Get the free Risk Profiling Questionnaire-

Get, Create, Make and Sign risk profiling questionnaire

How to edit risk profiling questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out risk profiling questionnaire

How to fill out risk profiling questionnaire

Who needs risk profiling questionnaire?

Risk Profiling Questionnaire Form: How-to Guide

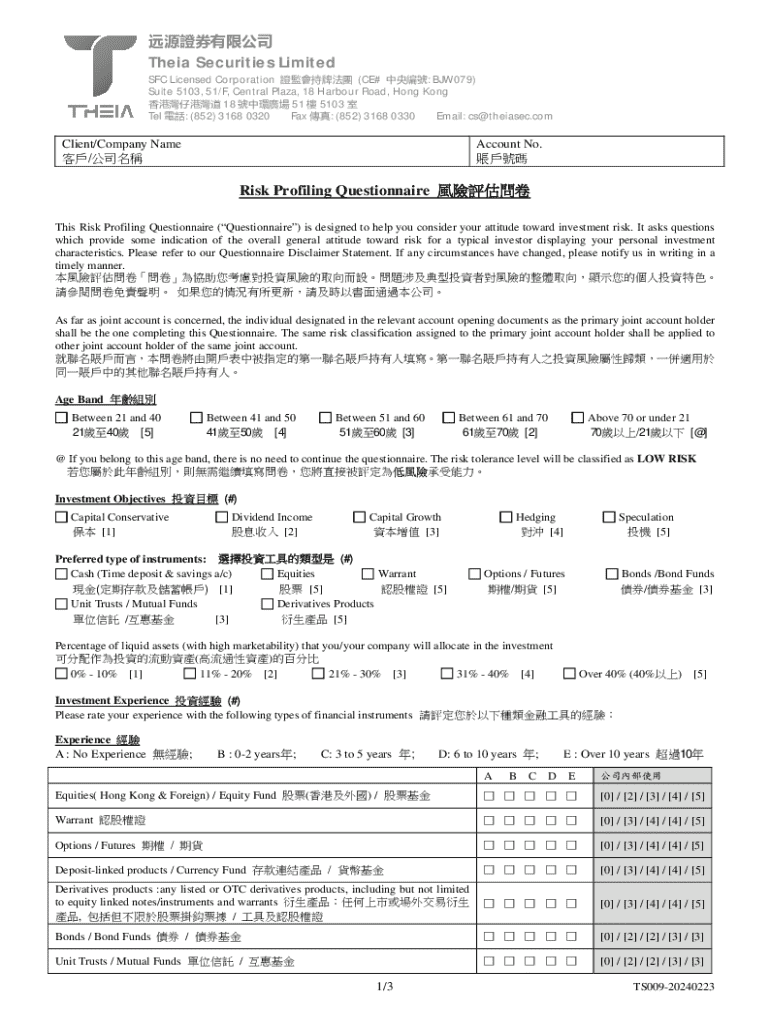

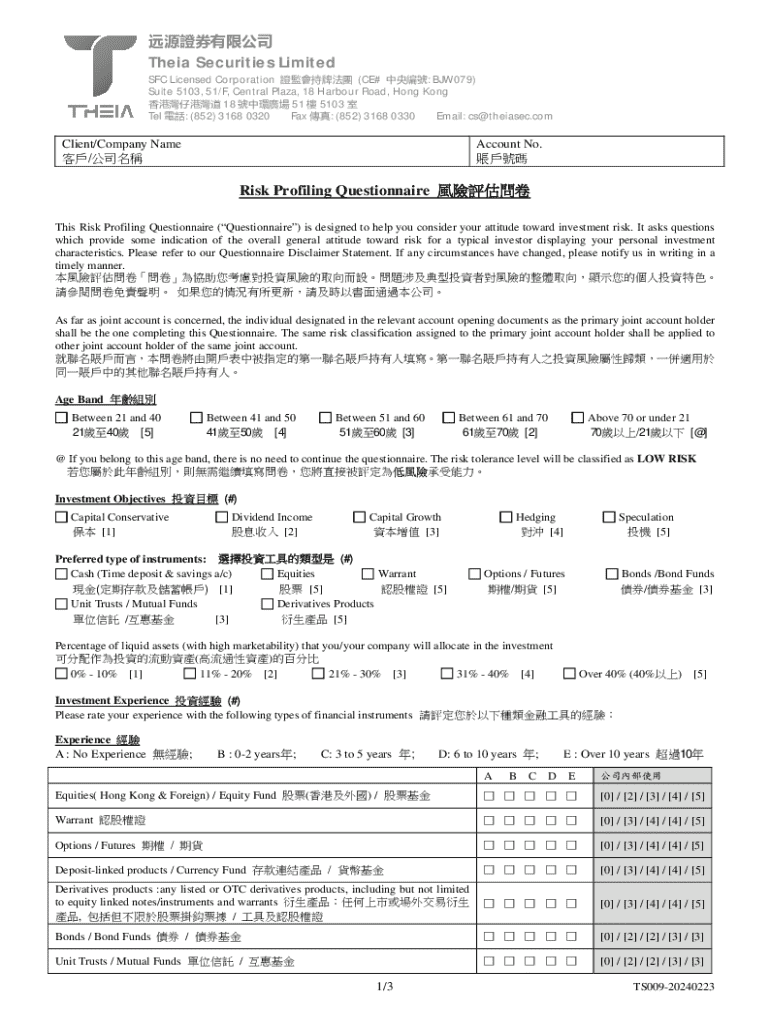

Understanding risk profiling

Risk profiling is a foundational concept in financial management that helps determine an individual’s willingness and ability to take risks. This process is critical for making informed decisions about investments, insurance, and overall financial planning. By clarifying one’s risk tolerance, individuals can engage in strategies that align their financial behaviors with their comfort levels, aspirations, and needs.

Using a risk profiling questionnaire allows individuals to quantify their attitudes towards risk and investment. By systematically answering various questions, users can identify their place on a risk spectrum, which can then inform important financial decisions, such as the types of investment products to pursue or insurance coverage options that are most suitable.

Overview of pdfFiller's risk profiling questionnaire form

pdfFiller offers a risk profiling questionnaire form designed to be intuitive and accessible. Its user-friendly interface ensures that anyone can navigate the form without prior experience, while interactive elements keep users engaged throughout the process. With secure cloud-based access, users can easily collaborate and share the questionnaire with their financial advisors or team members, ensuring that personalized advice and strategies are based on accurate risk assessments.

One of the notable benefits of using pdfFiller's platform is its seamless editing capabilities, allowing users to make changes quickly. The inclusion of electronic signature options enhances the efficiency of completing and approving documents, while document management tools enable real-time collaboration, making it easier than ever to stay organized in financial planning.

Steps to fill out the risk profiling questionnaire

Filling out the risk profiling questionnaire through pdfFiller is a straightforward process that can be completed in a few simple steps. First, users should access the form via pdfFiller’s platform. The search functionality or links provided can guide individuals to the risk profiling questionnaire form quickly.

Next, users will answer various questions that may include multiple-choice options to gauge their attitude toward risk or scale ratings to measure comfort levels with different financial products. Questions might inquire about previous investment experience, financial goals, or views on market fluctuations.

After completing the questionnaire, reviewing responses is essential. Users should double-check their answers to ensure accuracy, as the results depend on the honesty and precision of their inputs. pdfFiller allows easy access to edit any responses if changes are necessary before submitting the questionnaire.

Interpreting your results

Once the questionnaire is submitted, users will receive a risk profile that categorizes them based on their responses. Common risk profiles include categories like Cautious, Balanced, or Adventurous, each representing a distinct approach to financial management. Understanding these categories helps individuals recognize potential investment strategies and products suited to their profiles.

For instance, a Cautious profile might recommend safer investments such as bonds or stable mutual funds, while an Adventurous profile could align with stocks or more volatile investment choices. Engaging in an informed discussion with a financial advisor about these results can help individuals tailor their investment plans effectively.

Managing your financial documents with pdfFiller

The risk profiling questionnaire responses can be safely saved and stored within pdfFiller’s platform. Users can easily access their data and manage document permissions, allowing for controlled sharing with financial professionals or colleagues. This ensures that sensitive information remains private while still facilitating necessary collaborations.

It is also beneficial to revisit the risk profile on a regular basis, especially after significant life milestones or changes in financial circumstances. pdfFiller makes updating information straightforward, enabling users to revise their profile as needed to reflect their current situation or market conditions.

Additional financial tools and resources

In addition to the risk profiling questionnaire form, pdfFiller offers a range of related document templates that enhance financial planning. These may include budget worksheets, investment trackers, and other planning tools. Leveraging the insights from the risk profile can also inform broader financial strategies, ensuring alignment across various areas of financial management.

Utilizing the questionnaire's results can be powerful, as they can feed into investment calculators or budgeting tools available on pdfFiller’s platform. This holistic approach allows individuals to craft a comprehensive financial plan that adheres to their unique risk tolerance while pursuing their long-term goals.

Ensuring data security and compliance

Data security is paramount when handling sensitive financial documents. pdfFiller takes extensive measures to protect user information, employing robust encryption protocols and secure cloud storage solutions. This commitment to security ensures that personal financial data is safeguarded against unauthorized access.

Compliance with legal standards is also a critical component of pdfFiller's operations, which ensures that all processes related to financial documents adhere to industry regulations. Users can rest assured knowing that their information remains private and secure while enjoying the platform's features.

Frequently asked questions

Many individuals have concerns related to risk profiling, especially regarding the nuances of risk tolerance versus capacity. While risk tolerance focuses on one’s willingness to engage with risk, capacity considers the financial ability to endure losses. It is crucial to understand how these factors interplay when making financial decisions.

Furthermore, selecting the right financial products based on one’s risk profile is vital. Individuals with a Cautious profile should favor low-risk assets and avoid high-volatility investments. Conversely, those categorized as Adventurous can explore growth-centric strategies. It’s advisable to regularly reassess both one's risk profile and investment strategies to align with evolving financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit risk profiling questionnaire online?

How do I make edits in risk profiling questionnaire without leaving Chrome?

How do I fill out risk profiling questionnaire on an Android device?

What is risk profiling questionnaire?

Who is required to file risk profiling questionnaire?

How to fill out risk profiling questionnaire?

What is the purpose of risk profiling questionnaire?

What information must be reported on risk profiling questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.