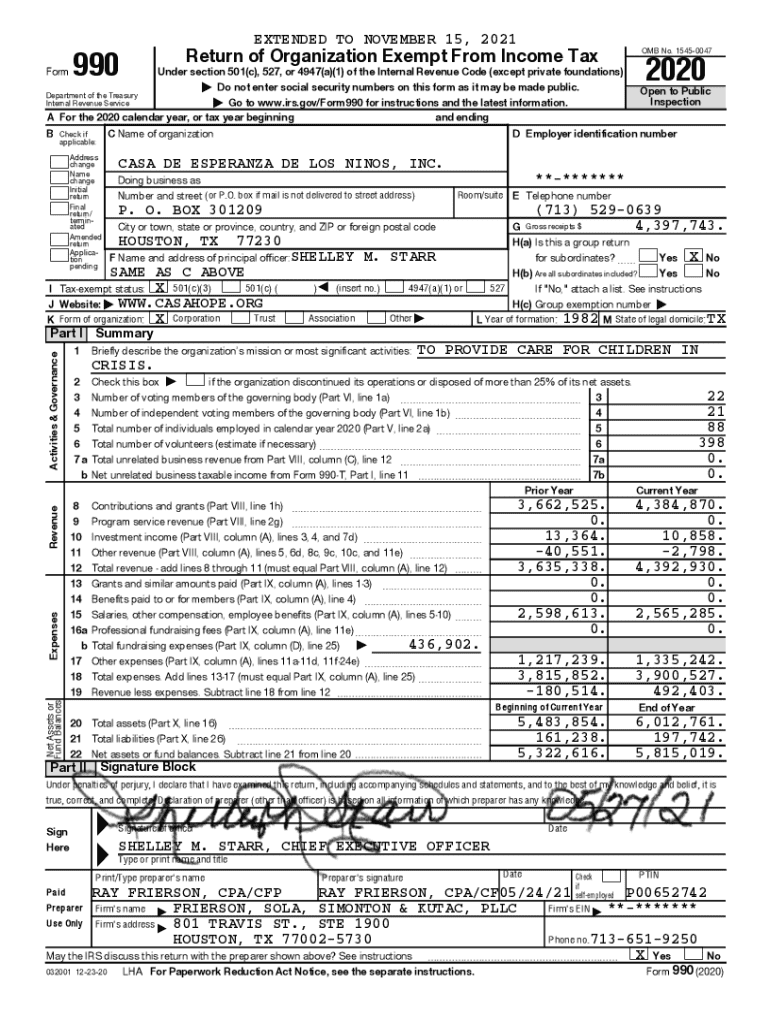

Get the free BOX 301209

Get, Create, Make and Sign box 301209

How to edit box 301209 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out box 301209

How to fill out box 301209

Who needs box 301209?

Comprehensive Guide to the Box 301209 Form on pdfFiller

Understanding the Box 301209 form

The Box 301209 Form is a critical document used in various administrative and business processes, serving as a formal mechanism for collecting specific information pertinent to transactions or compliance requirements. This form's primary purpose is to ensure that relevant data is captured correctly, allowing for seamless processing and evaluation. Its importance cannot be overstated, as accurate completion is essential for both individuals and teams involved in regulatory reporting, financial submissions, or project documentation.

Organizations in sectors such as finance, non-profit, and government frequently utilize the Box 301209 Form as it allows them to streamline their data requests and maintain compliance with various standards. The structured nature of the form facilitates a clear understanding of information requirements, which is crucial for effective communication among stakeholders.

Step-by-step instructions for completing the Box 301209 form

Completing the Box 301209 Form requires careful preparation and attention to detail to avoid errors that could delay processing. Before you start filling out the form, gather all necessary documents and information, ensuring a smoother experience and minimizing the chances of omissions.

Next, follow these detailed instructions for each section of the Box 301209 Form:

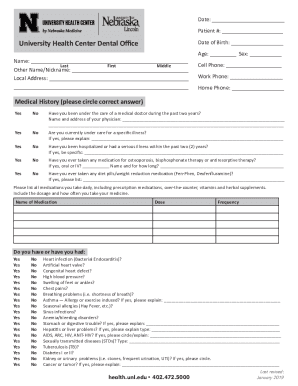

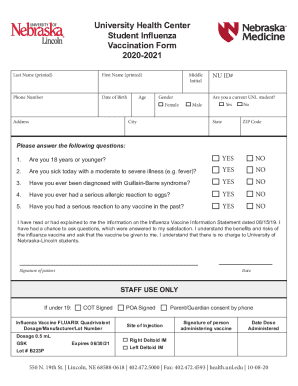

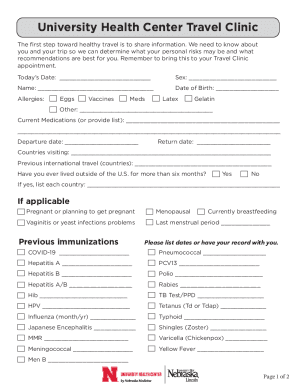

Section A: Personal Information

Section A requires your personal information, including your name, address, and date of birth. Ensure that the information is accurate and up-to-date. Double-check the spelling of names and the correctness of the contact details as inaccuracies can lead to processing issues.

Section B: Specific Data Entry Requirements

In Section B, you will provide specific details relevant to your situation. Common mistakes include incorrect numerical entries or missing required fields. Always verify the information entered corresponds directly to the documentation collected earlier. For example, if you are reporting income, ensure the amounts match your financial records.

Section : Review and Sign

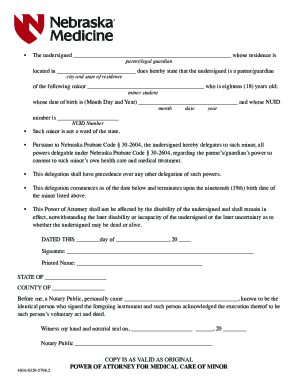

In the final section, review all entered information carefully. This step is vital, as it ensures that all data is complete and accurate. Once confirmed, you can sign the form electronically using pdfFiller, which makes it easy to add your signature securely. Remember, an accurate and legible signature is essential to validate the form.

Editing the Box 301209 form

If you need to make changes to your Box 301209 Form after initial completion, pdfFiller offers robust editing capabilities. Making revisions is straightforward and allows you to modify any section of the document quickly. Begin by accessing the form within your pdfFiller account, where editing tools are readily available.

Collaborating with others on the Box 301209 Form is also a breeze. You can invite team members to review or edit the document by sharing it through pdfFiller, where they can add comments and suggestions directly within the platform. This collaborative effort not only enhances the form's accuracy but also ensures that all stakeholders are informed and involved in the final submission.

e-signing and submitting the Box 301209 form

Once the Box 301209 Form is completed, the next step is to submit it. e-Signatures play a crucial role in this process, as they provide a legally binding way to sign documents electronically. pdfFiller guarantees that your electronic signature is securely captured and compliant with legal standards, ensuring the authenticity of your form submission.

Submitting the Box 301209 Form electronically can save time and ensures instant delivery. Alternatively, you can print and send a physical copy via mail if necessary. Being aware of submission options enables you to choose the most convenient method for your specific needs.

Frequently asked questions about the Box 301209 form

Individuals often have questions regarding the Box 301209 Form, particularly about mistakes and access to submitted forms. Should you encounter an error after submission, it is generally advisable to submit a corrected form promptly, indicating that it replaces the previous one. Always keep copies of all submitted forms for your records.

Consequently, if you experience any challenges with pdfFiller, their customer support is readily available. They provide assistance through various channels, including live chat and email, ensuring you're never left without help when managing your forms.

Managing your completed Box 301209 form

Once you have successfully completed and submitted the Box 301209 Form, managing it effectively becomes vital. pdfFiller provides cloud storage options for easy access and security. Storing your documents in the cloud allows you to retrieve them from anywhere, facilitating seamless organization and categorization within your personal or team accounts.

Sharing the Box 301209 Form with stakeholders is straightforward through pdfFiller. You can send the document via email or generate a shareable link, allowing collaborators to view or edit as needed. Additionally, you can set permissions to control who has access to the document, ensuring that sensitive information is shared securely.

Additional resources and tools

Beyond the Box 301209 Form, various forms may complement your needs, especially in business and compliance contexts. Specific forms like the 1099 or W-2 often accompany financial reports or transactional records, providing a comprehensive documentation suite. Utilizing different forms effectively can enhance reporting accuracy and regulatory compliance.

Moreover, pdfFiller is equipped with a suite of document management tools, enhancing overall productivity. Features such as template creation, bulk sending, and auto-fill fields help streamline the document preparation process, allowing you to focus on more critical tasks. By leveraging these tools within a cloud-based platform, you can ease the workflows associated with document handling.

User insights and testimonials

Users across different industries have reported success stories related to the effective use of the Box 301209 Form through pdfFiller. For instance, numerous non-profits have streamlined their grant application processes, resulting in faster approvals and funding access. This efficiency has proven beneficial for organizations aiming to optimize their project funding capabilities.

User feedback is also overwhelmingly positive regarding the intuitiveness of pdfFiller's interface and its extensive feature set, showcasing the platform’s adaptability to various document management needs.

Security measures at pdfFiller

Data security is a paramount concern when handling sensitive documents like the Box 301209 Form. pdfFiller implements stringent security protocols to protect your information, including encryption during transmission and storage, ensuring that unauthorized access is prevented. Compliance with legal and regulatory standards is also a cornerstone of pdfFiller’s operational framework, reassuring users that their data is safe.

Knowing that your forms are secured effectively allows you to focus on completing documents like the Box 301209 Form with confidence, knowing that sensitive information remains confidential.

Getting started with pdfFiller

To begin using pdfFiller for your documentation needs, setting up an account is quick and straightforward. You can create an account within minutes, which grants you access to a plethora of resources for managing forms like the Box 301209 Form.

Navigating the platform is intuitive, designed to allow users—both novice and experienced—to grasp the functionalities efficiently. From editing documents to managing e-signatures, pdfFiller supports your needs every step of the way.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my box 301209 directly from Gmail?

How do I edit box 301209 on an Android device?

How do I complete box 301209 on an Android device?

What is box 301209?

Who is required to file box 301209?

How to fill out box 301209?

What is the purpose of box 301209?

What information must be reported on box 301209?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.