Get the free Mortgage payoff statement: Everything you need to know

Get, Create, Make and Sign mortgage payoff statement everything

Editing mortgage payoff statement everything online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage payoff statement everything

How to fill out mortgage payoff statement everything

Who needs mortgage payoff statement everything?

Mortgage Payoff Statement: Everything You Need to Know

Understanding the mortgage payoff statement

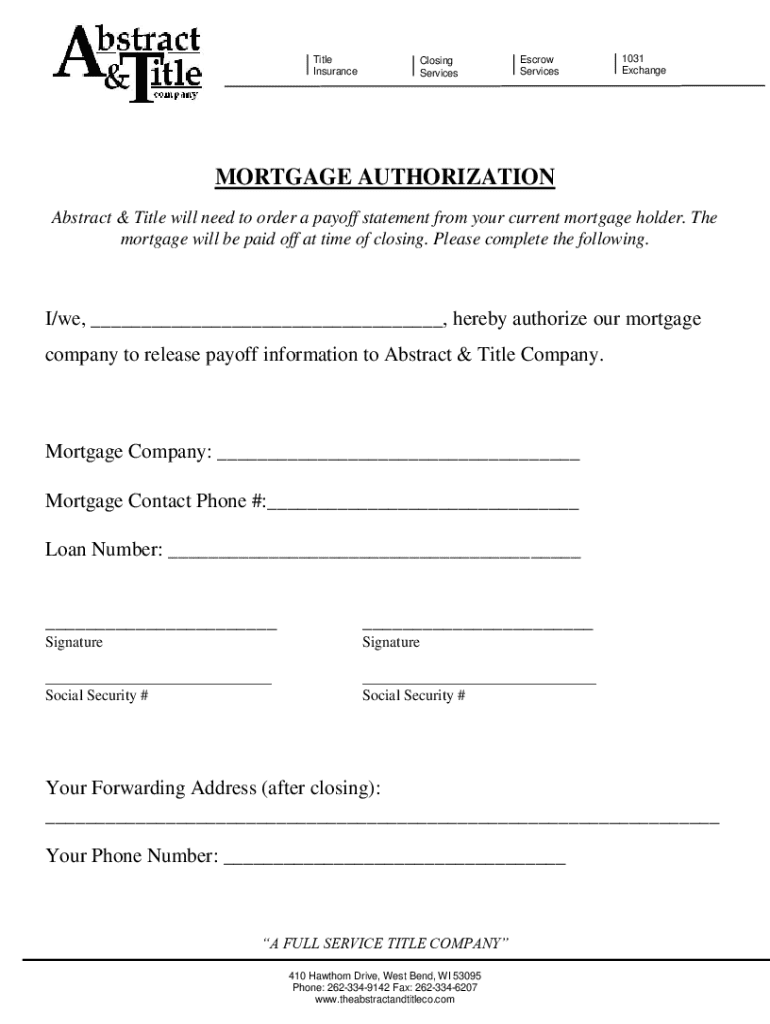

A mortgage payoff statement is a crucial document that shows the exact amount you need to pay to fully satisfy your mortgage obligation. This statement typically breaks down the loan balance, any accrued interest, and any additional fees that may apply. Understanding this statement is vital for anyone contemplating paying off their mortgage or those looking into refinancing options.

The importance of a mortgage payoff statement extends beyond simple financial management; it plays a key role in home sales and refinancing processes. By providing a clear snapshot of your mortgage obligations, it helps streamline transactions, clarify financial responsibilities, and protect both the seller's and buyer's interests.

The role of a mortgage payoff statement in your home financing journey

Whether you’re contemplating selling your home or exploring refinancing options, a mortgage payoff statement is an essential tool. Do you need one? Typically, if you're looking to pay off your loan in full or when you need an accurate projection of costs associated with selling your property, a payoff statement is indispensable.

Certain circumstances necessitate obtaining a mortgage payoff statement. For instance, listing your home for sale requires clarity on how much is outstanding on your loan. Similarly, when refinancing, you'll need this statement to evaluate your current loan position and potential savings from new financing. The impact of an accurate payoff statement can influence negotiations, ensuring a smoother closing process.

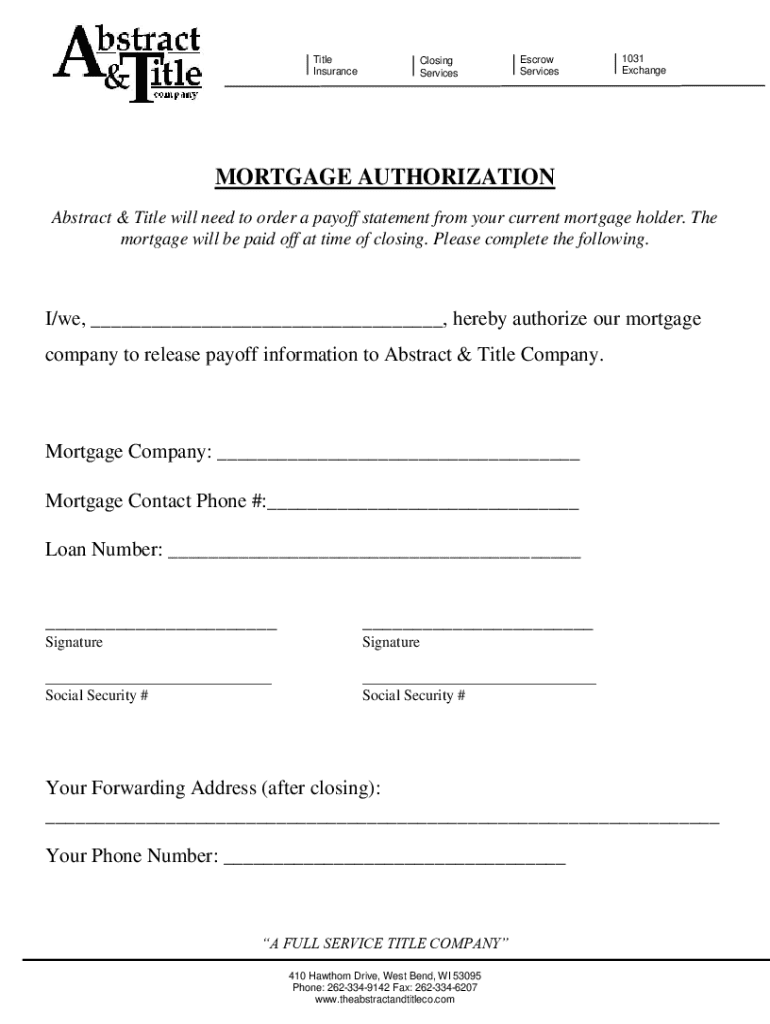

How to obtain a mortgage payoff statement

Obtaining your mortgage payoff statement is a straightforward process. First, you’ll need to contact your lender. Most lenders have specific procedures for this request. To speed up the process, ensure you have your loan number and any identification they might require.

When requesting this statement, provide essential information such as your name, loan number, and any relevant account identifiers. If you're tech-savvy, you can often request a payoff statement online through your lender's website. Alternatively, you can call customer service or visit a local branch for assistance.

Creating and managing mortgage payoff documents

Mortgage payoff statements should be formulated accurately to avoid any discrepancies. They are generated by your lender's systems based on your loan details and payment history. Ensuring that this documentation is correct is crucial for both your financial planning and any related transactions.

Maintaining accurate documentation throughout the payoff process is imperative. Make sure you file official deed records properly once your mortgage is paid off. This might include tracking additional paperwork for tax purposes, which can be essential in future financial dealings.

Understanding your mortgage payoff options

When it comes to paying off your mortgage, lenders typically accept a range of payment types. The most common include wire transfers, certified checks, and sometimes even online payments. Before opting for a specific method, check with your lender to confirm which payment types they accept for mortgage payoffs.

After you submit your payoff request, your lender will provide you with an updated payoff amount, often valid for a limited time. It's essential to consider what happens with your escrow account, which may contain funds meant for property taxes and insurance. Upon loan payoff, you should receive any remaining balance, but procedures can vary by lender.

Mortgage payoff FAQs

Many potential homeowners and existing mortgagors have common questions about mortgage payoff statements. A pressing question is whether lenders can charge you for providing a payoff statement. The good news is that in most cases, they cannot, but it's always best to verify your lender's policies beforehand.

Another frequently asked question involves when to cancel automatic payments. It's advisable to wait until you have received and confirmed that your payoff has been processed before canceling these transactions. After paying off your mortgage, your escrow account's fate depends on the lender; inquire early to ensure the return of any funds remains seamless.

Managing post-payoff procedures

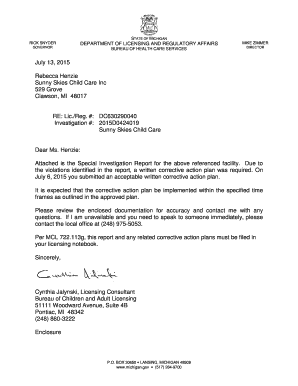

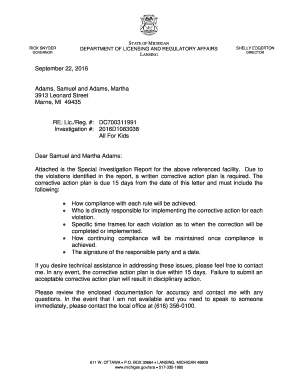

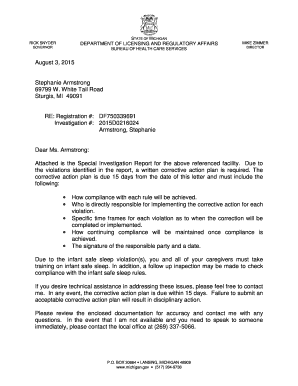

After successfully paying off your mortgage, there are a few crucial steps to take. First, ensure you receive a confirmation that your mortgage has been settled. This confirmation often comes in the form of a statement or a letter from your lender. Keep this document for your records, as it serves as proof of ownership.

In addition to obtaining a mortgage escrow refund, make sure to record your ownership deed with the relevant local authority to avoid potential issues in the future. This could also be a good time to evaluate your current insurance policies or consider refinancing your home if your financial situation changes down the road.

Tools and resources for managing mortgage payoffs

There are numerous tools available to help homeowners manage mortgage payoffs effectively. Utilizing mortgage prepayment resources can provide critical insights into the potential for savings when making extra payments. Various online calculators allow you to evaluate how different amounts might impact your total interest paid over the life of the loan.

Innovative interactive tools also exist to help organize your documents, ensuring you can track everything from your mortgage payoff statement to any related paperwork efficiently. By both tracking and optimizing these components of your financial journey, you can work towards streamlining your overall mortgage management experience.

Advanced considerations in the mortgage payoff process

As you navigate your mortgage payoff journey, understanding the Mortgage Electronic Registration Systems (MERS) can be beneficial. MERS acts as a central registry for tracking mortgage loans in the U.S. Knowing whether your lender is part of this system can provide insight into your loan's status, enhancing your mortgage management.

Another advanced consideration is the concept of escrow holdback. This strategy can serve as a buffer in transactions, particularly if you are close to closing on a home sale. By holding back a portion of the funds in escrow, all parties can feel secure as they complete necessary actions, ensuring a smooth transaction. Document management solutions like pdfFiller allow you to manage all of these documents conveniently, from editing to storing.

Additional support and information

When navigating mortgage payoffs, having access to live assistance can provide clarity and reassurance. Many lenders offer dedicated customer service for payoff queries. For those with complex situations, consulting financial experts who specialize in mortgages may be wise.

Moreover, utilizing platforms like pdfFiller ensures you can edit, sign, and securely store your mortgage payoff documents. The convenience of having everything in one cloud-based solution cannot be overstated, especially when dealing with multiple forms and documents related to your mortgage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mortgage payoff statement everything online?

How do I complete mortgage payoff statement everything on an iOS device?

How do I complete mortgage payoff statement everything on an Android device?

What is mortgage payoff statement everything?

Who is required to file mortgage payoff statement everything?

How to fill out mortgage payoff statement everything?

What is the purpose of mortgage payoff statement everything?

What information must be reported on mortgage payoff statement everything?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.