Get the free Managing risks and risk assessment at work: Overview

Get, Create, Make and Sign managing risks and risk

Editing managing risks and risk online

Uncompromising security for your PDF editing and eSignature needs

How to fill out managing risks and risk

How to fill out managing risks and risk

Who needs managing risks and risk?

Managing Risks and Risk Form

Understanding risk management

Risk management is a systematic approach to identifying, assessing, and mitigating risks that could negatively impact an organization’s operations, reputation, and financial performance. It plays a crucial role in strategic decision-making across various contexts, from corporate environments to small businesses and even personal projects. Effective risk management ensures organizations can anticipate potential threats and implement actions to minimize negative impacts.

The importance of risk management lies in its ability to enhance decision-making processes. By understanding the potential risks involved, stakeholders can make informed choices, allocate resources more effectively, and develop robust strategies that support long-term growth and stability.

Types of risks to manage

Understanding the different types of risks is vital for effective management. Each category presents unique challenges and requires tailored strategies for mitigation.

The importance of risk management

Properly managing risks is crucial for any organization. Effective risk management helps prevent significant losses and minimizes the impact of unforeseen events, thereby enhancing organizational resilience. By being prepared for potential issues, organizations can maintain business continuity even in challenging circumstances.

Additionally, a robust risk management framework improves stakeholder trust. When stakeholders see that an organization is committed to transparency and risk mitigation, they are more likely to maintain confidence and support, leading to improved relationships and engagement.

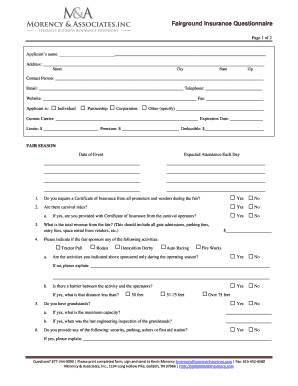

Risk management in different industries

Every industry has its own set of risks and corresponding management strategies. For example, the financial sector must deal with market volatility and regulatory compliance risks, while the healthcare industry is primarily focused on operational and compliance risks due to the sensitive nature of patient data.

Case studies demonstrate the effectiveness of tailored risk management strategies. For instance, a major airline implemented a comprehensive risk management strategy that included operational risk assessments and compliance checks, resulting in a significant reduction in incidents and enhanced customer satisfaction.

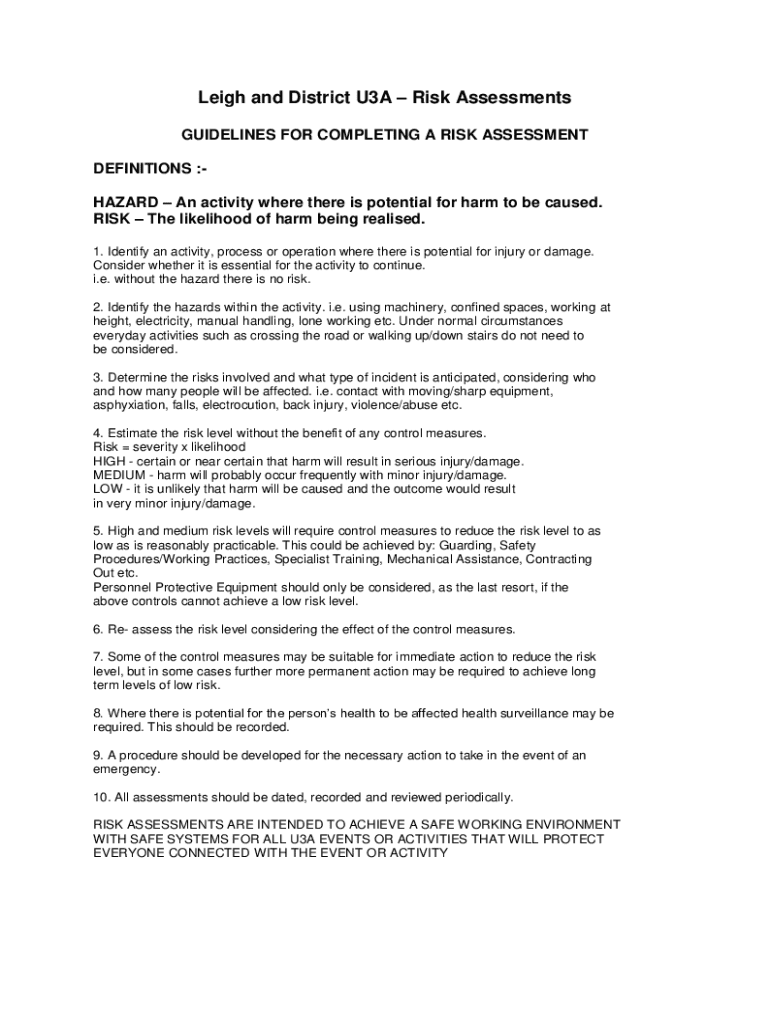

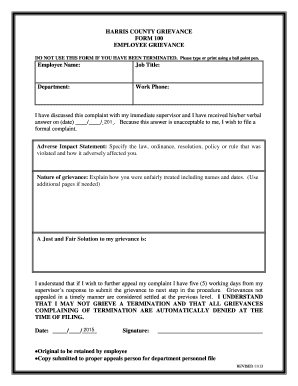

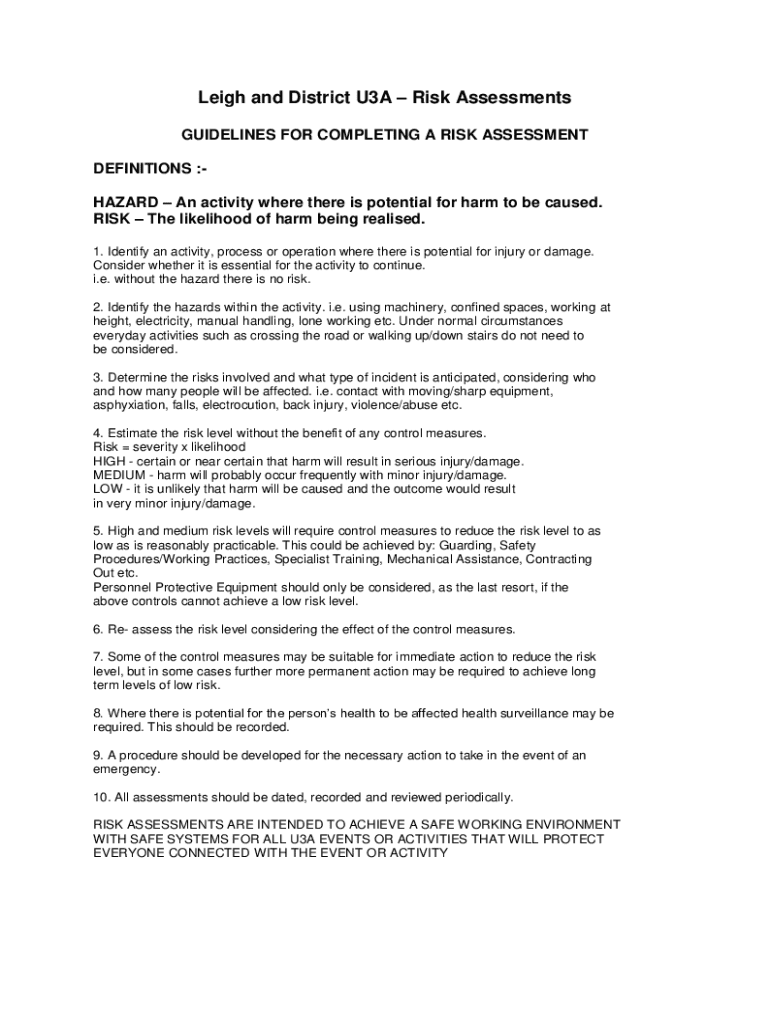

The risk assessment process

A risk assessment is a systematic process used to identify and evaluate potential risks. It involves assessing the likelihood and impact of different risks to prioritize mitigation strategies effectively.

Risk assessments can be qualitative or quantitative. Qualitative assessments evaluate risks based on subjective inputs, while quantitative assessments use numerical data and models to evaluate potential impacts.

Step-by-step guide to conducting a risk assessment

Conducting a risk assessment involves several critical steps to ensure a comprehensive analysis of potential hazards:

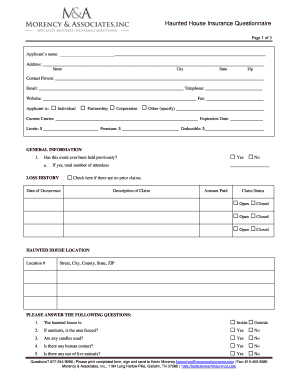

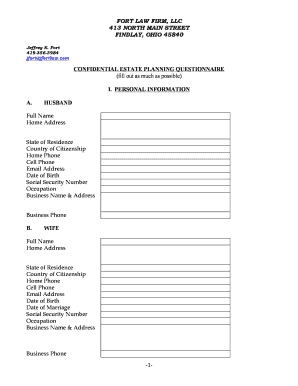

Creating a risk management plan

A robust risk management plan is essential for outlining how an organization will manage risks. Key elements include clearly defined roles, responsibilities, and specific objectives to guide risk management efforts.

Additionally, developing strategies for risk mitigation and having contingency plans in place ensures organizations are prepared for unforeseen events.

Best practices for managing risks

To effectively manage risks, organizations must cultivate a risk-aware culture. This involves regular training sessions, discussions, and policies that emphasize the importance of risk management at all levels of the organization.

Continuous education is vital; keeping team members updated on emerging risks and management strategies ensures proactive rather than reactive measures.

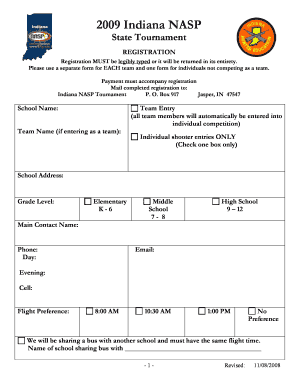

Interactive tools for risk management

pdfFiller offers extensive tools that simplify the risk management process. You can easily edit, sign, and manage risk assessment forms, ensuring they are up-to-date and compliant with current regulations.

The collaboration features available on pdfFiller allow for team-based assessments, ensuring that multiple stakeholders can contribute to and review risk assessments seamlessly.

Advanced risk management strategies

Organizations may implement advanced risk management strategies, choosing between dynamic and formal risk assessments based on their specific needs. Dynamic assessments allow for flexibility and adaptability in fast-changing environments, while formal assessments provide structured and thorough evaluations.

Choosing the right approach depends on the nature of the operation and the risks involved. It’s crucial for organizations to integrate risk management into their everyday operations seamlessly.

Additional insights on managing risks

Despite the obvious importance, organizations often encounter challenges in risk management. Common misconceptions, such as the belief that risk assessments are overly bureaucratic or time-consuming, can hinder effective implementation. It's essential to counter these beliefs with a clear demonstration of how streamlined assessments can lead to significant savings and enhanced decision-making.

Technology adoption presents another challenge. Organizations may struggle with integrating new tools into their existing workflows. However, leveraging tools like pdfFiller can ease this transition, providing an intuitive platform for managing risk-related documentation.

Utilizing metrics and indicators for risk management

Measuring the effectiveness of risk management initiatives is essential for ongoing improvement. Organizations should track specific metrics that align with their objectives, allowing them to evaluate the success and effectiveness of their strategies.

Common metrics include the frequency of incidents, financial impact of risks, compliance rating scores, and stakeholder feedback on risk management practices.

Popular questions about risk management

Understanding the complexities of risk management can raise several questions. Addressing these inquiries helps clarify the processes for individuals and teams invested in risk assessment.

Future trends in risk management

Emerging technologies are set to revolutionize the field of risk management. Tools powered by artificial intelligence and automation streamline the assessment process and provide real-time insights into potential risks, allowing organizations to act swiftly and effectively.

Additionally, staying compliant with evolving regulations will become increasingly critical. Organizations must equip themselves with knowledge and tools to adapt to these changes seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my managing risks and risk directly from Gmail?

Can I sign the managing risks and risk electronically in Chrome?

Can I edit managing risks and risk on an iOS device?

What is managing risks and risk?

Who is required to file managing risks and risk?

How to fill out managing risks and risk?

What is the purpose of managing risks and risk?

What information must be reported on managing risks and risk?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.