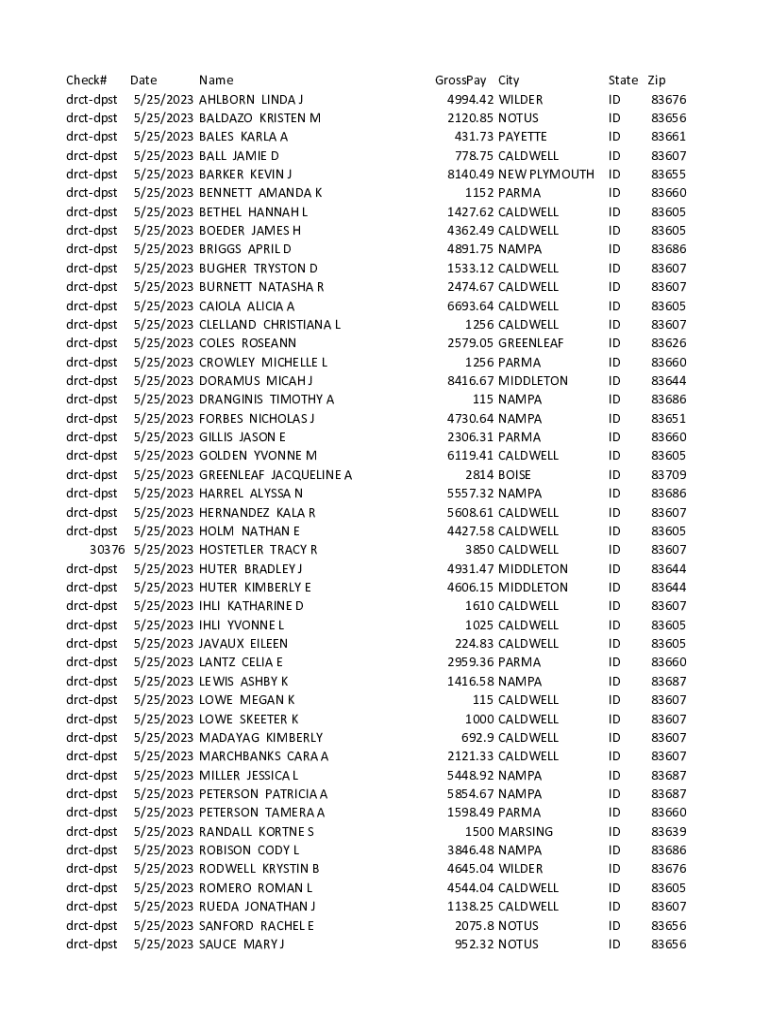

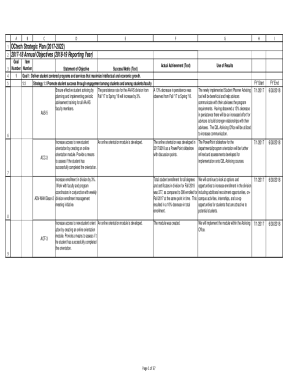

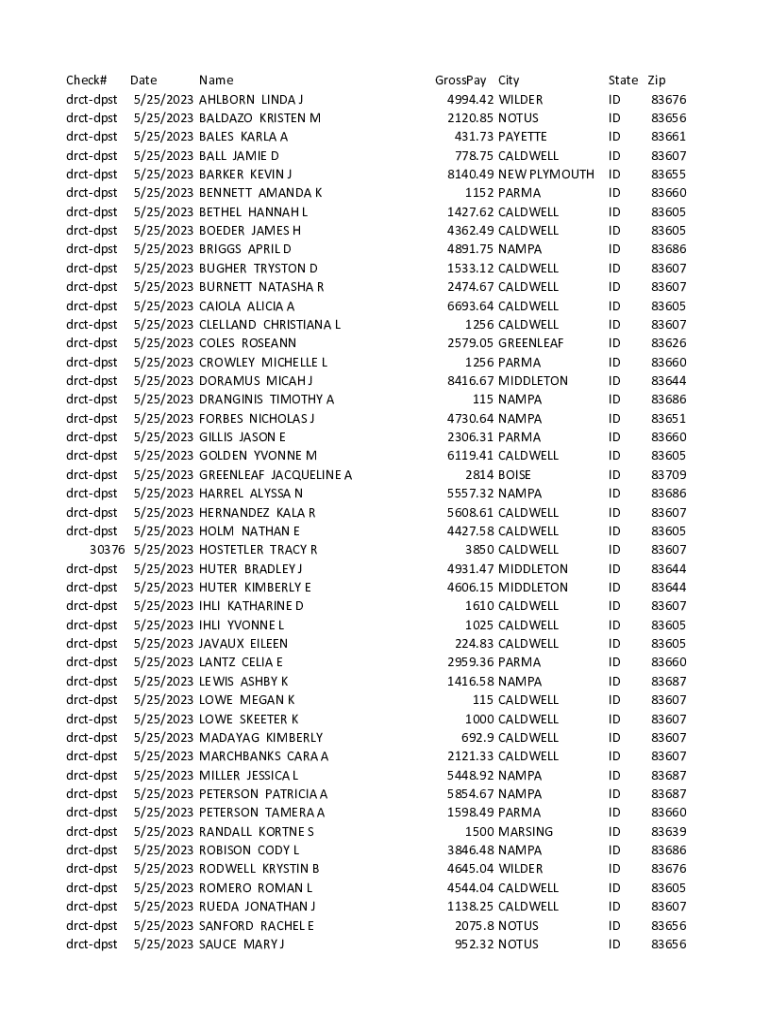

Get the free Check# Date Name GrossPay City State Zip drct-dpst 5/25/2023 ...

Get, Create, Make and Sign check date name grosspay

How to edit check date name grosspay online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check date name grosspay

How to fill out check date name grosspay

Who needs check date name grosspay?

Mastering the Check Date Name Grosspay Form: A Comprehensive Guide

Understanding the check date name grosspay form

The check date name grosspay form is a critical document in payroll processing. It records essential information such as the date of issuance, employee names, and gross pay amounts. Ensuring that this form is filled out correctly is vital for accurate payroll reporting and compliance with labor laws.

Accurate payroll documentation is crucial in maintaining employee trust and organizational integrity. Mistakes in payroll can lead to employee dissatisfaction, tax issues, and potential legal ramifications. Consequently, understanding the key components of the form is essential for payroll administrators.

Detailed breakdown of the grosspay section

Gross pay is the total amount an employee earns before deductions, such as taxes, retirement contributions, and insurance premiums. Understanding gross pay is crucial for both employers and employees to ascertain correct paychecks and manage budgets effectively.

Several components contribute to an employee’s gross pay. Regular earnings form the base salary or hourly wage. Overtime pay, which is earned for hours worked beyond the standard workweek, significantly boosts gross pay. Additionally, bonuses and incentives awarded for performance or achievements add extra value.

How to calculate grosspay: a step-by-step guide

Calculating gross pay is straightforward. Here’s a step-by-step guide:

For example, if an employee earns $20 per hour, works 40 hours, and has 10 hours of overtime at $30 per hour, their gross pay would be calculated as follows: 40 hours x $20 + 10 hours x $30 = $800 + $300 = $1,100.

Importance of accurate check dates

Check dates serve as crucial timestamps in payroll processing. They ensure that employees are paid on time and within the legal requirements set by state and federal regulations. Failure to use accurate check dates can lead to underpayment, overpayment, or delayed payroll, disrupting employee satisfaction and trust.

Incorrect check dates can have serious legal implications, including possible fines and penalties for employers. Adopting best practices, such as regular payroll audits and using reliable payroll systems, can help manage this risk effectively.

Filling out the check date name grosspay form

To fill out the check date name grosspay form accurately, organization and attention to detail are essential. Start by gathering all required employee information, including names, employee IDs, and their respective pay rates.

After preparing the necessary information, enter the details as follows: include the check date at the top, then list employee names along with their gross pay amounts. Ensure that all entries are clear and legible to avoid processing errors.

Common mistakes to avoid when filling out the form

By following these steps carefully, you can ensure that the check date name grosspay form is filled out correctly, minimizing potential errors in payroll processing.

Editing and managing your grosspay form

After filling out the check date name grosspay form, it might be necessary to edit or modify certain details. pdfFiller provides users with powerful editing tools to facilitate this process. You can easily adjust figures, update employee information, or rectify errors directly within the digital document.

Using pdfFiller’s interactive tools allows for an efficient workflow, enabling users to collaborate seamlessly with teammates. Real-time edits and comments help keep the team aligned and reduce the chances of mistakes.

Collaboration features: working with teams remotely

With these features, managing and editing the check date name grosspay form becomes a streamlined process that enhances overall productivity.

eSigning the check date name grosspay form

eSignatures are increasingly important in payroll management, offering a legally binding and secure way to approve documents. Using pdfFiller, you can add an electronic signature to the check date name grosspay form quickly and efficiently, ensuring compliance with digital signature laws.

The step-by-step eSigning process through pdfFiller is simple:

Employing eSignatures not only expedites the process but also enhances the security of sensitive payroll documents.

Managing and storing payroll documents

Proper document storage and compliance are paramount in payroll management. Best practices include maintaining organized folders, implementing access controls, and scheduling regular audits of documents.

pdfFiller can assist organizations in optimizing their document organization, offering integration capabilities to categorize payroll records effectively. Backups and archiving features allow for easy retrieval of current and past documents, ensuring compliance with federal and state requirements.

By leveraging these strategies, organizations can ensure their payroll documentation is well-managed and compliant with regulations.

Troubleshooting common issues with paycheck documentation

Common issues with the check date name grosspay form can arise, leading to discrepancies and employee concerns. Frequently occurring problems include calculation errors, missing signatures, and delays in document submission.

If errors are found after submission, it’s important to have a clear process in place for rectifying mistakes. This may involve issuing corrected paperwork and communicating with impacted employees to maintain transparency.

Being proactive in addressing these issues can significantly enhance trust and improve overall payroll accuracy.

Frequently asked questions about the check date name grosspay form

Understanding common queries surrounding the check date name grosspay form can help both employers and employees navigate payroll more effectively. Common questions include what actions to take when gross pay appears incorrect, or how to address discrepancies in paychecks.

It’s vital to understand related payroll terminology to avoid confusion and ensure accurate processing. Here are some commonly asked questions:

Having clarity on these topics empowers users to manage payroll-related issues more confidently.

Transitioning to new payroll providers: what you need to know

Transitioning to a new payroll provider can be a daunting task. It is essential first to assess your current payroll processes to identify any inefficiencies or challenges you face under your existing system.

Key factors to consider when switching providers include cost, available features, customer support, and compatibility with your existing systems. Utilizing pdfFiller during this transition period can simplify your document management needs.

With careful planning and efficient tools, transitioning to a new payroll provider can lead to improved practices and productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit check date name grosspay online?

Can I edit check date name grosspay on an Android device?

How do I fill out check date name grosspay on an Android device?

What is check date name grosspay?

Who is required to file check date name grosspay?

How to fill out check date name grosspay?

What is the purpose of check date name grosspay?

What information must be reported on check date name grosspay?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.