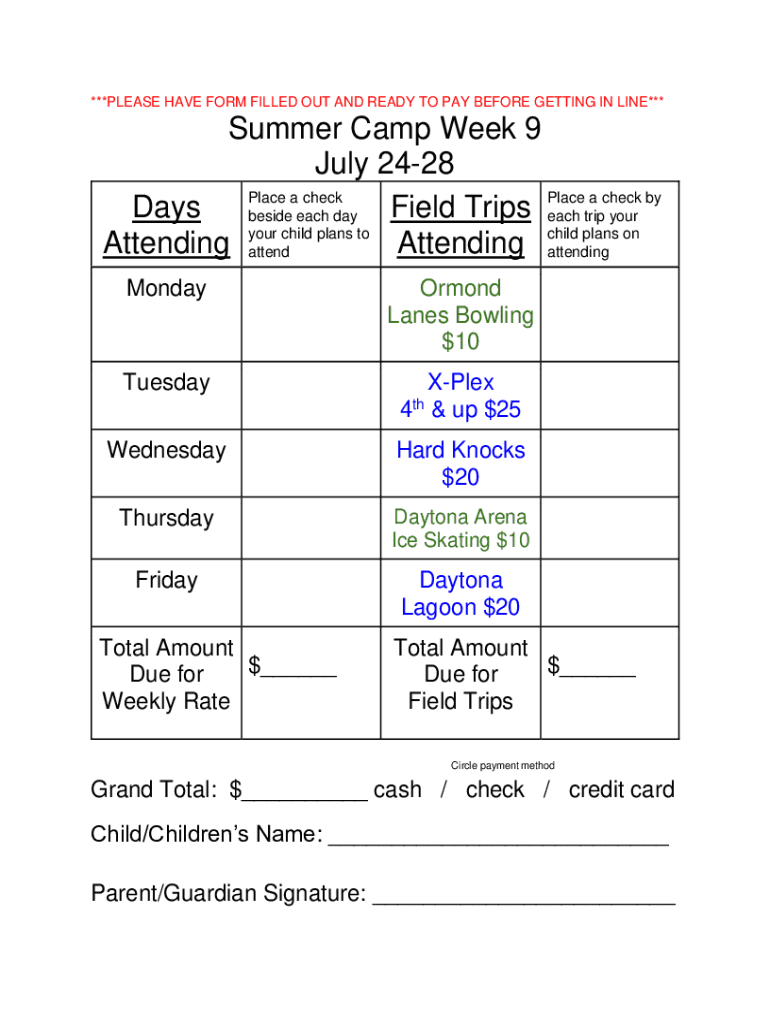

Get the free Place a check

Get, Create, Make and Sign place a check

How to edit place a check online

Uncompromising security for your PDF editing and eSignature needs

How to fill out place a check

How to fill out place a check

Who needs place a check?

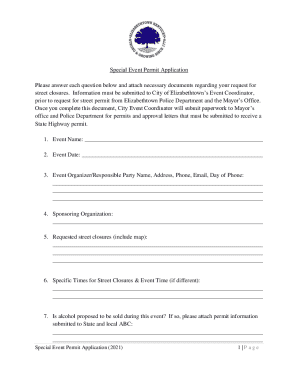

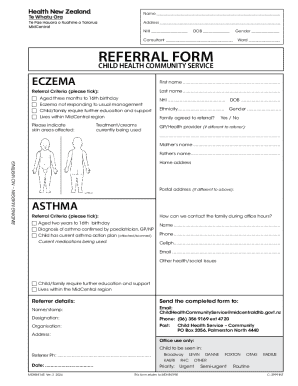

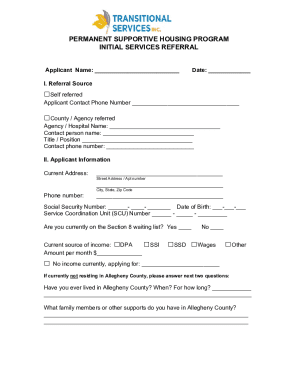

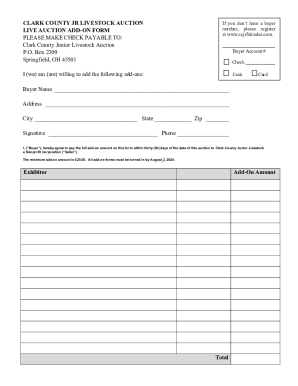

How to Place a Check Form

Understanding check forms

A check form serves as a vital document in financial transactions, providing a structured method to transfer funds from one entity to another. It essentially represents a written order directing a bank to pay a specified sum of money to the person or organization named on the check, known as the payee. Check forms streamline both personal and business financial activities, playing an essential role in various payments, from salary dispersals to vendor settlements.

The usage of check forms extends beyond simplicity; they encapsulate accountability and clarity in financial dealings. Fulfilling legal payment obligations often necessitates maintaining organized records of payments, which check forms facilitate.

Why use a check form?

Utilizing check forms provides numerous benefits that significantly enhance transactional efficiency. First and foremost, check forms simplify payment processes; they facilitate quick, organized, and traceable disbursements. This convenience is especially impactful for businesses that engage in frequent transactions, enabling them to execute payments without delay.

Another key benefit lies in the clarity they provide for both parties involved in a transaction. A check serves as tangible proof of payment, giving the payee reassurance and the payer a documented account of their financial commitments. This clarity nurtures trust and accountability, critical factors in personal finance management and business operations.

Creating a check form online with pdfFiller

Creating a check form online has never been easier, especially with tools like pdfFiller. To begin, you first need to access the appropriate template. Launch the pdfFiller interface and use the search functionality to locate the specific check form template tailored to your needs. The platform offers various customizable options to ensure your check form meets your unique requirements.

After selecting your template, the next step involves customizing the check form to incorporate all necessary fields. Key components include the payee's name, transaction amount, date, and any additional notes. pdfFiller’s intuitive interface enables effortless modifications to layouts and design elements.

Another vital step is ensuring your check form is secure and verifiable. Utilize pdfFiller’s features to incorporate digital signatures, ensuring authenticity and protecting against fraud. Setting up security features is crucial, particularly for organizations managing multiple transactions.

Advanced features of pdfFiller for check forms

When creating and managing check forms, advanced features on pdfFiller enhance usability and efficiency. Real-time collaboration features allow multiple team members to work simultaneously on the same check form, ensuring that corrections or updates can be made instantly and seamlessly. This capability is especially beneficial in fast-paced environments where time-sensitive payments need to be processed.

In addition, pdfFiller enables users to set up notifications for form submissions. This functionality includes automatically sending email alerts whenever a check form is submitted, helping manage financial processes and keeping relevant parties informed about transaction statuses. Tracking these responses plays a key role in efficient payment management.

Maximizing efficiency with your check form

To get the most out of your check forms, embracing best practices is essential. One such practice is ensuring comprehensive accuracy while filling out forms, as even minor errors like misspelled names or incorrect amounts can cause significant payment issues. Utilizing pdfFiller’s automated checks can assist in identifying potential mistakes before finalization.

Another way to enhance efficiency is by saving and reusing completed check forms. pdfFiller allows users to store templates, making it convenient to access completed forms easily, thereby streamlining frequently made payments. This not only saves time but also ensures that repetitive tasks are performed consistently.

Troubleshooting common issues

While utilizing check forms is straightforward, errors can occasionally occur. Common mistakes might include misspelled names, incorrect amounts, or formatting issues. Quick verification before submission can mitigate these problems. A good practice involves reviewing the final details with at least one other person, allowing for a second set of eyes on crucial information.

Additionally, using pdfFiller’s automated checking features can superbly reduce the likelihood of such errors. These proactive functionalities help guide users through the filling process and indicate potential misalignments, sharpening the accuracy of your check forms.

The future of check forms

The landscape of check processing is evolving rapidly, with more businesses adopting digital forms. This transition to online and mobile check forms not only enhances accessibility but also boosts efficiency in managing payments. The integration with accounting software presents an additional layer of convenience, aligning check management with broader financial systems.

Modern solutions like pdfFiller are adapting to these needs, continuously enhancing features and ensuring scalability for both individual users and businesses. As technology progresses, the ability to customize, collaborate, and securely manage check forms will become increasingly pivotal in financial environments.

Personal experiences and testimonials

Users of pdfFiller often share transformative experiences regarding their check processing. Many report significant time savings through the ease of creating, editing, and managing check forms online. One small business owner recounted how the platform enabled them to streamline payroll processes, reducing the time spent on monthly payments considerably.

Another user illustrated the ease of tracking expense reimbursements, stating that the hassle of traditional methods is now behind them. With pdfFiller, transactions are not only processed quickly but are also archived efficiently, which is essential for audit trails and financial reviews.

Enhancing your document management with pdfFiller

Moving beyond just check forms, pdfFiller offers a comprehensive solution for document creation and management. Users can create various documents, edit PDFs, eSign, and collaborate -- all within a single cloud-based platform. This flexibility makes it ideal for individuals and teams aiming to streamline their overall document workflow.

With pdfFiller, organizations can integrate and optimize document workflows, enhancing productivity across all operations. The platform is designed to accommodate a wide range of needs, ensuring that regardless of the form being managed, users benefit from an advanced toolkit that prioritizes efficiency and security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify place a check without leaving Google Drive?

How do I fill out place a check using my mobile device?

How can I fill out place a check on an iOS device?

What is place a check?

Who is required to file place a check?

How to fill out place a check?

What is the purpose of place a check?

What information must be reported on place a check?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.