Get the free Insolvency & Company Law MiriICM

Get, Create, Make and Sign insolvency amp company law

Editing insolvency amp company law online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insolvency amp company law

How to fill out insolvency amp company law

Who needs insolvency amp company law?

Insolvency and Company Law Form: A Comprehensive Guide

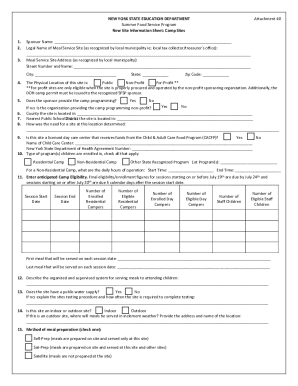

Overview of insolvency and company law forms

Insolvency refers to a situation where a company's liabilities exceed its assets, rendering it unable to pay its debts. This can occur through various avenues, including financial mismanagement, market shifts, or unexpected economic downturns. Understanding the relevant company law forms in these situations is crucial because they dictate how the insolvency process unfolds, ensuring compliance with legal requirements while protecting the interests of creditors and stakeholders.

Navigating insolvency can be complex and overwhelming, especially for businesses already facing financial distress. Knowledge of legal forms not only aids in securing the rights of stakeholders but also facilitates a structured resolution process. By grasping the nuances of each type of form, individuals and businesses can enhance their chances of a favorable outcome during insolvency proceedings.

Types of insolvency forms

Various forms are utilized during insolvency proceedings, each serving a unique purpose and context in managing the financial affairs of the company. The most common insolvency forms include:

Steps to fill out insolvency forms

Filling out insolvency forms correctly is crucial for ensuring a smooth resolution process. The steps to complete these forms can be broken down as follows:

Using tools like pdfFiller can simplify the process by allowing for seamless form management. Users can upload, edit, and collaborate on forms, utilizing e-signature options to streamline the process.

Navigating common challenges with insolvency forms

Filling out insolvency forms can lead to several common challenges, from misunderstandings of legal jargon to incorrectly reported financial data. To navigate these potential pitfalls, it’s essential to follow best practices:

By anticipating these challenges and preparing thoroughly, individuals and businesses can enhance their chances of a positive outcome in their insolvency proceedings.

Interactive tools for document preparation

pdfFiller offers several features designed to assist users in preparing insolvency forms efficiently. With interactive checklists and templates specifically tailored for insolvency situations, users can ensure they complete all necessary steps. Important aspects of pdfFiller include:

Leveraging these tools can significantly streamline the insolvency form process, making it more manageable and less daunting.

Insights on legal requirements and implications

Every insolvency form comes with specific legal requirements that must be adhered to for a successful submission. A clear understanding of these legalities is paramount, as inaccuracies or omissions can lead to severe consequences such as delayed resolutions or legal repercussions. For instance:

Collaboration with legal counsel is also advised, especially in complex scenarios where the implications of form submission may affect various stakeholders. Remaining informed and proactive in meeting legal standards enhances the viability of the insolvency process.

Case studies and practical examples

Examining real-life examples can provide valuable insights into navigating insolvency processes effectively. Companies that successfully filled out their insolvency forms often showcase the importance of thorough documentation and compliance with legal standards. For instance, Company X managed to restructure its debts through a DOCA, mainly because they invested time in preparing a comprehensive plan that addressed creditor concerns and offered feasible repayment terms.

Another case involves Company Y, which faced compulsory winding up due to unpaid debts. Their proactive approach in addressing the statutory demand with clear evidence and timely submission allowed them to negotiate terms that ultimately led to a minimized impact on their employees and creditors.

These cases demonstrate that proper form submissions and adherence to legal requirements can significantly alter the trajectory of an insolvency case, emphasizing the necessity for diligence in these processes.

Frequently asked questions (FAQs)

Questions frequently arise during the insolvency process, highlighting concerns that individuals and businesses often have about form submissions. Common inquiries include:

Testimonials from users

Users of pdfFiller have shared experiences about how the platform enhanced their document management processes during insolvency. Many emphasize the ease of document editing and collaboration, which significantly reduced their stress levels during a challenging time. For instance, one small business owner mentioned how the platform provided clarity in preparing statutory demands, ensuring they met all legal obligations without confusion.

Users often report a smoother transition through the insolvency process, highlighting features that allow for real-time updates and the flexibility to manage documents from any location. The appreciation for secure document handling was also a common theme, as it ensures sensitive information remains protected.

Expert commentary and latest updates

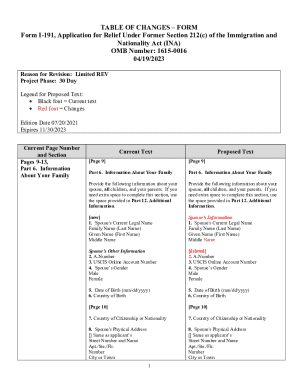

Insights from insolvency professionals are invaluable in understanding the current landscape surrounding company law forms. Legal experts assert the importance of remaining abreast of regulatory changes affecting insolvency procedures, particularly in light of recent economic fluctuations that prompted adjustments in insolvency laws.

One recent update includes the simplification of the statutory demand process, aimed at reducing the burden on both creditors and debtors. Moreover, enhancements within platforms like pdfFiller now offer features that facilitate improved form management, such as automated reminders for submission deadlines and streamlined e-signature processes. Staying informed ensures that users can maximize their efficiency and adhere to evolving legal standards effectively.

Contact information for expert assistance

Navigating insolvency requires expertise, and seeking legal advice can be a crucial step in ensuring compliance and proper execution of documents. Various legal consultants specialize in insolvency matters and are available for assistance. Furthermore, pdfFiller also provides support services, including guided tutorials for form management and access to customer support to resolve any document-related inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send insolvency amp company law to be eSigned by others?

How do I complete insolvency amp company law online?

How do I edit insolvency amp company law online?

What is insolvency & company law?

Who is required to file insolvency & company law?

How to fill out insolvency & company law?

What is the purpose of insolvency & company law?

What information must be reported on insolvency & company law?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.