Get the free reporting of trading by insiders - Mantra Capital

Get, Create, Make and Sign reporting of trading by

How to edit reporting of trading by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reporting of trading by

How to fill out reporting of trading by

Who needs reporting of trading by?

Reporting of trading by form: A comprehensive how-to guide

Understanding trading reports

Trading reports are essential documents used to inform stakeholders about the status and activities of trading operations. They serve as tools for transparency and accountability in financial markets, helping traders, regulators, and analysts make informed decisions.

These reports can reveal market trends, trader positions, and trading strategies impacting a given market segment. Hence, timely and accurate reporting not only fulfills regulatory requirements but also aids traders in assessing their strategies and positions against broader market movements.

Types of trading reports

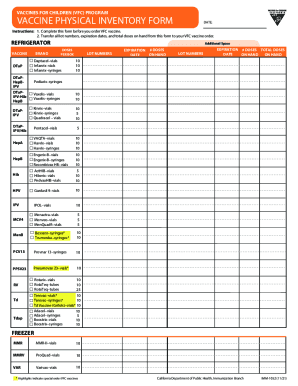

Key components of trading reporting forms

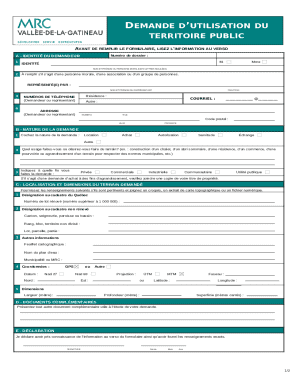

Filing the right trading report requires adherence to specific standards to ensure clarity and compliance. Certain essential information must be captured correctly to meet these criteria. This typically includes trader identification details, transaction specifics, and timestamps for each trade.

Furthermore, understanding standard form formats is critical when submitting these reports. Formats like PDF, CSV, or XML each have unique characteristics suitable for particular use cases, and accuracy in all forms is non-negotiable.

The reporting process: Step-by-step instructions

Preparing to report involves gathering all necessary documentation and data. An organized approach helps in avoiding common pitfalls such as missing documentation or inaccurately reported figures. Being meticulous at this stage saves time later in the process.

Filling out the trading report form involves several specific sections, each requiring careful attention.

Once filled, reviewing your submission with tools like pdfFiller can help ensure any inaccuracies are addressed before submission.

Submitting your trading report

Understanding the channels for submission is key in the trading report process. Digital submission is generally preferred due to its speed and efficiency, while physical submissions may be required in specific circumstances. Ensuring your reports are submitted on time aids compliance and avoids potential penalties.

Tracking submission status can be straightforward using available tools. Many regulatory bodies now provide online portals where traders can monitor the statuses of their submissions, ensuring you're informed if additional information is required.

Managing and storing trading reports

Implementing document management best practices is crucial for efficient reporting. Organizing reports for ease of retrieval is integral, particularly during audits or when updating records. Version control should also be implemented to track changes and ensure compliance in reporting.

Utilizing a platform like pdfFiller can facilitate efficient document management with cloud-based solutions that offer tagging, searching, and sharing features. These functionalities allow for streamlined access to important reports while enabling secure collaboration.

Regulatory considerations and compliance

Staying compliant with relevant regulations is non-negotiable in trading. Different regions may have distinct regulations governing trade reporting, necessitating that traders remain informed of applicable rules. This includes understanding potential penalties for non-compliance, which can severely impact businesses.

Best practices for ensuring compliance include regular audits of reporting processes and offering training sessions for teams on the latest requirements. These practices empower staff to navigate the complexities of reporting effectively.

Troubleshooting common reporting issues

Common reporting issues can arise, often caused by statistical discrepancies or inaccuracies in data entry. Identifying and resolving these errors during the preparation phase can significantly reduce risks and improve submission quality.

Accessing help is equally important. Whether from pdfFiller's support or official avenues from regulatory bodies, knowing where to seek assistance ensures that traders can clarify doubts and rectify issues swiftly.

Future trends in trading report automation

As technology evolves, trading report automation is becoming increasingly efficient. Current advancements in AI and machine learning can enhance the accuracy and speed of report generation, paving the way for future regulatory changes that embrace these technologies.

Platforms like pdfFiller continue to adapt, providing enhancements in document automation and eSignature features that align with emerging standards in trade reporting.

Interactive tools and resources for better reporting

Using interactive templates and online calculators can streamline the reporting process significantly. PdfFiller provides customizable templates that simplify form completion, making it easy for traders to adhere to regulatory requirements.

Additionally, using online tools to estimate report submission requirements based on trading volume can offer traders valuable insights for complying with specific thresholds set by regulators.

Reports in different markets and their implications

Each trading market involves different reporting practices based on varying regulations and oversight. For instance, equities markets may have distinct reporting requirements compared to commodities or foreign exchange markets. Understanding these differences is vital for compliance.

Moreover, global events such as economic crises can impact trading report requirements, leading to adjustments aimed at safeguarding market integrity and transparency.

Enhancing collaboration among teams

Collaboration in reporting enhances the accuracy and reliability of trading reports. Engaging team members in the reporting process fosters a culture of transparency and shared responsibility, which ultimately improves outcomes.

Tools like pdfFiller allow for real-time collaborative capabilities, making it easier for teams to contribute effectively in the document creation and approval processes.

Advanced reporting techniques

Utilizing data analytics to enhance reporting practices can yield significant advantages. Insights derived from trading data can inform strategies and improve decision-making processes across trading teams.

Integrating report data into broader trading strategies enables traders to fine-tune their approaches based on empirical evidence. This shift toward data-driven methodologies is critical for optimizing trading outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify reporting of trading by without leaving Google Drive?

How do I fill out the reporting of trading by form on my smartphone?

How do I edit reporting of trading by on an Android device?

What is reporting of trading by?

Who is required to file reporting of trading by?

How to fill out reporting of trading by?

What is the purpose of reporting of trading by?

What information must be reported on reporting of trading by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.