Get the free Smith Edward F

Get, Create, Make and Sign smith edward f

Editing smith edward f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out smith edward f

How to fill out smith edward f

Who needs smith edward f?

Comprehensive Guide to the Smith Edward F Form

Overview of the Smith Edward F Form

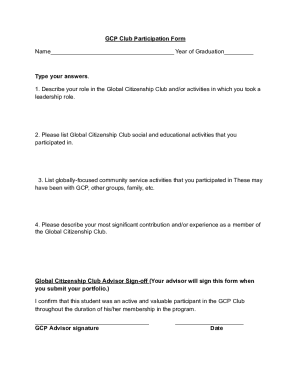

The Smith Edward F Form serves as a pivotal document in various administrative and financial processes. Often required in real estate transactions, financial institutions, and certain legal settings, this form gathers essential data that helps facilitate transactions and ensure compliance with regulatory standards. Understanding this form's importance is crucial for both individuals and teams involved in these contexts, as it can significantly impact financial and legal outcomes.

The Smith Edward F Form is particularly crucial for those involved in financial disclosures, reporting income, or validating eligibility for loans or grants. By accurately completing this document, users can streamline processes and minimize the risk of delays or denials. Individuals applying for mortgages, loans, or other financial products should ensure familiarity with this form, as it may be a required submission.

Key features of the Smith Edward F Form

The Smith Edward F Form is comprehensive, structured to capture critical data across various sections. For users to complete it accurately and efficiently, understanding its sections is essential.

Compliance is a significant aspect of the Smith Edward F Form. Users must adhere to specific guidelines when completing it, which vary by jurisdiction and purpose. Awareness of these requirements can aid in avoiding common pitfalls associated with improper form submissions.

How to fill out the Smith Edward F Form

Filling out the Smith Edward F Form can seem daunting, but a systematic approach simplifies the process. Begin by gathering all necessary documents to support your declarations.

Avoiding common mistakes can enhance your experience with the Smith Edward F Form. Pay close attention to detail and ensure that your financial figures are calculated correctly — discrepancies might raise flags during review.

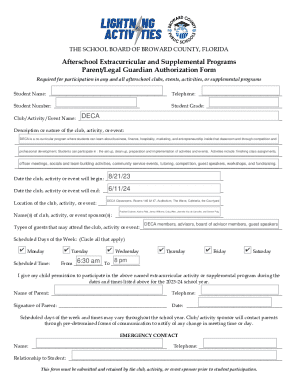

Interactive tools for managing the Smith Edward F Form

Utilizing tools like pdfFiller significantly enhances the efficiency of managing the Smith Edward F Form. With a suite of user-friendly editing features, applicants can modify their documents easily to suit their needs.

Additionally, converting the Smith Edward F Form into various formats (e.g., PDF, Word) allows for flexibility in future modifications and sharing. This versatility is vital for users needing to submit forms in different environments.

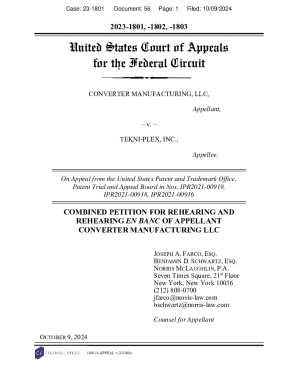

E-signing the Smith Edward F Form

The emergence of e-signatures has transformed how documents like the Smith Edward F Form are signed. E-signing offers numerous advantages over traditional methods, including speed, convenience, and enhanced security.

These features not only simplify the signing procedure but also make compliance with regulatory requirements more manageable.

Submitting the Smith Edward F Form

Submitting the Smith Edward F Form requires diligence and attention to detail. Depending on the requirements of the associated institution or agency, users have the option to both e-file or hand-deliver their forms.

Awareness of these submission options and protocols can greatly aid in ensuring a smooth process, especially for those inundated with administrative tasks.

Frequently asked questions (FAQs)

Users often have key concerns regarding the Smith Edward F Form, reflecting the common challenges associated with paperwork and compliance.

Addressing these FAQs helps empower individuals and teams as they navigate the complexities of form submission, reducing anxiety and boosting confidence.

Case studies and real-life applications

Understanding real-world applications of the Smith Edward F Form can provide valuable insights. For instance, a local small business applied the form to secure a financing option to expand its operations. By compiling accurate financial information, they successfully navigated the application process.

Another example involves an individual applying for a mortgage who meticulously completed the Smith Edward F Form. They were able to secure the loan by demonstrating strong financial standing through the documented information.

These case studies illustrate the form's transformative potential, highlighting the importance of diligence and accuracy in its completion.

Additional considerations and best practices

When dealing with forms like the Smith Edward F Form, protecting privacy and confidentiality is paramount. Ensure that all information submitted is handled securely and in compliance with legal obligations.

By being vigilant and adhering to best practices, users can enhance their experience with this form and mitigate risks associated with its usage.

Related forms and resources

The Smith Edward F Form often intersects with various other forms. Understanding these can streamline process requirements. For instance, users may also need to complete tax forms or loan applications alongside the Smith Edward F Form.

Leveraging these resources fosters a smoother form completion experience and builds confidence in handling administrative tasks.

Community feedback and user experiences

Feedback from users of the Smith Edward F Form often highlights the efficiency gained through usage. Many appreciate the integrated functionalities provided by pdfFiller, emphasizing how easy it is to edit, sign, and manage their forms, all in one platform.

This community feedback underscores the tool’s value and the best practices that can enhance user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute smith edward f online?

How do I edit smith edward f in Chrome?

How do I edit smith edward f straight from my smartphone?

What is smith edward f?

Who is required to file smith edward f?

How to fill out smith edward f?

What is the purpose of smith edward f?

What information must be reported on smith edward f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.