Form S-1-7 Form

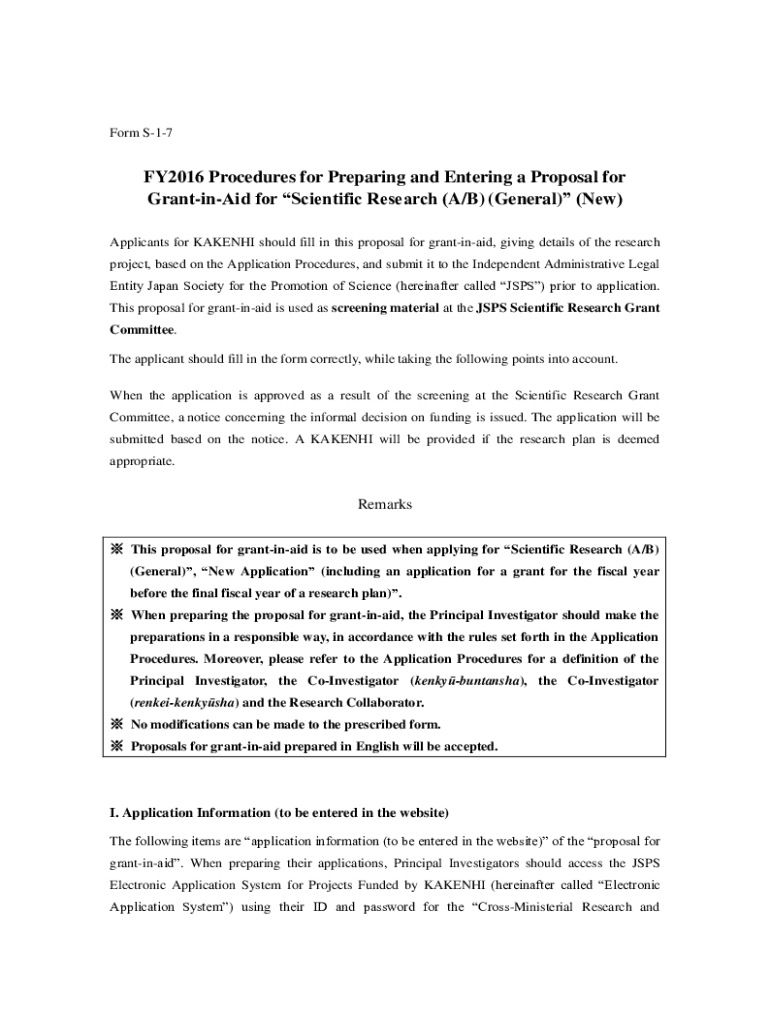

Understanding Form S-1-7

Form S-1-7 is a crucial document used for registering securities with the Securities and Exchange Commission (SEC). This form enables companies to provide necessary information to potential investors about the securities they wish to offer.

The purpose of Form S-1-7 is to ensure compliance with SEC regulations, providing transparency and protecting investors by disclosing relevant financial and operational details. Understanding the filing process is vital, as this ensures not just compliance but also paves the way for successful capital raising.

Key requirements for filing Form S-1-7

Before initiating the filing of Form S-1-7, it's essential to confirm eligibility criteria, which typically include being a U.S. entity and intending to sell securities to raise funds. Companies planning to raise over $1 million generally must file this form.

Detailed breakdown of Form S-1-7 sections

Completing Form S-1-7 involves providing specific information across distinct sections, each critical to presenting a complete picture of the offering.

Completing the form S-1-7: step-by-step instructions

Completing Form S-1-7 involves several structured steps to ensure accuracy and comprehensiveness.

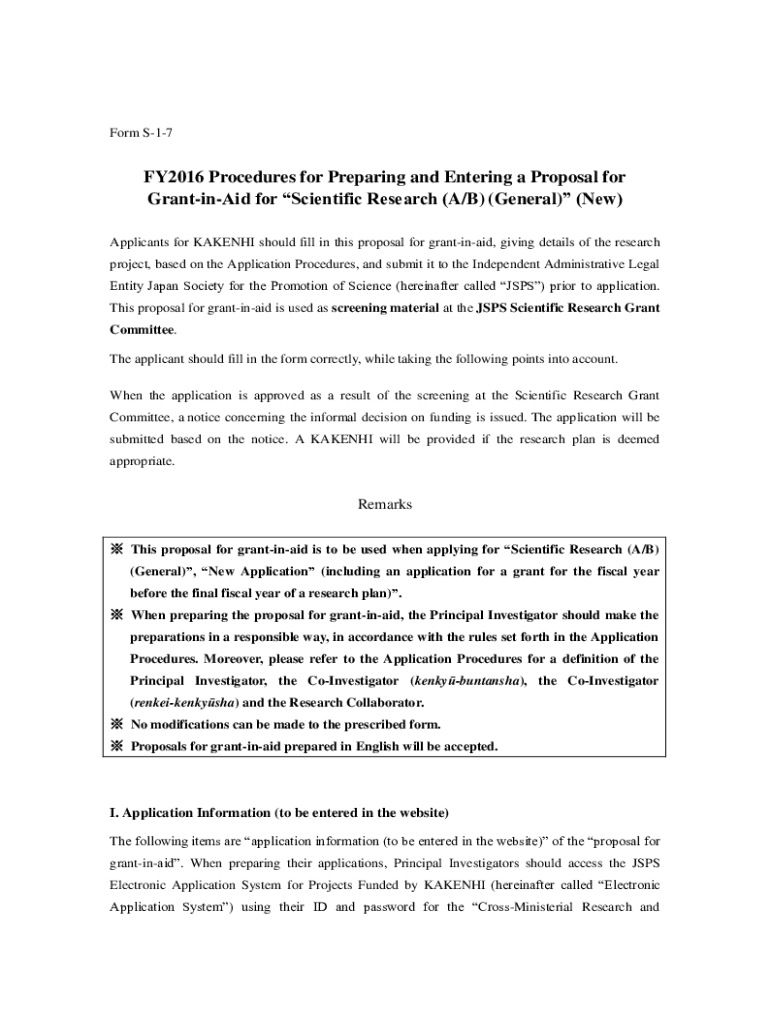

Common challenges in filling out Form S-1-7

Filing Form S-1-7 is critical, yet it presents challenges, particularly with the regulatory landscape which is essential to navigate effectively. Understanding the complexity of SEC regulations is key to ensuring your filing is compliant.

Submission and follow-up process for Form S-1-7

Once the form is completed, it needs to be submitted correctly, whether electronically via the SEC's EDGAR system or through physical mail. Tracking the submission status is equally important.

Leveraging pdfFiller for seamless form management

pdfFiller provides tools that streamline the preparation, completion, and submission of Form S-1-7, regardless of whether you’re a first-time filer or experienced in regulatory documentation.

Case studies: successful Form S-1-7 filings

Learning from successful filings offers valuable insights into best practices and common pitfalls to avoid. Companies that meticulously followed guidelines in their filings often found smoother acceptance.

Frequently asked questions (FAQs)

Addressing common inquiries surrounding Form S-1-7 can demystify the process. Many first-time filers worry about amendments, regulatory nuances, or the support available.

Additional tips for successful S-1-7 submission

Successful submissions require attention to detail, comprehensive preparation, and a strategy to stay updated on regulatory shifts. Keeping an eye on SEC announcements or potential changes will equip you well for the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in procedures for form s-1-7?

Can I edit procedures for form s-1-7 on an iOS device?

How do I fill out procedures for form s-1-7 on an Android device?

What is procedures for form s-1-7?

Who is required to file procedures for form s-1-7?

How to fill out procedures for form s-1-7?

What is the purpose of procedures for form s-1-7?

What information must be reported on procedures for form s-1-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.