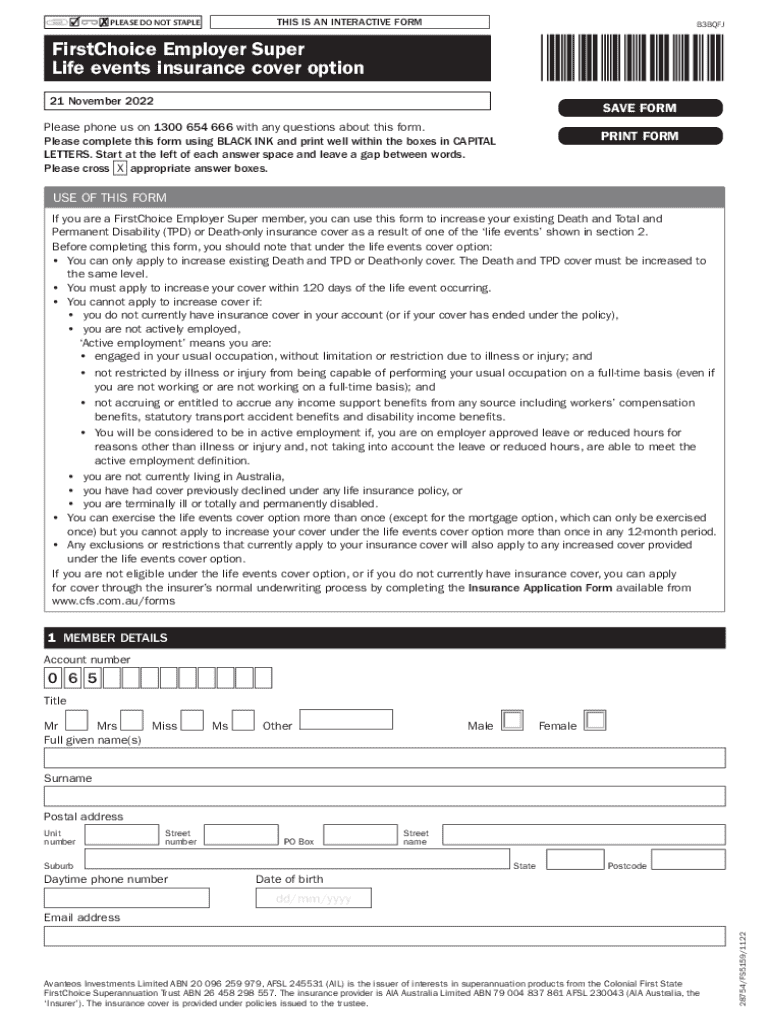

Get the free FirstChoice Employer Super Life events insurance cover ...

Get, Create, Make and Sign firstchoice employer super life

Editing firstchoice employer super life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out firstchoice employer super life

How to fill out firstchoice employer super life

Who needs firstchoice employer super life?

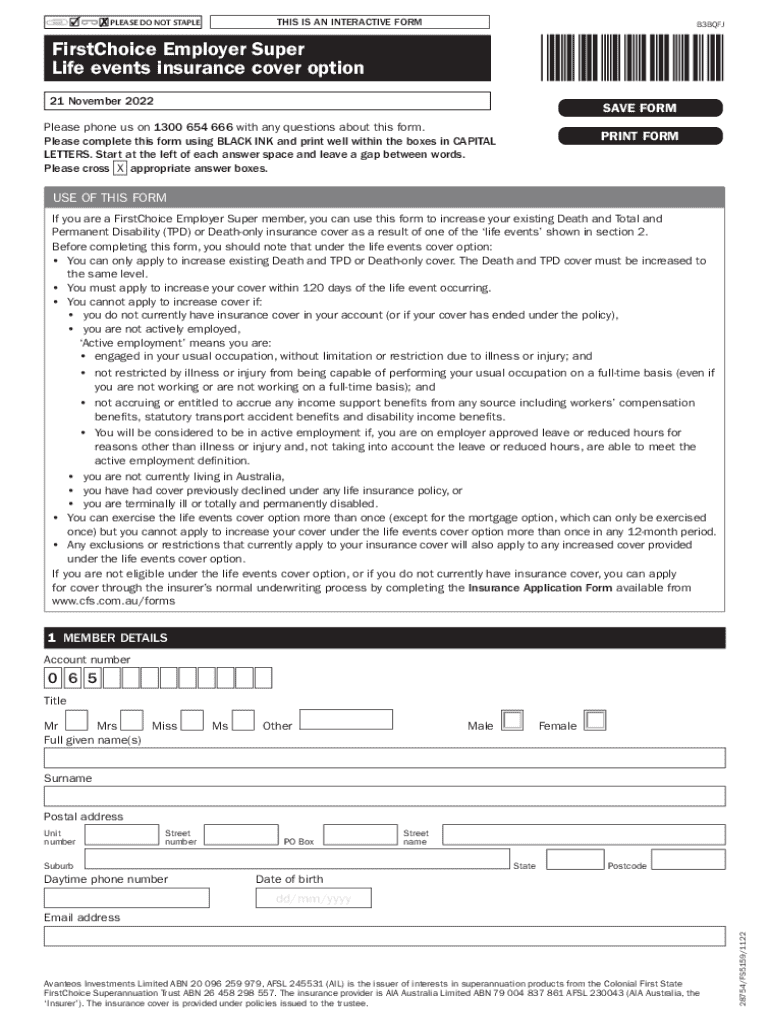

A comprehensive guide to the Firstchoice Employer Super Life Form

Overview of the Firstchoice Employer Super Life Form

The Firstchoice Employer Super Life Form is a crucial document designed to help employees manage their superannuation and life insurance needs effectively. This form not only serves as a means of initiating coverage but also plays a significant role in ongoing management and adjustments of one's superannuation strategy. Understanding the details of this form is essential for both employees and employers, ensuring that individuals can meet their financial goals and security.

The importance of this form lies in its ability to streamline the process of selecting and modifying superannuation options, particularly in relation to life insurance policies. For new employees, completing the Firstchoice Employer Super Life Form is often a necessary step for onboarding, while existing employees should revisit it periodically to reflect life changes, such as marriage, children, or job changes.

Key features of the Firstchoice Employer Super Life Form

The Firstchoice Employer Super Life Form offers several key features that make managing superannuation and life insurance straightforward. First, it provides comprehensive information across various life events, allowing users to specify their expected needs and tailor their plans accordingly. This flexibility ensures that every individual can find the appropriate coverage for their unique situation.

Additionally, the form presents flexible options for contributions and coverage, helping users choose amounts based on their financial capabilities and life goals. It seamlessly integrates with employer superannuation policies, making it easier for employers to oversee their employees' super plans. Another significant advantage of this form is that it's accessible from any device through pdfFiller, enabling users to fill out, sign, and submit their forms from anywhere.

Target audience: Who should use this form?

The Firstchoice Employer Super Life Form is aimed at a diverse audience. Individuals looking to understand their superannuation choices will find this form invaluable as it provides clarity on options available to them. Employers who wish to manage their employees’ super plans effectively are encouraged to use this form to simplify the onboarding and management process.

Moreover, financial advisors will also benefit from utilizing this form when guiding clients through their superannuation strategies. By becoming familiar with the Firstchoice Employer Super Life Form, advisers can better assist their clients in making informed decisions that align with their financial goals.

Step-by-step guide to filling out the form

Filling out the Firstchoice Employer Super Life Form is a straightforward process. Below is a detailed step-by-step guide to help you navigate through the necessary steps.

Common mistakes to avoid when filling out the form

While filling out the Firstchoice Employer Super Life Form, it's essential to pay attention to detail to ensure accuracy. Common mistakes can hinder the process efficiently.

Important information regarding the Firstchoice Employer Super Life Form

It's crucial to be aware of the legal obligations and compliance aspects when working with the Firstchoice Employer Super Life Form. This form must meet stringent regulations to ensure that both the employers and employees are protected under the law.

Additionally, staying informed about key deadlines for submissions and updates is vital for avoiding any lapses in coverage or compliance. If you need clarification on any aspects of the form, the support team is always available to assist, ensuring a smooth and efficient process.

Interactive tools available on pdfFiller

pdfFiller offers a range of interactive tools that aid in filling out and managing the Firstchoice Employer Super Life Form efficiently. One notable feature is the document comparison tool, which allows users to review changes and track edits made to the form.

Moreover, collaboration tools are available for team input and feedback, enabling multiple stakeholders to have access to the form simultaneously. Additionally, pdfFiller’s cloud storage benefits make it easy to access and manage your forms from any device, ensuring convenience and flexibility.

FAQs about the Firstchoice Employer Super Life Form

To clarify any uncertainties regarding the Firstchoice Employer Super Life Form, here are some frequently asked questions done to help users navigate their queries.

Adviser support menu

Financial advisers play a critical role in helping their clients navigate the complexities of the Firstchoice Employer Super Life Form. pdfFiller provides resources tailored for financial advisers, ensuring they have access to frequently updated forms and templates that can assist their clients effectively.

By utilizing these resources, advisers can better equip their clients with the right tools and strategies, facilitating more informed decisions regarding superannuation and life insurance.

Contact us for further assistance

If you require additional help regarding the Firstchoice Employer Super Life Form, pdfFiller offers a dedicated support team that is always available to assist. You can reach out via multiple options, including email, chat, or phone, offering users personalized support tailored to their needs.

Moreover, pdfFiller encourages feedback to continually improve service quality, ensuring users have an optimal experience when managing their documents.

Additional insights on managing superannuation and life insurance

Managing your superannuation and life insurance requires vigilance and regular updates, particularly following changes in your life status such as marriage or employment changes. Best practices suggest setting reminders for annual reviews of your coverage and contributions.

Staying educated about superannuation strategies and financial wellness is equally essential. Many online resources offer insights into effective planning and management that can significantly enhance your financial security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get firstchoice employer super life?

How do I edit firstchoice employer super life online?

How do I complete firstchoice employer super life on an Android device?

What is firstchoice employer super life?

Who is required to file firstchoice employer super life?

How to fill out firstchoice employer super life?

What is the purpose of firstchoice employer super life?

What information must be reported on firstchoice employer super life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.