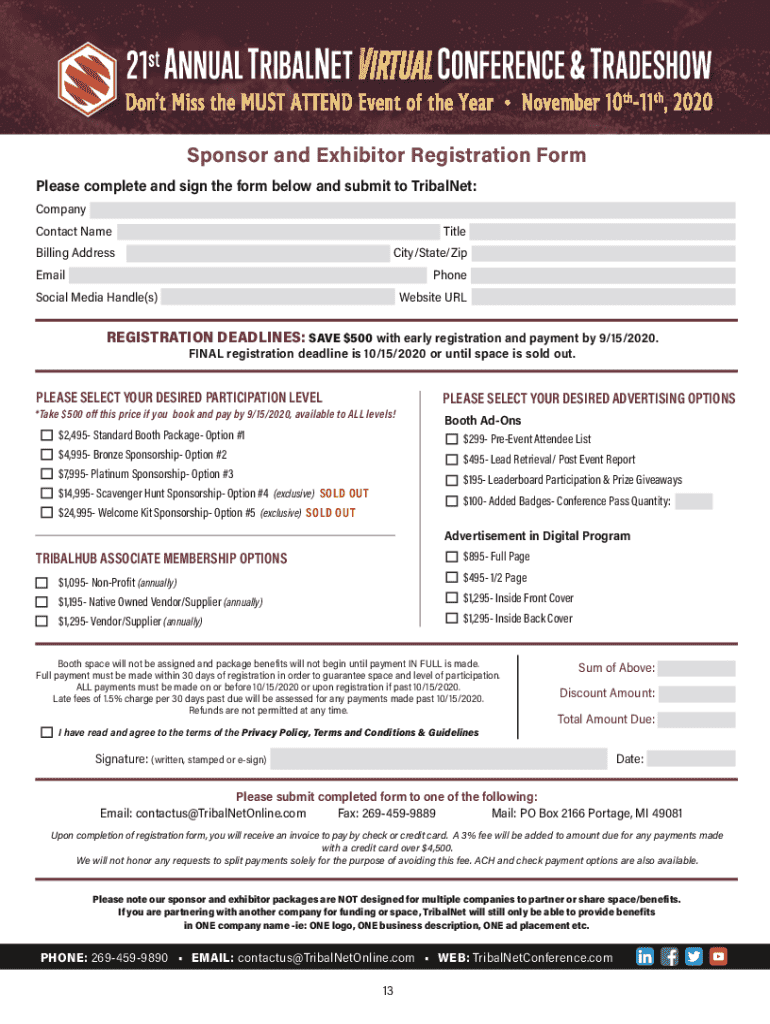

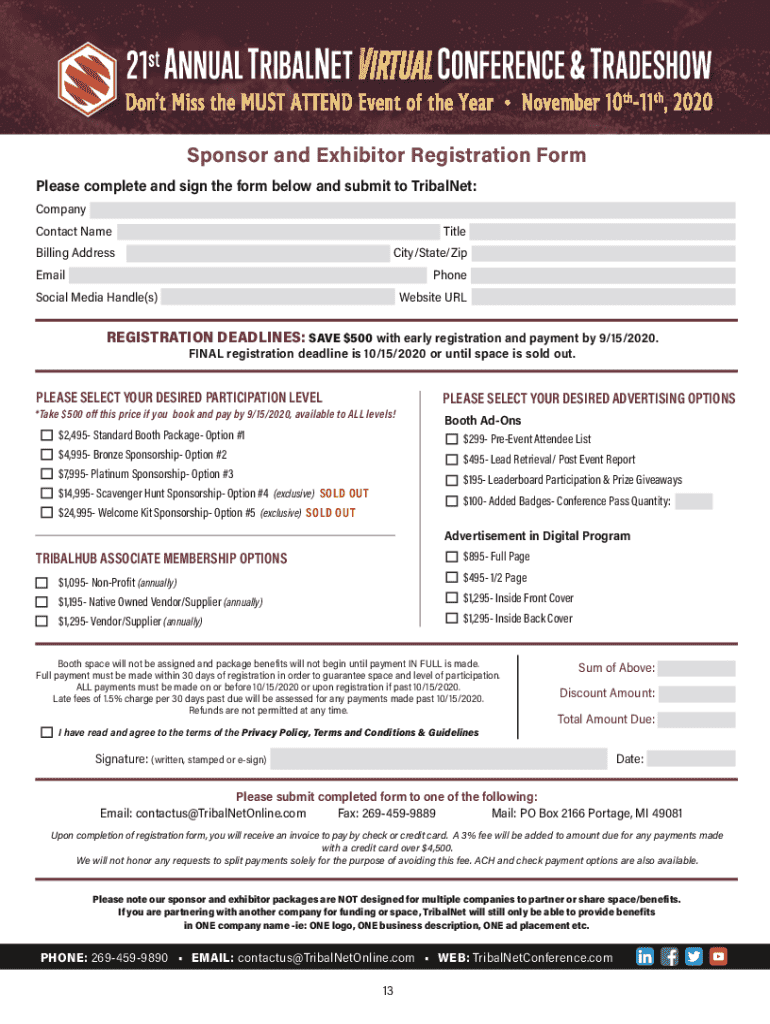

Get the free 21 st A NNUAL

Get, Create, Make and Sign 21 st a nnual

Editing 21 st a nnual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 21 st a nnual

How to fill out 21 st a nnual

Who needs 21 st a nnual?

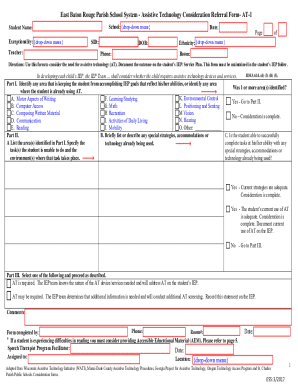

Understanding the 21st Annual Form: A Comprehensive Guide

Overview of the 21st Annual Form

The 21st Annual Form is a vital document required for reporting various financial activities and tax liabilities. Its purpose is to ensure that both individuals and organizations accurately disclose their income, deductions, and credits to the relevant tax authorities. Timely and precise submission of this form is crucial as it helps avoid penalties, reflects good financial practices, and supports the accurate assessment of taxable income.

Who needs to file the 21st Annual Form?

This form must be filed by a range of individuals and entities, including self-employed individuals, corporations, partnerships, and trusts. Each of these entities must adjust their reporting based on their specific financial situations. For instance, while individuals earning below a certain income level may qualify for exemptions, corporations typically have more stringent filing requirements. Special circumstances, such as filing for an extension or qualifying for specific tax credits, may also affect whether a particular entity is required to submit the form.

Understanding the structure of the 21st Annual Form

The 21st Annual Form is structured to facilitate clear and organized reporting. The primary sections include:

Navigating the layout of the 21st Annual Form can be complex. It is beneficial to go through each section carefully, ensuring all relevant details are covered and no mandatory fields are left blank.

Step-by-step instructions on completing the 21st Annual Form

Completing the 21st Annual Form requires careful preparation and attention to detail. Here's a straightforward guide:

Always double-check entries against your supporting documents to ensure accuracy before submission.

Tools for editing and managing your 21st Annual Form

Utilizing pdfFiller can significantly streamline the process of managing your 21st Annual Form. pdfFiller offers several features designed to make editing simple and efficient, such as:

These functionalities save both time and hassle, ensuring your form is prepared accurately for submission.

Collaborative features for teams

For teams handling the 21st Annual Form, collaboration is essential. pdfFiller allows you to invite team members to review and edit the form seamlessly. You can manage permissions effectively, granting access only to those who need it while ensuring sensitive data remains secure. This collaborative environment promotes accuracy and efficiency, reducing the chances of errors during the filing process.

Filing options for the 21st Annual Form

Once your 21st Annual Form is completed, it’s time to file. There are several options available:

Staying aware of your submission status is important to ensure you receive your confirmation in a timely manner.

Additional information and resources

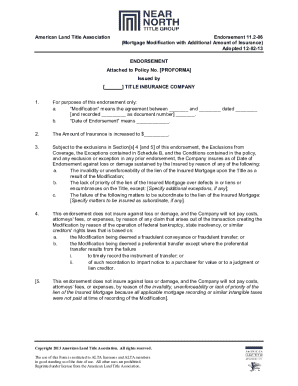

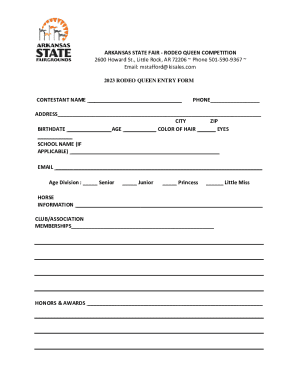

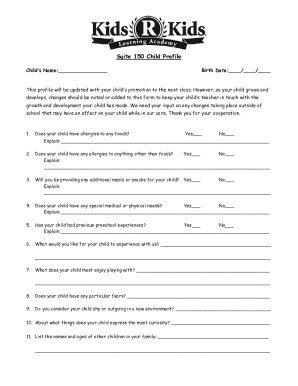

Completing the 21st Annual Form may require additional forms and documentation. It’s advisable to be aware of related documents you may need, such as:

If you have specific questions related to the 21st Annual Form, FAQs can provide quick guidance, and accessibility options are available to assist those with disabilities or language barriers.

Contact and support options

If you encounter challenges while filling out the 21st Annual Form, pdfFiller provides robust customer support. You can reach them directly via email or phone, and there are links available for live chat support. Additionally, users can offer feedback to improve service quality, ensuring all questions and concerns are addressed promptly.

Recent updates and changes to the 21st Annual Form

It’s crucial to stay informed about recent regulatory changes that might affect how the 21st Annual Form should be completed this filing year. Key changes may include updated deduction limits or new credit offerings. Understanding these modifications can help filers optimize their returns and avoid potential pitfalls.

Related popular forms and templates

In addition to the 21st Annual Form, there are other related documents that may be necessary for your financial reporting. For example, the 1040 Form is essential for individual tax returns, while the W-2 Form is vital for reporting employee earnings. On the pdfFiller platform, these forms are easily accessible, ensuring you can find what you need quickly.

Best practices for future filings

To maintain organization throughout the year for future filings, consider implementing strategies such as keeping all financial documents in a designated folder, setting reminders for important submission dates, and regularly updating records. Being proactive in your approach will ease the burden during filing season, allowing for a smoother completion of the 21st Annual Form and any other related documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 21 st a nnual online?

How do I edit 21 st a nnual straight from my smartphone?

How do I edit 21 st a nnual on an iOS device?

What is 21 st a nnual?

Who is required to file 21 st a nnual?

How to fill out 21 st a nnual?

What is the purpose of 21 st a nnual?

What information must be reported on 21 st a nnual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.