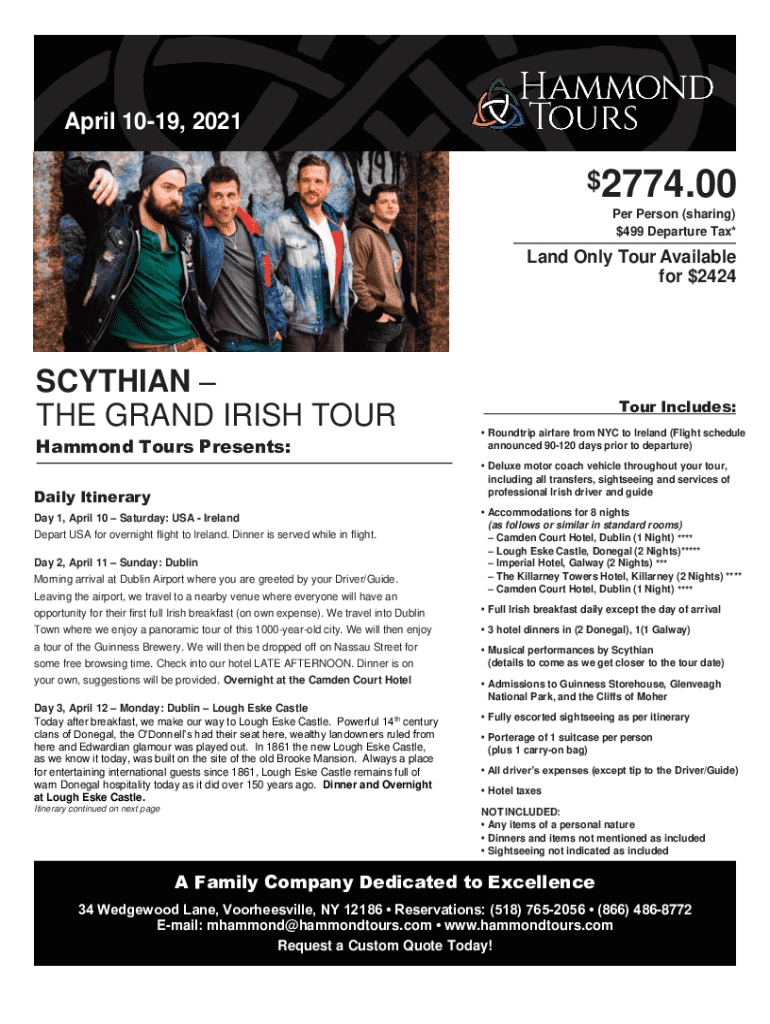

Get the free for $2424

Get, Create, Make and Sign for 2424

How to edit for 2424 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for 2424

How to fill out for 2424

Who needs for 2424?

Comprehensive Guide to the 2424 Form on pdfFiller

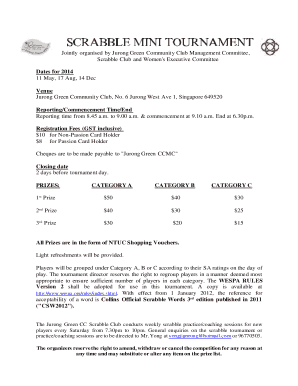

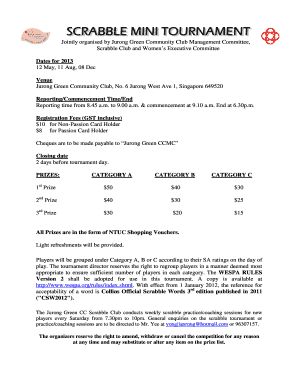

Understanding the 2424 Form

The 2424 Form is a critical document utilized primarily within specific regulatory or financial contexts. Its primary purpose is to collect detailed information regarding income, expenses, and assets. This form is essential for accurate reporting and compliance with relevant guidelines, ensuring that individuals and entities can substantiate their financial standings.

Primarily, the 2424 Form is used by tax professionals, business owners, and individuals engaged in financial activities requiring official documentation of their fiscal activities. Moreover, understanding the necessity of filing the form is paramount, as incorrect or missing submissions can lead to financial pitfalls or legal implications.

Getting started with the 2424 Form

Before diving into the intricate details of the 2424 Form, it is vital to gather all necessary information. Each section of the form correlates to specific aspects of financial reporting, including income, expenses, and assets. This preparation will ease the filling process and ensure accuracy.

Identify which sections apply to your unique situation, including personal information and financial specifics. It will help to review any previous forms you may have filed, as this can lend insight into required data and formats.

Step-by-step instructions for completing the 2424 Form

Completing the 2424 Form can be an intricate process, hence the need for a structured approach. Below are details on major sections of the form, providing a thorough breakdown for successful completion.

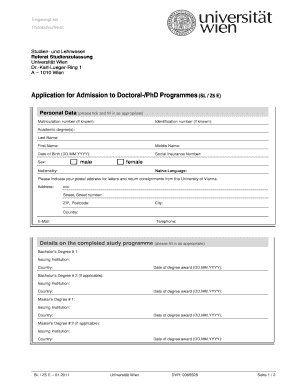

Section A: Personal information

In this section, you are required to provide your name, contact information, and relevant identification numbers. Detailed instructions involve confirming that each field is accurately filled. Double-check for typographical errors, which can lead to processing delays.

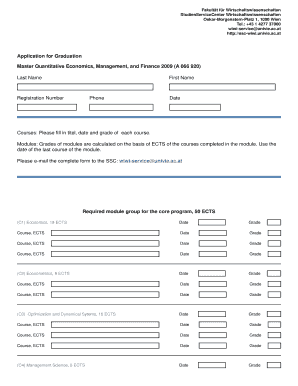

Section B: Income reporting

Here, report your total income from all sources. Include wages, dividends, business income, and other streams. Common mistakes include underreporting income or missing supplementary documentation; thus, always cross-reference your final figures with your accounting records.

Section : Interest expense overview

This section requires calculating all interest expenses that are deductible. Ensure you use accurate accounting techniques to determine these figures and substantiate them with supporting documents, like bank statements.

Section : Asset listing

Documenting and valuing your assets properly is essential. List down each asset, provide value estimation, and link them back to their respective sources, such as purchase receipts or appraisals to verify their worth.

Common mistakes and how to avoid them

Many users frequently make errors when filling out the 2424 Form, leading to potential penalties or filing rejections. It's crucial to understand these common pitfalls and how to navigate them effectively.

One prevalent mistake is the miscalculation of income or expenses due to oversight or lack of detailed records. It’s advisable to maintain meticulous records throughout the year to streamline the filing process. Additionally, failing to sign or date the form can also lead to delays; hence, always review your completed documents.

Editing and signing the 2424 Form with pdfFiller

Using pdfFiller greatly simplifies the editing and signing process for the 2424 Form. Leveraging its user-friendly interface, you can easily make necessary edits and customize your form to suit your needs.

To sign the form electronically, simply use pdfFiller's e-signing tools. These tools facilitate fast and secure signing, ensuring your submissions are legitimate and accepted by regulatory bodies. Additionally, collaborating on the document with team members is seamless, allowing for real-time edits and commentary.

Submitting the 2424 Form

Filing the 2424 Form can be done electronically through designated platforms or via traditional paper submission. The choice depends on personal preference and regulatory requirements for your particular situation.

If filing electronically, be sure to confirm receipt with the relevant agency. After submission, it is wise to keep a copy of the filed form and track any communications regarding its status. If opting for paper submission, use certified mail to have proof of posting and delivery.

Managing and storing your 2424 Form

Efficient document management is critical post-filing. Best practices advocate organizing your forms by year, type, and status for easy access and retrieval in the future. Utilizing tools like pdfFiller allows users to store documents securely in the cloud, ensuring they are accessible anytime and from any device.

Always prioritize security by enabling two-factor authentication on your pdfFiller account. This adds an extra layer of protection to your sensitive financial documents, keeping them secure from unauthorized access.

Related documents and forms

The 2424 Form does not exist in isolation; there are several other related forms that individuals might need to consider when managing their financial documents. Familiarizing yourself with these can enhance your filing efficiency and accuracy.

Utilizing pdfFiller, you can easily navigate through related forms that support the filing process of the 2424 Form. Being cognizant of these can lead to more comprehensive financial management.

Interactive tools for easy form management

pdfFiller provides a suite of interactive tools designed to streamline your workflow, allowing for a more robust document management experience. These features are focused on enhancing productivity and reducing the time spent on filling out forms.

Utilize features such as template creation, advanced editing options, and real-time collaboration tools. These resources encourage streamlined operations, creating an effective ecosystem for managing documents like the 2424 Form.

Support and additional assistance

Navigating through the nuances of the 2424 Form can sometimes warrant additional assistance. Whether it’s a technical issue with pdfFiller or specifics about form details, support channels are available to users.

For personalized assistance, you can reach out to pdfFiller's support team, which is knowledgeable in both form specifics and tool functionalities. User testimonials often highlight how support has contributed to successful filing experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get for 2424?

How can I fill out for 2424 on an iOS device?

How do I edit for 2424 on an Android device?

What is for 2424?

Who is required to file for 2424?

How to fill out for 2424?

What is the purpose of for 2424?

What information must be reported on for 2424?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.